Ahead of the Tape: Don't Expect Shock From Visa -- WSJ

October 24 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

The so-called quiet period before Visa Inc.'s coming earnings

report has been anything but that.

Just last week, Visa announced its chief executive was

resigning, it boosted its dividend and it announced a new

bitcoin-style network. Next up is Monday's earnings report. If

history is a guide, the release should offer fewer surprises.

Analysts polled by FactSet estimate Visa earned 73 cents a share

in the third quarter, up 17% from a year ago. The actual number

likely won't deviate much. The card giant has exceeded Wall

Street's estimates with uncanny regularity, missing earnings

forecasts only twice in the past five years. Both misses were

slight.

Like rival MasterCard Inc., Visa is a payment network that

processes credit-card and debit-card transactions, making a

percentage off each. It doesn't issue cards, lend money or set

interest rates, so it doesn't assume credit risk. That has allowed

it to benefit in recent years as consumers increasingly pay with

plastic.

Visa's stock has been a big winner since it returned to the

public markets in March 2008, rising 23% compounded annually and

far outpacing the S&P 500. Yet it now faces stiff competition,

with many financial-technology startups aiming to disrupt

traditional payments. So far, Visa hasn't just navigated this

environment well, but also maintained its position as the dominant

payments player. It has partnered with some fintech companies with

the hope of boosting the use of electronic payments globally.

In a deal announced over the summer, PayPal Holdings Inc. agreed

to stop steering customers away from Visa cards. In return, Visa

will make PayPal part of its "digital wallet" and won't increase

fees that it charges to PayPal. This should boost transactions made

on Visa-branded cards. Visa also has supported Apple Inc.'s Apple

Pay and invested in mobile-payments company Square Inc.

Wall Street has applauded these moves. Roughly four of five

analysts who cover the stock rate it a "buy," the highest

percentage since 2011. And while shares fetch a higher-than-average

25 times projected earnings, that is roughly in line with both

MasterCard and PayPal.

Many assume the future of finance will be dominated by digital

disrupters. Don't discount the old guard just yet.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

October 24, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

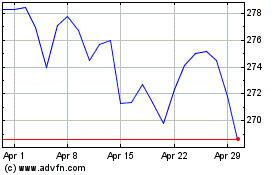

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024