Ahead of the Tape: General Electric Is Overdue for Good News -- WSJ

April 21 2017 - 3:03AM

Dow Jones News

By Steven Russolillo

General Electric Co. is in need of an energy boost.

The industrial bellwether has been a perennial underperformer,

trailing the Dow Jones Industrial Average over the past one, three,

five and 10 years. Since the beginning of last year, they have

registered three separate rallies in the double-digit percentages.

Unfortunately, all three were short-lived.

Friday's earnings report could be the needed catalyst to get the

shares going again, even though the headline numbers probably won't

be great.

Analysts estimate first-quarter earnings of 17 cents a share,

versus 21 cents a year earlier. Revenue is expected to have dropped

4.4% to $26.4 billion. GE's sales have missed estimates in 10 of

the past 12 quarters, according to FactSet, although much of that

is due to the slide in oil prices hitting the company's oil-and-gas

business.

But there are other reasons for optimism: Under pressure from

activist investor Trian Fund Management, GE said last month that it

would double its planned cost cuts in industrial operations to $2

billion over two years. The stock has risen about 4% since then,

outpacing the blue-chip index. GE could use Friday's earnings call

as a way to outline more specific ways to trim costs.

GE has spent the past two years divesting its GE Capital unit

and focusing more on the industrial part of the business. As The

Wall Street Journal reported earlier this month, GE is considering

a sale of its consumer-lighting business.

These moves have helped. The Federal Reserve no longer deems GE

as a "systemically important financial institution," meaning it is

free from the restrictions on buybacks. And then there is its

agreement announced last fall to combine its oil-and-gas business

with Baker Hughes Inc. The pact should prove beneficial once oil

prices move higher.

GE's shift away from financials makes it more of a global growth

story. And economies ranging from Europe to Japan to China have

been on the upswing, which should benefit GE. Plus, already a big

buyer of its own stock, GE said in January it would set aside $11

billion to $13 billion for share repurchases and another $8 billion

for dividends. The 3.1% dividend yield is compelling and could be

boosted by cash coming from cost savings.

The stock is reasonably priced, too. Fetching 17 times earnings

projected over the next 12 months, GE's forward multiple is near

its lowest over the past year. It is also cheaper than Caterpillar

Inc. and Deere & Co., while roughly in line with Honeywell

International Inc.

The ingredients are in place for yet another burst of enthusiasm

to pierce the gloom for GE's long-suffering shareholders.

(END) Dow Jones Newswires

April 21, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

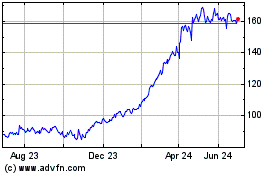

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

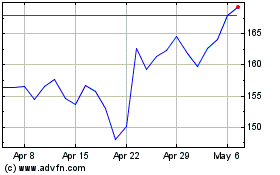

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024