Aflac Boosts 2016 Outlook, Operating Profit Beats Expectations

October 27 2016 - 6:00PM

Dow Jones News

Aflac Inc. raised its 2016 operating profit outlook as its

third-quarter operating earnings, which benefited from a stronger

Japanese yen, exceeded expectations.

The insurer's board also raised the company's quarterly dividend

by 4.9%, to 43 cents a share, an increase of 2 cents a share.

For the year, Aflac increased its per-share operating earnings

estimate to $6.40 to $6.60, from its previous estimate for

per-share profit of $6.17 to $6.41.

In U.S. dollar terms, premium income at Aflac's Japan business,

where the company generates most of its sales, climbed 21%, to $3.6

billion, while total revenue rose 19%, to $4.3 billion, and pretax

operating earnings increased 12%, to $882 million.

In yen terms, Japan segment premium income rose 1.1%, revenue

eased 0.5% and pretax operating earnings fell 6.4%.

In the U.S., premium income improved by 1.4%, to $1.4 billion,

while total revenue grew 1.4%, to $1.5 billion. Pretax operating

earnings rose 12%, to $323 million.

Over all, Aflac reported an operating profit of $748 million, or

$1.82 a share, up from $672 million, or $1.56 a share, a year

earlier.

Operating earnings are a widely watched benchmark for the

insurance industry because they exclude realized capital gains and

losses from companies' investment portfolios, among other items

that aren't considered recurring on a quarterly basis.

Revenue increased 13%, to $5.72 billion.

Analysts polled by Thomson Reuters expected per-share operating

profit of $1.74 and revenue of $5.75 billion.

Over all, Aflac reported earnings of $629 million, or $1.53 a

share, up from $567 million, or $1.32 a share, a year earlier.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 27, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

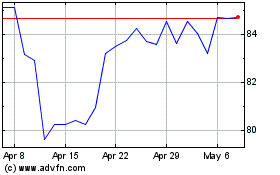

AFLAC (NYSE:AFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Apr 2023 to Apr 2024