Ahold trading statement fourth quarter and full year 2013

January 16 2014 - 12:44AM

Zaandam, the Netherlands -

Ahold today announced consolidated net sales of €7.5 billion for

the fourth quarter of 2013, a decrease of 1.1% at constant exchange

rates compared to the fourth quarter of 2012. At current exchange

rates net sales were down 4.2%.

For the full year 2013, consolidated net sales

were €32.6 billion, an increase of 2.0% at constant exchange rates

compared to 2012. At current exchange rates net sales were down

0.2%.

In the United States sales in the fourth

quarter were down 2.1%, reflecting a contracting food market

and the sales effect of Hurricane Sandy last year. We continue to

build our online business and opened another 31 pick-up

points, bringing the total to 120 in the United States.

Market share for the year was ahead of 2012 though down slightly in

the fourth quarter due to the strong comparative period last year

as a result of Hurricane Sandy. Supported by the ongoing progress

on our cost reduction program, we expect underlying operating

margin to be broadly in line with the performance during the

year.

In the Netherlands market conditions remained

challenging and sales growth of 0.7% was mainly driven by the

strong performance of our online businesses, both

at albert.nl and bol.com. The addition of the

C1000 stores is on track with 39 stores converted by year end. We

continue to be pleased with the performance of our Belgian stores

where we operated 19 stores at year end. At Albert Heijn

transactions remained broadly stable at an identical base while

basket size continued to be under pressure. For the full year

market share at Albert Heijn increased slightly, although market

share during the quarter was under pressure, similar to the third

quarter. We expect the underlying operating margin to be slightly

ahead of the prior quarter.

Our Slovakian business will no longer be reported

under Other Europe but as discontinued operations following the

announcement of its divestment. In an ongoing tough environment in

the Czech Republic, sales were down 1.9%, while for the year

underlying operating margin is expected to continue to show an

improving trend.

Ahold Trading statement Q4 / FY

2013

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Ahold via Globenewswire

HUG#1755022

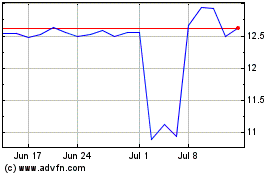

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

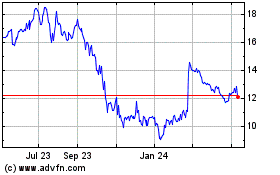

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024