Air Lease Corporation (ALC) (NYSE: AL) announced today financial

results for the three and nine months ended September 30,

2015. Items of note included:

- Diluted EPS increased 22% to $0.71 for

the three months ended September 30, 2015 as compared to $0.58

for the three months ended September 30, 2014.

- Adjusted diluted EPS increased 21% to

$1.20 for the three months ended September 30, 2015 as compared to

$0.99 for the three months ended September 30, 2014.

- Revenues increased 20% to $313 million

for the three months ended September 30, 2015 as compared to

$262 million for the three months ended September 30,

2014.

- Income before taxes increased 24% to

$120 million with a pretax margin of 38% for the three months ended

September 30, 2015 as compared to $96 million with a pretax

margin of 37% for the three months ended September 30,

2014.

- Market demand remains strong for our

aircraft and order book. We are 94% placed through 2017 and have

maintained 100% utilization of our current fleet across a diverse

customer base of 89 airlines in 50 countries.

- In October 2015, Standard & Poor's

Ratings Services revised its outlook on ALC to positive from stable

and affirmed all ratings on ALC, including its 'BBB-' corporate

credit rating.

- In August 2015, we completed a senior

unsecured notes offering of $500 million due 2018 at 2.625%.

- In September 2015, we entered into an

agreement to increase the capacity of our Syndicated Unsecured

Revolving Credit Facility by $90 million to $2.8 billion.

- Increased our annual cash dividend by

25%, from $0.16 per share per annum to $0.20 per share per annum.

The next quarterly dividend of $0.05 per share will be paid on

January 6, 2016 to holders of record of our common stock on

December 14, 2015.

The following table summarizes the results for the three and

nine months ended September 30, 2015 and 2014 (in thousands,

except share amounts):

Three Months Ended Nine Months Ended September

30, September 30, 2015 2014

$ change

% change 2015 2014

$ change

% change Revenues $ 313,126 $ 261,939 $ 51,187 19.5 %

$ 896,143 $ 764,549 $ 131,594 17.2 % Income before taxes $ 119,587

$ 96,277 $ 23,310 24.2 % $ 267,725 $ 286,666 $ (18,941 ) (6.6 ) %

Net income $ 77,042 $ 62,433 $ 14,609 23.4 % $ 172,492 $ 185,867 $

(13,375 ) (7.2 ) % Diluted EPS $ 0.71 $ 0.58 $ 0.13 22.4 % $ 1.60 $

1.73 $ (0.13 ) (7.5 ) % Adjusted income before taxes(1) $ 131,654 $

107,582 $ 24,072 22.4 % $ 374,879 $ 319,790 $ 55,089 17.2 %

Adjusted diluted EPS(1) $ 1.20 $ 0.99 $ 0.21 21.2 % $ 3.43 $ 2.95 $

0.48 16.3 % (1) Adjusted net income and adjusted

diluted earnings per share have been adjusted to exclude the

effects of certain non-cash items, one-time or non-recurring items,

such as settlement expense, that are not expected to continue in

the future and certain other items. See note 1 under the

Consolidated Statements of Income included in this earnings release

for a discussion of the non-GAAP measures adjusted net income and

adjusted diluted EPS.

“ALC continued to execute its long-term business plan delivering

a 38% pretax profit margin, a 24% increase in our pretax income and

a 20% increase in our revenues compared to the third quarter of

2014. The consistency of these results along with our strong credit

metrics will continue to benefit ALC’s capital raising and

competitive position. Recognizing ALC's continuing strong

performance, our Board authorized an increase in ALC's quarterly

dividend to $0.05 per share,” said Steven F. Udvar-Házy, Chairman

and Chief Executive Officer of Air Lease Corporation.

“Continued positive global passenger traffic trends have

generated robust demand for aircraft in our order book and

maintained the values of our used aircraft. This year to date, ALC

has added 17 new customers and signed 67 lease agreements. Airline

customer demand for both the modern narrowbody and widebody

aircraft in our fleet remains healthy and we see stability in the

market for aircraft pricing as evidenced by our aircraft sales to

date and what we see in our forward deal pipeline,” said John L.

Plueger, President and Chief Operating Officer of Air Lease

Corporation.

Flight Equipment

Portfolio

As of September 30, 2015, we owned 235 aircraft in our

operating lease portfolio and we leased the aircraft to a globally

diversified customer base of 89 airlines in 50 countries. During

the quarter ended September 30, 2015, we took delivery of nine

aircraft from our order book and acquired three incremental

aircraft. In addition, we sold four aircraft, which were previously

classified as held for sale as of June 30, 2015. We also added two

aircraft to our managed fleet ending the quarter with 26 aircraft

managed for third parties.

Below are portfolio metrics of our fleet as of

September 30, 2015 and December 31, 2014:

September 30, 2015

December 31, 2014 Owned fleet 235 213 Managed fleet 26 17

Weighted-average fleet age(1) 3.5 years 3.5 years Weighted-average

remaining lease term(1) 7.3 years 7.3 years Aggregate fleet net

book value $ 10.4 billion $ 9.0 billion

(1) Weighted-average fleet age and remaining

lease term calculated based on net book value of ALC's owned fleet.

The following table sets forth the percentage of net book value

of our aircraft portfolio in the indicated regions as of

September 30, 2015 and December 31, 2014:

September 30, 2015

December 31, 2014 Region % of Net Book Value

% of Net Book Value Asia 43.2 % 42.9 % Europe 29.7 % 33.0 %

The Middle East and Africa 10.0 % 5.6 % Central America, South

America and Mexico 9.0 % 8.7 % Pacific, Australia, New Zealand 4.1

% 5.2 % U.S. and Canada 4.0 % 4.6 % Total 100.0 % 100.0 %

The following table sets forth the number of aircraft we leased

by aircraft type as of September 30, 2015 and

December 31, 2014:

September 30, 2015 December 31, 2014 Number

of Number of Aircraft type Aircraft %

of Total Aircraft % of Total Airbus A319/320/321

69 29.4 % 64 30.0 % Airbus A330-200/300 21 8.9 % 21 9.8 % Boeing

737-700/800 83 35.3 % 69 32.4 % Boeing 767-300ER 1 0.4 % 1 0.5 %

Boeing 777-200/300ER 16 6.8 % 10 4.7 % Embraer E175/190 26 11.1 %

30 14.1 % ATR 42/72-600 19 8.1 % 18 8.5 % Total 235 100.0 % 213

100.0 %

Debt Financing

Activities

We ended the third quarter of 2015 with total debt, net of

discounts and issuance costs, of $7.5 billion as compared to $6.6

billion as of December 31, 2014. Total debt was comprised of

$6.7 billion of unsecured debt, representing 88% of our debt

portfolio as of September 30, 2015 from 82% as of

December 31, 2014. In addition, our fixed rate debt increased

to 81% as of September 30, 2015 from 75% as of

December 31, 2014.

During the quarter, the Company issued $500 million in aggregate

principal amount of senior unsecured notes due 2018 that bear

interest at a rate of 2.625%. In addition, the Company entered into

an agreement to increase the capacity of its Syndicated Unsecured

Revolving Credit Facility by $90 million to $2.8 billion. We ended

the quarter with $2.8 billion in liquidity and a debt to equity

ratio of 2.55:1.

The Company’s debt financing was comprised of the following at

September 30, 2015 and December 31, 2014 (dollars in

thousands):

September 30,

2015 December 31, 2014 Unsecured Senior notes $

5,677,769 $ 4,579,194 Revolving credit facilities 494,000 569,000

Term financings 286,276 196,146 Convertible senior notes

200,000 200,000 Total unsecured debt financing

6,658,045 5,544,340

Secured Term financings 499,120 636,411

Warehouse facility 374,595 484,513 Export credit financing

59,893 64,884 Total secured debt financing

933,608 1,185,808 Total debt financing 7,591,653 6,730,148

Less: Debt discounts and issuance costs (93,413 )

(99,390 )

Debt financing, net of discounts and issuance

costs $ 7,498,240 $ 6,630,758

Selected

interest rates and ratios: Composite interest rate(1) 3.61 %

3.64 % Composite interest rate on fixed-rate debt(1) 4.04 % 4.22 %

Percentage of total debt at fixed-rate 80.83 % 75.26 % (1)

Pursuant to the early adoption of ASU No. 2015-03,

Interest-Imputation of Interest, debt issuance costs have been

presented as a direct deduction from the carrying amount of the

related debt liability. This change has been applied

retrospectively. (2) This rate does not include the effect of

upfront fees, undrawn fees or issuance cost amortization.

Conference Call

In connection with the earnings release, Air Lease Corporation

will host a conference call on November 5, 2015 at 4:30 PM

Eastern Time to discuss the Company's financial results for the

third quarter of 2015.

Investors can participate in the conference call by dialing

(877) 280-2126 domestic or (678) 562-4234 international. The

passcode for the call is 52144828.

The conference call will also be broadcast live through a link

on the Investor Relations page of the Air Lease Corporation website

at www.airleasecorp.com. Please visit the website at least 15

minutes prior to the call to register, download and install any

necessary audio software. A replay of the broadcast will be

available on the Investor Relations page of the Air Lease

Corporation website.

For your convenience, the conference call can be replayed in its

entirety beginning at 8:30 PM ET on November 5, 2015 until

11:59 PM ET, November 12, 2015. If you wish to listen to the replay

of this conference call, please dial (855) 859-2056 domestic or

(404) 537-3406 international and enter passcode 52144828.

About Air Lease Corporation (NYSE: AL)

Air Lease Corporation is a leading aircraft leasing company

based in Los Angeles, California that has airline customers

throughout the world. ALC and its team of dedicated and experienced

professionals are principally engaged in purchasing commercial

aircraft and leasing them to its airline customers worldwide

through customized aircraft leasing and financing solutions. For

more information, visit ALC's website at www.airleasecorp.com.

Forward-Looking Statements

Statements in this press release that are not historical facts

are hereby identified as “forward-looking statements,” including

any statements about our expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance.

These statements are often, but not always, made through the use of

words or phrases such as “anticipate,” “believes,” “can,” “could,”

“may,” “predicts,” “potential,” “should,” “will,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends”

and similar words or phrases. These statements are only predictions

and involve estimates, known and unknown risks, assumptions and

uncertainties that could cause actual results to differ materially

from those expressed in such statements, including as a result of

the following factors, among others:

- our inability to make acquisitions of,

or lease, aircraft on favorable terms;

- our inability to sell aircraft on

favorable terms;

- our inability to obtain additional

financing on favorable terms, if required, to complete the

acquisition of sufficient aircraft as currently contemplated or to

fund the operations and growth of our business;

- our inability to obtain refinancing

prior to the time our debt matures;

- impaired financial condition and

liquidity of our lessees;

- deterioration of economic conditions in

the commercial aviation industry generally;

- increased maintenance, operating or

other expenses or changes in the timing thereof;

- changes in the regulatory

environment;

- potential natural disasters and

terrorist attacks and the amount of our insurance coverage, if any,

relating thereto; and

- the factors discussed under “Part I –

Item 1A. Risk Factors,” In our Annual Report on Form 10-K for the

year ended December 31, 2014 and other SEC filings

All forward-looking statements are necessarily only estimates of

future results, and there can be no assurance that actual results

will not differ materially from expectations. You are therefore

cautioned not to place undue reliance on such statements. Any

forward-looking statement speaks only as of the date on which it is

made, and we undertake no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which the statement is made or to reflect the occurrence of

unanticipated events.

Air Lease Corporation and

Subsidiaries

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and par

value amounts)

September 30, 2015 December 31, 2014

(unaudited) Assets Cash and cash equivalents $

119,722 $ 282,819 Restricted cash 10,700 7,469 Flight equipment

subject to operating leases 11,533,922 9,832,421 Less accumulated

depreciation (1,114,720 ) (878,617 ) 10,419,202

8,953,804 Deposits on flight equipment purchases 1,084,075

1,144,603 Other assets 277,995 302,485

Total assets $ 11,911,694 $ 10,691,180

Liabilities and Shareholders’ Equity Accrued interest and

other payables $ 168,558 $ 190,952 Debt financing, net of discounts

and issuance costs 7,498,240 6,630,758 Security deposits and

maintenance reserves on flight equipment leases 802,226 698,172

Rentals received in advance 84,630 75,877 Deferred tax liability

418,592 323,359

Total

liabilities $ 8,972,246 $ 7,919,118

Shareholders’ Equity Preferred Stock, $0.01 par value;

50,000,000 shares authorized; no shares issued or outstanding — —

Class A common stock, $0.01 par value; authorized 500,000,000

shares; issued and outstanding 102,580,955 and 102,392,208 shares

at September 30, 2015 and December 31, 2014, respectively 1,010

1,010 Class B Non-Voting common stock, $0.01 par value; authorized

10,000,000 shares; no shares issued or outstanding — — Paid-in

capital 2,222,682 2,215,479 Retained earnings 715,756

555,573

Total shareholders’ equity $ 2,939,448

$ 2,772,062

Total liabilities and shareholders’

equity $ 11,911,694 $ 10,691,180 (1)

Pursuant to the early adoption of ASU No. 2015-03,

Interest-Imputation of Interest, debt issuance costs have been

presented as a direct deduction from the carrying amount of the

related debt liability. This change has been applied

retrospectively.

Air Lease Corporation and

Subsidiaries

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except share and per

share amounts)

Three Months Ended Nine Months Ended

September 30, September 30, 2015 2014

2015 2014 (unaudited) Revenues Rental

of flight equipment $ 304,264 $ 252,519 $ 860,281 $ 725,448

Aircraft sales, trading and other 8,862 9,420

35,862 39,101

Total revenues

313,126 261,939 896,143 764,549

Expenses Interest 60,103

48,582 173,654 140,275 Amortization of debt discounts and issuance

costs 7,419 7,423 22,782

20,902 Interest expense 67,522 56,005 196,436 161,177

Depreciation of flight equipment 102,046 86,119 291,460

245,736 Settlement — — 72,000 — Selling, general and administrative

19,323 19,656 56,150 58,748 Stock-based compensation 4,648

3,882 12,372 12,222

Total expenses 193,539 165,662

628,418 477,883 Income before

taxes 119,587 96,277 267,725 286,666 Income tax expense

(42,545 ) (33,844 ) (95,233 ) (100,799 ) Net

income $ 77,042 $ 62,433 $ 172,492 $ 185,867

Net income per share of Class A and B common

stock Basic $ 0.75 $ 0.61 $ 1.68 $ 1.82 Diluted $ 0.71 $ 0.58 $

1.60 $ 1.73

Other financial data Adjusted net

income(1) $ 131,654 $ 107,582 $ 374,879 $ 319,790 Adjusted diluted

earnings per share(1) $ 1.20 $ 0.99 $ 3.43 $ 2.95 (1)

Adjusted net income (defined as net income excluding the effects of

certain non-cash items, one-time or non-recurring items, such as

settlement expense, that are not expected to continue in the future

and certain other items), and adjusted diluted earnings per share

(defined as net income excluding the effects of certain non-cash

items, one-time or non-recurring items, such as settlement expense,

that are not expected to continue in the future and certain other

items divided by the weighted average diluted common shares

outstanding) are measures of operating performance that are not

defined by GAAP and should not be considered as an alternative to

net income, earnings per share, and diluted earnings per share, or

any other performance measures derived in accordance with GAAP.

Adjusted net income and adjusted diluted earnings per share, are

presented as supplemental disclosure because management believes

they provide useful information on our earnings from ongoing

operations.

Management and our board of directors use

adjusted net income and adjusted diluted earnings per share to

assess our consolidated financial and operating performance.

Management believes these measures are helpful in evaluating the

operating performance of our ongoing operations and identifying

trends in our performance, because they remove the effects of

certain non-cash items, one-time or non-recurring items that are

not expected to continue in the future and certain other items from

our operating results. Adjusted net income and adjusted diluted

earnings per share, however, should not be considered in isolation

or as a substitute for analysis of our operating results or cash

flows as reported under GAAP. Adjusted net income and adjusted

diluted earnings per share do not reflect our cash expenditures or

changes in or cash requirements for our working capital needs. In

addition, our calculation of adjusted net income and adjusted

diluted earnings per share may differ from the adjusted net income

and adjusted diluted earnings per share or analogous calculations

of other companies in our industry, limiting their usefulness as a

comparative measure.

Air Lease Corporation and

SubsidiariesCONSOLIDATED STATEMENTS OF INCOME(In

thousands, except share and per share amounts)

The following tables show the reconciliation

of net income to adjusted net income (in thousands):

Three Months Ended Nine Months

Ended September 30, September 30, 2015

2014 2015 2014 (unaudited)

(unaudited) Reconciliation of net income to adjusted net

income: Net income $ 77,042 $ 62,433 $ 172,492 $ 185,867

Amortization of debt discounts and issuance costs 7,419 7,423

22,782 20,902 Stock-based compensation 4,648 3,882 12,372 12,222

Settlement — — 72,000 — Provision for income taxes 42,545

33,844 95,233 100,799 Adjusted net income $

131,654 $ 107,582 $ 374,879 $ 319,790

The following table shows the reconciliation

of net income to adjusted diluted earnings per share (in thousands,

except share and per share amounts):

Three Months Ended

September 30,

Nine Months Ended

September 30,

2015 2014 2015 2014 (unaudited)

(unaudited) Reconciliation of net income to adjusted

diluted earnings per share: Net income $ 77,042 $ 62,433 $

172,492 $ 185,867 Amortization of debt discounts and issuance costs

7,419 7,423 22,782 20,902 Stock-based compensation 4,648 3,882

12,372 12,222 Settlement — — 72,000 — Provision for income taxes

42,545 33,844 95,233 100,799 Adjusted

net income $ 131,654 $ 107,582 $ 374,879 $ 319,790 Assumed

conversion of convertible senior notes 1,463 1,465

4,341 4,346 Adjusted net income plus assumed

conversions $ 133,117 $ 109,047 $ 379,220 $ 324,136

Weighted-average diluted shares outstanding 110,623,960

110,457,170 110,635,282 109,997,159 Adjusted

diluted earnings per share $ 1.20 $ 0.99 $ 3.43 $ 2.95

Air Lease Corporation and

Subsidiaries

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

Nine Months Ended

September 30,

2015 2014 (unaudited) Operating

Activities Net income $ 172,492 $ 185,867 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation of flight equipment 291,460 245,736 Stock-based

compensation 12,372 12,222 Deferred taxes 95,233 100,799

Amortization of discounts and debt issuance costs 22,782 20,902

Gain on aircraft sales, trading and other activity (29,061 )

(37,075 ) Changes in operating assets and liabilities: Other assets

18,384 12,702 Accrued interest and other payables (5,857 ) 22,960

Rentals received in advance 8,753 7,060

Net cash provided by operating activities 586,558

571,173

Investing Activities Acquisition of

flight equipment under operating lease (1,697,742 ) (1,206,985 )

Payments for deposits on flight equipment purchases (482,798 )

(480,791 ) Proceeds from aircraft sales, trading and other activity

691,458 293,278 Acquisition of furnishings, equipment and other

assets (189,493 ) (168,092 ) Net cash used in

investing activities (1,678,575 ) (1,562,590 )

Financing Activities Issuance of common stock upon exercise

of options 40 845 Cash dividends paid (12,302 ) (9,171 ) Tax

withholdings on stock-based compensation (5,302 ) (18,089 ) Net

change in unsecured revolving facilities (75,000 ) (349,000 )

Proceeds from debt financings 1,217,384 1,656,395 Payments in

reduction of debt financings (293,736 ) (526,984 ) Net change in

restricted cash (3,231 ) 79,110 Debt issuance costs (4,188 ) (7,627

) Security deposits and maintenance reserve receipts 150,318

128,630 Security deposits and maintenance reserve disbursements

(45,063 ) (22,194 ) Net cash provided by financing

activities 928,920 931,915 Net decrease

in cash (163,097 ) (59,502 ) Cash and cash equivalents at beginning

of period 282,819 270,173 Cash and cash

equivalents at end of period $ 119,722 $ 210,671

Supplemental Disclosure of Cash Flow Information Cash paid

during the period for interest, including capitalized interest of

$30,449 and $31,907 at September 30, 2015 and 2014, respectively $

199,745 $ 149,466

Supplemental Disclosure of Noncash

Activities Buyer furnished equipment, capitalized interest,

deposits on flight equipment purchases and seller financing applied

to acquisition of flight equipment and other assets applied to

payments for deposits on flight equipment purchases $ 766,616 $

583,776 Cash dividends declared, not yet paid $ 4,103 $ 3,072

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151105006748/en/

Air Lease CorporationInvestors:Ryan McKennaVice

PresidentEmail: rmckenna@airleasecorp.comorMedia:Laura St.

JohnManager, Media and Investor RelationsEmail:

lstjohn@airleasecorp.comPhone: 310-553-0555

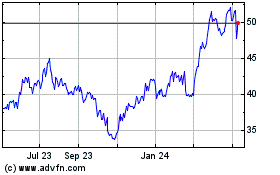

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

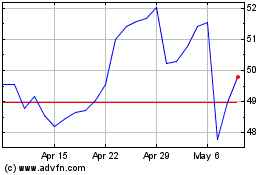

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024