TIDMAGTA

RNS Number : 9678N

Agriterra Ltd

14 August 2017

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Agriterra Ltd / Ticker: AGTA / Index: AIM / Sector:

Agriculture

14 August 2017

Agriterra Ltd ('Agriterra' or the 'Company')

Subscription of New Shares Raising $4.32 million

Proposed Board Changes, Waiver of Rule 9 of the Takeover Code

and

Notice of General Meeting

Agriterra Limited, the AIM listed African agricultural company,

is pleased to announce, subject to shareholder approval, a proposed

Subscription for new Ordinary Shares in the Company, raising

approximately $4.32 million.

Summary of the Proposed Subscription:

-- Cash subscription by Magister Investments Limited

("Magister") for 1,062,243,291 new Ordinary Shares

-- Subscription price of 0.3126 pence per Ordinary Share,

represents a premium of 60.3 per cent. to the closing share price

of the Company as at 11 August 2017

-- Magister will hold 50.01 per cent. of the Enlarged Share

Capital immediately following completion of the Subscription

-- Strengthening of the Board with the appointments of Mr.

Hamish Rudland, Mr. Gary Smith and Mr. Brendan Scott. Mr. Groves

will also step down from the Board immediately following the

General Meeting

Caroline Havers, Non-Executive Chair of Agriterra said: "This

proposed investment comes at a pivotal time in the development of

Mozambique's agricultural markets, and I am confident that this

injection of capital will position Agriterra strongly as we look to

build and grow our grain and beef businesses. Following the end of

a two-year drought, coupled with an ameliorating political and

economic environment which is attracting increasing foreign

investment to Mozambique, we believe the agricultural platform

which we have established is now ripe for growth.

"Importantly, this investment not only provides us with

significant capital to execute our development plans, but also

brings with it the skills and operational expertise that will

strengthen our board and enable Agriterra to deliver its strategy

of becoming a leading food producer in sub-Saharan Africa."

A circular is being posted to shareholders today, which includes

a notice of General Meeting to be held at 11.00 a.m. on 14

September 2017, to explain the background to and reasons for the

Waiver and to seek its approval, and to explain why the Independent

Directors believe that the Waiver is in the best interests of the

Company and its Shareholders as a whole and to recommend that

Independent Shareholders vote in favour of the Resolutions to be

proposed at the General Meeting.

For further information please visit www.agriterra-ltd.com or

contact:

Daniel Cassiano-Silva Agriterra Ltd Tel: +44 (0)

20 7408 9200

David Foreman Cantor Fitzgerald Tel: +44 (0)

Europe 20 7894 7000

Michael Reynolds Cantor Fitzgerald Tel: +44 (0)

Europe 20 7894 7000

Susie Geliher St Brides Partners Tel: +44 (0)

20 7236 1177

The following has been extracted from the circular which will be

available from 7:00 a.m. on 15 August 2017 on the Company's

website: www.agriterra-ltd.com. Unless the context otherwise

requires, defined terms herein shall have the same meaning as

ascribed to them in the Circular.

1. Introduction

On 14 August 2017, Agriterra announced that it had conditionally

raised approximately $4.32 million before expenses by way of a cash

subscription by Magister for 1,062,243,291 new Ordinary Shares

(assuming no other issuances of Ordinary Shares occur prior to

Subscription and Admission) at a price of 0.3126 pence per Ordinary

Share, such that Magister will hold 50.01 per cent. of the Enlarged

Share Capital immediately following completion of the

Subscription.

Magister is a private limited company incorporated in the

Republic of Mauritius, wholly owned by Mauritius International

Trust Company Limited, as trustee of the Casa Trust (a Mauritius

registered trust). Mr. Hamish Rudland is the settlor of the Casa

Trust and the beneficiaries of the Casa Trust are Mr. Rudland, his

wife, Mrs. Bridgette Rudland and their three children (all of whom

are under 18 years old). Under presumption 5 of the City Code these

family members are presumed to be in concert as they are close

relatives. Neither Magister nor its concert parties (as defined in

the City Code) currently hold or are beneficially interested in any

Ordinary Shares or any other securities in Agriterra.

An initial heads of terms was entered into between the Company

and Magister on 8 June 2017, under which the parties agreed,

subject to contract, that the Subscription would be undertaken at a

price of 0.32 pence per Ordinary Share; this pricing represented a

significant premium of 52.4 per cent. to the Closing Price of 0.21

pence per Ordinary Share on 7 June 2017. Due to the functional

currency of the Group being USD, the parties subsequently agreed in

principle, on 15 June 2017, that the Subscription would be

undertaken in USD and agreed to fix the exchange rate to

USD1.27:GBP1 thereby setting the Subscription Price and the agreed

aggregate subscription commitment; these terms were later reflected

in the conditional subscription agreement dated 14 August 2017

between the Company and Magister (further details of which are

provided elsewhere in this document). Subsequent exchange rate

movements mean the sterling equivalent Subscription Price is 0.3126

pence per Ordinary Share, as at the last business day prior to the

date of this Circular. The Subscription Price represents a premium

of 60.3 per cent. to the closing share price of the Company as at

11 August 2017 (being the latest practicable date prior to the

publication of this Circular).

The Subscription Shares will rank pari passu in all respects

with Ordinary Shares in issue prior to completion of the

Subscription, including the right to receive all dividends and

other distributions declared following Admission.

The Subscription, which has been granted the Waiver by the

Panel, is conditional, inter alia, upon Admission of the

Subscription Shares and passing of the Resolutions at the General

Meeting notice of which is set out at the end of this document.

Should Shareholder approval not be obtained at the General Meeting,

the Subscription will not proceed.

The purpose of this document is to:

(a) explain the background to, and reasons for, the Subscription;

(b) explain why the Directors believe that the Subscription is

in the best interests of Shareholders as a whole;

(c) provide further detail in relation to the Whitewash

Resolution and the implications to Shareholders of the Waiver;

and

(d) recommend that, where entitled to do so, Shareholders vote

in favour of the Resolutions to be proposed at the General

Meeting.

2. The Subscription

The Subscription is to be made pursuant to a conditional

subscription agreement dated 14 August 2017 between the Company and

Magister, whereby Magister agreed to subscribe for the Subscription

Shares (at the Subscription Price). As noted above, the

Subscription is conditional, inter alia, upon Admission of the

Subscription Shares and passing of the Resolutions at the General

Meeting.

On completion of the Subscription, Magister will be interested

in 50.01 per cent. of the Enlarged Share Capital and total voting

rights of the Company.

The City Code applies to the Company and as such the

Shareholders are entitled to the protections afforded by the City

Code, as described in Section 4 below.

Without a waiver of the obligations under Rule 9 of the City

Code, the Subscription would require Magister to make a general

offer for any class of equity share capital of the Company whether

voting or non-voting and also to the holders of any other class of

transferable securities of the Company carrying voting rights. The

Panel has agreed to such Waiver (subject to the Whitewash

Resolution being approved at the General Meeting (on a poll) by

"independent shareholders", such that any Shareholder presumed to

be acting in concert with Magister will be disenfranchised from

voting. As neither Magister, nor any member of the Concert Party

currently hold any Ordinary Shares, all of the Shareholders of the

Company will be deemed to be "independent shareholders" for the

purposes of the Whitewash Resolution.

Further details of the Subscription Agreement are set out in

paragraph 7 of Part II of the Circular. There are no further

arrangements made by the Company in connection with, or dependent

on, the Subscription Agreement.

Admission, settlement and dealings

The Subscription Shares will on Admission, rank pari passu in

all respects with the Existing Ordinary Shares and will rank in

full for all dividends and other distributions declared, made or

paid in respect of the Existing Ordinary Shares after Admission.

Application will be made to the London Stock Exchange for the

Subscription Shares to be admitted to trading on AIM. Subject to

certain conditions, it is expected that Admission will become

effective and that dealings in respect of such Subscription Shares

will commence at 8.00 a.m. on 15 September 2017.

3. Use of proceeds

The amount being raised pursuant to the Subscription is expected

to be $4.32 million gross and approximately $4.24 million net of

all expenses, assuming no other issuances of Ordinary Shares occur

prior to Subscription and Admission.

The Board and Magister expect that the net proceeds of the

Subscription will be used:

-- to strengthen the existing operations of the Company's Beef

division in Mozambique and take advantage of the anticipated growth

in northern Mozambique arising primarily from the development of

the natural gas resources, both in terms of camps supporting these

projects and the general local area; and

-- for general working capital purposes, in particular:

o for animal and grain inventory purchases; and

o to reduce the Group's requirements to draw down additional

external banking facilities, thereby limiting exposure to high

financing costs currently being experienced in Mozambique (at

present ranging between 26.25 per cent. and 28.50 per cent. on the

Group's borrowings).

4. City Code on Takeovers and Mergers

Under Rule 9 of the City Code, any person who acquires an

interest (as such term is defined in the City Code) in shares

which, taken together with the shares in which he and persons

acting in concert with him are interested, carry 30 per cent. or

more of the voting rights in a company which is subject to the City

Code, is normally required to make a general offer to all of the

remaining shareholders to acquire their shares.

Similarly, when any person, together with persons acting in

concert with him, is interested in shares which in aggregate carry

not less than 30 per cent. of the voting rights but does not hold

shares carrying more than 50 per cent. of the voting rights of such

a company, a general offer will normally be required if any further

interest in shares are acquired by any such person which increases

the percentage of shares carrying voting rights. These limits apply

to the entire concert party as well as the total beneficial

holdings of individual members. Such an offer would have to be made

in cash at a price not less than the highest price paid by him, or

by any member of the group of persons acting in concert with him,

for any interest in shares in the company during the 12 months

prior to the announcement of the offer.

You should note that if the Subscription completes, Magister

will hold 50.01 per cent. of the voting rights of the Company. In

these circumstances, Magister would be permitted to make further

purchases of Ordinary Shares without incurring an obligation under

Rule 9 to make a general offer to all holders of Ordinary Shares.

As long as the Concert Party holds more than 50 per cent.,

individual members of the Concert Party will be allowed to increase

their holdings subject to Note 4 of Rule 9.1. As the Concert Party

will hold more than 50 per cent. of the voting rights of the

Company, members of the Concert Party (for so long as they continue

to be treated as acting in concert) may accordingly increase their

aggregate interest in shares without incurring any obligation under

Rule 9 to make a general offer, although individual members of the

Concert Party will not be able to increase their percentage

interests in shares through or between a Rule 9 threshold without

Panel consent.

The Panel has agreed, subject to the Whitewash Resolution being

passed by Shareholders on a poll, to waive the requirement under

Rule 9 of the City Code for Magister to make a mandatory offer for

the entire issued ordinary share capital of the Company as would

otherwise be required.

The Whitewash Resolution is subject to the approval of

Shareholders on a poll where each Shareholder will be entitled to

one vote for each Ordinary Share held.

The Directors believe that it is in the best interests of the

Company that the Whitewash Resolution be passed.

5. About Magister

Magister was established as a diversified investment vehicle

focused on investments in Central and South Eastern Africa.

As described above, Magister is private limited company

incorporated in the Republic of Mauritius on 10 September 2014

under the name "Magister Zimbabwe Limited" (its name having been

changed to "Magister Investments Limited" on 20 June 2016).

Magister is wholly owned by Mauritius International Trust

Company Limited, as trustee of the Casa Trust (a Mauritius

registered trust). Mr. Hamish Rudland is the settlor of the Casa

Trust and the beneficiaries of the Casa Trust are Mr. Rudland, his

wife, Mrs. Bridgette Rudland and their three children (all of whom

are under 18 years old). Neither Magister nor its concert parties

currently hold or are beneficially interested in any Ordinary

Shares or any other securities in Agriterra. Under the City Code

all of the foregoing are presumed to be acting in concert.

Mr. Rudland has extensive experience in owning and managing

companies in Zimbabwe, mainly in logistics, agriculture, agro

processing, distribution and property sectors. Through this

industry exposure Mr. Rudland and Magister became aware of

Agriterra's operations in Mozambique. Further details on Mr.

Rudland's background are set out at Section 8 below and further

details on Magister and Mr. Rudland are set out in paragraph 3 of

Part IV of the Circular.

6. Intentions of Magister and Mr. Hamish Rudland

Mr. Rudland has confirmed that he is not proposing, following

the Subscription, to seek any change in the general nature of the

Company's business, and has confirmed that he does not intend to

take any action through his interest in the Company via Magister's

shareholding or otherwise to alter the management of the Company

(save as noted herein), the continued employment of the Group's

employees (including any material change in conditions of

employment), the location of the Company's places of business and

the deployment of the Company's fixed assets.

Other than changes to be made in the ordinary course, Mr.

Rudland intends to conduct the business of the Company in

substantially the same manner as it is currently conducted and

there are no plans to introduce any material change to the business

of the Company. The priority is to return the Mozambique operations

to profitability, principally through increased utilisation of

assets and targeting crops and livestock that help deliver this

strategy. Once the Group's operations have been stabilised and

returned to profit, the Board will consider introducing other meat

products for sale and also consider geographic expansion.

Mr. Rudland has also confirmed he has no intention to cause the

Company to cease to maintain its AIM listing in respect of the

Ordinary Shares.

In the event that the Subscription and Waiver are approved at

the General Meeting, neither Magister nor any member of the Concert

Party will be restricted from making an offer for the Company.

7. Agriterra's business and prospects

Agriterra is a pan-African agricultural company with operations

principally focused on beef and maize trading and processing. The

audited annual report and financial statements of the Group for the

10 month period ended 31 March 2017 were published by Agriterra on

17 July 2017. A website link to the audited annual report and

financial statements is provided in Part III of the Circular.

The period ended 31 March 2017 continued to be a challenging one

for the Group as reflected in the results which show a loss after

taxation and discontinued operations of $3,774,000 (12 month period

ended 31 May 2016: loss $8,455,000), including an impairment charge

against current and non-current assets of $nil (12 month period

ended 31 May 2016: $3,069,000 arising against the Group's beef

assets in Mozambique).

As Shareholders are aware from the annual report and financial

statements, during the 10 month period ended 31 March 2017 the

Board re-focussed efforts on the Group's Grain and Beef operations

in Mozambique, following the decision to dispose of the Group's

Cocoa operations in Sierra Leone, which was completed in June

2017.

The Board and Magister hold the view that there is significant

development potential in Mozambique's

agricultural markets, for a number of factors, including the

following:

-- as a result of the natural growth in demand which will

develop as the local population gains spending power, coupled with

the expected growth uplift that is expected to arise from the

development of the liquefied natural gas ('LNG') industry in the

north of the country, which now appears to be imminent through

infrastructure and construction initiatives being implemented by a

consortium of companies, led by ENI S.p.A (and including Galp

Energia, ExxonMobile and others), which in early June 2017

announced a final investment decision to proceed with a $7bn

offshore LNG platform off the coast of Cabo Delgado, in north-east

Mozambique. This development has already started to generate

positive effects both for the country and in terms of demand for

Agriterra's products (in particular, the Group's beef).

-- since January 2017, the macro-economic and political

environment in Mozambique has improved as a result of a number of

factors, including a cease-fire agreement between FRELIMO and

RENAMO, combined with the relative strengthening (and stability) of

the Metical. Furthermore, the prevailing sentiment now is that the

donor community and the IMF may soon resume much needed support to

the Mozambique government, which is a significant positive

change.

-- two years of drought have now come to an end, with a return

to normal or higher than normal rainfall in central to northern

Mozambique, and Sub-Saharan Africa in general. The risk of damage

to the maize harvest in Mozambique from armyworm infestation has

also been alleviated and the crop is now being harvested with no

evidence of any significant effect; the result is a sizeable

harvest in many of the key staple agricultural products, including

maize, in Mozambique and the wider region, which can only be

beneficial to the poorer households who have been facing ever

rising prices.

Although, the financial period ended 31 March 2017 as a whole

was significantly and negatively impacted by the difficult trading

conditions and whilst without a significant cash injection, the

Group will not be in a position to take full advantage of

development opportunities (due to working capital constraints), the

recent environmental improvements are expected to lead to an

improvement in trading conditions going forward.

Save as disclosed in the Company's audited consolidated accounts

of the Company for the financial period

ended 31 March 2017, issued on 18 July 2017 there has been no

material or significant change in the financial or trading position

of the Company since 31 March 2017, being the date of the Company's

last audited accounts.

8. Proposed Board changes

It has been agreed that upon completion of the Subscription the

composition of the Board will change.

The Proposed New Directors will join the Board, and Andrew

Groves will step down as a director. On Admission, the Board will

comprise:

Name Appointment Remarks

---------------------- ----------------------- -------------

Caroline Havers Non-Executive Chair Director

---------------------- ----------------------- -------------

Daniel Cassiano-Silva Finance Director Director

---------------------- ----------------------- -------------

Brendan Scott Chief Operating Proposed New

Officer - Mozambique Director

---------------------- ----------------------- -------------

Hamish Bryan Non-Executive Director Proposed New

Wilburn Rudland Director

---------------------- ----------------------- -------------

Gary Ronald Smith Non-Executive Director Proposed New

Director

---------------------- ----------------------- -------------

Brief biographies of the Proposed New Directors are set out

below:

Hamish Bryan Wilburn Rudland, Non-Executive Director, aged

45

After graduating from Massey University, New Zealand in 1995, Mr

Rudland returned to Zimbabwe in 1997 and started a passenger

transport business under the brand "Pioneer Coaches". The business

grew steadily throughout the late 1990's and early 2000's, by

leveraging its balance sheet and borrowing from banks in an

inflationary economy. In the early 2000's the business diversified

into fuel tanker haulage. Thereafter, with foreign investors

pulling out of Zimbabwe due to political and economic risk, Mr

Rudland structured acquisitions of foreign-owned asset rich

companies which he then listed on the Zimbabwe Stock Exchange

(financed with external bank debt, leveraged on balance sheets with

USD assets holding their value in a hyper-inflationary economy)

including Tandem Scania in 2001, Clan Holdings Limited in 2002 and

Unifreight Limited in 2005. The latter two companies have since

been merged into Unifreight Africa Limited after "Pioneer Coaches"

initially reverse listed into Clan Holdings in 2003.

Consolidation of these different entities offered opportunities

to exploit synergies and reduce costs during the Zimbabwean

hyper-inflation era which ended in 2009. In 2009, the US Dollar

became the official trading currency of Zimbabwe, which immediately

created huge balance sheet value in the assets held by the

companies in which Mr Rudland had interests. As a result, he

continued to acquire similar assets in areas where business

synergies could be realised to grow market share.

The focus of Mr Rudland's businesses are logistics, agriculture,

agro-processing, distribution and property. Mr Rudland has

substantial investments in Zimbabwe Stock Exchange listed entities

which focus on these core competencies but also synergise where

advantages can be made. Mr. Rudland is a resident and citizen of

Zimbabwe.

Mr. Rudland is a current or past director of the following

companies:

Present Past five years

------------------------------ --------------------------

A Million Up Investments Unifreight Africa Limited

86 (Pty) Limited

------------------------------ --------------------------

CFI Holdings Limited

------------------------------ --------------------------

Dry Fly Trading (Private)

Limited t/a JCBLink

------------------------------ --------------------------

Holdsworth Holdings (Private)

Limited

------------------------------ --------------------------

Pioneer Development Company

(Private) Limited

------------------------------ --------------------------

Ramsway (Private) Limited

------------------------------ --------------------------

Scanlink (Private) Limited

------------------------------ --------------------------

Transport & Equipment

Finance Company (Private)

Limited

------------------------------ --------------------------

TSL Limited

------------------------------ --------------------------

Tredcor Zimbabwe (Private)

Limited t/a Trentyre

------------------------------ --------------------------

Umfurudzi Park (Private)

Limited

------------------------------ --------------------------

Unifreight Limited

------------------------------ --------------------------

United Transport Zimbabwe

Freight Limited

------------------------------ --------------------------

Zimre Holdings Limited

------------------------------ --------------------------

Gary Ronald Smith, Non-Executive Director, aged 49

Mr. Smith is an experienced finance professional and is

currently a non-executive director of several companies, including

Unifreight Africa Limited, a Zimbabwe based transport and logistics

group which he was Finance Director and Chief Executive Officer of

between 2013 and 2015. Mr. Smith worked in the UK for several years

where he was employed at Deutsche Bank, University of Surrey and

Foxhills Club & Resort.

Upon returning to Africa he worked for a large transport and

logistics company in Mozambique for four years before returning

home to Zimbabwe and the above positions. Mr. Smith is a Chartered

Accountant and a resident and citizen of Zimbabwe.

Mr. Smith is a current or past director of the following

companies:

Present Past five years

--------------------------- ----------------

Unifreight Africa Limited None

--------------------------- ----------------

Scanlink (Private) Limited

--------------------------- ----------------

Tredcor Zimbabwe (Private)

Limited t/a Trentyre

--------------------------- ----------------

Unifreight Limited

--------------------------- ----------------

Brendan Scott, Chief Operating Officer - Mozambique, aged 42

Having studied agriculture in the UK, Mr. Scott returned to

Zimbabwe to practice commercial farming. In 2000 he returned to the

UK and worked in the irrigation sector for two years before moving

across to the Special Works Division of ISG Plc. In 2009, Mr. Scott

founded ESP International Limited which focused on Fuel Logistics,

Quarrying Aggregates and manufacturing Concrete Products,

Construction Services, Heavy Earth Moving Equipment and Plant Hire

in the East and Southern African regions. He joined Agriterra in

2015 as the Chief Operating Officer for Mozambique.

Mr. Scott is a current or past director of the following

companies:

Present Past five years

-------------------------- ----------------

ESP International Limited None

-------------------------- ----------------

As at the date of the Circular, none of the Proposed New

Directors have a beneficial interest in the issued share capital of

the Company. Mr Smith is a director of Unifreight and is therefore

well known to Mr Rudland, who also sits on the same board. Mr Scott

is employed by the Company as the Chief Operation Officer -

Mozambique and is therefore ideally placed to provide operational

insight to the Board.

There are no other matters under paragraph (g) of Schedule 2 of

the AIM rules to be disclosed in connection with the Proposed New

Directors.

For completeness, brief biographies of the Continuing Directors

are set out below:

Caroline Havers, Non-Executive Chair, aged 58

Ms. Havers is a highly experienced litigation/dispute resolution

lawyer having spent 30 years in international law firms working

with clients operating in a variety of African jurisdictions and

industry sectors. During her legal career, Ms. Havers has been both

a partner and managing director of different law firms. She

currently serves as compliance officer of the London office of a US

law firm, provides ad hoc compliance and legal services to various

clients and is a qualified CEDR Mediator (over 15 years'

experience).

Daniel Cassiano-Silva, Finance Director, aged 39

Mr Cassiano-Silva has over 16 years of financial experience and

a wealth of operational expertise gained in Mozambique, South

Africa, Sierra Leone and the Democratic Republic of Congo with AIM

quoted Paragon Resources PLC from 2009 until 2013 (where he held

senior positions as Group Controller and Compliance Officer and

Chief Financial Officer) and later Agriterra from 2013 to date

(where he holds the position of Finance Director). During this time

he played a pivotal role in implementing the business plans for

these companies within the administrative and finance functions as

well as operational matters. Prior to joining Paragon, Mr

Cassiano-Silva worked with Deloitte LLP as a Senior Audit Manager

until 2009 and is a Chartered Accountant.

9. Independent advice

The City Code requires the Board to obtain competent independent

advice regarding the merits of the transaction which is the subject

of the Whitewash Resolution, the controlling position which it will

create, and the effect which it will have on the Shareholders

generally.

Cantor Fitzgerald Europe, as the Company's nominated adviser and

broker, has provided formal advice to the Board regarding the

Subscription and in providing such advice, Cantor Fitzgerald Europe

has taken into account the Directors commercial assessments.

Cantor Fitzgerald Europe confirms that it is independent of

Magister and has no commercial relationship with Magister.

10. General Meeting

The Directors currently do not have existing authorities to

allot shares. Accordingly, in order for the Company to allot and

issue the Subscription Shares, the Company needs to first obtain

approval from its Shareholders to grant to the Board the authority

to allot the Subscription Shares.

In addition to the Whitewash Resolution described at paragraphs

2 and 4 above, the Company is therefore also seeking Shareholder

authority to grant the Directors with authority to allot the

Subscription Shares.

Set out at the end of the Circular is a notice convening the

General Meeting of the Company to be held at 11:00 a.m. on 14

September 2017 at The Winchester Suite, The Washington Mayfair

Hotel, 5 Curzon Street, London W1J 5HE, at which the Resolutions

will be proposed. Please note that the summary and explanation set

out below is not the full text of the Resolutions and Shareholders

should read the full text of the Resolutions as set out in the

Notice of General Meeting before returning their Forms of

Proxy.

The Resolutions are all inter-conditional such that if any

Resolution is not passed by Shareholders at the General Meeting,

the Waiver will not be effective and Subscription will not proceed.

The Resolutions can be summarised as follows:

-- Resolution 1 - an ordinary resolution (to be taken on a poll

of the shareholders voting in person and by proxy) to seek the

approval of the shareholders to waive the obligation on Magister to

make a general offer to the remaining shareholders to acquire their

shares which would otherwise arise under Rule 9 as a result of the

Subscription; and

-- Resolution 2 - an ordinary resolution to seek the approval of

Shareholders to authorise the Directors to allot the Subscription

Shares.

11. Action to be taken

A Form of Proxy is enclosed for use by Shareholders at the

General Meeting. Whether or not Shareholders intend to be present

at the General Meeting, Shareholders are asked to complete, sign

and return the Form of Proxy to the Company's transfer agent,

Neville Registrars Limited, Neville House, 18 Laurel Lane,

Halesowen, B63 3DA, as soon as possible and, in any event, not

later than 11:00 a.m. on 12 September 2017. The completion and

return of a Form of Proxy will not preclude you from attending the

General Meeting and voting in person if you so wish. If a

Shareholder has appointed a proxy, and attends the General Meeting

in person, his proxy appointment will automatically be terminated

and his vote in person will stand in its place.

If you hold shares in CREST, you may appoint a proxy in

accordance with the procedures set out in the notice convening the

General Meeting set out at the end of the Circular.

Please note that Neville Registrars Limited cannot provide any

financial, legal or tax advice on the merits of the

Subscription.

12. Further information

Your attention is drawn to Part II of the Circular which

contains further information relating to Magister and

Agriterra.

13. Recommendation to shareholders

The Directors, who have been so advised by Cantor Fitzgerald

Europe, consider that the Waiver and the issue of Subscription

Shares are fair and reasonable and are in the best interests of the

Company and Shareholders as a whole.

Accordingly, the Board unanimously recommends Shareholders to

vote in favour of the Resolutions to be proposed as they intend to

do in respect of their own beneficial holdings which equates to

1.42 per cent. of the Issued Share Capital of the Company.

Yours faithfully

Caroline Havers

Chair

** ENDS **

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOESFUFMLFWSEFA

(END) Dow Jones Newswires

August 14, 2017 12:30 ET (16:30 GMT)

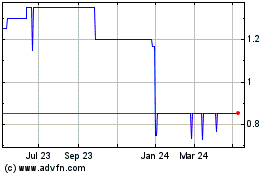

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

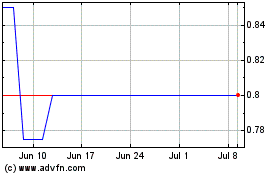

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Apr 2023 to Apr 2024