Africa Opportunity Fund Limited Net Asset Value and Portfolio Allocation Update (0410Q)

September 06 2017 - 1:24PM

UK Regulatory

TIDMAOF

RNS Number : 0410Q

Africa Opportunity Fund Limited

06 September 2017

06 September 2017

Africa Opportunity Fund Limited ("AOF")

Net Asset Value and Portfolio Allocation Update

Net Asset Value

Africa Opportunity Fund Limited (SFS: AOF) announces that as at

close of business on 31 August 2017, its unaudited net asset value

per Ordinary share was US$0.955.

Portfolio allocation update

Following the C share conversion as announced on 21 August 2017,

the Company provides the following update in relation to its

portfolio allocation as at 31 August 2017.

Portfolio allocation as at 31 August 2017

Total NAV: $71,454,408

Total Shares Outstanding: 74,849,606

NAV/Share: 0.955

Geographic and Sectoral Allocation

Africa Opportunity

Fund

Geographic

Exposure

% of Sec

Sector holdings

-------------------- ----------

Zambia 8.5%

Ghana 37.4%

Senegal 15.4%

Other 3.9%

Nigeria 5.0%

Cote D'Ivoire 2.9%

Morocco 1.0%

Zimbabwe 9.2%

Egypt 2.8%

Kenya 3.2%

Botswana 2.8%

Tanzania 2.1%

South Africa 3.0%

Uganda 2.8%

----------

Total 100.0%

----------

Africa Opportunity

Fund

Sectoral Exposure

% of Sec

Sector holdings

-------------------- ----------

Telecommunications 12.4%

Financial Services 35.0%

Consumer Finance 3.5%

Utilities 12.2%

Oil Exploration

& Production 5.3%

Consumer Products

& Services -0.9%

Plantations 5.5%

Mining Industry 11.0%

Real Estate 7.3%

Materials 1.3%

Beverages 2.1%

Other 5.3%

----------

Total 100.0%

----------

Geographic and sectoral allocation takes the sum of positions in

a particular category as a percentage of total security

holdings.

Top 10 Consolidated Positions

Description % of NAV on % of NAV on

Top Ten Holdings 31 Aug 2017 30 June 2017

- AOF

---------------------------- --------------------------------------- ------------- --------------

Ghanaian property & casualty

insurance and life assurance

Enterprise Group company 24.2% 13.6%

---------------------------- --------------------------------------- ------------- --------------

Dominant Senegalese and regional

integrated telecommunication

Sonatel operator 10.1% 11.7%

---------------------------- --------------------------------------- ------------- --------------

Copperbelt Energy Leading electricity distributor

Corp in the Zambian Copperbelt 7.5% 8.8%

---------------------------- --------------------------------------- ------------- --------------

1st priority bond backed by

Tizirr 9.0% 28 Grande Cote mineral sands project

Sep 2017 in Senegal 4.2% 4.7%

---------------------------- --------------------------------------- ------------- --------------

Gold mining company operating

Anglogold Ashanti in 11 countries 4.2% 4.1%

---------------------------- --------------------------------------- ------------- --------------

Standard Chartered Leading commercial bank in

Bank Ghana 4.0% 3.4%

---------------------------- --------------------------------------- ------------- --------------

Mashonaland Holdings Zimbabwean real estate company 3.6% 3.9%

---------------------------- --------------------------------------- ------------- --------------

Leading Pan-African reinsurer

Continental Reinsurance based in Nigeria 3.5% 3.3%

---------------------------- --------------------------------------- ------------- --------------

Pearl Properties Zimbabwean real estate company 3.2% 3.2%

---------------------------- --------------------------------------- ------------- --------------

Kenya Power & Lighting Leading electricity distributor

Ltd in Kenya 3.0% 2.5%

---------------------------- --------------------------------------- ------------- --------------

Total 67.5% 59.2%

--------------------------------------------------------------------- ------------- --------------

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684 1528

Liberum (Corporate Broker)

Andrew Davis

Henry Freeman/Rob Johnson Tel: +44 20 3100 2000

For more information about AOF, see

www.africaopportunityfund.com

Prior to its release, this announcement contained inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVZMGGLNVGGNZM

(END) Dow Jones Newswires

September 06, 2017 13:24 ET (17:24 GMT)

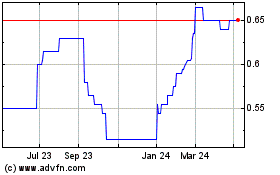

Africa Opportunity (LSE:AOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

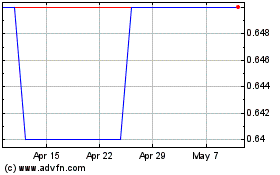

Africa Opportunity (LSE:AOF)

Historical Stock Chart

From Apr 2023 to Apr 2024