Aflac Operating Profit Rises 7.1%

April 26 2016 - 5:50PM

Dow Jones News

Aflac Inc. said its first-quarter operating earnings rose 7.1%

as a stronger yen benefited results in the insurer's business in

Japan, where the company generates most of its sales.

Operating earnings are a widely watched benchmark for the

insurance industry because they exclude realized capital gains and

losses from companies' investment portfolios, among other items

that aren't considered recurring on a quarterly basis.

For the latest quarter, in U.S. dollar terms, premium income at

Aflac's Japan business rose 3.3% to $3.2 billion, while revenue

increased 3% to $3.8 billion and pretax operating earnings grew

2.4% to $838 million.

In yen terms, Japan segment premium income edged up 0.1%,

revenue eased 0.2% and pretax operating earnings edged down

0.8%.

In the U.S., premium income rose 2.1% to $1.4 billion, while

revenue increased 2.3% to $1.5 billion. Pretax operating earnings

improved 16% to $332 million.

Chairman and Chief Executive Daniel P. Amos said in prepared

remarks that the company continues to believe that in its U.S.

business, changes made in its career and broker management

infrastructure have created a foundation for greater long-term

growth opportunities.

Aflac's operating earnings increased to $726 million, or $1.73 a

share, up from $678 million, or $1.54 a share, a year earlier.

Revenue increased 4.3% to $5.45 billion.

In all, Aflac reported net income of $731 million, or $1.74 a

share, up from $663 million, or $1.51 a share, a year earlier.

Analysts polled by Thomson Reuters expected a per-share

operating profit of $1.63 and revenue of $5.26 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 26, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

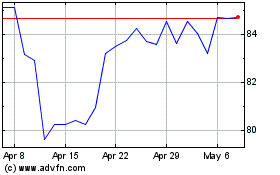

AFLAC (NYSE:AFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Apr 2023 to Apr 2024