Pivotal Phase 3 Programs for Macrilen™ and

Zoptrex™ Expected Completion in Q3 2016

All $ amounts are in US Dollars

First quarter key developments

- Product development on track towards

registration

- Zoptrex™ (zoptarelin doxorubicin)

pivotal Phase 3 clinical program on track for completion in Q3

2016

- Zoptrex™ licensee in China and related

territories, Sinopharm A-Think Pharmaceuticals Co., Ltd., scheduled

to file IND in Q2 2016 and to commence clinical study in H2 of

2016

- Macrilen™ (macimorelin) confirmatory

Phase 3 Trial for the evaluation of AGHD enrollment and site

initiation also on track for completion in Q3 2016

- Co-promotion commission revenue

showing favorable trend

- Saizen® new-patient-starts exceeded the

baseline by over 66%; new-patient-starts increased 88% over the

fourth quarter of 2015

- APIFINY® generates commission revenue,

although promotion by entire sales force began only midway through

first quarter.

- APIFINY® agreement expanded to

exclusive promotion agreement throughout the U.S. effective June

1.

- Solid Financial condition as

anticipated

- $33.0 million unrestricted cash and

cash equivalents at Quarter end

- Expected average monthly operating burn

rate of approximately $2.8 million during remainder of 2016

- No Common Shares issued during Quarter;

9,928,697 Common Shares outstanding at Quarter end

Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the “Company”),

a specialty biopharmaceutical company engaged in developing and

commercializing novel treatments in oncology, endocrinology and

women’s health, today reported financial and operating results for

the first quarter ended March 31, 2016.

Commenting on first quarter results, David A. Dodd, Chairman,

President and Chief Executive Officer of the Company, stated,

“During the first quarter, we made steady progress in the areas of

product development, commercial performance and financial

operations. I am pleased to report that we remain on track to

attain our 2016 corporate objectives. We still expect to complete

the pivotal Phase 3 Zoptrex™ trial in Q3 of 2016 and to report

top-line results by year-end.”

Mr. Dodd continued his commentary with a discussion of the

development of Macrilen™, which, if approved, will be the only

FDA-approved means of evaluating adult growth hormone deficiency

(AGHD), “Since announcing patient recruitment in the fourth quarter

of last year, our CRO has opened approximately 20 of our

anticipated 30 sites, enrolling approximately 30 patients. The pace

of recruitment is accelerating, confirming our expectation that the

confirmatory Phase 3 clinical study of Macrilen™ will be concluded

in Q3 of 2016, also with top-line results being reported as soon as

possible following trial conclusion. We feel very confident that

the confirmatory study, which will consist of approximately 30

sites and a minimum of 110 patients, is on schedule.”

Concluding, Mr. Dodd addressed the Company’s commercial

operations, stating, “We are pleased with the building of success

from our promotion of Saizen® during the first quarter. Exceeding

our baseline by 66% during the quarter was a great accomplishment

by our sales team. Now that they have a number of targets that more

closely matches our promotional capacity, we believe they should be

in a position to produce meaningful commission revenue this year. I

am hopeful that we will be able to add even more targets as EMD

Serono recognizes the success of our efforts. Our full sales force

sold APIFINY® for only half of the first quarter but managed to

generate commission revenue nevertheless. We are hopeful about the

commercial potential of APIFINY® because it is the only

cancer-specific, non-PSA blood test for the evaluation of the risk

of prostate cancer. Physicians have long needed such an adjunct to

the PSA test. With APIFINY®, we believe we can satisfy that need.

As a result of our promotional efforts, we are realizing an

increasing penetration and acceptance of APIFINY®. More recently,

we announced the expansion of our APIFINY® agreement to reflect our

exclusive rights to promote this product throughout the U.S. We

believe that such an expanded agreement opens significant revenue

opportunities in support of this exciting product.”

First Quarter 2016 Financial Highlights

R&D costs were $3.7 million for the three-month period ended

March 31, 2016, compared to $4.5 million for the same period in

2015. The decrease for the three-month period ended March 31, 2016,

as compared to the same period in 2015, is mainly attributable to

lower comparative third-party costs. The decrease in third-party

costs is mainly attributable to the fact that the number of

patients in active treatment in the clinical trial for Zoptrex™ was

lower in the first quarter of 2016, as compared to the same period

in 2015. The overall decrease in R&D costs is also explained by

lower employee compensation and benefits costs, lower facilities

rent and maintenance as well as lower other costs. A substantial

portion of this decrease is due to the realization of cost savings

in connection with our effort to streamline our R&D activities

and to increase our commercial operations and flexibility by

reducing our R&D staff, which was started in 2014 (the

"Resource Optimization Program"), for which a provision was

recorded in the third quarter of 2014.

G&A expenses were $1.9 million for the three-month period

ended March 31, 2016, as compared to $3.4 million for the same

period in 2015. The decrease is mainly attributable to the

recording during three-month period ended March 31, 2015 of certain

transaction costs associated with the completion of a public,

registered offering of shares and warrants in March 2015.

Selling expenses were $1.7 million for the three-month period

ended March 31, 2016, essentially unchanged as compared to the same

period in 2015. The selling expenses for the three-month periods

ended March 31, 2016 and 2015 represent the costs of our contracted

sales force related to the co-promotion activities as well as our

internal sales management team. Those activities were launched

during the fourth quarter of 2014.

Net loss for the three-month period ended March 31, 2016 was

$3.7 million, or $0.37 per basic and diluted share, compared to a

net loss of $9.7 million, or $13.59 per basic and diluted share for

the same period in 2015. The decrease in net loss for the

three-month period ended March 31, 2016, as compared to the same

period in 2015, is due largely to lower operating expenses and

higher comparative net finance income.

Cash and cash equivalents were approximately $33.0 million as at

March 31, 2016, compared to $41.5 million as at December 31,

2015.

Conference Call & Webcast

The Company will host a conference call and live webcast to

discuss these results on Tuesday, May 10, 2016, at 8:30 a.m.,

Eastern Time. Participants may access the live webcast via the

Company's website at www.aezsinc.com,

or by telephone using the following number: 201-689-8029,

Confirmation #13635224. A replay of the webcast will also be

available on the Company’s website for a period of 30 days.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company

engaged in developing and commercializing novel treatments in

oncology, endocrinology and women’s health. We are engaged in drug

development activities and in the promotion of products for others.

We are now conducting Phase 3 studies of two internally developed

compounds. The focus of our business development efforts is the

acquisition or license of products that are relevant to our

therapeutic areas of focus. We also intend to license out certain

commercial rights of internally developed products to licensees in

territories where such out-licensing would enable us to ensure

development, registration and launch of our product candidates. Our

goal is to become a growth-oriented specialty biopharmaceutical

company by pursuing successful development and commercialization of

our product portfolio, achieving successful commercial presence and

growth, while consistently delivering value to our shareholders,

employees and the medical providers and patients who will benefit

from our products. For more information, visit www.aezsinc.com.

Forward-Looking Statements

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of the US Securities

Litigation Reform Act of 1995. Forward-looking statements may

include, but are not limited to statements preceded by, followed

by, or that include the words “expects,” “believes,” “intends,”

“anticipates,” and similar terms that relate to future events,

performance, or our results. Forward-looking statements involve

known and unknown risks and uncertainties that could cause the

Company's actual results to differ materially from those in the

forward-looking statements. Such risks and uncertainties include,

among others, the availability of funds and resources to pursue

R&D projects and clinical trials, the successful and timely

completion of clinical studies, the risk that safety and efficacy

data from any of our Phase 3 trials may not coincide with the data

analyses from previously reported Phase 1 and/or Phase 2 clinical

trials, the rejection or non-acceptance of any new drug application

by one or more regulatory authorities and, more generally,

uncertainties related to the regulatory process, the ability of the

Company to efficiently commercialize one or more of its products or

product candidates, the degree of market acceptance once our

products are approved for commercialization, the ability of the

Company to take advantage of business opportunities in the

pharmaceutical industry, the ability to protect our intellectual

property, the potential of liability arising from shareholder

lawsuits and general changes in economic conditions. Investors

should consult the Company's quarterly and annual filings with the

Canadian and US securities commissions for additional information

on risks and uncertainties relating to forward-looking statements.

Investors are cautioned not to place undue reliance on these

forward-looking statements. The Company does not undertake to

update these forward-looking statements. We disclaim any obligation

to update any such factors or to publicly announce the result of

any revisions to any of the forward-looking statements contained

herein to reflect future results, events or developments, except if

required to do so.

Condensed Interim Consolidated

Statements of Comprehensive Loss Information

(Unaudited)

Three months ended March 31, (in thousands, except

share and per share data)

2016 2015

$ $ Revenues Sales Commission and Other

181 — License fees

61 73

242

73

Operating expenses Research and development

costs

3,657 4,466 General and administrative expenses

1,894 3,443 Selling expenses

1,682 1,700

7,233 9,609

Loss from operations

(6,991 ) (9,536 ) Gain (loss) due to changes in

foreign currency exchange rates

468 (1,474 ) Change in fair

value of warrant liability

2,805 1,189 Other finance income

42 185

Net finance income (costs)

3,315 (100 )

Net loss from continuing

operations (3,676 ) (9,636 )

Net loss from

discontinued operations — (100 )

Net loss

(3,676 ) (9,736 )

Other comprehensive loss:

Items that may be reclassified subsequently to profit or loss:

Foreign currency translation adjustments

(469 ) 1,775

Items that will not be reclassified to profit or loss: Actuarial

loss on defined benefit plans

(1,426 ) (1,301 )

Comprehensive loss (5,571 ) (9,262 )

Net

loss per share (basic and diluted) from continuing operations

(0.37 ) (13.45 )

Net loss per share (basic and

diluted) from discontinued operations — (0.14 )

Net loss per share (basic and diluted) (0.37 )

(13.59 )

Weighted average number of shares outstanding:

Basic

9,928,697 716,536 Diluted

9,928,697 716,536

Consolidated Interim Consolidated

Statement of Financial Position Information

(Unaudited)

As at March 31, As at December 31, (in

thousands)

2016 2015 $ $ Cash

and cash equivalents1

32,981 41,450 Trade and other

receivables and other current assets

1,358 944 Restricted

cash equivalents

266 255 Property, plant and equipment

231 256 Other non-current assets

9,210 8,593

Total

assets 44,046 51,498 Payables and other current

liabilities2

3,643 4,770 Current portion of deferred

revenues

254 244 Warrant liability (current and non-current

portion)

8,086 10,891 Non-financial non-current liabilities3

15,766 13,978

Total liabilities 27,749 29,883

Shareholders' equity 16,297 21,615

Total

liabilities and shareholders' equity 44,046 51,498

1 Approximately $1.1 and $1.5 million are

denominated in EUR as at March 31, 2016 and

December 31, 2015, respectively.

2 Approximately $0.2 and $0.6 million

related to our provision for restructuring as at

March 31, 2016 and December 31, 2015,

respectively.

3 Comprised mainly of employee future

benefits, provisions for onerous contracts and

non-current portion of deferred

revenues.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160509006633/en/

Aeterna Zentaris Inc.Philip A. Theodore, Senior Vice

President843-900-3211, IR@aezsinc.com

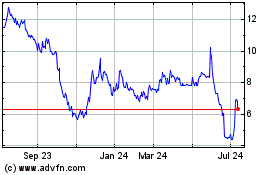

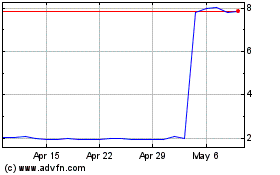

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024