Air Lease Corporation (ALC) (NYSE: AL) announced record

quarterly financial results for the three months ended

March 31, 2016. Items of note include:

- Generated record quarterly adjusted

diluted EPS of $1.38 for the three months ended March 31,

2016, an increase of 34.0% as compared to $1.03 for the three

months ended March 31, 2015.

- Generated record quarterly revenues of

$343.3 million for the three months ended March 31, 2016, an

increase of 23.4% or $65.0 million as compared to $278.3 million

for the three months ended March 31, 2015.

- Generated record quarterly adjusted net

income of $151.1 million with an adjusted margin of 44.4% for the

three months ended March 31, 2016 as compared to $112.8

million with an adjusted margin of 40.5% for the three months ended

March 31, 2015.

- Placed 85% of our order book on

long-term leases for aircraft delivering through 2018. Maintained

100% utilization of our current fleet with only 10% of our leases

due to expire over the next three years.

- Purchased $731.6 million in aircraft

during the quarter, including 10 aircraft from our order book and

one incremental aircraft.

- Sold $221.5 million in aircraft,

comprised of 12 ATR aircraft, during the three months ended

March 31, 2016. Expect to complete the sale of our existing

ATR fleet during the next quarter and to sell at delivery the

remaining five ATR aircraft from our order book over the next two

quarters.

- Completed a senior unsecured notes

offering in April 2016, issuing $600 million at 3.375%, maturing in

2021.

- Declared a quarterly cash dividend of

$0.05 per share on our outstanding common stock to be paid on July

7, 2016, to holders of record of our common stock as of June 13,

2016.

The following table summarizes the results for the three months

ended March 31, 2016 and 2015 (in thousands, except share

amounts):

Three Months Ended March

31,

2016 2015

$ change

% change

Revenues $ 343,328 $ 278,315 $ 65,013 23.4 % Income before taxes $

143,991 $ 29,974 $ 114,017 380.4 % Net income $ 92,858 $ 19,332 $

73,526 380.3 % Adjusted net income(1) $ 151,141 $ 112,802 $ 38,339

34.0 % Diluted EPS $ 0.85 $ 0.19 $ 0.66 347.4 % Adjusted diluted

EPS(1) $ 1.38 $ 1.03 $ 0.35 34.0 % (1) Adjusted net income

and adjusted diluted earnings per share have been adjusted to

exclude the effects of certain non-cash items, one-time or

non-recurring items, such as settlement expense, net of recoveries,

that are not expected to continue in the future and certain other

items. See note 1 under the Consolidated Statements of Income

included in this earnings release for a discussion of the non-GAAP

measures adjusted net income and adjusted diluted EPS.

"Passenger traffic grew 7% system-wide through the first quarter

of the year and airline health remains on a good footing globally,

driven by passenger demand and low fuel prices, and capacity

discipline. ALC’s business model continues to produce the highest

operating margin of any publicly traded aircraft lessor. We see the

manufacturers adjusting production rates in line with forward

market projections of aircraft demand, which contributes to a

healthy long-term balance in the marketplace,” said Steven F.

Udvar-Házy, Chairman and Chief Executive Officer.

“During the quarter, we found buying opportunities originating

in South America that will add to our growth outside the region.

Globally, we’ve now achieved 85% placement of our new aircraft

delivering through 2018. We continue to see good activity in our

new aircraft lease placements and campaigns, and our lease yields

remain steady. Buyer demand for our used aircraft portfolios

remains solid,” said John L. Plueger, President and Chief Operating

Officer.

Flight Equipment

Portfolio

As of March 31, 2016, our fleet was comprised of 239 owned

aircraft, with a weighted-average age and remaining lease term of

3.6 years and 7.2 years, respectively, and 29 managed aircraft. We

have a globally diversified customer base of 88 airlines in 50

countries.

During the quarter ended March 31, 2016, we took delivery

of ten aircraft from our order book, acquired one incremental

aircraft and sold 12 ATR aircraft from our operating lease

portfolio.

Below are the key portfolio metrics of our fleet:

March 31, 2016 December 31, 2015

Owned fleet 239 240 Managed fleet 29 29 Order book 386 389

Weighted-average fleet age(1) 3.6 years 3.6 years Weighted-average

remaining lease term(1) 7.2 years 7.2 years Aggregate fleet net

book value $11.2 billion $10.8 billion

(1) Weighted-average fleet age and

remaining lease term calculated based on net book value.

The following table details the regional concentration of our

fleet:

March 31, 2016 December 31, 2015

Region % of Net Book Value % of Net Book Value

Europe 30.7 % 30.0 % Asia (excluding China) 22.0 % 21.4 % China

21.6 % 22.6 % The Middle East and Africa 9.0 % 9.5 % Central

America, South America and Mexico 8.2 % 8.5 % U.S. and Canada 4.3 %

4.1 % Pacific, Australia, New Zealand 4.2 % 3.9 % Total 100.0 %

100.0 %

The following table details the composition of our fleet by

aircraft type:

March 31, 2016 December 31, 2015

Aircraft type Number ofAircraft % of

Total Number ofAircraft % of Total

Airbus A319/320/321 69 28.9 % 68 28.5 % Airbus A330-200/300 21 8.8

% 21 8.8 % Boeing 737-700/800 95 39.7 % 87 36.2 % Boeing 767-300ER

1 0.4 % 1 0.4 % Boeing 777-200ER 1 0.4 % 1 0.4 % Boeing 777-300ER

19 8.0 % 17 7.1 % Embraer E175/190 26 10.9 % 26 10.8 % ATR

42/72-600 7 2.9 % 19 7.8 % Total 239 100.0 %

240 100.0 %

Debt Financing

Activities

We ended the first quarter of 2016 with total debt, net of

discounts and issuance costs, of $8.0 billion resulting in a debt

to equity ratio of 2.58:1 and available liquidity of $1.8

billion.

Our debt financing was comprised of unsecured debt of $7.3

billion, representing 89.7% of our debt portfolio as of

March 31, 2016 as compared to 88.4% as of December 31,

2015. Our fixed rate debt represented 69.2% of our debt portfolio

as of March 31, 2016 as compared to 78.7% as of December 31,

2015. Our composite cost of funds decreased to 3.34% as of

March 31, 2016 as compared to 3.59% as of December 31,

2015.

The Company’s debt financing was comprised of the following at

March 31, 2016 and December 31, 2015 (dollars in

thousands):

March 31, 2016

December 31,2015

Unsecured Senior notes $ 5,176,343 $ 5,677,769 Revolving

credit facility 1,599,000 720,000 Term financings 283,540 292,788

Convertible senior notes 200,000 200,000 Total

unsecured debt financing 7,258,883 6,890,557

Secured Term

financings 440,287 477,231 Warehouse facility 340,820 372,423

Export credit financing 56,566 58,229 Total secured

debt financing 837,673 907,883 Total debt financing

8,096,556 7,798,440 Less: Debt discounts and issuance costs (79,055

) (86,019 ) Debt financing, net of discounts and issuance costs $

8,017,501 $ 7,712,421

Selected interest rates and

ratios: Composite interest rate(1) 3.34 % 3.59 % Composite

interest rate on fixed-rate debt(1) 4.00 % 4.04 % Percentage of

total debt at fixed-rate 69.24 % 78.70 %

(1) This rate does not include the effect

of upfront fees, undrawn fees or issuance cost amortization.

Conference Call

In connection with the earnings release, Air Lease Corporation

will host a conference call on May 5, 2016 at 4:30 PM Eastern

Time to discuss the Company's financial results for the first

quarter of 2016.

Investors can participate in the conference call by dialing

(855) 308-8321 domestic or (330) 863-3465 international. The

passcode for the call is 90607465.

The conference call will also be broadcast live through a link

on the Investor Relations page of the Air Lease Corporation website

at www.airleasecorp.com. Please visit the website at least 15

minutes prior to the call to register, download and install any

necessary audio software. A replay of the broadcast will be

available on the Investor Relations page of the Air Lease

Corporation website.

For your convenience, the conference call can be replayed in its

entirety beginning at 7:30 PM ET on May 5, 2016 until 7:30 PM

ET May 12, 2016. If you wish to listen to the replay of this

conference call, please dial (855) 859-2056 domestic or (404)

537-3406 international and enter passcode 90607465.

About Air Lease Corporation (NYSE: AL)

Air Lease Corporation is a leading aircraft leasing company

based in Los Angeles, California that has airline customers

throughout the world. ALC and its team of dedicated and experienced

professionals are principally engaged in purchasing commercial

aircraft and leasing them to its airline customers worldwide

through customized aircraft leasing and financing solutions. For

more information, visit ALC's website at www.airleasecorp.com.

Forward-Looking Statements

Statements in this press release that are not historical facts

are hereby identified as “forward-looking statements,” including

any statements about our expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance.

These statements are often, but not always, made through the use of

words or phrases such as “anticipate,” “believes,” “can,” “could,”

“may,” “predicts,” “potential,” “should,” “will,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends”

and similar words or phrases. These statements are only predictions

and involve estimates, known and unknown risks, assumptions and

uncertainties that could cause actual results to differ materially

from those expressed in such statements, including as a result of

the following factors, among others:

- our inability to make acquisitions of,

or lease, aircraft on favorable terms;

- our inability to sell aircraft on

favorable terms;

- our inability to obtain additional

financing on favorable terms, if required, to complete the

acquisition of sufficient aircraft as currently contemplated or to

fund the operations and growth of our business;

- our inability to obtain refinancing

prior to the time our debt matures;

- impaired financial condition and

liquidity of our lessees;

- deterioration of economic conditions in

the commercial aviation industry generally;

- increased maintenance, operating or

other expenses or changes in the timing thereof;

- changes in the regulatory

environment;

- potential natural disasters and

terrorist attacks and the amount of our insurance coverage, if any,

relating thereto; and

- the factors discussed under “Part I –

Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the

year ended December 31, 2015 and other SEC filings.

All forward-looking statements are necessarily only estimates of

future results, and there can be no assurance that actual results

will not differ materially from expectations. You are therefore

cautioned not to place undue reliance on such statements. Any

forward-looking statement speaks only as of the date on which it is

made, and we undertake no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which the statement is made or to reflect the occurrence of

unanticipated events.

Air Lease Corporation and Subsidiaries CONSOLIDATED

BALANCE SHEETS (In thousands, except share and par value

amounts)

March 31,2016

December 31,2015

(unaudited) Assets Cash and cash equivalents $

162,814 $ 156,675 Restricted cash 16,490 16,528 Flight equipment

subject to operating leases 12,550,836 12,026,798 Less accumulated

depreciation (1,311,215 ) (1,213,323 ) 11,239,621 10,813,475

Deposits on flight equipment purchases 1,079,690 1,071,035 Other

assets 284,795 297,385

Total assets $

12,783,410 $ 12,355,098

Liabilities and

Shareholders’ Equity Accrued interest and other payables $

192,389 $ 215,983 Debt financing, net of discounts and issuance

costs 8,017,501 7,712,421 Security deposits and maintenance

reserves on flight equipment leases 865,206 853,330 Rentals

received in advance 90,281 91,485 Deferred tax liability 513,630

461,967

Total liabilities $ 9,679,007 $

9,335,186

Shareholders’ Equity Preferred Stock, $0.01

par value; 50,000,000 shares authorized; no shares issued or

outstanding — — Class A common stock, $0.01 par value; authorized

500,000,000 shares; issued and outstanding 102,829,369 and

102,582,669 shares at March 31, 2016 and December 31, 2015,

respectively 1,010 1,010 Class B Non-Voting common stock, $0.01 par

value; authorized 10,000,000 shares; no shares issued or

outstanding — — Paid-in capital 2,224,151 2,227,376 Retained

earnings 879,242 791,526

Total shareholders’

equity $ 3,104,403 $ 3,019,912

Total

liabilities and shareholders’ equity $ 12,783,410 $

12,355,098

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

share, per share amounts and percentages)

Three Months Ended March

31,

2016 2015 (unaudited) Revenues

Rental of flight equipment $ 317,198 $ 269,256 Aircraft sales,

trading and other 26,130 9,059 Total revenues 343,328

278,315

Expenses Interest 60,960 55,403 Amortization of debt

discounts and issuance costs 7,161 7,682 Interest

expense 68,121 63,085 Depreciation of flight equipment 108,575

91,012 Settlement — 72,000 Selling, general and administrative

19,402 19,098 Stock-based compensation 3,239 3,146

Total expenses 199,337 248,341 Income before taxes

143,991 29,974 Income tax expense (51,133 ) (10,642 ) Net income $

92,858 $ 19,332

Net income per share of

Class A and B common stock Basic $ 0.90 $ 0.19 Diluted $ 0.85 $

0.19

Weighted-average shares outstanding Basic 102,679,411

102,455,040 Diluted 110,563,526 110,558,709

Other

financial data Pre-tax profit margin 41.9 % 10.8 % Adjusted net

income(1) $ 151,141 $ 112,802 Adjusted margin(1) 44.4 % 40.5 %

Adjusted diluted earnings per share(1) $ 1.38 $ 1.03 (1)

Adjusted net income (defined as net income

excluding the effects of certain non-cash items, one-time or

non-recurring items, such as settlement expense, net of recoveries,

that are not expected to continue in the future and certain other

items), adjusted margin (defined as adjusted net income divided by

total revenues, excluding insurance recoveries) and adjusted

diluted earnings per share (defined as adjusted net income divided

by the weighted average diluted common shares outstanding) are

measures of operating performance that are not defined by GAAP and

should not be considered as an alternative to net income, pre-tax

profit margin, earnings per share, and diluted earnings per share,

or any other performance measures derived in accordance with GAAP.

Adjusted net income, adjusted margin and adjusted diluted earnings

per share, are presented as supplemental disclosure because

management believes they provide useful information on our earnings

from ongoing operations.

Management and our board of directors use

adjusted net income, adjusted margin and adjusted diluted earnings

per share to assess our consolidated financial and operating

performance. Management believes these measures are helpful in

evaluating the operating performance of our ongoing operations and

identifying trends in our performance, because they remove the

effects of certain non-cash items, one-time or non-recurring items

that are not expected to continue in the future and certain other

items from our operating results. Adjusted net income, adjusted

margin and adjusted diluted earnings per share, however, should not

be considered in isolation or as a substitute for analysis of our

operating results or cash flows as reported under GAAP. Adjusted

net income, adjusted margin and adjusted diluted earnings per share

do not reflect our cash expenditures or changes in or cash

requirements for our working capital needs. In addition, our

calculation of adjusted net income, adjusted margin and adjusted

diluted earnings per share may differ from the adjusted net income,

adjusted margin and adjusted diluted earnings per share or

analogous calculations of other companies in our industry, limiting

their usefulness as a comparative measure.

The following tables show the

reconciliation of net income to adjusted net income and adjusted

margin (in thousands, except percentages):

Three Months Ended March 31, 2016

2015 Reconciliation of net income to adjusted net

income: (unaudited) Net income $ 92,858 $ 19,332

Amortization of debt discounts and issuance costs 7,161 7,682

Stock-based compensation 3,239 3,146 Settlement — 72,000 Insurance

recovery on settlement (3,250 ) — Provision for income taxes 51,133

10,642 Adjusted net income $ 151,141 $ 112,802

Adjusted margin(1) 44.4 % 40.5 % (1) Adjusted margin is

adjusted net income divided by total revenues, excluding insurance

recoveries. The following table shows the

reconciliation of net income to adjusted diluted earnings per share

(in thousands, except share and per share amounts):

Air Lease

Corporation and Subsidiaries CONSOLIDATED STATEMENTS OF

INCOME (In thousands, except share, per share amounts and

percentages) Three Months Ended March 31,

2016 2015 Reconciliation of net income to

adjusted diluted earnings per share: (unaudited) Net

income $ 92,858 $ 19,332 Amortization of debt discounts and

issuance costs 7,161 7,682 Stock-based compensation 3,239 3,146

Settlement — 72,000 Insurance recovery on settlement (3,250 ) —

Provision for income taxes 51,133 10,642 Adjusted net income

$ 151,141 $ 112,802 Assumed conversion of convertible senior notes

1,454 1,433 Adjusted net income plus assumed conversions $

152,595 $ 114,235 Weighted-average diluted shares outstanding

110,563,526 110,558,709 Adjusted diluted earnings per share

$ 1.38 $ 1.03

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

Three Months Ended March 31, 2016

2015 (unaudited) Operating Activities Net

income $ 92,858 $ 19,332 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation of flight

equipment 108,575 91,012 Settlement — 72,000 Stock-based

compensation 3,239 3,146 Deferred taxes 51,133 10,642 Amortization

of debt discounts and issuance costs 7,161 7,682 Gain on aircraft

sales, trading and other activity (20,979 ) (8,030 ) Changes in

operating assets and liabilities: Other assets 9,446 20,005 Accrued

interest and other payables (22,483 ) (7,476 ) Rentals received in

advance (1,204 ) 1,188 Net cash provided by operating

activities 227,746 209,501

Investing

Activities Acquisition of flight equipment under operating

lease (458,435 ) (488,175 ) Payments for deposits on flight

equipment purchases (200,908 ) (162,660 ) Proceeds from aircraft

sales, trading and other activity 191,824 102,423 Acquisition of

furnishings, equipment and other assets (52,845 ) (65,174 ) Net

cash used in investing activities (520,364 ) (613,586 )

Financing Activities Cash dividends paid (5,129 ) (4,094 )

Tax withholdings on stock-based compensation (5,877 ) (5,302 ) Net

change in unsecured revolving facilities 879,000 (231,000 )

Proceeds from debt financings 100,000 692,134 Payments in reduction

of debt financings (680,885 ) (144,034 ) Net change in restricted

cash 38 (9,510 ) Debt issuance costs (198 ) (978 ) Security

deposits and maintenance reserve receipts 26,920 37,226 Security

deposits and maintenance reserve disbursements (15,112 ) (3,020 )

Net cash provided by financing activities 298,757 331,422

Net increase/(decrease) in cash 6,139 (72,663 ) Cash and

cash equivalents at beginning of period 156,675 282,819

Cash and cash equivalents at end of period $ 162,814

$ 210,156

Supplemental Disclosure of Cash Flow

Information Cash paid during the period for interest, including

capitalized interest of $9,470 and $10,704 at March 31, 2016 and

2015, respectively $ 86,481 $ 62,472

Supplemental Disclosure of

Noncash Activities Buyer furnished equipment, capitalized

interest, deposits on flight equipment purchases and seller

financing applied to acquisition of flight equipment and other

assets applied to payments for deposits on flight equipment

purchases $ 290,195 $ 239,276 Cash dividends declared, not yet paid

$ 5,142 $ 4,101

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160505006580/en/

Air Lease CorporationInvestors:Ryan McKennaVice

President310-553-0555rmckenna@airleasecorp.comorMedia:Laura

St. JohnManager, Media and Investor

Relations310-553-0555lstjohn@airleasecorp.com

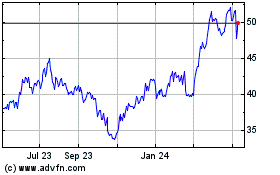

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

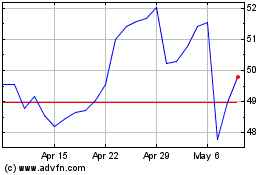

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024