By Scott Patterson, John W. Miller and Alexandra Wexler

CAPE TOWN--For the world's mining elite, the party is over.

Executives of the industry gathered Monday at a 316-year-old

winery owned by U.K. giant Anglo American PLC for a night of

dancing, drinking fine wine and deal making. But the dancing was

subdued, and there were few deals to discuss as a colossal slump in

commodity prices cast a pall over the shindig.

"It's a tough time for the industry," Mark Cutifani, chief

executive of Anglo American, told partygoers at Vergelegen, the

vast winery the company bought during better days in 1987. If

miners don't develop "new pathways to success...there will be no

future."

Then, a steak dinner was served with the estate's signature

wines, and the dance music started.

Investing in African Mining Indaba, the industry's most

important conference, kicked off this week in Cape Town with the

sector in a state of collapse. Once mighty companies such as Anglo

American, Glencore PLC and BHP Billiton Ltd. are scrambling to

adapt as their profits plunge and their shares hemorrhage

value.

Indaba, as the annual conference is known, was once an

unmissable week of top speakers such as former U.K. Prime Minister

Tony Blair by day and beachfront parties thrown by Glencore traders

in the balmy South African summer air by night.

"You'd get invitations to parties on gold coins," said Nichole

McCulloch, managing partner of the Ashton Partnership, a

London-based headhunting firm.

This year, Mr. Cutifani was the leading corporate speaker. Most

of Glencore's top executives didn't show up.

The tone also is glum at International Petroleum Week, a London

conference that draws executives from the world's top energy and

trading companies. Oil prices are down more than 70% since June

2014.

Overall attendance at the event is the same this year,

organizers said, but a black-tie dinner on Thursday night is

expected to draw 13% fewer attendees. "People either are cutting

back or they don't want to be seen entertaining," during the

downturn, a spokeswoman said.

At Anglo's winery party--sponsored by Indaba's organizers--the

company decided not to show their usual highlight movie showing

scenes from its sprawling international empire.

Mr. Cutifani's speech focused more on South African rugby, the

quality of the Vergelegen's wines and the restoration of local

flora than on iron ore or copper markets.

"There were more empty chairs than last year, and Cutifani

couldn't find anything positive to say about mining, so he talked

about sports and wine," said Rhulani Maluleke, managing director of

Hape, a South African mining-services firm with 18 employees.

The grim mood is broadly reflected on the conference floor,

where service and technology companies pitch their wares to the

world's biggest mining outfits. The Indaba organizers say

attendance is down 10% from a year ago as companies have sent fewer

delegates.

"The place used to be packed, you couldn't walk from one side of

a room to another without running into 10 people you knew," said

Tom Albanese, CEO of Indian mining giant Vedanta Resources PLC and

former chief of Rio Tinto, who has been attending the conference

since the early 2000s.

Deal activity among miners has skidded five years in a row, and

few expect it to pick up in 2016, according to a Ernst & Young

report released last week.

Mining companies have announced plans to cut tens of thousands

of workers in the past year as the prices for what they dig up and

sell has plummeted. Copper prices have fallen 28% since last year's

peak, while the benchmark price for iron ore delivered to China has

plunged 27% over the past year.

Glencore aims to raise at least $10 billion to reduce its debt

by eliminating its dividend, mothballing mines, issuing $2.5

billion in new stock and selling assets. Anglo has plans to sharply

scale back its business, resulting in the loss of a 85,000

employees.

With mining jobs on the chopping block around the world, and

businesses that cater to miners scrambling to find business,

attendees struggled to put on a brave face about the future.

"It's less of a party atmosphere," said Chris Griffith, CEO of

Anglo American Platinum Ltd., the world's top producer of the

precious metal. "It's very somber, and it's somber for a good

reason."

Indaba is still seen by African nations hungry for investment as

a useful way to lure executives. The Democratic Republic of Congo's

mining ministry sent 30 people.

"It's still a good opportunity for us to get business," said

Prosper Dawe, investment promotion chief at the Congo's mining

ministry.

An Indaba veteran, Mr. Dawe said this year's conference was

"timid."

"Normally, this is the conference with the best parties," he

said, "the most cultural activities."

There are still parties scheduled, but most are planned to be

subdued affairs.

Mr. Griffith called Anglo's party "very necessary."

"We can have important conversations that are not so easy in a

presentation-type format like the Indaba," he said. He added that

"it certainly doesn't feel like a party to me. It feels like

work."

Nicole Friedman in London contributed to this article.

Write to Scott Patterson at scott.patterson@wsj.com, John W.

Miller at john.miller@wsj.com and Alexandra Wexler at

alexandra.wexler@wsj.com

(END) Dow Jones Newswires

February 09, 2016 13:26 ET (18:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

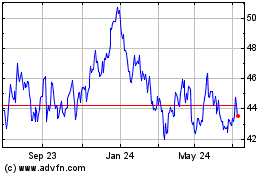

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024