Air Liquide Sees 2016 Profitability Rising on Airgas Acquisition

August 01 2016 - 2:57AM

Dow Jones News

By Inti Landauro

PARIS--French industrial gas supplier Air Liquide SA (AI.FR) on

Monday said its profitability would be lifted this year by its $10

billion acquisition of U.S. rival Airgas.

The company said its earnings-per-share in 2016 will be higher

than the 5.12 euros ($5.72) reported in 2015, including the impact

of its planned sale of up to EUR3.5 billion worth of new shares

later this year.

In the first half of the year, Air Liquide's net profit fell

4.5% to EUR811 million, mainly because of costs of EUR92 million

related to the Airgas merger. Revenue rose 2.2% to EUR8.30 billion,

which included five weeks of sales from Airgas valued at EUR511

million.

Air Liquide said the capital gains it expects to make on some

Airgas assets being sold for anti-trust reasons will more than

offset costs related to the acquisition.

Air Liquide said most of its business lines grew during the

first half of the year.

In 2015, it offered to buy Airgas for $10 billion in a deal that

valued the U.S. company at $13 billion when factoring its debt. The

French company said it will finance the acquisition with debt and

the sale of between EUR3 billion and EUR3.5 billion in new

shares.

-Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

August 01, 2016 02:42 ET (06:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

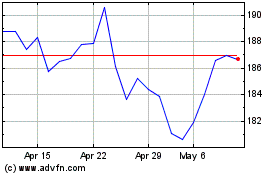

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024