Apartment Investment and Management Company (“Aimco”) (NYSE:

AIV) announced today results for first quarter 2016.

Chairman and Chief Executive Officer Terry Considine comments:

“Aimco enjoyed a solid first quarter. Operating results were ahead

of guidance with accelerating revenue growth and good cost control.

New and renewal lease rates increased at a greater rate in first

quarter 2016 than they did in first quarter 2015. Portfolio quality

improved with average monthly revenue per apartment home now

exceeding $1,860. Construction continues at two phased

redevelopments in Center City Philadelphia: Park Towne Place and

The Sterling. The Aimco balance sheet continues its steady

improvement. For the fourth consecutive year, Aimco was recognized

by The Denver Post as one of Colorado’s Top Workplaces.”

Chief Financial Officer Paul Beldin adds: “First quarter AFFO of

$0.51 per share increased 11% compared to first quarter 2015 and

was $0.05 per share ahead of the midpoint of our guidance range. Of

this outperformance, $0.02 per share was driven by Same Store

property operating results and $0.03 per share was due to the

timing of income tax related items and Capital Replacements

spending. We are increasing our full year Pro forma FFO and AFFO

guidance by $0.01 at the midpoints to take into account first

quarter results and our expectations for the balance of the year.

We are also updating our full year Same Store NOI growth guidance

to a range of 5.5% to 6.5%, an increase of 25 basis points at the

midpoint.”

Financial Results: First Quarter AFFO

Up 11%

FIRST

QUARTER (all items per common share - diluted)

2016 2015 Variance Net

income $ 0.15 $ 0.58

(74 )%

Funds From Operations (FFO)

$ 0.57 $ 0.51

12 % Add back Aimco share of preferred

equity redemption related amounts $ —

$ 0.01 (100 )%

Pro forma Funds From

Operations (Pro forma FFO) $ 0.57

$ 0.52 10

% Deduct Aimco share of Capital Replacements $

(0.06 ) $ (0.06 ) — %

Adjusted Funds From Operations

(AFFO)

$ 0.51 $

0.46 11 %

Pro forma FFO (per diluted common share) -

Year-over-year, first quarter Pro forma FFO increased 10% as a

result of: Property Net Operating Income growth; increased

contribution from redevelopment and acquisition communities; and

lower interest expense. These increases were partially offset by

lower non-core earnings, including tax benefit and amortization of

deferred tax credit income, and by the loss of income from

apartment communities that were sold in 2015.

Adjusted Funds from Operations (per diluted common

share) - Year-over-year, first quarter AFFO increased 11% as a

result of higher Pro forma FFO. As Aimco concentrates its

investment capital in higher-quality, higher price point apartment

communities, its free cash flow margins are increasing and

contributing to a higher AFFO growth rate.

Operating Results: First Quarter

Conventional Same Store NOI Up 7.1%

FIRST QUARTER

Year-over-Year Sequential

2016 2015

Variance 4th Qtr. Variance

Average Rent Per Apartment Home $1,614 $1,535

5.1 % $1,604 0.6 % Other Income Per Apartment

Home 179 177 1.1 % 170

5.3 % Average Revenue Per Apartment Home $1,793

$1,712 4.7 % $1,774 1.1 % Average Daily

Occupancy 96.0 % 95.9 % 0.1 %

95.5 % 0.5 %

$ in Millions

Revenue $172.9 $165.0 4.8

% $170.2 1.6 % Expenses 53.9

53.9 0.1 % 51.8 4.1 % NOI $119.0

$111.1 7.1 % $118.4 0.5 %

Conventional Same Store Rental Rates - Aimco measures

changes in rental rates by comparing, on a lease-by-lease basis,

the rate on a newly executed lease to the rate on the expiring

lease for that same apartment. Newly executed leases are classified

either as a new lease, where a vacant apartment is leased to a new

customer, or as a renewal. The table below details new and renewal

lease rates for Aimco’s first quarter 2016 Same Store

portfolio.

2016 Jan Feb

Mar 1st Qtr. Renewal rent increases

5.7% 6.0% 6.3% 6.0% New lease

rent increases 2.8% 3.2% 4.4%

3.5% Weighted average rent increases 4.0% 4.3%

5.4% 4.6%

Conventional Non-Same Store NOI - Aimco’s Conventional

non-Same Store NOI for first quarter 2016 increased by 26%

year-over-year and 3.3% as compared to fourth quarter 2015,

primarily due to increasing contribution from Aimco’s Redevelopment

apartment communities.

FIRST QUARTER

Year-over-Year Sequential

$ in Millions 2016 2015

Variance 4th Qtr.

Variance Conventional Redevelopment and Development

$11.1 $7.8 41.8 % $10.3 7.2 %

Conventional Acquisition 0.8 0.1 782.6

% 0.9 (10.7 )% Conventional Other 9.9

9.4 5.8 % 9.9 (0.2 )%

Total

Conventional non-Same Store $21.8

$17.3 26.0 % $21.1

3.3 %

Redevelopment and Development:

Progressing as Planned

During first quarter, Aimco invested $31 million in

redevelopment, most of which related to the ongoing redevelopment

of The Sterling and Park Towne Place, mixed-use communities located

in Center City Philadelphia. Since 2014, Aimco has completed the

redevelopment of 279 apartment homes, or 68% of the total approved

for redevelopment, at The Sterling. At March 31, 2016, Aimco

had leased 91% of the completed apartment homes in The Sterling, at

rental rates above underwriting. At Park Towne Place, Aimco had

completed redevelopment of 223 apartment homes, or 47% of the total

approved for redevelopment. At March 31, 2016, Aimco had

leased 88% of the completed apartment homes in Park Towne Place, at

rental rates above underwriting. Costs for both projects are

consistent with underwriting.

During first quarter, Aimco invested $15.6 million in its One

Canal development in Boston. Aimco expects completion of

construction in second quarter 2016. Leasing is progressing as

planned and at March 31, 2016, 6% of the apartment homes were

leased at rental rates ahead of underwriting. Initial occupancy is

expected in May 2016.

Aimco continued the lease-up of Vivo, a 91 apartment home

community located in Cambridge, Massachusetts. At March 31, 2016,

62% of the apartment homes were leased at rental rates above

underwriting.

Portfolio Management: Revenue Per

Apartment Home Up 9% to $1,864

Aimco portfolio strategy seeks predictable rent growth from a

portfolio of apartment communities that is diversified across “A,”

“B” and “C+” price points, averaging “B/B+” in quality, and that is

also diversified across large coastal and job growth markets in the

U.S. Aimco target markets are primarily coastal markets, and also

include several Sun Belt cities and Chicago, Illinois. Please refer

to the Glossary for a description of our Portfolio Quality

Ratings.

As part of its portfolio strategy, Aimco seeks to sell each year

the lowest-rated 5% to 10% of its portfolio and to reinvest the

proceeds from such sales in higher quality apartment communities

through redevelopment of communities in its current portfolio,

occasional development of new communities, and selective

acquisitions. Through this disciplined approach to capital

recycling, Aimco has significantly increased the quality and

expected growth rate of its portfolio.

FIRST QUARTER

2016 2015

Variance Communities 139 141

(2 ) Apartment Homes 40,376

42,566 (2,190 ) % NOI in Target Markets

91 % 87 % 4 % Revenue per Apartment Home

$ 1,864 $ 1,704 9 %

Portfolio Average Rents as a Percentage of Local Market Average

Rents 112 % 109 % 3 % Percentage A (1Q

2016 Revenue per Apartment Home $2,367) 48 %

43 % 5 % Percentage B (1Q 2016 Revenue per Apartment Home

$1,687) 35 % 36 % (1 )% Percentage C+

(1Q 2016 Revenue per Apartment Home $1,552) 17 %

19 % (2 )% Percentage C — % 2 %

(2 )% NOI Margin 68 % 66 % 2 %

Free Cash Flow Margin* 62 % 59 % 3 %

* Assumes Capital Replacements spending of

$1,200 per apartment home.

First Quarter 2016 Portfolio Transactions - In first

quarter, Aimco sold one Conventional apartment community with 96

apartment homes for $10 million in gross proceeds. Aimco’s share of

net sales proceeds after payment of transaction costs was $9.6

million. Aimco did not acquire any apartment communities during the

first quarter.

Quarter-End Portfolio - First quarter 2016 Conventional

portfolio average monthly revenue per apartment home was $1,864, a

9% increase compared to first quarter 2015, due to: year-over-year

Same Store monthly revenue per apartment home growth of 4.7%; the

sale of Conventional apartment communities in 2015 and 2016, with

average monthly revenues per apartment home substantially lower

than those of the retained portfolio; and reinvestment of the sales

proceeds through redevelopment, development and acquisition of

apartment communities with higher rents and better prospects.

Bay Area Acquisition Update - As previously reported,

Aimco has agreed to acquire for $320 million an apartment community

with 463 apartment homes currently under construction in Northern

California. Closing of the acquisition is expected to occur upon

completion of construction, which is anticipated for summer 2016.

Aimco has begun leasing and at March 31, 2016, had leased

approximately 5% of the apartment homes at rental rates above

underwriting.

Balance Sheet and

Liquidity:

Components of Aimco Leverage

AS OF MARCH 31,

2016 $ in Millions Amount

% of Total

Weighted Avg.Maturity

(Yrs.)

Aimco share of long-term, non-recourse property debt

$ 3,695.8 91 % 7.9 Outstanding borrowings on

revolving credit facility 106.1 3 %

2.5 Preferred securities* 246.0

6 % 40.0 Total leverage $ 4,047.9

100 % 9.6

* Aimco’s preferred securities are

perpetual in nature; however, for illustrative purposes,

Aimcocomputes the weighted average maturity of its total leverage

assuming a 40-year maturityon its preferred securities.

Leverage Ratios

Aimco target leverage ratios are: Debt and Preferred Equity to

EBITDA below 7.0x; and EBITDA to Interest Expense and Preferred

Dividends greater than 2.5x. Aimco also focuses on the ratios of

Debt to EBITDA and EBITDA to Interest Expense. Please see the

Glossary for definitions of these metrics.

TRAILING-TWELVE-MONTHSENDED

MARCH 31,

2016 2015 Debt to EBITDA

6.4x 6.5x Debt and Preferred Equity to EBITDA

6.8x 6.9x EBITDA to Interest Expense

3.2x 2.8x EBITDA to Interest Expense and Preferred

Dividends 2.9x 2.6x

Future leverage reduction is expected both from earnings growth,

especially as apartment communities now being redeveloped or

developed are completed and leased, and from regularly scheduled

property debt amortization funded from retained earnings.

During the second quarter, Aimco expects to provide notice of

redemption to the holders of its 7% Class Z Perpetual Preferred

Stock. Such securities have a redemption value of $35 million and

are first available for redemption on July 29, 2016.

Liquidity

Aimco’s only recourse debt at March 31, 2016, was its

revolving credit facility, which Aimco uses for working capital and

other short-term purposes, and to secure letters of credit.

At quarter-end, Aimco had outstanding borrowings on its

revolving credit facility of $106.1 million and available capacity

of $463.9 million, after consideration of $30 million of letters of

credit backed by the facility. Aimco also held cash and restricted

cash on hand of $152.9 million.

Finally, Aimco held properties in its unencumbered asset pool

with a total estimated fair market value of approximately $1.8

billion.

Equity Activity

Dividend - As previously announced, the Aimco Board of

Directors declared a quarterly cash dividend of $0.33 per share of

Class A Common Stock for the quarter ended March 31, 2016. On

an annualized basis, this represents an increase of 12% compared to

the dividends paid during 2015. This dividend is payable on May 31,

2016, to stockholders of record on May 20, 2016.

2016 Outlook: Guidance Raised to

Reflect First Quarter Outperformance

($ Amounts

represent Aimco Share)

FULL YEAR2016

PREVIOUS FULLYEAR 2016

FULL YEAR2015

Net

Income per share $0.41 to $0.51 $0.37 to

$0.47 $1.52

Pro forma FFO per share

$2.24 to $2.34 $2.23 to $2.33 $2.23

AFFO per

share $1.92 to $2.02 $1.91 to $2.01

$1.88

Conventional Same Store Operating Measures

Revenue change compared to prior

year 4.50% to 5.00% 4.50% to 5.00% 4.5%

Expense change compared to prior year 1.75% to 2.25%

2.50% to 3.00% 2.1% NOI change compared to prior year

5.50% to 6.50% 5.25% to 6.25% 5.6%

($ Amounts

represent Aimco Share)

SECONDQUARTER 2016

Net income per share

$0.08 to $0.12

Pro forma FFO per share

$0.54 to $0.58

AFFO per share $0.45 to $0.49

Conventional Same Store Operating

Measures NOI change compared to first

quarter 2016 0.25% to 1.25% NOI change compared to

second quarter 2015 3.50% to 4.50%

Aimco’s guidance for second quarter year-over-year Same Store

NOI growth of 4% at the midpoint reflects a lower rate of growth

than in second quarter 2015. This lower rate of growth is due to

two factors:

- First, during 2016, Aimco has

undertaken to reduce the number of lease expirations occurring in

off-peak months and to move more leasing volume into the second and

third quarters where Aimco typically enjoys greater pricing power.

The increased number of lease expirations will increase frictional

vacancy during the second quarter, reducing average daily occupancy

and increasing turnover expenses. Together, these factors are

expected to reduce second quarter year-over-year Same Store NOI

growth by approximately 100 basis points.

- Second, Aimco’s second quarter expenses

last year included non-routine items that resulted in negative

year-over-year expense growth for second quarter 2015. The

comparison of Aimco’s second quarter expenses for 2016 to the

reduced level in 2015 is expected to reduce year-over-year Same

Store NOI growth for second quarter 2016 by approximately 100 basis

points.

Earnings Conference Call

Information

Live Conference Call:

Conference Call Replay: Friday, April 29, 2016 at 1:00 p.m.

ET Replay available until 9:00 a.m. ET on July 29, 2016 Domestic

Dial-In Number: 1-888-317-6003 Domestic Dial-In Number:

1-877-344-7529 International Dial-In Number: 1-412-317-6061

International Dial-In Number: 1-412-317-0088 Passcode: 0213315

Passcode: 10083886

Live webcast and replay:

http://www.aimco.com/investors

Supplemental Information

The full text of this Earnings Release and the Supplemental

Information referenced in this release are available on Aimco’s

website at http://www.aimco.com/investors.

Glossary & Reconciliations of

Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release

and the Supplemental Information include certain financial measures

used by Aimco management that are measures not defined under

accounting principles generally accepted in the United States

(“GAAP”). These measures are defined in the Glossary in the

Supplemental Information and, where appropriate, reconciled to the

most comparable GAAP measures.

About Aimco

Aimco is a real estate investment trust focused on the ownership

and management of quality apartment communities located in selected

markets in the United States. Aimco is one of the country’s largest

owners and operators of apartments, with 195 communities in 22

states and the District of Columbia. Aimco common shares are traded

on the New York Stock Exchange under the ticker symbol AIV, and are

included in the S&P 500. For more information about Aimco,

please visit our website at www.aimco.com.

Forward-looking

Statements

This Earnings Release and Supplemental Information contain

forward-looking statements within the meaning of the federal

securities laws, including, without limitation, statements

regarding projected results and specifically forecasts of: second

quarter and full year 2016 results, including but not limited to:

Pro forma FFO and selected components thereof; AFFO; Aimco

redevelopment and development investments, timelines and Net

Operating Income contribution; Aimco acquisition and lease-up

timelines and Net Operating Income contribution; expectations

regarding sales of Aimco apartment communities and the use of

proceeds thereof; and Aimco liquidity and leverage metrics.

These forward-looking statements are based on management’s

judgment as of this date which is subject to risks and

uncertainties. Risks and uncertainties include, but are not limited

to: Aimco’s ability to maintain current or meet projected

occupancy, rental rate and property operating results; the effect

of acquisitions, dispositions, redevelopments and developments;

Aimco’s ability to meet budgeted costs and timelines, and achieve

budgeted rental rates related to Aimco developments and

redevelopments; Aimco’s ability to meet timelines and budgeted

rental rates related to Aimco lease-up properties; and Aimco’s

ability to comply with debt covenants, including financial coverage

ratios.

Actual results may differ materially from those described in

these forward-looking statements and, in addition, will be affected

by a variety of risks and factors, some of which are beyond the

control of Aimco, including, without limitation: real estate risks,

including fluctuations in real estate values and the general

economic climate in the markets in which we operate and competition

for residents in such markets; national and local economic

conditions, including the pace of job growth and the level of

unemployment; the amount, location and quality of competitive new

housing supply; financing risks, including the availability and

cost of capital markets’ financing and the risk that our cash flows

from operations may be insufficient to meet required payments of

principal and interest; the risk that our earnings may not be

sufficient to maintain compliance with debt covenants; the terms of

governmental regulations that affect Aimco and interpretations of

those regulations; the competitive environment in which Aimco

operates; the timing of acquisitions, dispositions, redevelopments

and developments; insurance risk, including the cost of insurance;

natural disasters and severe weather such as hurricanes;

litigation, including costs associated with prosecuting or

defending claims and any adverse outcomes; energy costs; and

possible environmental liabilities, including costs, fines or

penalties that may be incurred due to necessary remediation of

contamination of apartment communities presently or previously

owned by Aimco. In addition, Aimco’s current and continuing

qualification as a real estate investment trust involves the

application of highly technical and complex provisions of the

Internal Revenue Code and depends on its ability to meet the

various requirements imposed by the Internal Revenue Code, through

actual operating results, distribution levels and diversity of

stock ownership.

Readers should carefully review Aimco’s financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended

December 31, 2015, and the other documents Aimco files from

time to time with the Securities and Exchange Commission.

These forward-looking statements reflect management’s judgment

as of this date, and Aimco assumes no obligation to revise or

update them to reflect future events or circumstances. This press

release does not constitute an offer of securities for sale.

Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited) Three Months Ended March 31,

2016 2015 REVENUES Rental and other property

revenues $ 241,481 $ 238,289 Tax credit and asset management

revenues 4,758 5,976 Total revenues 246,239

244,265

OPERATING EXPENSES Property operating

expenses 88,397 95,492 Investment management expenses 975 1,603

Depreciation and amortization 79,828 74,432 General and

administrative expenses 11,935 10,652 Other expenses, net 1,570

1,019 Total operating expenses 182,705 183,198

Operating income 63,534 61,067 Interest income 1,835

1,725 Interest expense (47,634 ) (53,520 ) Other, net 77

2,264

Income before income taxes and gain on

dispositions 17,812 11,536 Income tax benefit 5,886

6,921

Income before gain on dispositions 23,698

18,457 Gain on dispositions of real estate, net of tax 6,187

85,693

Net income 29,885 104,150 Noncontrolling

interests: Net income attributable to noncontrolling interests in

consolidated real estate partnerships (930 ) (4,756 ) Net income

attributable to preferred noncontrolling interests in Aimco OP

(1,726 ) (1,736 ) Net income attributable to common noncontrolling

interests in Aimco OP (1,172 ) (4,398 ) Net income attributable to

noncontrolling interests (3,828 ) (10,890 )

Net income

attributable to Aimco 26,057 93,260 Net income attributable to

Aimco preferred stockholders (2,757 ) (3,522 ) Net income

attributable to participating securities (77 ) (394 )

Net income

attributable to Aimco common stockholders $ 23,223 $

89,344 Net income attributable to Aimco per common

share - basic and diluted $ 0.15 $ 0.58

Weighted average common shares outstanding – basic 155,791

153,821 Weighted average common shares outstanding – diluted

156,117 154,277

Consolidated Balance

Sheets (in thousands) (unaudited) March

31, 2016 December 31, 2015 ASSETS Buildings and

improvements $ 6,525,006 $ 6,446,326 Land 1,861,157

1,861,157 Total real estate 8,386,163 8,307,483 Accumulated

depreciation (2,858,642 ) (2,778,022 ) Net real estate 5,527,521

5,529,461 Cash and cash equivalents 64,454 50,789 Restricted cash

90,158 86,956 Other assets 460,080 448,405 Assets held for sale —

3,070 Total assets $ 6,142,213 $ 6,118,681

LIABILITIES AND EQUITY Non-recourse property

debt, net $ 3,811,510 $ 3,822,141 Revolving credit facility

borrowings 106,080 27,000 Total indebtedness

3,917,590 3,849,141 Accounts payable 37,792 36,123 Accrued

liabilities and other 305,604 317,481 Deferred income 59,961 64,052

Liabilities related to assets held for sale — 53

Total liabilities 4,320,947 4,266,850 Preferred

noncontrolling interests in Aimco OP 86,201 87,926 Equity:

Perpetual Preferred Stock 159,126 159,126 Class A Common Stock

1,566 1,563 Additional paid-in capital 4,068,196 4,064,659

Accumulated other comprehensive loss (431 ) (6,040 ) Distributions

in excess of earnings (2,625,295 ) (2,596,917 ) Total Aimco equity

1,603,162 1,622,391 Noncontrolling interests in

consolidated real estate partnerships 142,742 151,365 Common

noncontrolling interests in Aimco OP (10,839 ) (9,851 ) Total

equity 1,735,065 1,763,905 Total liabilities and

equity $ 6,142,213 $ 6,118,681

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428006932/en/

AimcoElizabeth Coalson, 303-691-4350Vice President-Investor

Relationsinvestor@aimco.com

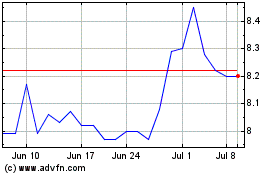

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

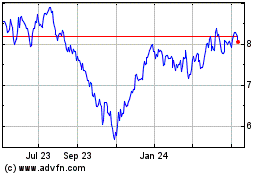

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2023 to Apr 2024