PARIS—Long before Air France workers tore their managers' shirts

off, the company knew it had a staffing problem.

Nearly 10 years ago, as the freshly forged Franco-Dutch alliance

Air France-KLM was preparing to launch its own budget carrier,

management sat down with pilots to press them to accept pay cuts so

that the new unit would better compete. Paying workers at the

carrier, Transavia, as much as their Air France colleagues, "was

not the end of the world," pilot representative Philippe Raffin

said.

"Yes, it's nothing. But it's my profit margin," said Jean-Cyril

Spinetta, then chief executive of Air France-KLM.

A decade later, the standoff with pilots continues to haunt Air

France-KLM. Management sat down Thursday with workers in downtown

Paris, in a bid to relaunch negotiations over a sweeping plan

designed to fend off no-frills rivals as well as Gulf airlines

offering fancier flights to Asia.

Those talks ran aground due to pilots' refusal to fly more hours

without more pay, leaving the carrier threatening thousands of job

cuts and creating a frenzied atmosphere that fueled a worker ambush

on management earlier this month.

Years of losses have left Air France-KLM with more than €4.5

billion ($5.10 billion) in net debt at the end of June. Shares in

the airline are down almost 20% so far this year, in contrast to

many of its peers who are racking up hefty profits.

"Our costs are higher than our competitors and our economic

performance is not at their level," said Air France-KLM CEO

Alexandre de Juniac in a recent television interview.

The travails of Air France-KLM expose the shortcomings of its

merger, unveiled with much fanfare in 2004 as the new model for

national carriers. While the airlines combined their businesses

financially, they kept largely separate operational structures,

reflecting regulatory hurdles on international landing rights,

political interests and strong labor unions.

"We didn't imagine competition would transform to that point,"

said Jean-Marc Espalioux, an Air France board member at the time.

"The merger would yield synergies and commercial alliances would

boost revenue-that was it."

Since then, Air France has struggled—even with a series of

restructuring plans—to compete with rivals and slash costs.

By contrast, British Airways battled through protracted labor

disputes to force cost savings that have translated into

double-digit profitability. That focus was applied again when

British Airways merged with Spain's Iberia to create the

International Consolidated Airlines Group that now includes Vueling

and Aer Lingus. Iberia is now profitable and shares in IAG are up

almost 25% this year.

Air France has wrestled especially with its powerful pilots who

have slowed the company's efforts to expand Transavia.

Air France handed over some of that leverage: Under a 2007

bargaining agreement, pilots have a say in the number of aircraft

the budget unit can operate from France.

"Pilots have the nuclear button, they have the capacity to

ground the airline," said Jean-Pierre Bernasse, a union

representative for Air France maintenance crew. Other workers

aren't as unionized or can be replaced during a strike, he

said.

When Air France sought to muscle up Transavia a year ago, pilots

balked. The ensuing two-week pilot strike in September 2014 cost

Air France almost €425 million, without which it would have posted

a profit for the year.

"KLM workers were inflamed that Air France's pilots led the

group into a loss," said Jacob de Vries, a ground staff union

representative at the Dutch carrier.

Since then, pilots have yielded some ground, agreeing after the

strike last year to increase Transavia's fleet in France. Air

France narrowed losses in 2014 and reduced its payroll size without

firing workers; some employees, such as technicians, have accepted

working more days and taken pay cuts.

Still, its expenses are much higher than many rivals.

Air France's unit costs, measured by costs per available seat

kilometer, were 13% higher than KLM's last year and their combined

costs are 12% above IAG's, according to the CAPA Center for

Aviation. Air France-KLM's cost disadvantage is even greater

against budget carrier EasyJet, with 38% higher costs.

Productivity of Air France-KLM pilots lags that at competitors.

On average, each pilot for Ryanair Holdings PLC, Europe's largest

budget airline, generates 40% more available seat miles—a standard

measure of airline capacity—than a typical Air France-KLM

pilot.

Now, Air France is scrambling to adapt. It is canceling some

aircraft orders, shuttering some long-haul routes and pushing

pilots to fly more for the same pay.

"It's like a pay cut," said Emmanuel Mistrali, said a spokesman

for the main pilots union SNPL.

Competition is set to intensify. Barcelona-based Vueling plans

to open a base in Air France's backyard, at Charles de Gaulle

airport.

Budget airlines represent only around 17%-18% of the French

market, compared with around 30% Europe-wide, said John Grant,

executive vice president at aviation consultancy OAG.

"It is going to get a lot hotter," said Mr. Grant.

Ellen Proper contributed to this article.

Write to Inti Landauro at inti.landauro@wsj.com and Robert Wall

at robert.wall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 22, 2015 08:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

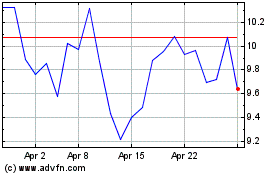

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024