Aéroports de Paris: Groupe ADP has converted its SETA shares into Mexican airport operator OMA shares and announces its inte...

October 06 2016 - 5:30PM

PRESS RELEASE

Paris, 6 October 2016

Aéroports de Paris SA

Groupe ADP has

converted its SETA shares

into Mexican airport operator OMA shares and

announces its intention to sell these

shares, while maintaining a technical and operational

advisory mission with SETA

Groupe ADP today announced that it

has informed Empresas ICA (BMV: ICA) and Grupo Aeroportuario del

Centro Norte, known as OMA (NASDAQ: OMAB; BMV: OMA) which operates

13 international airports in central and northern Mexico, of its

decision to exercise its option to exchange its 25.5% shareholding

in Servicios de Tecnología Aeroportuaria S.A. de C.V. (SETA), the

strategic partner of OMA, for OMA's B shares, for 4.3 %

(approximately 3.2% net of taxes) of OMA's total shares, held

by SETA.

Groupe ADP has also informed of

its intention to sell this equity interest in OMA through an

international private placement, with Goldman Sachs as sole

bookrunner.

The result of the private

placement will be communicated after the closing of the

bookbuilding.

Upon completion of the

transactions, Groupe ADP should no longer be an equity investor

either in SETA or in OMA.

Groupe ADP has been extremely

pleased with its strategic partnership with OMA through its

joint-venture SETA with ICA since 2000.

Groupe ADP, ICA and SETA expect to

maintain a relationship, through which Groupe ADP will continue to

provide technical and operational advisory to SETA under

appropriate service arrangements, including participation on behalf

of SETA on OMA's Board of Directors until the next Annual

Shareholders' Meeting.

Press contact:

Elise Hermant, Media and Reputation Department Manager +33 1 43 35

70 70

Investor Relations: Aurélie Cohen, Head of

Investor Relations +33 1 43 35 70 58 - invest@adp.fr

Groupe ADP builds, develops and

manages airports, including Paris-Charles de Gaulle, Paris-Orly and

Paris-Le Bourget. In 2015, Paris Aéroport handled more than 95

million passengers and 2.2 million metric tonnes of freight and

mail at Paris-Charles de Gaulle and Paris-Orly, and more than 55

million passengers at airports abroad through its subsidiary ADP

Management. Boasting an exceptional geographic location and a major

catchment area, the Group is pursuing its strategy of adapting and

modernising its terminal facilities and upgrading quality of

services; the Group also intends to develop its retail and real

estate businesses. In 2015, Group revenue stood at €2,916 million

and net income at €430 million.

Registered office: 291, boulevard

Raspail, 75014 PARIS

Aéroports de Paris is a public limited company (Société Anonyme)

with share capital of €296,881,806.

Registered in the Paris Trade and Company Register under no. 552

016 628 RCS Paris

groupeadp.fr

Aéroports de Paris SA: exchange of

SETA shares into OMA shares

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Aéroports de Paris via Globenewswire

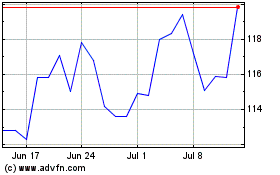

ADP Promesses (EU:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADP Promesses (EU:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024