TIDMAFCR

Ticker: AFCR / Index: AIM / Sector: Mining

4 December 2014

African Consolidated Resources plc

("AFCR" or "the Company")

African Consolidated Resources plc, the AIM listed resource and

development company, is pleased to announce its results for the six

months to 30 September 2014.

Highlights

30 September 2014 30 September 2013

$'000 $'000

Loss for the period 2,779 2,335

Dalny deal prepayment forfeited* 500 -

Zimra VAT refund** 180 117

Cash balance 260 5,087

* The balance of $500,000 is receivable over a period of 12 months

** Additional $177,000 received in October 2014 mainly in respect of the

VAT dispute with Zimra.

Post period-end

-- Cash Balance at 30 November 2014 $1.045 million

-- Ball mill disposed of post period end EUR540,000 ($672,840 receivable).

-- Joint venture agreed for funding development of Pickstone Peerless mine

at 10,000 tonnes per month.

-- Loan of $2,000,000 secured of which $1,000,000 received in connection

with opportunities in Romania.

Chief Executive Officer's report

Introduction

In both the Chairman's and my strategic reports in the 2014 Annual

Report the transformation of the Company from an exploration focus to a

mining and cash generation company was emphasised. This process is

ongoing and all exploration activities remain on hold. Wherever

possible, employees have been reassigned and inevitably some have had to

be regrettably retrenched.

The international resources sector remains extremely constrained and

securing funding for new mines remains an enormous challenge. Reducing

overheads and costs is still a major focus of management in order to

ensure that available resources are sufficient until cash generation,

which is expected in H2 2015.

The specific challenges faced in Zimbabwe and the international status

of gold has resulted in the transition process in AFCR incorporating a

wider development focus and a more significant presence in Romania.

The transition taking place in each of the regions where AFCR is now

active are detailed below.

Zimbabwe

As announced on 30 September 2014, the reluctance of investors outside

of Zimbabwe to fund the Dalny Mine/Pickstone-Peerless Mine Project

resulted in its postponement pending further evaluation of how it may be

resumed in the future. AFCR remains in contact with Falcon Gold Zimbabwe

Limited.

Funding for the development of the Pickstone-Peerless Mine, albeit at a

reduced volume of 10,000 tonnes per month, has been secured from a

Zimbabwean source. A new joint venture company Dallaglio Investments

(Pvt) Ltd ('Dallaglio') has been established whereby AFCR will hold a 50

per cent. interest in Dallaglio and the joint venture partner, Grayfox

Investments (Pvt) Limited ('Grayfox') the other 50 per cent. The joint

venture includes the Pickstone-Peerless Mine and the mining claims

surrounding the former Giant Mine.

Pursuant to an option Grayfox has the right to exchange its shareholding

in Dallaglio for 288,333,333 shares in AFCR, which if effected would

return these assets to 100 percent AFCR ownership (subject to

indigenisation regulations).

The current plant design for this joint venture is expected to suffice

for the oxide gold cap, which has an estimated life of six years. During

this period, expansion of the plant to treat the open cast sulphides, at

a rate at least double the current monthly volume will be evaluated,

including the Dalny Mine option.

Mine commissioning is planned for the beginning of H2 2105 with first

positive cash flows later in H2 2105.

Future Zimbabwe operations will be administered through the AFCR

Zimbabwe holding company - Canape Investments (Pvt) Limited - as

depicted in the diagram on the attached PDF document.

Zambia

AFCR has copper and rare earth prospects in Zambia. In view of current

limited funding and management time the Zambian assets are not currently

a focus while we still await the outcome of the two outstanding Zambian

Supreme Court cases on the Kalengwa copper mine. The Board continues to

review its options with regard to these assets in order to maximise

shareholder value.

Romania

The attitude towards investing in Zimbabwe and for AFCR's advantageous

position with securing good mining assets in Romania, with limited

competition, has prompted management to accelerate the evaluation and

acquisition of mining opportunities in that country.

The Company is advancing discussions regarding a number of opportunities

and will make further announcements, as appropriate, in due course.

Conclusion

Notwithstanding the very challenging resource sector market conditions,

AFCR has secured sufficient funding to commence development of its first

gold mine in Zimbabwe.

Roy Pitchford

Chief Executive Officer

For further information, please contact:

African Consolidated Resources plc www.afcrplc.com

Roy Tucker (Finance Director) +44 (0) 1622 816918

Roy Pitchford (Chief Executive Officer) +44 (0) 7920 189012

+263 (0) 7721 69833

+40 (0) 7411 11900

Strand Hanson Limited - Financial & Nominated Adviser www.strandhanson.co.uk

James Spinney +44 (0) 20 7409 3494

Ritchie Balmer

James Bellman

Daniel Stewart and Company - Broker www.danielstewart.co.uk

Martin Lampshire +44 (0) 20 7776 6550

Colin Rowbury

St Brides Media & Finance Ltd www.stbridesmedia.co.uk

Susie Geliher +44 (0) 20 7236 1177

Group statement of comprehensive income

for the six months ended 30 September 2014

For the six months ended 30 September 2014 For the six months ended 30 September 2013

Group Group

Notes $'000 $'000

Revenue - -

Share options expenses (37) (131)

Other administrative expenses (2,742) (2,206)

Administrative expenses (2,779) (2,337)

Operating loss (2,779) (2,337)

Finance income - 2

Loss before and after taxation attributable to the

equity holders of the parent company 3 (2,779) (2,335)

Other comprehensive income

Gain on available for sale financial assets 18 (7)

Total comprehensive loss attributable to the equity

holders of the parent company (2,761) (2,342)

Loss per share - basic and diluted (cents) 3 (0.34) (0.43)

Group statement of changes in equity

for the six months ended 30 September 2014

Share Share Share Foreign Available EBT Retained earnings/ Total

capital premium option currency for sale reserve (losses)

account account reserve translation reserve

reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

At 31 March 2013 14,004 62,751 331 (1,843) 31 (3,944) (27,428) 43,902

Total comprehensive

loss for the year - - - - (62) - (11,650) (11,712)

Share option charges - - 173 - - - - 173

Shares issued:

- to settle

liabilities

(including

Directors) 71 142 - - - - - 213

At 31 March 2014 14,075 62,893 504 (1,843) (31) (3,944) (39,078) 32,576

Total comprehensive

loss for the period - - - - 18 - (2,779) (2,761)

Share option charges - - 37 - - - - 37

At 30 September 2014 14,075 62,893 541 (1,843) (13) (3,944) (41,857) 29,852

Group statements of financial position

As at 30 September 2014

30

September 31 March

2014 Group 2014 Group

Note $'000 $'000

Assets

Non-current assets

Intangible assets 4 28,768 28,710

Property, plant and equipment 1,099 2,683

29,867 31,393

Current assets

Inventory - 1

Receivables 1,505 1,180

Available for sale investments 24 6

Cash and cash equivalents 260 568

Total current assets 1,789 1,755

Total Assets 31,656 33,148

Equity and Liabilities

Capital and reserves attributable to equity holders

of the Company

Called-up share capital 14,075 14,075

Share premium account 62,893 62,893

Share option reserve 541 504

Foreign currency translation reserve (1,843) (1,843)

Available for sale reserve (13) (31)

EBT reserve (3,944) (3,944)

Retained earnings (41,857) (39,078)

Total equity 29,852 32,576

Current liabilities

Short term portion loan 5 1 200 -

Trade and other payables 604 572

Total current liabilities 1,804 572

Total Equity and Liabilities 31,656 33,148

Group statements of cash flow

for the six months ended 30 September 2014

For the six months ended

For the six months ended 30 September 2014 30 September 2013

Group Group

$'000 $'000

CASH FLOW FROM OPERATING ACTIVITES

Loss for the year (2,779) (2,335)

Adjustments for:

Depreciation 245 19

Impairment charge on intangible assets - -

Write off of revaluation reserve in subsidiary - -

Unrealised exchange loss/(gain) on cash and cash

equivalents 6 (43)

Finance income - (2)

Loss on sale of financial assets -

Loss on sale of property, plant and equipment (116)

Liabilities settled in shares - 177

Share option expense 37 131

(2,607) (2,053)

Changes in working capital:

(Increase)/decrease in receivables (324) 106

Decrease/(increase) in inventories 1 (20)

Increase/(decrease) in payables 1,233 (252)

910 (166)

Cash used in operations (1,697) (2,219)

Investing activities:

Payments to acquire intangible assets (54) (3,336)

Payments to acquire property, plant and equipment - (365)

Proceeds on disposal of property, plant and

equipment 1,449 -

Interest received - 2

1,395 (3,699)

Financing Activities:

Proceeds from the issue of ordinary shares, net of

issue costs - -

Decrease in cash and cash equivalents (302) (5,918)

Cash and cash equivalents at beginning of year 568 10,962

Exchange (loss)/gain on cash and cash equivalents (6) 43

Cash and cash equivalents at end of year 260 5,087

Interim report notes

1 Interim Report

The information relates to the period from 1 April 2014 to 30 September

2014.

The interim report was approved by the Directors on 3 December 2014.

The interim report, which is unaudited, does not include all information

required for full financial statements and should be read in conjunction

with the Group's consolidated annual financial statements for the period

ended 31 March 2014.

2 Basis of preparation

1. The unaudited condensed interim financial statements for the six months

ended 30 September 2014 do not constitute statutory accounts and have

been drawn up using accounting policies and presentation expected to be

adopted in the Group's full financial statements for the year ended 31

March 2014, which are not expected to be significantly different to those

set out in note 1 to the Group's audited financial statements for the

year ended 31 March 2014

2. These interim financial statements consolidate the financial statements

of the Company and all its subsidiaries.

3. After review of the Group's operations, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, the

directors continue to adopt the going concern basis in preparing the

unaudited condensed interim financial statements.

3 Loss per share

For the six months ended For the six months ended

30 September 2014 Group 30 September 2013 Group

Loss per ordinary share has been calculated using

the weighted average number of ordinary shares in

issue during the relevant financial year.

The weighted average number of ordinary shares in

issue for the period is: 818,897,396 547,342,776

Losses for the period: ($'000) (2,779) (2,335)

Loss per share basic and diluted (cents) (0.34) (0.43)

The effect of all potentially dilutive share options

is anti-dilutive.

4 Intangible assets

Deferred exploration

Group costs Mining options Total

$'000 $'000 $'000

Balance 31 March 2013 24,246 4,595 28,841

Additions during the year 6,581 - 6,581

Impairment loss (6,417) (295) (6,712)

Balance 31 March 2014 24,410 4,300 28,710

Additions during the year 58 - 58

Balance 30 September 2014 24,468 4,300 28,768

5 Short term portion loan

This loan is repayable on 30 June 2015 and is convertible at the

lender's election into new ordinary shares of the Company at an issue

price of 1.5p or the price at which the Company secures new funding

prior to the repayment date whichever is the lower.

6 Financial information

The financial information for the year ended 31 March 2014 has been

extracted from the statutory accounts for that period. While the

auditors' report for the year ended 31 March 2014 was unqualified, it

did include an emphasis of matters concerning going concern and the

political and economic stability in Zimbabwe, to which the auditors drew

attention by way of emphasis without qualifying their report. Full

details of these comments are contained in the report of the Auditors on

Pages 18 and 19 of the Final Results for the year to 31 March 2014,

released elsewhere on this website on 5 September 2014.

7 Events after the reporting date

The acquisition of the Dalny Mine did not proceed as a result of the

failure of the Company to raise $12.0 million which constituted a

condition precedent in the Purchase Agreement entered with Falcon Gold

Zimbabwe Limited.

In October 2014 the Company secured joint venture finance for its

Pickstone-Peerless Mine with Grayfox under which the Pickstone-Peerless

and the Giant Mines are being transferred to a jointly owned company

Dallaglio Investments (Pvt) Ltd into which Grayfox will contribute $4.0

million in cash and in addition plant equal to the carrying value of the

Company's own plant at Pickstone-Peerless, which is estimated to have a

carrying value of $1.0 million. Grayfox may at its election convert its

50 percent holding in the jointly owned company to 288,333,333 ordinary

shares in the Company.

The Company also secured a $2 million loan facility from Grayfox for use

as to $1 million for the Company's projects in Romania and as to $1

million for general corporate purposes.

In November 2014 the Company entered into an option to acquire, at its

own discretion, a 68 percent interest in Mineral Mining SA which company

owns the Baita Bihor polymetallic mine in Transylvania, Romania. The

acquisition price is EUR1,200,000 (approximately $1,630,000) of which

EUR950,000 (approximately $1,290,000) is payable on a deferred basis.

The Company is in advance stage discussions with the intention of

raising approximately $2.5 million by way of a placing of ordinary

shares in order to finance the acquisition of Mineral Mining SA and to

enable the Baita Bihor mine to be put back into production. It is

expected that the directors will participate in this placing.

Interim Results - PDF attachment:

http://hugin.info/138338/R/1877016/661586.pdf

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: African Consolidated Resources Plc via Globenewswire

HUG#1877016

http://www.acrplc.com/

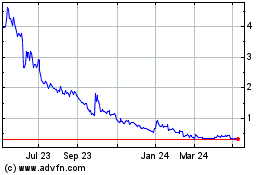

Vast Resources (LSE:VAST)

Historical Stock Chart

From Mar 2024 to Apr 2024

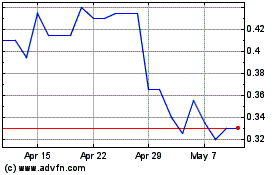

Vast Resources (LSE:VAST)

Historical Stock Chart

From Apr 2023 to Apr 2024