Aegon CFO Says Approval of Solvency II Model Expected in December

November 12 2015 - 4:49AM

Dow Jones News

By Archie Van Riemsdijk

Dutch life insurer and pension provider Aegon expects the

country's regulator will give its approval in December for its

internal risk model to calculate its capital requirements under the

new regulatory framework Solvency II, after recent constructive

talks, the company's chief financial officer said.

Aegon didn't provide an update on its estimated range for its

solvency level under the new framework, ahead of the approval. "But

we have had very good conversations and the tone is good," chief

financial officer Darryl Button said in an interview with Dow Jones

Newswires on Thursday. "We therefore expect to receive approval in

December."

Aegon will wait until January to formally update investors on

its Solvency II level. The new regulatory framework will be in

force as of the start of next year.

At the time of its half-year earnings in August, Aegon lowered

its solvency guidance to a range of 140% to 170%, from 150% to 200%

previously. This caused a negative market reaction, with a drop in

Aegon's share price. Aegon also said it had recently submitted its

internal risk model for approval under the new regulatory

framework, known as Solvency II, which will replace the current

regulation next year.

Mr. Button also said the designation of Aegon as one of the nine

global systemically important insurance companies, or GSIIs, won't

be a binding constraint for the company. He said the status does

come with higher capital requirements, but those are well within

the current capital policy of Aegon, he said.

Aegon on Thursday reported a net loss of 524 million euros ($563

million) as a result of a book loss on selling its Canadian

insurance business.

Its IGD solvency ratio improved to 225%. This number measures

the ability of the insurance company to meet its future financial

obligations, even though it will soon become obsolete in the new

Solvency II framework.

IGD solvency improved due to positive spread developments for

Dutch mortgages.

At the company's U.S. operations, which generate most Aegon's

income, excess capital dropped to $600 million from $1 billion, due

to negative results from market-impact hedging.

Aegon's hedge "did not perform very well", Mr. Button conceded,

which caused a loss at the time when global stocks markets fell due

to market fears about decreasing Chinese economic growth. Due to a

yearly change of assumptions and models at the company, there was a

'hedging gap' which caused the loss, the CFO said. Lower excess

capital could potentially mean lower dividends for shareholders in

the future.

Write to Archie Van Riemsdijk at archieVan Riemsdijk.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 04:34 ET (09:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

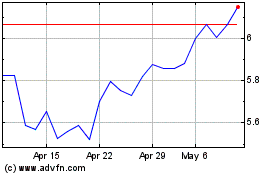

Aegon (EU:AGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aegon (EU:AGN)

Historical Stock Chart

From Apr 2023 to Apr 2024