TIDMAMS

RNS Number : 2151S

Advanced Medical Solutions Grp PLC

16 March 2016

16 March 2016

Advanced Medical Solutions Group plc

("AMS" or the "Group")

Unaudited preliminary Results for the year ended 31 December

2015

Continued delivery of strong growth and innovation

Winsford, UK: Advanced Medical Solutions Group plc (AIM: AMS), a

leading developer and manufacturer of advanced products for the

global surgical and wound care markets, today announces its

unaudited preliminary results for the year ended 31 December

2015.

Financial Highlights

2015 2014 Reported Growth

growth at constant

currency(1)

----------------------------- ----- ----- --------- -------------

Group revenue (GBP million) 68.6 63.0 9% 11%

----------------------------- ----- ----- --------- -------------

Adjusted(2) operating

margin (%) 25.4 24.7 70bps -

----------------------------- ----- ----- --------- -------------

Adjusted(2) profit before

tax (GBP million) 17.4 15.6 12% -

----------------------------- ----- ----- --------- -------------

Profit before tax (GBP

million) 17.0 15.2 12% -

----------------------------- ----- ----- --------- -------------

Adjusted(2) diluted

earnings per share (p) 6.86 6.26 10% -

----------------------------- ----- ----- --------- -------------

Diluted earnings per

share (p) 6.68 6.08 10% -

----------------------------- ----- ----- --------- -------------

Net operating cash flow(3) 22.5 18.4 22%

----------------------------- ----- ----- --------- -------------

Net cash (GBP million)(4) 34.2 17.3 98% -

----------------------------- ----- ----- --------- -------------

-- Proposed final dividend of 0.55p per share, making a total

dividend for the year of 0.80p (2014: 0.70p), up 14.3%

Business Highlights:

-- Good sales progress across all Business Units on a constant currency basis;

o Branded Distributed up 37% to GBP14.6 million (2014: GBP10.7

million)(5) , and up 38% at constant currency

o Branded Direct down 3% to GBP22.3 million (2014: GBP23.2

million)(5) , and up 3% at constant currency

o OEM up 10% to GBP27.7 million (2014: GBP25.3 million), and up

8% at constant currency

o Bulk Materials up 2% to GBP3.9 million (2014: GBP3.9 million),

and up 12% at constant currency

-- Strong performance in the US with LiquiBand(R) tissue adhesive range

o Revenues up 79% at constant currency to GBP8.0m (2014: GBP4.1

million)

o As at 31 December 2015, market share by volume(6) increased to

16.8% (July 2015: 11.1%) in the combined hospital and non -

hospital market

-- ActivHeal(R) continued to make good progress in the UK NHS, with an 8% increase in revenue

-- Silver alginate revenues increased by 10% at constant

currency to GBP15.5 million (2014: GBP13.7 million)

-- Hernia mesh fixation device, LiquiBand(R) Fix8(TM), delivered

GBP1.0m of sales in the first full year and launched in 20

countries

-- CE approval for antimicrobial foam including

Polyhexamethylene Biguanide (PHMB) for Europe received on 27 August

2015 with launches expected in 2016

-- FDA approval for two new product claims for the octyl

formulation product, LiquiBand Exceed(TM), giving it a competitive

advantage in the US topical skin adhesive market

-- FDA approval to market suture portfolio in the US in line

with strategy post acquisition of Resorba.

Commenting on the results Chris Meredith, Chief Executive

Officer of AMS, said:

"We have delivered another strong year of growth and are pleased

to report that all of our business units are performing well

despite some challenging currency conditions. The growth in the US

has been markedly strong for AMS where the performance and range of

our LiquiBand(R) tissue adhesives, in particular, is driving market

share gains. We have also been pleased with the number of new

product approvals we have achieved this year, demonstrating the

continuing success of our innovation and we are confident that,

with our strong R&D pipeline, we will continue to deliver

growth."

- End -

(1) Constant currency removes the effect of currency movements

by re-translating the current period's performance at the previous

period's exchange rates

(2) All items are shown before amortisation of acquired

intangible assets which, in 2015, were GBP0.4 million (2014: GBP0.4

million) as defined in the financial review

(3) Operating cash flow is arrived at by taking the operating

profit for the period and adjusting it for depreciation,

amortisation, working capital movements and other non cash

items

(4) Net cash is defined as cash and cash equivalents plus short

term investments less financial liabilities and bank loans

(5) GBP0.4m of sutures for the dental market has been

reclassified from the Branded Direct to the Branded Distributed

segment. The 2014 revenues have been restated to aid comparison

(6) data supplied by Global Healthcare Exchange

For further information, please visit our new website

www.admedsol.com or contact:

Advanced Medical Solutions Group Tel: +44 (0)

plc 1606 545508

Chris Meredith, Chief Executive

Officer

Mary Tavener, Group Finance Director

Consilium Strategic Communications Tel: +44 (0)

20 3709 5700

Mary-Jane Elliott / Jonathan

Birt / Matthew Neal / Hendrik

Thys

Investec Bank PLC (NOMAD & Broker) Tel: +44 (0)

20 7597 5970

Gary Clarence / Daniel Adams

/ Patrick Robb

About Advanced Medical Solutions Group plc

AMS is a world-leading independent developer and manufacturer of

innovative and technologically advanced products for the global

surgical, wound care and wound closure markets, focused on quality

outcomes for patients and value for payors. AMS has a wide range of

products that include silver alginates, alginates, foams, tissue

adhesives, sutures and haemostats, which it markets under its

brands; ActivHeal(R), LiquiBand(R) and RESORBA(R) as well as

supplying under white label.

AMS's products, manufactured out of two sites in the UK, one in

the Netherlands, two in Germany and one in the Czech Republic, are

sold in more than 70 countries via a network of multinational or

regional partners and distributors, as well as via AMS's own direct

sales forces in the UK, Germany, the Czech Republic and Russia.

Established in 1991, the Company has 510 employees. For more

information please see www.admedsol.com.

Chairman's Statement

AMS continues to progress as a leading, international provider

of high quality, high value innovative and technologically advanced

products for the advanced wound care and wound closure markets and

has delivered another year of good growth.

The performance of LiquiBand(R) in the US was particularly

strong. We continue to gain market share and are fast approaching

our initial goal of building a 20% market share with our

LiquiBand(R) range in the US. We are also pleased with the success

of our LiquiBand(R) Fix8(TM) hernia mesh fixation device, our first

device using medical adhesive inside the body. It is now being sold

in 20 countries and has achieved GBP1 million of sales in its first

full year since launch.

We have also received a number of product and market approvals

in the year, demonstrating our continued success in innovation,

with launches planned in 2016, supporting the sales growth in the

Group.

Financially, we are pleased to report a 9% increase in revenue

to GBP68.6 million (2014: GBP63.0 million), representing growth of

11% on a constant currency basis and an increase in adjusted(1)

profit before tax of 12% to GBP17.4 million (2014: GBP15.6

million).

The strong cash flow generation of the Group was again evident

and we ended the year with net cash of GBP34.2 million (2014:

GBP17.3 million). AMS continues to be in robust financial health

and is well positioned to invest in internal and external

opportunities in line with the Group's strategy.

Dividend

The Board is proposing a final dividend of 0.55p per share,

making a total dividend for the year of 0.80p per share, a 14.3%

increase on 2014. If approved at the Annual General Meeting on 2

June 2016, this will be paid on 10 June 2016 to shareholders on the

register at the close of business on 20 May 2016.

People

On behalf of the Board, I would like to thank all of our

employees, customers, suppliers, business partners and shareholders

for their support over the past year in helping AMS achieve its

goals.

Peter Allen

Chairman

(1) All items are shown before amortisation of acquired

intangible assets which, in 2015, were GBP0.4 million (2014: GBP0.4

million) as defined in the financial review

Chief Executive's Statement

I am pleased to report another strong set of results across the

Group.

Branded Distributed

The Branded Distributed Business Unit reports the sales of our

brands through third party distributors.

Branded Distributed revenue was 37% higher at GBP14.6 million

(2014: GBP10.6 million)(5) and 38% higher at constant currency. The

main contributor to this growth was LiquiBand(R) sales in the US,

which accounted for 55% of the business unit's total sales.

LiquiBand(R) in the US

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

Sales of LiquiBand(R) in the US increased by 93% to GBP8.0

million (2014: GBP4.1 million) at reported currency and by 79% at

constant currency. The latest data(2) for December 2015 shows our

volume market share in the US hospital sector increasing to 16.0%,

up from 9% at July 2015, while our volume market share in the US

non-hospital, or alternate site, market is now estimated(2) at

22.2%, increased from 21.5% at June 2015, making an overall market

share of 16.8% (11.1% at July 2015).

The launch of our 2-octyl cyanoacrylate formulation,

LiquiBand(R) Exceed(TM), has extended our portfolio of products and

has contributed to the momentum of growth. We now have a number of

formulations of cyanoacrylate within our marketed LiquiBand(R)

product range, including very fast setting formulations with

applicators allowing for quick, precision closure; film-forming

formulations that are designed to close and provide a protective

barrier layer over wounds as well as formulations that have

properties in between. Our LiquiBand(R) products are now able to

accommodate the full spectrum of wound closing needs, each in

innovatively designed applicators favoured by surgeons.

On 3 November 2015, the FDA approved two new product claims for

LiquiBand Exceed(TM) giving it a competitive advantage in the

topical skin adhesive market. These claims allow AMS and its

distribution partners to differentiate LiquiBand Exceed(TM) from

the market leader on wound coverage, volume of useable glue and

ability to re-use during the same operational procedure, saving

both time and cost. The two new claims include the use of a single

device to cover wounds of up to 30cm in length, as well as a single

device being suitable for intra-operative reuse for up to 90

minutes on a single patient. Both claims are unique for the US

Topical Skin Adhesive Market and will help us to continue to

provide a superior product for clinicians and a versatile solution

for healthcare providers in this key market, helping AMS to further

grow its market share.

LiquiBand(R) in the EU and Rest Of the World

Elsewhere, within the EU and ROW, LiquiBand(R) sales through our

distributors continued to show good growth. France and Italy remain

our largest markets outside the US, UK and Germany. Overall sales

increased by 12% to GBP1.7 million (2014: GBP1.5 million) at

reported currency and constant currency.

The regulatory approval process for LiquiBand(R) in China has

continued to be challenging. Given the difficulties that have been

experienced due to changes in the regulatory pathway, we have

withdrawn our original file and re-started the submission process

with our most recent formulations and designs of LiquiBand(R)

Exceed(TM) and LiquiBand(R) Flowcontrol(TM) and are not expecting

approval in the current year.

Hernia Mesh Fixation device - LiquiBand(R) Fix8(TM)

We have been delighted with the response we have received from

surgeons following the launch of LiquiBand(R) Fix8(TM). Feedback

has been extremely positive about the ease of use of this device

and the benefit it brings to patients regarding the reduced risk of

post operative pain. A number of surgeons have been keen to endorse

the product and we are also receiving valuable feedback about other

possible applications suitable for this type of device on which we

are currently working.

AMS received approval to market this highly innovative product,

LiquiBand(R) Fix 8(TM), in Europe in May 2014. This was the Group's

first application using medical cyanoacrylate technology inside the

body. Through the accurate delivery of individual drops of

cyanoacrylate adhesive, LiquiBand(R) Fix8(TM) is used to hold

hernia meshes in place within the body instead of traditional tacks

and staples. This accurate laparoscopic application of adhesive is

expected to reduce surgical complications, in particular the

potential pain associated with the use of tacks and staples,

thereby improving the patient experience

(2) data supplied by Global Healthcare Exchange

and reducing healthcare costs overall.

We were able to expand the indications of LiquiBand(R) Fix 8(TM)

in May 2015 and the device is now able to be used for the

laparoscopic surgical mesh fixation for all types of abdominal

hernia as well as for the closure of the membrane lining the

abdominal wall (peritoneum). This was the first extension of the

claims of LiquiBand(R) Fix 8(TM) and we expect to develop further

opportunities for this kind of application, broadening the market

for the use of adhesives internally.

In the first full reporting year, GBP1.0 million of LiquiBand(R)

Fix 8(TM) sales have been achieved across the Group, with GBP0.7

million (2014: GBP0.1 million) resulting from sales to

distributors. The product is now launched in 20 countries.

RESORBA(R)

Sales of RESORBA(R) products to all export markets (excluding

Russia) declined by 7% at reported currency to GBP3.1 million

(2014: GBP3.3 million)(3) , but increased by 4% at constant

currency. France and Italy remain our largest markets for export

and good growth was seen in both territorities, offset by a weak

performance in China where sales declined 19%. Sales in Russia

decreased by 10% at constant currency, but decreased 40% to GBP0.8

million (2014: GBP1.3 million) at reported currency, reflecting

both the weak economic conditions within Russia and the impact of

the weak Rouble.

We received approval from the FDA on 4 November 2015 that we had

clearance to market the majority of our suture product portfolio,

successfully adding to our first US suture approval from early

2015. With only one more suture type still awaiting US market

approval, we are now well positioned to launch a comprehensive

range of sutures into the US in mid-2016 through a combination of

our branded and unbranded routes to market. The US surgical suture

market is estimated to be in excess of $1billion in size and is

dominated by a few major brands. Gaining US approval for the

RESORBA(R) product range has been a strategic aim for the Group

since we acquired the business in late 2011, providing a

significant opportunity for AMS in the medium term.

In R&D our focus is on continuing to improve the

formulations of the base monomers that are used in our adhesives as

well as extending the applications of tissue adhesives for other

internal uses.

Branded Direct

The Branded Direct Business Unit reports sales of our branded

products through our own sales forces in the UK, Germany and Czech

Republic. Reported revenue declined 3% to GBP22.3 million (2014:

GBP23.2 million)(3) but grew by 3% at constant currency.

2015 was a year of investment in this Business Unit with a

number of senior management hires and in particular, a new Business

Unit Director was hired in June. As a consequence of these

investments, a number of new initiatives have been put in place to

drive the business forward in 2016.

ActivHeal(R)

ActivHeal(R) , which delivers a high quality range of woundcare

dressings that offer significant cost savings without compromising

on clinical outcomes or patient care, continues to be a compelling

proposition for the NHS. Sales of our ActivHeal(R) range increased

by 8% to GBP6.4 million (2014: GBP6.0 million). We continue to

broaden our product range to the NHS, including our recently

approved anti-microbial and atraumatic foam dressings within our

offering.

LiquiBand(R)

Sales of LiquiBand(R) into the Accident and Emergency Room

('A&E') in the UK fell 13% to GBP2.3 million (2014: GBP2.6

million). We expect the initiatives we have taken to restore growth

in 2016. Sales into the OR increased 17% to GBP0.7 million (2014:

GBP0.6 million).

Sales of LiquiBand(R) in Germany increased 27% at constant

currency to GBP1.6 million and by 13% at reported currency. Within

this, sales of LiquiBand(R) Fix8(TM) contributed GBP0.3 million

(2014: nil).

RESORBA(R)

Sales of RESORBA(R) branded products in Germany and the Czech

Republic were 10% lower at GBP11.3

million (2014: GBP12.5 million)(3) at reported level but flat at

constant currency with some pricing pressure being seen. Within

this sales of haemostats increased by 1% at constant currency to

GBP3.3 million (2014: GBP3.6 million) and sales of sutures and

collagens into the dental market increased 5% at constant curency

to GBP3.1 million, whilst sales of sutures into hospitals fell

2%.

We believe our ability to supply a comprehensive range of high

quality sutures that provide cost savings to hospitals is

compelling, and we are targetting smaller accounts where conversion

will not be seen as such a difficult challenge. This strategy looks

to be proving successful with a number of hospitals already

agreeing to convert their suture ranges in the A&E departments

in 2016.

In R&D, our focus is on extending the attributes of our

collagens to meet the needs of dental practitioners and oral

surgeons as well as including new antibiotics in our

haemostats.

OEM

The OEM Business Unit reports the sales of products that are

sold under third parties' brands.

OEM revenue increased by 10% at reported currency to GBP27.7

million (2014: GBP25.3 million) and by 8% at constant currency.

Our silver alginate ranges of dressings continued to perform

well, with sales increasing by 13% at reported currency and by 10%

at constant currency to GBP15.5 million (2014: GBP13.7 million).

Our partners continued to do well with the range of silver fibre

dressings we provide, gaining market share as well as accessing new

geographical markets. We continue to support them with regulatory

approvals and marketing data.

On 1 September 2015 we received CE approval in Europe for a new

non-adhesive antimicrobial foam dressing containing

Polyhexamethylene Biguanide (PHMB).

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

PHMB has been shown to be effective against several bacteria

including, amongst others, Staphylococcus Aureus including the

methicillin resistant type, (MRSA) and Escherichia Coli (E-Coli).

This antimicrobial foam wound dressing may be used throughout the

healing process on moderate to heavily exuding chronic and acute

wounds that are infected or are at risk of infection and may be

used on pressure ulcers, leg and foot ulcers, diabetic ulcers and

surgical wounds.

In addition, we also now have approval for an atraumatic wound

dressing containing silicone which can be removed from a wound

without damaging the skin. Contracts have been agreed to launch

both the PHMB foam and the atraumatic foam with our OEM partners

and are expected to launch in 2016. We expect that the launch of

our antibiotic foam dressings may result in some initial

substitution of our silver alginate dressings.

Sales of our existing foam-based dressings were flat at GBP1.8

million. With the expansion of our product portfolio, growth is

expected in 2016.

Our other woundcare and skin protectant products delivered good

growth and grew 6% to GBP9.7 million at constant currency (2014:

GBP9.0 million), and 7% at reported currency.

We continue to work on extending our advanced woundcare ranges

by looking to add other antimicrobial products to the range,

improving the absorbancy of the dressings as well as combining a

number of materials to enhance the performance of our

dressings.

Bulk Materials

The Bulk Business Unit reports sales of bulk materials to third

party convertors.

Bulk Materials revenue increased by 2% at reported currency to

GBP3.9 million (2014: GBP3.9 million) and by 12% at constant

currency.

(3) GBP0.4m of sutures for the dental market has been

reclassified from the Branded Direct to the Branded Distributed

segment. The 2014 revenues have been restated to aid

comparison.

Rollstock foam contributed around 86% of Bulk revenue and good

growth was seen by one signficant customer that had destocked in

2014. Sales by some newer and smaller partners are also now

starting to gain traction and are expected to bring benefits in

2016.

In R&D, the focus is on developing new foam formulations

with antimicrobials, working in conjunction with the OEM Business

Unit.

Operations

Efficiency and gross margins

We continue to make operational improvements by reducing set up

times, eliminating non-value added activities and increasing

outputs. These incremental efficiencies are helping to improve

gross margins acoss the Group and have helped to generate an

improvement of approximately 100 basis points in 2015. We have

invested in improving both our converting and packing capability in

Winsford. This equipment has provided increased operational

flexibility, improved efficiency and provided additional

capacity.

Capacity and resource

The capacity of our collagen plant in Germany has been increased

with a new freeze drier and ancillary services. The total cost of

this investment is GBP0.8 million, of which GBP0.2 million was

incurred in 2015. This plant is now fully running, following

commissioning in February 2016 and has increased our collagen

manufacturing capacity by 50%.

We continue to invest in improving our ERP (Enterprise Resource

Planning) management and reporting systems and having already

successfully completed the implementation in Winsford, Plymouth and

Etten Leur facilities, are now working on improvements to our

systems in Germany.

Regulatory and quality assurance

With the regulatory framework becoming increasingly complex, we

have continued to invest in both Regulatory and Quality functions

and systems to ensure that we are able to support our partners with

winning approvals in new markets as well as obtaining approval for

our own products. We have started work on scoping the process to

gain approval to market LiquiBand(R) Fix 8(TM) in the US which will

involve a full Pre Market Approval (PMA) and is likely to take at

least three years. We are also working on identifying the

regulatory pathway to include antibiotics in collagens.

Summary and Outlook

We have delivered a reported revenue growth of 9%, 11% at

constant currency, and improved profitability and cash generation

during the year.

All Business Units have delivered growth at constant currency

with the US sales, in particular, delivering a very strong

performance. We have been very pleased with the successful launch

of our LiquiBand(R) Fix8(TM) hernia mesh fixation device. Sales in

the first year have given us confidence that this product will

drive growth and support our strategy of accessing the OR.

We have also received a number of approvals in the year

demonstrating our continued success with new products and

underlines our commitment to investing in R&D. We expect to

make further advancements in these activities and to launch new

products as a result of our innovation.

We are confident that the Group is well placed to drive growth

and remain excited by the prospects for our future.

Financial Review

Summary

Group revenue increased by 9% to GBP68.6 million (2014: GBP63.0

million). At constant currency, revenue growth would have been

11%.

Comparisons with 2014 are made on a pre-amortisation of acquired

intangible asset cost basis, as we believe that this provides a

more relevant representation of the Group's trading performance.

Amortisation of acquired intangible assets was GBP0.4 million in

the period (2014: GBP0.4 million).

To aid comparison, the Group's adjusted income statement is

summarised in Table 1 below.

Table 1 Year ended Year ended

31 Dec 31 Dec

2015 2014

Adjusted Income Statement GBP'000 GBP'000 % Change

---------------------------- -------------- -------------- ---------

Revenue 68,596 63,010 9%

---------------------------- -------------- -------------- ---------

Gross profit 39,908 35,843 11%

Distribution costs (951) (853)

Administration expenses(3) (22,138) (19,681)

Other income 589 250

---------------------------- -------------- -------------- ---------

Adjusted operating

profit 17,408 15,559 12%

Net finance (costs)

/ income/ (45) 48

---------------------------- -------------- -------------- ---------

Adjusted profit before

tax 17,363 15,607 11%

Amortisation of acquired

intangibles (367) (389)

---------------------------- -------------- -------------- ---------

Profit before taxation 16,996 15,218 12%

Taxation (2,877) (2,354)

---------------------------- -------------- -------------- ---------

Profit for the period 14,119 12,864 10%

---------------------------- -------------- -------------- ---------

Adjusted earnings

per share - basic(4) 6.95p 6.39p 9%

Earnings per share

- basic(4) 6.78p 6.20p 9%

---------------------------- -------------- -------------- ---------

Adjusted earnings

per share - diluted(4) 6.86p 6.26p 10%

Earnings per share

- diluted(4) 6.68p 6.08p 10%

---------------------------- -------------- -------------- ---------

3 Administration expenses exclude amortisation of acquired intangible assets

4 See Note 7 Earnings per share for details of calculation

Revenues were negatively impacted by approximately GBP1.5

million due to the effects of currency movements in the year. This

also had an impact on Group gross margins which were reduced by 30

bps as a result. Gross margins were positively impacted by sales

mix effect by 60bps, as well as the 100bps improvement made from

operational eficiences.

Adjusted operating profit increased by 12% to GBP17.4 million

(2014: GBP15.6 million) and the adjusted operating margin increased

by 70 bps to 25.4% (2014: 24.7%). Administration costs increased by

12% to GBP22.1m (2014: GBP19.7 million) as investments were made in

selling and marketing, particularly to support the Branded Direct

business unit. Within this, the Group expensed to the income

statement GBP1.8 million on R&D (2014: GBP2.1 million). Spend

as a percentage of sales reduced to 2.6% (2014: 3.3%).

Profit before tax for the year was 12% higher at GBP17.0 million

(2014: GBP15.2 million).

The Group's effective rate of tax for the year was 16.9 % (2014:

15.5%). This is reflective of the utilisation of previously

unrecognised brought-forward tax losses in the UK, together with

Patent Box and R&D relief. It also reflects the impact of

blending profits and losses from different countries and the

different tax rates associated with these countries. The effective

tax rate of the Group is expected to increase as the Group is no

longer classified as a Small Medium Enterprise (SME) and will no

longer be able to gain R&D relief at the SME rate from

2017.

A reconciliation between the standard rate of taxation in the UK

and the Group's effective rate is summarised in Table 2 below.

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

Table 2

Taxation %

Standard taxation rate 20.25

Loss utilisation and recognition (1.58)

Impact of differential between UK and

overseas tax rate 2.09

Patent box relief (2.58)

R&D relief (1.91)

Expenses not deductible, prior year adjustments,

depreciation & share based payments 0.65

-------------------------------------------------- -------

Effective taxation rate 16.9

-------------------------------------------------- -------

Earnings (excluding amortisation of acquired intangible assets)

increased by 9% to GBP14.5 million (2014: GBP13.3 million),

resulting in a 9% increase in adjusted basic earnings per share to

6.95p (2014: 6.39p) and a 10% increase in diluted adjusted earnings

per share to 6.86p (2014: 6.26p).

Profit after tax increased by 9% to GBP14.1 million (2014:

GBP12.9 million), resulting in a 9% increase in basic earnings per

share to 6.78p (2014: 6.20p) and a 10% increase in diluted earnings

per share to 6.68p (2014: 6.08p).

The Board is proposing a final dividend of 0.55p per share, to

be paid on 10 June 2016 to shareholders on the register at the

close of business on 20 May 2016. This follows the interim dividend

of 0.25p per share that was paid on 30 October 2015 and would make

a total dividend for the year of 0.80p per share (2014: 0.70p), a

14.3% increase on 2014.

The operational performance of the Business Units is shown in

Table 3 below. The adjusted profit from operations and the adjusted

margin are shown after excluding amortisation of acquired

intangibles. To aid comparison and in determining the operational

margins of the individual Business Units, the revenue of the Bulk

Materials Business Unit sales made to other Business Units of

GBP0.8 million (2014: GBP0.7 milllion) is included.

Table 3

Operating Result by Business Unit

------------------------------------------------------------------------

Year ended 31 December Branded Branded OEM Bulk

2015 Direct Distributed Materials

GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- -------- -----------

Revenue(6) 22,344 14,631 27,674 4,772

Profit from operations 5,235 4,366 7,139 814

Amortisation of

acquired intangibles 214 127 25 -

Adjusted profit

from operations(5) 5,449 4,493 7,164 814

Adjusted operating

margin(5) 24.4% 30.7% 25.9% 17.1%

------------------------ -------- ------------- -------- -----------

Year ended 31 December

2014

Revenue 23,194 10,663 25,275 4,580

Profit from operations 6,012 2,999 6,225 485

Amortisation of

acquired intangibles 227 135 27 -

Adjusted profit

from operations(5) 6,239 3,134 6,252 485

Adjusted operating

margin(5) 26.9% 29.4% 24.7% 10.6%

------------------------ -------- ------------- -------- -----------

(5) excludes amortisation of intangible assets

(6) GBP0.4m of sutures for the dental market has been

reclassified from the Branded Direct to the Branded Distributed

segment. The 2014 revenues have been restated to aid

comparison.

Branded Direct

The adjusted operating margin of this Business Unit reduced to

24.4% (2014: 26.9%) and lower than the position at H1 2015 (26.7%).

Operating margin was reduced partly as a result of some pricing

pressure in Germany as well as the investment we have made in our

direct sales teams which we highlighted at the half year. We expect

the benefit of this investment to start coming through in 2016.

Branded Distributed

The adjusted operating margin of this Business Unit increased to

30.7% (2014: 29.4%), reflecting the improved profitability from the

increase in sales in this Business Unit and, in particular, from

sales to the US. The growth in sales to the US mitigated the impact

in the reduction in margin from sales made into Russia and

continued the improvement in margin seen at H1 2015 (26.5%).

OEM

The adjusted operating margin of this Business Unit was at a

higher level to the prior year at 25.9% (2014: 24.7%), and lower

than the margin reported at H1 2015 (26.8%) due to the mix of

business.

Bulk Materials

The adjusted operating margin of this Business Unit increased to

17.1% (2015: 10.6%), and improved from the position in H1 2015

(12.6%). Margins were affected by the higher volumes of production

and sales.

Geographic breakdown of revenues

The geographic breakdown of Group revenues in 2015 is shown in

Table 4 below:

Table 4

Geographic Breakdown of Group Revenues

---------------------------------------------------

GBP millions 2015 % of 2014 % of

total total

------------------- ----- ------- ----- -------

Europe (excluding

UK & Germany) 19.1 27.8% 18.7 29.7

Germany 13.4 19.5% 14.0 22.3

UK 16.7 24.3% 15.3 24.3

USA 17.8 25.9% 13.8 21.9

Rest of World 1.6 2.3% 1.1 1.8

------------------- ----- ------- ----- -------

47% of the Group's sales are in Europe (excluding the UK),

however, only around 30% of sales are denominated in Euros.

Approximately 85% of all sales to the US are denominated in US

Dollars. The Group hedges significant transactional exposure by

using forward contracts and options, and aims to have 70% of its

estimated transactional exposure for the next twelve months

hedged.

The Group estimates that a 10% movement in GBP:US$ or GBP: Euro

exchange rate will impact Sterling revenues by approximately 2.3%

and 3.0% respectively and in the absence of any cash flow hedging

this would have an impact on profit of 1.3% and 0.1%.

Cash Flow

Table 5 summarises the Group's cash flows.

Table 5

Group Cash Flows

Year ended 31 December 2015 2014

GBP'000 GBP'000

------------------------------------- -------- --------

Adjusted operating profit (Table

1) 17,408 15,559

Non-cash items 3,153 2,993

------------------------------------- -------- --------

EBITDA 20,561 18,552

Working capital movement 1,983 (104)

------------------------------------- -------- --------

Net operating cashflow 22,544 18,448

Capital expenditure and capitalised

R&D (2,675) (2,406)

Net interest (paid)/received (47) 45

Tax paid (1,253) (1,876)

------------------------------------- -------- --------

Free cash flow 18,569 14,211

Dividends paid (1,521) (1,307)

Proceeds from share issues 494 65

Net increase in cash and cash

equivalents 17,542 12,969

------------------------------------- -------- --------

Note: EBITDA is earnings before interest, tax, depreciation,

intangible asset amortisation and share based payments

EBITDA increased by 11% to GBP20.6 million (2014: GBP18.6

million).

Working capital decreased in the year mainly due to the effects

of translating overseas working capital balances held in Euros into

Sterling. Inventory across the group slightly increased to 4.4

months of supply (2014: 4.2 months of supply). Trade debtor days

were slightly lower than the prior year at 41 days (2014: 42 days)

while trade payable days decreased slightly to 34 days (2014: 36

days).

The Group generated net cash from operating activities of

GBP22.5 million (2014: GBP18.4 million) (see Table 5) and had net

cash of GBP34.2 million (2014: GBP17.3 million) at the end of the

year.

We invested GBP2.7 million in capital equipment, software and

capitalised R&D in the year (2014: GBP2.4 million). We have

invested in equipment around the Group that improves converting and

packaging in Winsford as well increasing capacity in Germany.

The Group generated a free cash flow of GBP18.6 million in the

year (2014: GBP14.2 million). The conversion of adjusted operating

profit into free cash flow was 107% (2014: 91%).

The Group paid its final dividend for the year ended 31 December

2014 of GBP0.94 million (2014: for the year ending 2013, GBP0.85

million) on 29 May 2015, and its interim dividend for the six

months ended 30 June 2015 of GBP0.59 million (2014: GBP0.46

million) on 30 October 2015.

In December 2014 the Group entered into a new, five-year, GBP30

million, multi-currency revolving credit facility with an accordion

option under which AMS can request up to an additional GBP20

million on the same terms. The previous facility for GBP4 million

was due to expire in 2015. The Group chose to take advantage of

favourable credit conditions to put in place a more suitable

facility to support its growth ambitions. The new facility is

provided jointly by the Group's existing bankers, HSBC, as well as

The Royal Bank of Scotland. It is unsecured and has not been drawn

down. This facility carries an annual interest rate of LIBOR or

EURIBOR plus a margin that varies between 0.65% and 1.75% depending

on the Group's net debt to EBITDA ratio.

At the end of the period, the Group had net cash of GBP34.2

million (2014: GBP17.3 million). The movement in net cash from the

start of the year to net cash at the end of the year is reconciled

in Table 6 below:

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

Table 6

Movement in net cash GBP'000

--------------------------------- --------

Net cash as at 1 January 2015 17,280

Exchange rate impacts (621)

Free cash flow 18,569

Dividends paid (1,521)

Proceeds from share issues 494

Net cash as at 31 December 2015 34,201

--------------------------------- --------

The Group's going concern position is fully described in note

2.

CONSOLIDATED INCOME STATEMENT

(Unaudited) (Audited)

Year ended 31 2015 2014

December

Total Total

Note GBP'000 GBP'000

------------------------ ----- ------------ ----------

Revenue from

continuing operations 4 68,596 63,010

Cost of sales (28,688) (27,167)

------------------------- ----- ------------ ----------

Gross profit 39,908 35,843

Distribution

costs (951) (853)

Administration

costs (22,505) (20,070)

Other income 589 250

------------------------- ----- ------------ ----------

Profit from

operations 4,5 17,041 15,170

Finance income 73 49

Finance costs (118) (1)

------------------------- ----- ------------ ----------

Profit before

taxation 16,996 15,218

Income tax 6 (2,877) (2,354)

------------------------- ----- ------------ ----------

Profit attributable

to equity holders

of the parent 14,119 12,864

-------------------------

Earnings per

share

Basic 7 6.78p 6.20p

Diluted 7 6.68p 6.08p

Adjusted diluted 7 6.86p 6.26p

------------------------- ----- ------------ ----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited) (Audited)

Year ended 31 December 2015 2014

GBP'000 GBP'000

------------------------------------- ------------ ----------

Profit for the year 14,119 12,864

Items that may be reclassified

subsequently to profit and loss:

Exchange differences on translation

of foreign operations (3,348) (4,200)

Loss arising on cash flow hedges (3) (1,173)

------------------------------------- ------------ ----------

Other comprehensive expense for

the year (3,351) (5,373)

------------------------------------- ------------ ----------

Total comprehensive income for

the year attributable to equity

holders of the parent 10,768 7,491

------------------------------------- ------------ ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Audited)

At 31 December 2015 2014

GBP'000 GBP'000

-------------------------------- ------------ ----------

Assets

Non-current assets

Acquired intellectual property

rights 8,359 9,238

Software intangibles 2,009 1,835

Development costs 1,803 1,850

Goodwill 34,579 36,696

Property, plant and equipment 15,795 16,003

Deferred tax assets 135 1,108

Trade and other receivables 13 22

-------------------------------- ------------ ----------

62,693 66,752

Current assets

Inventories 8,843 7,532

Trade and other receivables 10,817 12,969

Current tax assets 9 -

Cash and cash equivalents 34,201 17,280

-------------------------------- ------------ ----------

53,870 37,781

-------------------------------- ------------ ----------

Total assets 116,563 104,533

-------------------------------- ------------ ----------

Liabilities

Current liabilities

Trade and other payables 9,139 7,649

Current tax liabilities 806 584

Other taxes payable 234 259

Obligations under finance

leases 1 2

------------

10,180 8,494

Non-current liabilities

Trade and other payables 415 472

Deferred tax liabilities 2,311 2,513

Obligations under finance

leases - 1

2,726 2,986

-------------------------------- ------------ ----------

Total liabilities 12,906 11,480

-------------------------------- ------------ ----------

Net assets 103,657 93,053

-------------------------------- ------------ ----------

Equity

Share capital 10,451 10,393

Share premium 33,196 32,742

Share-based payments reserve 2,253 1,563

Investment in own shares (152) (148)

Share-based payments deferred

tax reserve 437 278

Other reserve 1,531 1,531

Hedging reserve (525) (522)

Translation reserve (8,215) (4,867)

Retained earnings 64,681 52,083

-------------------------------- ------------ ----------

Equity attributable to equity

holders of the parent 103,657 93,053

-------------------------------- ------------ ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to equity holders of the Group

Share Investment Share

based

Share Share based in own payments Other Hedging Translation Retained

capital premium payments shares deferred reserve reserve reserve earnings Total

tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------

At 1 January

2014

(audited) 10,343 32,364 1,326 (144) 158 1,531 651 (667) 40,526 86,088

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Consolidated

profit

for the year

to 31

Dec 2014 - - - - - - - - 12,864 12,864

Other

comprehensive

income - - - - - - (1,173) (4,200) - (5,373)

---------------

Total

comprehensive

income - - - - - - (1,173) (4,200) 12,864 7,491

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Share based

payments - - 592 - 120 - - - - 712

Share options

exercised 50 378 (355) - - - - - - 73

Shares

purchased by

EBT - - - (190) - - - - - (190)

Shares sold by

EBT - - - 186 - - - - - 186

Dividends paid - - - - - - - - (1,307) (1,307)

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

At 31 December

2014

(audited) 10,393 32,742 1,563 (148) 278 1,531 (522) (4,867) 52,083 93,053

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Consolidated

profit

for the year

to 31

Dec 2015 - - - - - - - - 14,119 14,119

Other

comprehensive

income - - - - - - (3) (3,348) - (3,351)

---------------

Total

comprehensive

income

(unaudited) - - - - - - (3) (3,348) 14,119 10,768

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Share based

payments - - 709 - 159 - - - - 868

Share options

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

exercised 58 454 (19) - - - - - - 493

Shares

purchased by

EBT - - - (262) - - - - - (262)

Shares sold by

EBT - - - 258 - - - - - 258

Dividends paid - - - - - - - - (1,521) (1,521)

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

At 31 December

2015

(unaudited) 10,451 33,196 2,253 (152) 437 1,531 (525) (8,215) 64,681 103,657

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited) (Audited)

Year ended 31 December 2015 2014

GBP'000 GBP'000

------------------------------------------------ ------------ ----------

Cash flows from operating

activities

Profit from operations 17,041 15,170

Adjustments for:

Depreciation 1,745 1,750

Amortisation - intellectual

property rights 367 389

- development costs 410 331

- software intangibles 289 228

Impairment of development

costs - 92

(Increase) / decrease in

inventories (1,501) 221

Decrease / (increase) in

trade and other receivables 2,148 (1,623)

Increase in trade and other

payables 1,336 1,298

Share based payments expense 709 592

Taxation (1,253) (1,876)

Net cash inflow from operating

activities 21,291 16,572

------------------------------------------------ ------------ ----------

Cash flows from investing

activities

Purchase of software (472) (408)

Capitalised research and

development (373) (581)

Purchases of property, plant

and equipment (1,907) (1,478)

Disposal of property, plant

and equipment 77 61

Interest received 73 50

Net cash used in investing

activities (2,602) (2,356)

------------------------------------------------ ------------ ----------

Cash flows from financing

activities

Dividends paid (1,521) (1,307)

Finance lease (2) (4)

Issue of equity shares 498 69

Shares purchased by EBT (262) (190)

Shares sold by EBT 258 186

Interest paid (118) (1)

Net cash used in financing

activities (1,147) (1,247)

------------------------------------------------ ------------ ----------

Net increase in cash and

cash equivalents 17,542 12,969

Cash and cash equivalents

at the beginning of the year 17,280 5,257

Effect of foreign exchange

rate changes (621) (946)

Cash and cash equivalents

at the end of the year 34,201 17,280

------------------------------------------------ ------------ ----------

Notes Forming Part of the Condensed Consolidated Financial

Statements

1. Reporting entity

Advanced Medical Solutions Group plc ("the Company") is a public

limited company incorporated and domiciled in England and Wales

(registration number 2867684). The Company's registered address is

Premier Park, 33 Road One, Winsford Industrial Estate, Cheshire,

CW7 3RT.

The Company's ordinary shares are traded on the AIM market of

the London Stock Exchange plc. The consolidated financial

statements of the Company for the twelve months ended 31 December

2015 comprise the Company and its subsidiaries (together referred

to as the "Group").

The Group is primarily involved in the design, development and

manufacture of novel high performance polymers (both natural and

synthetic) for use in advanced woundcare dressings and materials,

and medical adhesives and sutures for closing and sealing tissue,

for sale into the global medical device market and dental

market.

2. Basis of preparation

These condensed unaudited consolidated financial statements have

been prepared in accordance with the accounting policies set out in

the annual report for the year ended 31 December 2014.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), as adopted for use in the EU, this announcement

does not itself contain sufficient information to comply with

IFRSs. The Group expects to publish full financial statements that

comply with IFRSs in April 2016.

The financial information set out in the announcement does not

constitute the Group's statutory accounts for the years ended 31

December 2015 or 31 December 2014. The financial information for

the year ended 31 December 2014 is derived from the statutory

accounts for that year, which have been delivered to the Registrar

of Companies. The auditor reported on those accounts; their report

was unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain a

statement under s498 (2) or (3) Companies Act 2006. The audit of

the statutory accounts for the year ended 31 December 2015 is not

yet complete. These accounts will be finalised on the basis of the

financial information presented by the directors in this

preliminary announcement and will be delivered to the Registrar of

Companies following the Group's annual general meeting.

The financial statements have been prepared on the historical

cost basis of accounting except as disclosed in the accounting

policies set out in the annual report for the year ended 31

December 2014.

With regards to the Group's financial position, it had cash and

cash equivalents at the year end of GBP34.2 million. The Group also

has in place a five-year, unsecured, new multi-currency, credit

facility for GBP30 million which was undrawn in 2015.

While the current economic environment is uncertain, the Group

operates in markets whose demographics are favourable, underpinned

by an increasing need for products to treat chronic and acute

wounds. Consequently, market growth is predicted. The Group has a

number of long-term contracts with customers across different

geographic regions and also with substantial financial resources,

ranging from government agencies through to global healthcare

companies.

Having taken the above into consideration the Directors have

reached a conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

preliminary announcement.

In the current year, the group has adopted the following new

standards and interpretations: IFRS10 Consilidated Financial

Statements, IFRS 11 Joint arrangements, IFRS12 Disclosue of

Interests in Other Entities, Amendments to IAS27 Separate Financial

Statements, IAS28 Investments in Associates and Joint Ventures,

Amendments to IAS 32 and IFRS7 for Offsetting Financial Assets and

Liabilities. The adoption of the new standard and amendments have

had no significant impact in the financial statements of the

Group.

At the date of authorisation the following standards and

interpretations, which have not been applied in these financial

statements, were in issue but not yet effective: IAS19 Defined

Benefit Plans: Employee Contributions, IFRS 9 Financial

Instruments, IFRS 15 Revenue from Contracts with Customers, IFRS16

Leases, Amendments to IAS 36 and Amendments to IAS39. The Directors

anticipate that the adoption of these standards and interpretations

will have no material impact on the financial statements of the

Group.

3. Accounting policies

The same accounting policies, presentations and methods of

computation are followed in the condensed set of financial

statements as applied in the Group's latest annual audited

financial statements. The annual financial statements of Advanced

Medical Solutions Group plc are prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union.

4. Segment information

As referred to in the Chief Executive's Report, the Group is

organised into four business units: Branded Direct, Branded

Distributed, OEM (original equipment manufacturer) and Bulk

Materials. These business units are the basis on which the Group

reports its segment information.

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis. Unallocated items comprise mainly investments,

and related revenue, corporate assets, head office expenses and

income tax assets. These are the measures reported to the Group's

Chief Executive for the purposes of resource allocation and

assessment of segment performance.

Business segments

Segment information about these businesses is presented

below.

Year ended Branded Branded OEM Bulk Eliminations Consolidated

31 December Direct Distributed Materials

2015

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- ------------- -------- ----------- ------------- -------------

Revenue

External

sales 22,344 14,631 27,675 3,946 - 68,596

Inter segment

sales 826 (826) -

--------------- -------- ------------- -------- ----------- ------------- -------------

Total revenue 22,344 14,631 27,675 4,772 (826) 68,596

--------------- -------- ------------- -------- ----------- ------------- -------------

Result

---------------- ------ ------ ------ ---- --------

Segment result 5,235 4,366 7,139 814 - 17,554

Unallocated

expenses (513)

--------

Profit from

operations 17,041

Finance income 73

Finance costs (118)

---------------- ------ ------ ------ ---- --------

Profit before

tax 16,996

Tax (2,877)

---------------- ------ ------ ------ ---- --------

Profit for

the year 14,119

---------------- ------ ------ ------ ---- --------

At 31 December Branded Branded OEM Bulk Consolidated

2015 Direct Distributed Materials

Other Information GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- -------- ----------- -------------

Capital additions:

Software intangibles 111 15 333 13 472

Research & development 102 67 200 4 373

Property, plant

and equipment 730 332 663 182 1,907

Depreciation

and amortisation (855) (431) (1,309) (217) (2,812)

------------------------ -------- ------------- -------- ----------- -------------

Balance sheet

Assets

Segment assets 57,317 20,948 32,774 5,359 116,398

Unallocated assets 165

------------------------ -------- ------------- -------- ----------- -------------

Consolidated

total assets 116,563

------------------------ -------- ------------- -------- ----------- -------------

Liabilities

Segment liabilities 5,353 2,888 3,930 735 12,906

Consolidated

total liabilities 12,906

------------------------ -------- ------------- -------- ----------- -------------

Year ended Branded Branded OEM Bulk Eliminations Consolidated

31 December Direct Distributed Materials

2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- ------------- -------- ----------- ------------- -------------

Revenue

External

sales(7) 23,194 10,663 25,275 3,878 - 63,010

Inter-segment

sales 702 (702) -

--------------- -------- ------------- -------- ----------- ------------- -------------

Total revenue 23,194 10,663 25,275 4,580 (702) 63,010

--------------- -------- ------------- -------- ----------- ------------- -------------

Result

---------------- ------ ------ ------ ---- --------

Segment result 6,012 2,999 6,225 485 - 15,721

Unallocated

expenses (551)

--------

Profit from

operations 15,170

Finance income 49

Finance costs (1)

---------------- ------ ------ ------ ---- --------

Profit before

tax 15,218

Tax (2,354)

---------------- ------ ------ ------ ---- --------

Profit for

the year 12,864

---------------- ------ ------ ------ ---- --------

(7) 0.4m of sutures for the dental market has been reclassified

from the Branded Direct to the Branded Distributed segment

As at 31 December Branded Branded OEM Bulk Consolidated

2014 Direct Distributed Materials

Other Information GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- -------- ----------- -------------

Capital additions:

Software intangibles 88 11 272 37 408

Research & development 200 113 262 6 581

Property, plant

and equipment 586 179 617 96 1,478

Depreciation

and amortisation (903) (356) (1,188) (251) (2,698)

------------------------ -------- ------------- -------- ----------- -------------

Balance sheet

Assets

Segment assets 54,442 19,755 26,024 4,104 104,325

Unallocated assets 208

------------------------ -------- ------------- -------- ----------- -------------

Consolidated

total assets 104,553

------------------------ -------- ------------- -------- ----------- -------------

Liabilities

Segment liabilities 5,257 2,159 3,531 533 11,480

------------------------ -------- ------------- -------- ----------- -------------

Consolidated

total liabilities 11,480

------------------------ -------- ------------- -------- ----------- -------------

Geographic segments

The Group operates mainly in the UK, the Netherlands, Germany,

the Czech Republic and Russia, with a sales office located in the

USA. In presenting information on the basis of geographical

segments, segment revenue is based on the geographical location of

customers. Segment assets are based on the geographical location of

the assets.

The following table provides an analysis of the Group's sales by

geographical market, irrespective of the origin of the

goods/services, based upon location of the Group's customers:

Year ended 31 December 2015 2014

GBP'000 GBP'000

--------------------------------- -------- --------

United Kingdom 16,657 15,308

Germany 13,371 14,042

Europe excluding United Kingdom

and Germany 19,223 18,747

United States of America 17,766 13,786

Rest of World 1,579 1,127

--------------------------------- -------- --------

68,596 63,010

--------------------------------- -------- --------

The following table provides an analysis of the Group's total

assets by geographical location.

As at 31 December 2015 2014

GBP'000 GBP'000

--------------------------------- -------- --------

United Kingdom 62,785 46,049

Germany 50,592 52,887

Europe excluding United Kingdom

and Germany 3,060 5,506

United States of America 126 91

--------------------------------- -------- --------

116,563 104,533

--------------------------------- -------- --------

5. Profit from operations

Year ended 31 December 2015 2014

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Profit from operations is

arrived at after charging

/ (crediting):

Depreciation of property,

plant and equipment 1,754 1,750

Amortisation of:

- acquired intellectual property

rights 367 389

- software intangibles 289 228

- development costs 393 331

Operating lease rentals -

plant and machinery 250 228

(MORE TO FOLLOW) Dow Jones Newswires

March 16, 2016 03:01 ET (07:01 GMT)

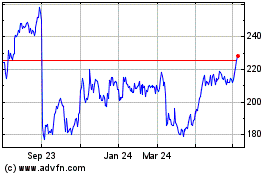

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

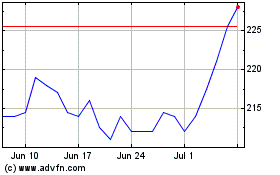

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024