Prepares for Q4 2017 FDA Approval and Q1 2018

Commercial Launch

Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (the

“Company”), a specialty biopharmaceutical company engaged in

developing and commercializing novel pharmaceutical therapies,

today reported financial and operating results for the third

quarter ended September 30, 2017.

Third Quarter 2017 Highlights:

- Macimorelin development progressing

toward completion with Prescription Drug User Fee Act date of

December 30, 2017;

- Company prepares for the U.S. Food and

Drug Administration (“FDA”) approval and Q1 2018 target commercial

launch date;

- Jeffrey A. Whitnell joins as Interim

Chief Financial Officer;

- Stifel, Nicolaus & Company,

Incorporated retained as strategic advisors;

- Cash on hand of $12.2 million of

unrestricted cash and cash equivalents at quarter-end sufficient to

take Macrilen™ through approval and no third-party debt;

- Company adopts disciplined business

model focused on cost containment through zero-based budgeting and

preserving cash reserves for Macrilen™ product launch.

“We are continuing our laser focus on preparation for the FDA

approval of Macrilen™ by December 30, 2017, which will be the only

FDA-approved drug for assessing adult growth hormone deficiency in

the United States,” said Michael V. Ward, Aeterna Zentaris, Chief

Executive Officer. “Our goal is to launch the product in the first

quarter of 2018. The Company has reached an important point in its

evolution with Jeff Whitnell joining us as the Interim Chief

Financial Officer and retention of Stifel Nicolaus during the

quarter. We are making progress building out a stronger management

team and adopting a disciplined process for strategic review of

plans, resources and opportunities. Going forward, we will continue

to demonstrate our commitment to ensure that we optimize the use of

resources and capital and best position the Company to maximize

shareholder value.”

“I am pleased at this time to report that we are almost $2

million dollars ahead in cash reserves of where we thought we would

be at this time due to our disciplined new business model that

focuses on cost containment realized through zero-based budgeting,

said Jeff Whitnell, Interim Chief Financial Officer, Aeterna

Zentaris. “These cash reserves position us to take Macrilen™

through approval.”

Third Quarter Financials

All Amounts are in U.S. Dollars

Revenues

Revenues were $241,000 and $745,000 for the three and nine

months ended September 30, 2017, as compared to $269,000 and

$607,000 for the same periods in 2016. The year-to-date increase is

mainly explained by the expanded contract with Armune BioScience,

Inc. (APIFINY®), which was effective June 1, 2016 and the

amortization of the up-front payment received in connection with

one of the out-licensing agreements that we entered into in the

third quarter of 2016 for ZoptrexTM.

Research and Development (“R&D”) costs

R&D costs were $4.1 million and $10.2 million for the three

and nine months ended September 30, 2017, compared to $4.5 million

and $11.9 million for the same periods in 2016. R&D costs

decreased for the three-month and nine-month periods ended

September 30, 2017. The decrease in our R&D costs is mainly

attributable to lower comparative third-party costs partially

offset by the recording, in the third quarter of 2017, of a

provision in connection with the Restructuring Program.

Third-party costs attributable to Zoptrex™ decreased during the

three and nine months ended September 30, 2017, as compared to the

same period in 2016, mainly due to the fact that we closed out the

study and related activities in the second quarter following the

negative ZoptrexTM top-line results on May 1, 2017. The negative

costs for the three-month period ended September 30, 2017 are

mainly explained by lower close out costs as compared to the

accrual made in the second quarter.

Third-party costs attributable to Macrilen™ decreased during the

three and nine months ended September 30, 2017, as compared to the

same period in 2016. This is mainly due to the fact that we

completed the Phase 3 clinical trial at the end of 2016. The costs

incurred in 2017 related to the detailed analysis of the top-line

results as well as the preparation of the New Drug Application

(“NDA”) filing which was submitted on June 30, 2017. The cost

incurred in the third quarter of 2017 are explained mainly by the

close out costs as well as additional analysis required by the

FDA.

General and Administrative (“G&A”) Expenses

G&A expenses were $1.7 million and $5.4 million for both the

three and nine-month periods ended September 30, 2017, as compared

to $1.6 million and $5.4 million for the same periods in 2016. The

G&A expenses were in-line with our expectations.

Selling Expenses

Selling expenses were $1.7 million and $4.6 million for the

three and nine months ended September 30, 2017, as compared to $1.8

million and $5.2 million for the same periods in 2016. Selling

expenses for the three and nine months ended September 30, 2017 and

2016 represent mainly the costs of our sales force related to

co-promotion activities as well as our sales management team. The

decrease in selling expenses is explained by the reduction in the

number of sales representatives from 20 to 13 since February 2017.

In July 2017, we further reduced the number of sales representative

to 10 and we reduced our headcount by one sales manager. Following

the creation of the Strategic Review Committee, the board of

directors of the Company is currently evaluating options to be

ready to promote Macrilen™ quickly following the expected

approval.

Net Finance (Costs) Income

Net finance (costs) income was $(2.4) million and $3.2 million

for the three and nine months ended September 30, 2017, as compared

to $1.6 million and $5.1 million, for the same periods in 2016. The

decrease in finance income is mainly attributable to the change in

fair value recorded in connection with our warrant liability. Such

change in fair value results from the periodic "mark-to-market"

revaluation, via the application of option pricing models, of

outstanding share purchase warrants. The closing price of our

common shares, which, on the NASDAQ, fluctuated from $0.84 to $3.65

during the nine-month period ended September 30, 2017, compared to

$2.67 to $4.40 during the same period in 2016, also had a direct

impact on the change in fair value of warrant liability.

Net Loss

Net loss for the three and nine months ended September 30, 2017

was $9.6 million and $16.3 million (or $0.61 and $1.13 per share),

as compared to a net loss of $6.1 million and $16.7 million (or

$0.61 and $1.68 per share) for the same periods in 2016. The

increase in net loss for the three-month period ended September 30,

2017 is mainly explained by the change in fair value of the warrant

liability due to the increase in the share price since June 30,

2017. However, the loss per share during the same period remained

stable due to the increase in the weighted average number of shares

due to a share issuance done in November 2016 and “at-the-market”

issuances done in 2017. The increase in the weighted average number

of shares also explains the decrease in the loss per share for the

nine-month period.

Liquidity

Cash and cash equivalents were $12.2 million as at September 30,

2017, as compared to $22.0 million as at December 31, 2016. The

decrease in cash and cash equivalents as at September 30, 2017, as

compared to December 31, 2016, is due to the net cash used in

operating activities including variations in components of our

working capital. The decrease was partially offset by the net

proceeds generated by the issuance of common shares under our

various “at-the-market” programs.

Conference Call

The Company will host a conference call to discuss these results

on Thursday, November 9, 2017 at 8:30 a.m., Eastern Time.

Participants may access the conference call using the following

dial-in numbers:

- Toll-Free: 877-407-8029,

Confirmation #13672701

- Toll: 201-689-8029, Confirmation

#13672701

A replay of the conference call will also be available on the

Company’s website for a period of 30 days.

For reference, management’s discussion and analysis of financial

condition and results of operations for the third quarter ended

September 30, 2017, as well as the Company’s interim condensed

consolidated financial statements as at September 30, 2017, can be

found at www.aezsinc.com in the

“Investors” section.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company

engaged in developing and commercializing novel pharmaceutical

therapies. We are engaged in drug development activities and in the

promotion of products for others. We recently resubmitted an NDA to

the FDA seeking approval of Macrilen™, an internally developed

compound. The focus of our business development efforts is the

acquisition of licenses to products that are relevant to our

therapeutic areas of focus. We also intend to license out certain

commercial rights of internally developed products to licensees in

non-U.S. territories where such out-licensing would enable us to

ensure development, registration and launch of our product

candidates. Our goal is to become a growth-oriented specialty

biopharmaceutical company by pursuing successful development and

commercialization of our product portfolio, achieving successful

commercial presence and growth, while consistently delivering value

to our shareholders, employees and the medical providers and

patients who will benefit from our products. For more information,

visit www.aezsinc.com.

Forward-Looking Statements

This press release contains forward-looking statements made

pursuant to the safe-harbor provision of the U.S. Securities

Litigation Reform Act of 1995 and applicable Canadian securities

laws, which reflect our current expectations regarding future

events. Forward-looking statements may include, but are not limited

to statements preceded by, followed by, or that include the words

“expects,” “believes,” “intends,”, “would”, “could”, “may”

“anticipates,” and similar terms that relate to future events,

performance, or our results. Forward-looking statements involve

known risks and uncertainties, many of which are discussed under

the caption “Key Information - Risk Factors” in our most recent

Annual Report on Form 20-F filed with the relevant Canadian

securities regulatory authorities in lieu of an annual information

form and with the U.S. Securities and Exchange Commission (“SEC”).

Such statements include, but are not limited to, statements about

the timing of, and prospects for, regulatory approval and

commercialization of our product candidates, statements about the

status of our efforts to establish a commercial operation and to

obtain the right to promote or sell products that we did not

develop and estimates regarding our capital requirements and our

needs for, and our ability to obtain, additional financing. Known

and unknown risks and uncertainties could cause our actual results

to differ materially from those in forward-looking statements. Such

risks and uncertainties include, among others, our now heavy

dependence on the success of Macrilen™ and the continued

availability of funds and resources to successfully launch the

product in the event the FDA approves Macrilen™, the rejection or

non-acceptance of the NDA by one or more regulatory authorities

and, more generally, uncertainties related to the regulatory

process, the ability of the Company to efficiently commercialize

Macrilen™, the degree of market acceptance of Macrilen™ in the

event it is approved for commercialization by the FDA, our ability

to obtain necessary approvals from the relevant regulatory

authorities to enable us to use the desired brand names for our

products, the impact of securities class action litigation, the

litigation involving two former officers of the Company, or other

litigation on our cash flow, results of operations and financial

position; any evaluation of potential strategic alternatives to

maximize potential future growth and stakeholder value may not

result in any such alternative being pursued, and even if pursued,

may not result in the anticipated benefits, our ability to take

advantage of business opportunities in the pharmaceutical industry,

our ability to protect our intellectual property, the potential of

liability arising from shareholder lawsuits and general changes in

economic conditions. Investors should consult the Company’s

quarterly and annual filings with the applicable Canadian and U.S.

securities commissions for additional information on risks and

uncertainties. Given these uncertainties and risk factors, readers

are cautioned not to place undue reliance on these forward-looking

statements. We disclaim any obligation to update any such factors

or to publicly announce any revisions to any of the forward-looking

statements contained herein to reflect future results, events or

developments, unless required to do so by a governmental authority

or applicable law.

Condensed Interim Consolidated Statement of Financial

Position Information

(In thousands)

As at September 30, As

at December 31, (unaudited)

2017 2016 $ $

Cash and cash equivalents 1

12,173 21,999 Trade and other

receivables and other current assets

802 744 Restricted cash

equivalents

377 496 Property, plant and equipment

154

204 Other non-current assets

9,032 8,216

Total

assets 22,538 31,659 Payables and other

current liabilities

2,665 3,745 Provision for restructuring

costs

2,452 33 Current portion of deferred revenues

479 426 Warrant liability

3,419 6,854 Non-financial

non-current liabilities 2

15,478 14,389

Total

liabilities 24,493 25,447 Shareholders'

(deficiency) equity (1,955 ) 6,212

Total

liabilities and shareholders' (deficiency) equity 22,538

31,659

_________________________

- Approximately $1.0 million and $1.5

million were denominated in EUR as at September 30, 2017 and

December 31, 2016, respectively, and approximately $1.7 million and

$3.7 million were denominated in Canadian dollars as at September

30, 2017 and December 31, 2016, respectively.

- Comprised mainly of employee future

benefits, provisions for onerous contracts and non-current portion

of deferred revenues.

Condensed Interim Consolidated Statements of

Comprehensive Loss Information

(In thousands, except share and per share

data)

Three months ended

Nine months ended September 30, 2017 September 30,

2017 (unaudited)

2017 2016 2017

2016 $ $ $ $

Revenues Sales commission and other

122 105

406 319 License fees

119 164

339

288

241 269

745

607

Operating expenses Research and development costs

4,124 4,512

10,178 11,876 General and administrative

expenses

1,665 1,631

5,420 5,390 Selling expenses

1,652 1,829

4,643 5,219

7,441 7,972

20,241

22,485

Loss from operations (7,200 )

(7,703 )

(19,496 ) (21,878 ) Gain (loss) due to

changes in foreign currency exchange rates

169 (64 )

430 326 Change in fair value of warrant liability

(2,617 ) 1,687

2,700 4,682 Other finance

income

17 25

54 131

Net finance (costs) income (2,431 ) 1,648

3,184 5,139

Net loss

(9,631 ) (6,055 )

(16,312 ) (16,739 )

Other comprehensive (loss) income: Items that may be

reclassified subsequently to profit or loss: Foreign currency

translation adjustments

(400 ) (62 )

(1,192

) (301 ) Items that will not be reclassified to profit or

loss: Actuarial gain (loss) on defined benefit plans

—

(400 )

635 (2,622 )

Comprehensive loss

(10,031 ) (6,517 )

(16,869 ) (19,662 )

Net loss per share (basic and diluted) (0.61 )

(0.61 )

(1.13 ) (1.68 )

Weighted average number of

shares outstanding: Basic and Diluted

15,803,080

9,951,573

14,457,421 9,938,980

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108006480/en/

Aeterna Zentaris Inc.Michael V. WardChief Executive

OfficerIR@aezsinc.com843-900-3223

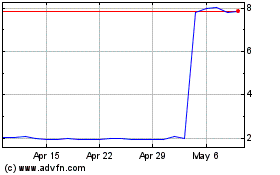

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

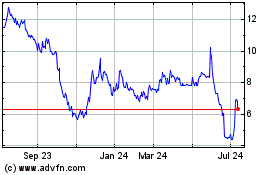

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024