TIDMAMS

RNS Number : 5621Q

Advanced Medical Solutions Grp PLC

13 September 2017

For immediate release 13 September 2017

Advanced Medical Solutions Group plc

("AMS" or the "Group")

Interim Results for the six months ended 30 June 2017

Winsford, UK, 13 September 2017: Advanced Medical Solutions

Group plc (AIM: AMS), the surgical and advanced woundcare

specialist company, today announces its unaudited interim results

for the six months ended 30 June 2017.

Financial Highlights:

H1 H1 Reported Growth

2017 2016 growth at constant

currency(1)

--------------------------- ------- ------ --------- -------------

Group revenue (GBP

million) 45.9 39.2 17% 8%

--------------------------- ------- ------ --------- -------------

Adjusted(2) profit

before tax (GBP million) 11.5 9.5 21% -

--------------------------- ------- ------ --------- -------------

Profit before tax (GBP

million) 11.4 9.0 27% -

--------------------------- ------- ------ --------- -------------

Adjusted(2) diluted

earnings per share

(pence) 4.31p 3.68p 17% -

--------------------------- ------- ------ --------- -------------

Diluted earnings per

share (pence) 4.26p 3.46p 23% -

--------------------------- ------- ------ --------- -------------

Net operating cash

flow before exceptional

items(3) (GBP million) 9.1 9.8 (7%) -

--------------------------- ------- ------ --------- -------------

Net cash (GBP million)(4) 55.2 41.1 34% -

--------------------------- ------- ------ --------- -------------

Interim dividend per

share (pence) 0.35p 0.30p 17%

--------------------------- ------- ------ --------- -------------

Business Highlights:

-- Group revenues up 17% to GBP45.9 million and by 8% at constant currency

-- Group streamlined into two Business Units; Branded and OEM,

to support strategic initiatives

o Branded revenues up 26% to GBP27.3 million (2016 H1: GBP21.6

million) and by 15% at constant currency

o OEM revenues up 6% to GBP18.6 million (2016 H1: GBP17.5

million) and unchanged at constant currency

-- Continued strong performance with LiquiBand(R) topical tissue

adhesives, sales up 40% to GBP13.0 million (2016 H1: GBP9.3

million) and by 26% at constant currency

o US revenues up 52% to GBP9.1 million (2016 H1: GBP6.0

million), and by 32% at constant currency. US market share by

volume increased to 24% (June 2016: 19%)

-- RESORBA(R) branded products, up 20% to GBP10.3 million (2016

H1: GBP8.6 million) and by 6% at constant currency

-- Antimicrobial dressings up 19% to GBP9.7 million (2016 H1:

GBP8.1 million) and by 13% at constant currency

Commenting on the interim results, Chris Meredith, CEO of AMS,

said:

"The Group has delivered another good set of results and we are

confident of meeting Board expectations for the full year.

"Sales of LiquiBand(R) are strong in all main markets. All of

our brands have made good progress and have shown improved

performance as a result of our marketing initiatives.

"We remain optimistic about our organic growth prospects and our

innovative R&D pipeline and continue to closely monitor and

evaluate acquisition opportunities to capitalise on our strong

financial and strategic position."

- End -

1 Constant currency adjusts for the effect of currency movements

by re-translating the current period's performance at the previous

period's exchange rates

2 All items are shown before exceptional items which, in 2017 H1

were GBPnil (2016 H1: GBP0.4 million) and before amortisation of

acquired intangible assets which, in 2017 H1, were GBP0.1 million

(2016 H1: GBP0.1 million) as defined in the financial review

3 Operating cash flow is arrived at by taking the operating

profit for the period before exceptional items of GBPnil (2016 H1:

GBP0.4 million) and adjusting it for depreciation, amortisation,

working capital movements and other non-cash items

4 Net cash is defined as cash and cash equivalents plus short

term investments less financial liabilities and bank loans

For further information, please contact:

Advanced Medical Solutions Group Tel: +44 (0)

plc 1606 545508

Chris Meredith, Chief Executive

Officer

Mary Tavener, Chief Financial

Officer

Consilium Strategic Communications Tel: +44 (0)

20 3709 5700

Mary-Jane Elliott / Matthew Neal

/ Philippa Gardner / Rosie Phillips

Investec Bank plc (NOMAD) & Broker Tel: +44 (0)

20 7597 5970

Daniel Adams / Patrick Robb

About Advanced Medical Solutions Group plc

AMS is a world-leading independent developer and manufacturer of

innovative and technologically advanced products for the global

surgical, woundcare and wound closure markets, focused on quality

outcomes for patients and value for payers. AMS has a wide range of

products which it markets under its brands ActivHeal(R) ,

LiquiBand(R) and RESORBA(R) as well as supplying under white

label.

AMS's products, manufactured out of two sites in the UK, one in

the Netherlands, two in Germany and one in the Czech Republic, are

sold in 75 countries via a network of multinational or regional

partners and distributors, as well as via AMS's own direct sales

forces in the UK, Germany, the Czech Republic and Russia.

Established in 1991, the Group has approximately 600 employees. For

more information please see www.admedsol.com.

Chairman's Statement

AMS continues to perform well across the Group and is set to

deliver another year of good growth and strong financial

performance.

The Group has reviewed its business structure and has

consolidated its Business Units from four to two. The Branded

Direct and Branded Distributed Business Units have now been

combined into the Branded Business Unit which will focus on

selling, marketing and innovation of all AMS branded products,

whether sold directly by our sales teams or through our

distributors. The OEM and Bulk Business Units have been

consolidated within the OEM Business Unit and will focus on the

distribution, marketing and innovation of the Group's products that

are supplied to our medical device partners under their brands.

This new structure will enhance focus, improve marketing

efficiencies and support the strategic initiatives of the

Group.

The Group's strategic initiatives continue to be:

-- Growing the business by investing in R&D

-- Extending the markets for our existing products

-- Evaluating acquisition opportunities that align with the Group's strategy

Good progress has been made with all of our brands. LiquiBand(R)

continues to gain market share in the US, now at 24%, gaining 4%

since June 2016. Our RESORBA(R) brands grew steadily across all

territories and ActivHeal(R) reversed its decline and grew 9% to

GBP3.1 million (2016 H1: GBP2.9 million).

We launched a number of new foam product ranges in the first

half of 2016 through our OEM partners and, as previously guided, we

have seen the effects of last year's pipeline filling this year.

Despite this effect, we are pleased to report that, sales in this

Business Unit grew 6% at reported currency to GBP18.6 million (2016

H1: GBP17.5 million) and were unchanged at constant currency.

The Group continues to deliver a strong financial performance.

Revenue increased by 17% to GBP45.9 million (2016 H1: GBP39.2

million) and by 8% at constant currency and adjusted profit before

tax(5) increased by 21% to GBP11.5 million (2016 H1: GBP9.5

million). Our net cash position 30 June 2017 was GBP55.2 million

(31 December 2016: GBP51.1 million).

Dividend

The Board intends to pay an interim dividend of 0.35p per share

(2016 H1: 0.30p), an increase of 17%, on 27 October 2017 to

shareholders on the register at the close of business on 29

September 2017.

Team

On behalf of the Board, I would like to thank all employees for

their continued hard work that has helped AMS to prosper as a

global medical technology business, as well as our customers,

suppliers, business partners and shareholders for their continued

support.

Summary

The Group continues to deliver solid results and is trading in

line with Board expectations for the year ending 31 December

2017.

Peter Allen

Chairman

5 Adjusted profit before tax is adjusted for exceptional items

and amortisation of acquired intangible assets

Chief Executive's Review

I am pleased to report that the Group again performed strongly

in the period under review. Following a decision to streamline our

Business Units in alignment with our strategic focus, all segment

information is presented under the new Business Unit structure and

includes a restatement of the prior year values.

Business Review

Branded Business Unit

Branded revenue was 26% higher at GBP27.3 million (2016 H1:

GBP21.6 million) and 15% higher at constant currency.

LiquiBand(R)

LiquiBand(R) , our range of medical adhesives based on

cyanoacrylate, is our largest brand with sales of GBP13.0 million

(2016 H1: GBP9.3 million), up 40% on the prior six months and up

26% at constant currency. It is sold in over 50 countries and

includes our adhesives that are used to close wounds topically in

the Operating Room and Accident and Emergency setting.

The US is our largest market and where we continue to gain

market share. We access the market through distributors who are

able to target both hospitals and non-hospitals, helping to

identify customers and convert opportunities into sales. Sales

increased by 52% to GBP9.1 million and by 32% at constant currency

(2016 H1: GBP6.0 million) with our portfolio of cyanoacrylate

formulations successfully addressing the needs of the market. Our

overall US market share by volume, now stands at 24%, an increase

of 1% since December 2016.

Outside of the US, our direct teams in the UK and Germany have

performed well, with reported revenues up 15% to GBP2.8 million

(2016 H1: 2.4 million) and up 12% at constant currency. Sales

through our distributors in other territories, have increased 27%

to GBP1.2 million (2016 H1: GBP0.9 million) and 25% at constant

currency.

LiquiBand(R) Fix8(TM)

LiquiBand(R) Fix8(TM) is our brand of adhesive and related

device that is used internally in hernia mesh fixation procedures.

Sales increased by 5% to GBP0.8 million (2016 H1 GBP0.8 million)

and by 2% at constant currency. Sales growth has been restricted

due to design modifications made following surgeon feedback to

enhance the device. The updated device is now available and

increased surgeon uptake is expected to return next year.

Work is ongoing to broaden the claims on the use of the device

for hernia mesh fixation as well as for a number of other

laparoscopic surgical applications. Additionally, we are developing

a device for hernia mesh fixation for use in open surgery which we

expect to launch in the first half of 2018.

At present, the device is approved for use within Europe and

those markets that accept European approval standards. We started

the process to get LiquiBand(R) Fix8(TM) approved for use in the US

market at the beginning of the year. A Contract Research

Organisation (CRO) has been selected following study design and in

anticipation of first patient recruitment.

Surgeon response remains extremely positive and the future

growth potential of this product is very strong.

RESORBA(R)

Our RESORBA(R) branded products portfolio is comprised of a

comprehensive range of sutures which are used to close wounds and a

range of bio-surgical products that include collagens, cellulose

and bone substitutes that can be used as haemostats or scaffolds

for tissue growth. Sales of RESORBA(R) products increased by 20% to

GBP10.3 million (2016 H1: GBP8.6 million), and by 6% at constant

currency.

Within this, sales of sutures increased by 19% to GBP6.4 million

(2016 H1: GBP5.3 million) and by 5% at constant currency and sales

of bio-surgical products increased by 22% to GBP3.7 million (2016

H1: GBP3.0 million) and by 8% at constant currency.

Of the GBP10.3 million sales, GBP6.5 million (2016 H1: GBP5.8

million) were in Germany, up 13% on the prior year and 1% at

constant currency, while sales outside Germany increased by 34% to

GBP3.8 million (2016 H1: GBP2.8 million) and 17% at constant

currency. We continue to access new markets, in particular Asia

Pacific and target specific applications for our RESORBA(R)

brands.

In R&D we are making good progress towards including a range

of different antibiotics that can be incorporated in our

bio-surgical range of products. We expect to file for European

approval for the first of these in Q2 2018.

ActivHeal(R)

ActivHeal(R) is our range of high quality woundcare dressings

that offer the NHS cost savings.

Sales of ActivHeal(R) increased by 9% to GBP3.1 million (2016

H1: GBP2.9 million) in the first six months. The Group has enhanced

its education and marketing materials as well as broadened its

product range with our new antimicrobial and atraumatic foam

dressing ranges which launched last year. Further additions to the

range, such as our new high performance dressing, are expected to

be launched later this year. Overall, we are pleased with the

progress that has been made, reversing the decline that was

reported at the previous set of results.

OEM Business unit

Our OEM business supports our partners with a multi-product

portfolio of advanced woundcare products and bulk materials.

Reported revenue increased 6% to GBP18.6 million (2016 H1: GBP17.5

million) and was unchanged at constant currency. As previously

reported, our 2016 results included pipeline fill of approximately

GBP1 million relating to the atraumatic foam product launch, which

was anticipated to impact reordering in the current year.

Sales of antimicrobial dressings increased by 19% to GBP9.7

million (2016 H1: GBP8.1 million) and by 13% at constant currency.

Within this, silver alginate products grew by 13% to GBP8.6 million

(2016 H1: GBP7.6 million) and by 7% at constant currency and the

PHMB foam range grew by 116% at reported and constant currency to

GBP1.1 million (2016 H1: GBP0.5 million). Our PHMB foam range was

approved for use in Europe in 2016 and approval for use in the US

was expected in 2017. We have now received approval to market our

PHMB foam dressings in the US, however, due to claim limitations,

we have decided to pause launching in the US until we can market

these products with extended claims.

In our non-antimicrobial ranges of products, sales of our base

foams were down 27% at reported currency to GBP3.4 million (2016

H1: GBP4.6 million) and by 33% at constant currency. Sales were

impacted by the pipeline fill of new products in 2016. Sales of our

other technologies, which include alginates and gels, increased 15%

at reported currency to GBP5.5 million (2016 H1: GBP4.8 million)

and by 9% at constant currency.

In the latter part of 2016, we also noted a slowdown in activity

in the Middle East which impacted one of our partners with

significant business in the region. This trend did not recover in

the first half of 2017, however, we continue to believe in the

medium and long term potential of this market.

In R&D we are continuing to work on extending our product

portfolio. We have developed a range of high performance dressings

and atraumatic thin foams which we expect to launch later in the

year and we are also developing a range of surgical dressings which

are expected to launch in the first half 2018.

Operations and regulatory

With the business continuing to show strong organic growth, we

have made investments in our converting capability in our Etten

Leur site which is due to complete by the end of this year, as well

as improving our packing capability in Nuremberg which is expected

to complete in 2018.

In planning for the medium to long term, we have leased two

adjacent units at the Winsford site and have also made plans to

extend the capacity of the Plymouth facility.

Following the FDA inspection of our Winsford site in June 2016,

our Plymouth facility was also inspected by the FDA in April 2017.

We were very pleased with the outcome of this audit with no non-

conformances raised.

The new European Medical Devices Regulation (MDR) entered into

force on 25 May 2017, marking the start of the transition period

for manufacturers selling medical devices into Europe. The MDR,

which replaces the Medical Devices Directive (MDD) has a transition

period of three years and manufacturers have this transition period

to update their technical documentation and processes to meet the

new requirements. The MDR brings more scrutiny on product safety

and performance and stricter requirements on clinical evaluation

and post-market clinical follow up. Our notified body BSI is an

early adopter of the new standard and we are working with our OEM

partners to ensure that we meet the new requirements. We anticipate

that, although there will be some additional costs associated with

meeting the new requirements, overall, the tighter regulatory

standards should prove beneficial for the Group.

Our implementation of Oracle ERP is ongoing in Germany and is

expected to complete later this year. It is anticipated that this

will bring benefits from better availability of information.

A supplier raw material change has required a process

revalidation of some of our more established foam ranges. This

process change is now completing and there has been no meaningful

impact on sales in H1.

Acquisitions strategy

The Group is actively looking for businesses that meet its

acquisition strategy of:

-- licensing or acquiring technology that allows us to leverage

our global OEM customer base or branded routes to market,

-- licensing or acquiring additional brands within the

woundcare, wound closure or surgical setting that complement our

existing range, and

-- geographic expansion through acquiring surgically focused

companies with strong direct sales capability and ownership of

complementary products

We have an internal team working with advisors to identify,

appraise and progress acquisition opportunities.

Referendum vote to leave the EU

To date, there has been no day-to-day operational impact of the

referendum vote to leave the European Union, other than changes to

currency exchange rates. In preparation, the Group is investigating

the possibility of obtaining Authorised Economic Operator status

for its UK trading entities and with a strong footprint in mainland

Europe, the Group continues to be well placed to deal with the

uncertain outcome of the UK negotiations with the EU.

Summary and outlook

The first half of 2017 has seen another good performance by the

Group and we are confident of meeting Board expectations for the

full year. With our increasing portfolio of products, strong

partners and the opportunities we see from our R&D pipeline,

the Board remains optimistic about our prospects and the potential

for further growth.

Financial Review

Overview

Revenue increased by 17.3% to GBP45.9 million (2016 H1: GBP39.2

million). At constant currency, revenue growth would have been

8.1%.

Amortisation of acquired intangible assets was GBP0.1 million in

the six month period (2016 H1: GBP0.1 million).

Comparisons with 2016 are made on a pre-exceptional and

pre-amortisation of acquired intangible asset cost basis, as we

believe that this provides a more relevant representation of the

Group's trading performance. To aid comparison, the Group's

adjusted income statement is summarised in Table 1 below.

Table 1 Six months Six months

ended ended

30 June 30 June 2016

2017

Adjusted Income Statement GBP'000 GBP'000 Change

--------------------------- -------------- -------------- --------

Revenue 45,910 39,153 17.3%

--------------------------- -------------- -------------- --------

Gross profit 27,478 22,473 22.3%

Distribution costs (534) (512) 4.3%

Adjusted administrative

expenses(6) (15,711) (12,879) 22.0%

Other income 273 415 (34.2)%

--------------------------- -------------- -------------- --------

Adjusted operating

profit 11,506 9,497 21.2%

Net finance income - 2

--------------------------- -------------- -------------- --------

Adjusted profit before

tax 11,506 9,499 21.1%

Amortisation of acquired

intangibles (94) (122) (23.8)%

Exceptional items - (361)

--------------------------- -------------- -------------- --------

Profit before tax 11,412 9,016 26.6%

Tax (2,301) (1,680) 37.0%

--------------------------- -------------- -------------- --------

Profit for the period 9,111 7,336 24.2%

--------------------------- -------------- -------------- --------

Adjusted earnings

per share - basic(7) 4.37p 3.74p 16.8%

Earnings per share

- basic(7) 4.32p 3.51p 23.3%

--------------------------- -------------- -------------- --------

Adjusted earnings

per share - diluted(7) 4.31p 3.68p 16.9%

Earnings per share

- diluted(7) 4.26p 3.46p 23.3%

--------------------------- -------------- -------------- --------

6 Administration expenses exclude exceptional items and

amortisation of acquired intangible assets

7 see Note 4 Earnings per share for details of calculation

The gross margin percentage for the Group was 59.9% (2016 H1:

57.4%). This 250bps increase in gross margin was mainly as a result

of sales mix and favourable exchange rates

Adjusted operating profit increased by 21.2% to GBP11.5 million

(2016 H1: GBP9.5 million) and the adjusted operating margin

increased by 80bps to 25.1% (2015 H1: 24.3%) due to sales mix and

favourable foreign exchange movements. Administration expenses

(excluding exceptional items and amortisation of acquired

intangible assets) increased by 22%. Of this, approximately 15% was

due to foreign exchange effects arising from the translation of

costs in Europe and the US arising from the weakness of sterling

against both the Euro and the US dollar. The remainder of the

increase was due to investment in sales and marketing and increased

costs from regulatory and clinical work.

Adjusted diluted earnings per share increased by 16.9% to 4.31p

(2016 H1: 3.68p) and diluted earnings per share increased by 23.3%

to 4.26p (2016 H1: 3.46p).

The Group generated profit before tax of GBP11.4 million (2016

H1: GBP9.0 million) and had net cash of GBP55.2 million at the half

year end (2016 H1: GBP41.1 million).

The Group has a strong balance sheet enabling financing of

further organic growth and acquisitions.

Income Statement

The operational performance of the business units is shown in

Table 2 below. The adjusted profit from operations and the adjusted

operating margin are shown after excluding exceptional items and

amortisation of acquired intangibles.

Table 2

Operating result by

business segment

Six months ended

30 June 2017 Branded OEM

GBP'000 GBP'000

------------------------------ ---- -------- --------

Revenue 27,342 18,568

Profit from operations 7,936 3,724

Amortisation of

acquired intangibles 89 5

Adjusted profit

from operations(8) 8,025 3,729

Adjusted operating

margin(8) 29.4% 20.1%

------------------------------------ -------- --------

Six months ended

30 June 2016 (re-presented)

Revenue 21,622 17,531

Profit from operations 6,134 3,524

Amortisation of

acquired intangibles 116 6

Adjusted profit

from operations(8) 6,250 3,530

Adjusted operating

margin(8) 28.9% 20.1%

------------------------------------ -------- --------

8 Excludes amortisation of acquired intangible assets

Expenses relating to exceptional items, to non-executive

Directors and plc costs are not allocated to business units and are

included within unallocated expenses.

Branded

Branded revenues increased by 26.5% to GBP27.3 million (2016 H1:

GBP21.6 million) and by 14.8% at constant currency, with sales of

LiquiBand(R) into the US being the main driver of growth.

Adjusted operating margin increased by 50 bps to 29.4% (2016 H1:

28.9%) despite ongoing investment in our sales & marketing

teams. R&D expense was 2.2% of revenues (2016 H1: 2.1%) with

expenditure in this segment being incurred on projects to improve

our formulation and applicators for tissue adhesives, as well as

ongoing development of the internal use of tissue adhesives.

OEM

OEM revenues increased by 5.9% to GBP18.6 million (2016 H1:

GBP17.5 million) at reported currency but were unchanged at

constant currency. R&D expense was 4.0% of revenues (2016 H1:

3.8%) with spend being incurred in the development of post-surgical

dressings and high performance dressings.

Adjusted operating margin was unchanged at 20.1% (2016 H1:

20.1%).

Geographic breakdown of revenues

The geographic breakdown of Group revenues in 2017 is set out in

note 5. Sterling sales represent the largest currency with

significant sales also in Euros and US dollars. The Group's policy

is to put in place natural hedges where possible and to hedge

transactional risk. The Group estimates that a 10% movement in the

GBP:US$ or GBP:Euro exchange rate would impact Sterling revenues by

approximately 4% and 3% respectively and, in the absence of any

hedging, this would result in an impact on profit of 2.0% and 0.1%

respectively.

Net finance income/costs

Net finance income/costs is comprised of finance income of

GBP50,000 (2016 H1: GBP57,000) representing interest received on

cash balances and finance costs of GBP50,000 (2016 H1: GBP55,000)

resulting from facility costs.

Profit before tax

Profit before tax for the six months was 26.6% higher at GBP11.4

million (2016 H1: GBP9.0 million).

Taxation

The Group's effective rate of tax for the six months was 20.2%

(2016 H1: 18.6%). This reflects the blend of profits and tax rates

in the countries in which the Group operates and incorporates UK

patent box and R&D relief. However, due to its sustained

growth, the Group no longer qualifies for SME R&D relief and

instead accesses the large company R&D scheme, which is less

beneficial and impacts the Group's effective tax rate by

approximately 2%, in comparison to 2016. The Group expects its

anticipated effective tax rate to be approaching 21% for the full

year ending 31 December 2017.

Profit after tax and earnings per share

Adjusted profit after tax increased by 17.7% to GBP9.2 million

(2016 H1: GBP7.8 million), resulting in a 16.8% increase in

adjusted basic earnings per share to 4.37p (2016 H1: 3.74p) and a

16.9% increase in adjusted diluted earnings per share to 4.31p

(2016 H1: 3.68p).

Profit after tax increased 24.2% to GBP9.1 million (2016 H1:

GBP7.3 million), resulting in a 23.3% increase in basic earnings

per share to 4.32p (2016 H1: 3.51p) and a 23.3% increase in diluted

earnings per share to 4.26p (2016 H1: 3.46p).

Dividend per share

The Board intends to pay an interim dividend of 0.35p per share

on 27 October 2017 to shareholders on the register on 29 September

2017. This is an increase of 17% compared with the first half of

2016.

Cash Flow and Balance Sheet

Table 3 summarises the Group cash flows.

Table 3 Six months Six months

ended ended

30 June 30 June

2017 2016

Cash Flow GBP'000 GBP'000

--------------------------------- --------------------------------------------------------------- -------------

Adjusted operating profit

(Table 1) 11,506 9,497

Non-cash items 1,970 1,993

Adjusted EBITDA(9) 13,476 11,490

Working capital movement (4,416) (1,730)

Operating cash flow before

exceptional items 9,060 9,760

Exceptional items - (361)

Operating cash flow after

exceptional items 9,060 9,399

Capital expenditure and

capitalised R&D (2,236) (1,265)

Net interest income - 1

Tax (2,048) (933)

Free cash flow 4,776 7,202

Dividends paid (1,307) (1,150)

Proceeds from share issues 555 416

Exchange gains 11 430

Net increase in cash and

cash equivalents 4,035 6,898

--------------------------------- -------------------------------------------------------------- -----------

9 Adjusted EBITDA is earnings before interest, tax,

depreciation, intangible asset amortisation, share based payments

and exceptional items

The Group had an operating cash flow before exceptional items of

GBP9.1 million (2016 H1: GBP9.8 million) and a conversion of

adjusted operating profit into free cash flow of 42% (2016 H1:

76%). The reduction in cash conversion was due to increased trade

debtors, capital expenditure and capitalised R&D and increased

tax payments, resulting from historical tax losses being fully

utilised.

Working capital increased by GBP4.4 million. Within this, trade

receivables increased by GBP4.2 million due to timing of sales and

the effect of translating balances denominated in Euros and US

dollars with debtor days at 53 (2016 H1: 49 days). Inventory

decreased by GBP0.4 million in the first six months with months of

supply being 4.1 (2016 H1: 4.4 months). Trade payables decreased

GBP0.6 million, excluding the fair value of forward foreign

exchange contracts.

We have invested GBP2.3 million in fixed assets, software and

capitalised R&D in the first six months (2016 H1: GBP1.3

million), including our Etten Leur converting capability, Nuremberg

packing capacity and the Germany ERP project. GBP0.4 million of

R&D spend was capitalised in the period (2016 H1: GBP0.1

million).

Net taxation of GBP2.0 million was paid which is in line with

the Group's profitability within the tax jurisdictions in which it

operates, now that historical tax losses have been fully utilised

within the trading businesses.

The Group paid its final dividend for the year ended 31 December

2016 of GBP1.3 million on 16 June 2017 (2016 H1: GBP1.2

million).

The Group had a free cash flow as defined in Table 3 of GBP4.8

million in the period (2016 H1: GBP7.2 million), with a net

increase in cash equivalents of GBP4.0 million (2016 H1: GBP6.9

million increase).

At the end of the period, the Group had net cash(10) of GBP55.2

million (2016 H1: net cash(10) of GBP41.1 million).

The Group has a five-year, GBP30 million, multi-currency,

revolving credit facility, obtained in December 2014, with an

accordion option under which AMS can request up to an additional

GBP20 million on the same terms. The facility is provided jointly

by HSBC and The Royal Bank of Scotland PLC. It is unsecured on the

assets of the Group and is currently wholly undrawn.

The movement in net cash during the first half of 2017 is

reconciled in Table 4 below:

Table 4

Movement in net cash(10) GBP'000

-------------------------- -------------------------------------------------------------

Net cash as at 1 January

2017 51,125

Exchange rate impacts 11

Free cash flow 4,776

Dividends paid (1,307)

Proceeds from share

issues 555

Net cash as at 30

June 2017 55,160

-------------------------- ---------------------------------------------------------------

10 Net cash is defined as cash and cash equivalents plus short

term investments less financial liabilities and bank loans

The Group's going concern position is fully described in note 12

and the Group had no borrowings in the period.

Financial Summary

The Group has delivered another good set of results in the

period and we are confident of meeting Board expectations for the

full year. We remain focused on capitalising on our strong

financial and strategic position.

CONDENSED CONSOLIDATED INCOME STATEMENT for the six months ended

30 June 2017

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended 31 December

30 June 2017 30 June 2016 2016

Before Exceptional Before Exceptional Before Exceptional

exceptional items exceptional Items exceptional items

items (see Total items (see Total Items (see Total

note note note

7) 7) 7)

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

Revenue from

continuing

operations 5 45,910 - 45,910 39,153 - 39,153 82,621 - 82,621

Cost of sales (18,432) - (18,432) (16,680) - (16,680) (35,194) - (35,194)

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

Gross profit 27,478 - 27,478 22,473 - 22,473 47,427 - 47,427

Distribution

costs (534) - (534) (512) - (512) (1,047) - (1,047)

Administration

costs (15,805) - (15,805) (13,001) (361) (13,362) (27,535) (361) (27,896)

Other income 273 - 273 415 - 415 621 - 621

Profit/(loss)

from

operations 11,412 - 11,412 9,375 (361) 9,014 19,466 (361) 19,105

Finance income 50 - 50 57 - 57 108 - 108

Finance costs (50) - (50) (55) - (55) (111) - (111)

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

Profit/(loss)

before

taxation 11,412 - 11,412 9,377 (361) 9,016 19,463 (361) 19,102

Income tax 8 (2,301) - (2,301) (1,680) - (1,680) (3,410) - (3,410)

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

Profit/(loss)

for

the period

attributable

to equity

holders

of the parent 9,111 - 9,111 7,697 (361) 7,336 16,053 (361) 15,692

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

Earnings per

share

Basic 4 4.32p - 4.32p 3.68p (0.17p) 3.51p 7.65p (0.17p) 7.48p

Diluted 4 4.26p - 4.26p 3.63p (0.17p) 3.46p 7.55p (0.17p) 7.38p

Adjusted(11)

diluted 4 4.31p - 4.31p 3.68p (0.17p) 3.68p 7.66p (0.17p) 7.49p

---------------- ----- ------------ ------------ --------- ------------ ------------ --------- ------------ ------------ ---------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended 31 December

30 June 2017 30 June 2016 2016

GBP'000 GBP'000 GBP'000

----------------------------- ----------------- ----------------- -----------------------

Profit for the period 9,111 7,336 15,692

Items that will potentially

be classified subsequently

to profit and loss

Exchange differences

on translation of foreign

operations 1,548 6,560 8,851

Gain/(loss) arising

on cash flow hedges 2,556 (2,419) (3,009)

------------------------------ ----------------- ----------------- -----------------------

Other comprehensive

income for the period 4,104 4,141 5,842

------------------------------ ----------------- ----------------- -----------------------

Total comprehensive

income for the period

attributable to equity

holders of the parent 13,215 11,477 21,534

------------------------------ ----------------- ----------------- -----------------------

(11) Adjusted for exceptional items and for amortisation of

acquired intangible assets

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Unaudited) (Audited)

30 June 30 June 31 December

2017 2016 2016

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Acquired intellectual

property rights 9,629 9,264 9,468

Software intangibles 2,730 1,966 2,500

Development costs 1,747 1,777 1,645

Goodwill 41,430 38,940 40,337

Property, plant and

equipment 16,951 16,538 16,177

Trade and other receivables 13 10 10

----------------------------- ------------ ------------ ------------

72,500 68,495 70,137

Current assets

Inventories 11,182 10,465 11,440

Trade and other receivables 16,712 13,074 11,872

Current tax assets 461 8 432

Cash and cash equivalents 55,160 41,099 51,125

----------------------------- ------------ ------------ ------------

83,515 64,646 74,869

----------------------------- ------------ ------------ ------------

Total assets 156,015 133,141 145,006

----------------------------- ------------ ------------ ------------

Liabilities

Current liabilities

Trade and other payables 11,461 12,089 12,901

Current tax liabilities 2,356 1,420 2,049

Other taxes payable 103 302 85

Obligations under finance - 1 -

leases

13,920 13,812 15,035

Non-current liabilities

Trade and other payables 341 1,473 1,291

Deferred tax liabilities 2,748 2,783 3,152

3,089 4,256 4,443

----------------------------- ------------ ------------ ------------

Total liabilities 17,009 18,068 19,478

----------------------------- ------------ ------------ ------------

Net assets 139,006 115,073 125,528

----------------------------- ------------ ------------ ------------

Equity

Share capital 10,606 10,499 10,524

Share premium 34,478 33,578 34,005

Share-based payments

reserve 4,082 2,945 3,469

Investment in own shares (152) (152) (152)

Share-based payments

deferred tax reserve 861 404 459

Other reserve 1,531 1,531 1,531

Hedging reserve (978) (2,944) (3,534)

Translation reserve 2,184 (1,655) 636

Retained earnings 86,394 70,867 78,590

----------------------------- ------------ ------------ ------------

Equity attributable

to equity holders of

the parent 139,006 115,073 125,528

----------------------------- ------------ ------------ ------------

CONDENSED CONSOLIDATED Statement of Changes in Equity

Attributable to equity holders of the Group

Share- Investment Share-based

Share Share based in own payments Other Hedging Translation Retained

capital premium payments shares deferred reserve reserve reserve earnings Total

tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

At 1 January

2017

(audited) 10,524 34,005 3,469 (152) 459 1,531 (3,534) 636 78,590 125,528

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Consolidated

profit for

the

period to 30

June 2017 - - - - - - - - 9,111 9,111

Other

comprehensive

income - - - - - - 2,556 1,548 - 4,104

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Total

comprehensive

income - - - - - - 2,556 1,548 9,111 13,215

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Share-based

payments - - 613 - 402 - - - - 1,015

Share options

exercised 82 473 - - - - - - 555

Shares

purchased

by EBT - - - (484) - - - - - (484)

Shares sold by

EBT - - - 484 - - - - - 484

Dividends paid - - - - - - - - (1,307) (1,307)

At 30 June

2017

(unaudited) 10,606 34,478 4,082 (152) 861 1,531 (978) 2,184 86,394 139,006

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Share- Investment Share-based

Share Share based in own payments Other Hedging Translation Retained

capital premium payments shares deferred reserve reserve reserve earnings Total

tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

At 1 January

2016

(audited) 10,451 33,196 2,253 (152) 437 1,531 (525) (8,215) 64,681 103,657

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Consolidated

profit for

the

period to 30

June 2016 - - - - - - - - 7,336 7,336

Other

comprehensive

income - - - - - - (2,419) 6,560 - 4,141

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Total

comprehensive

income - - - - - - (2,419) 6,560 7,336 11,477

Share-based

payments - - 693 - (33) - - - - 660

Share options

exercised 48 382 (1) - - - - - - 429

Shares

purchased

by EBT - - - (449) - - - - - (449)

Shares sold by

EBT - - - 449 - - - - - 449

Dividends paid - - - - - - - - (1,150) (1,150)

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

At 30 June

2016

(unaudited) 10,499 33,578 2,945 (152) 404 1,531 (2,944) (1,655) 70,867 115,073

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Share- Investment Share-based

Share Share based in own payments Other Hedging Translation Retained

capital premium payments shares deferred reserve reserve reserve earnings Total

tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

At 1 January

2016

(audited) 10,451 33,196 2,253 (152) 437 1,531 (525) (8,215) 64,681 103,657

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Consolidated

profit for

the

year to 31

December

2016 - - - - - - - - 15,692 15,692

Other

comprehensive

income - - - - - - (3,009) 8,851 - 5,842

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

Total

comprehensive

income - - - - - - (3,009) 8,851 15,692 21,534

Share-based

payments - - 1,230 - 22 - - - - 1,252

Share options

exercised 73 809 (14) - - - - - - 868

Shares

purchased

by EBT - - - (449) - - - - - (449)

Shares sold by

EBT - - - 449 - - - - - 449

Dividends paid - - - - - - - - (1,783) (1,783)

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

At 31 December

2016

(audited) 10,524 34,005 3,469 (152) 459 1,531 (3,534) 636 78,590 125,528

--------------- -------- -------- --------- ----------- ------------ -------- -------- ------------ --------- --------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited) (Unaudited) (Audited)

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2017 2016 2016

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------ ------------ ------------

Cash flows from operating

activities

Profit from operations 11,412 9,014 19,105

Adjustments for:

Depreciation 1,012 924 1,898

Amortisation - intellectual

property rights 94 122 242

- development costs 208 203 329

- software intangibles 137 173 441

Impairment of development

costs - - 125

Decrease/(increase) in

inventories 362 (1,147) (2,005)

Increase in trade and

other receivables (4,205) (1,962) (674)

(Decrease)/increase in

trade and other payables (573) 1,379 1,199

Share-based payments expense 613 693 1,230

Taxation (2,048) (933) (2,065)

Net cash inflow from operating

activities 7,012 8,466 19,825

---------------------------------------------- ------------ ------------ ------------

Cash flows from investing

activities

Purchase of software (622) (125) (795)

Capitalised research and

development (371) (149) (259)

Purchases of property,

plant and equipment (1,278) (1,016) (1,523)

Disposal of property,

plant and equipment 35 25 41

Interest received 50 57 109

Net cash used in investing

activities (2,186) (1,208) (2,427)

---------------------------------------------- ------------ ------------ ------------

Cash flows from financing

activities

Dividends paid (1,307) (1,150) (1,783)

Finance lease - (1) (1)

Issue of equity shares 555 416 868

Shares purchased by EBT (484) (449) (449)

Shares sold by EBT 484 449 449

Interest paid (50) (55) (111)

Net cash used in financing

activities (802) (790) (1,027)

---------------------------------------------- ------------ ------------ ------------

Net increase in cash and

cash equivalents 4,024 6,468 16,371

Cash and cash equivalents

at the beginning of the

period 51,125 34,201 34,201

Effect of foreign exchange

rate changes 11 430 553

Cash and cash equivalents

at the end of the period 55,160 41,099 51,125

---------------------------------------------- ------------ ------------ ------------

Notes Forming Part of the Consolidated Financial Statements

1. Reporting entity

Advanced Medical Solutions Group plc ("the Company") is a public

limited company incorporated and domiciled in England and Wales

(registration number 2867684). The Company's registered address is

Premier Park, 33 Road One, Winsford Industrial Estate, Cheshire,

CW7 3RT.

The Company's ordinary shares are traded on the AIM market of

the London Stock Exchange plc. The consolidated financial

statements of the Company for the twelve months ended 31 December

2016 comprise the Company and its subsidiaries (together referred

to as the "Group").

The Group is primarily involved in the design, development and

manufacture of novel high performance polymers (both natural and

synthetic) for use in advanced woundcare dressings and materials,

medical adhesives for closing and sealing tissue, and sutures and

haemostats for sale into the global medical device market.

2. Basis of preparation

The information for the year ended 31 December 2016 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor

reported on those accounts; their report was unqualified, did not

draw attention to any matters of emphasis without qualifying the

report and did not contain a statement under section 498 (2) or (3)

of the Companies Act 2006.

The individual financial statements for each Group company are

presented in the currency of the primary economic environment in

which it operates (its functional currency). For the purpose of the

consolidated financial statements, the results and financial

position of each Group company are expressed in pounds sterling,

which is the functional currency of the Company and the

presentation currency for the consolidated financial

statements.

3. Accounting policies

The same accounting policies, presentations and methods of

computation are followed in the condensed set of financial

statements as applied in the Group's latest annual audited

financial statements. No new or revised standards adopted in the

current period have had a material impact on the Group's financial

statements.

The unaudited condensed set of financial statements included in

this half-yearly financial report have been prepared in accordance

with International Accounting Standard 34 'Interim Financial

Reporting', as adopted by the European Union. These condensed

interim accounts should be read in conjunction with the annual

accounts of the Group for the year ended 31 December 2016. The

annual financial statements of Advanced Medical Solutions Group plc

are prepared in accordance with International Financial Reporting

Standards as adopted by the European Union.

4. Earnings per share

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2017 2016 2016

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ------------

Earnings

Earnings for the purposes

of basic and diluted

earnings per share

being net profit attributable

to equity holders of

the parent 9,111 7,336 15,692

Number of shares '000 '000 '000

-------------------------------- ------------ ------------ ------------

Weighted average number

of ordinary shares

for the purposes of

basic earnings per

share 210,838 209,271 209,815

-------------------------------- ------------ ------------ ------------

Effect of dilutive

potential ordinary

shares: share options,

deferred share bonus,

LTIPs 2,942 3,006 2,778

-------------------------------- ------------ ------------ ------------

Weighted average number

of ordinary shares

for the purposes of

diluted earnings per

share 213,780 212,277 212,593

-------------------------------- ------------ ------------ ------------

Basic EPS is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of shares

outstanding during the period.

Diluted EPS is calculated on the same basis as basic EPS but

with the further adjustment to the weighted average shares in issue

to reflect the effect of all potentially dilutive share options.

The number of potentially dilutive share options is derived from

the number of share options and awards granted to employees where

the exercise price is less than the average market price of the

Company's ordinary shares during the period.

4. Earnings per share continued

Adjusted earnings per share

Adjusted EPS is calculated after adding back exceptional items

and amortisation of acquired intangible assets and is based on

earnings of:

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

Ended ended ended

30 June 30 June 31 December

2017 2016 2016

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ------------

Earnings

Earnings for the purposes

of basic and diluted

earnings per share

being net profit attributable

to equity holders of

the parent 9,111 7,336 15,692

Exceptional items - 361 361

Amortisation of acquired

intangible assets 94 122 242

Earnings excluding

exceptional items and

amortisation of acquired

intangible assets 9,205 7,819 16,295

-------------------------------- ------------ ------------ ------------

The denominators used are the same as those detailed above for

both basic and diluted earnings per share.

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

Ended ended ended

30 June 30 June 31 December

2017 2016 2016

pence pence pence

---------------------- ------------ ------------ ------------

Adjusted basic EPS 4.37p 3.74p 7.77p

Adjusted diluted EPS 4.31p 3.68p 7.66p

---------------------- ------------ ------------ ------------

The adjusted diluted EPS information is considered to provide a

fairer representation of the Group's trading performance.

5. Segment information

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis. Unallocated items comprise mainly investments

and related revenue, corporate assets, head office expenses,

exceptional items, income tax assets and the Group's external

borrowings. These are the measures reported to the Group's Chief

Executive for the purposes of resource allocation and assessment of

segment performance.

Business segments

The principal activities of the business units are as follows.

(Prior year comparators have been re-presented following the

Business Unit restructure).:

Branded

Selling, marketing and innovation of the Group's branded

products either sold directly by our sales teams or by

distributors.

OEM

Distribution, marketing and innovation of the Group's products

supplied to medical device partners under their brands and the

distribution of bulk materials to medical device partners and

convertors.

Segment information about these Business Units is presented

below:

Six months ended

30 June 2017 Branded OEM Consolidated

(unaudited) GBP'000 GBP'000 GBP'000

------------------------ -------- -------- -------------

Revenue 27,342 18,568 45,910

------------------------ -------- -------- -------------

Result

------------------------ -------- -------- -------------

Segment result 7,936 3,724 11,660

Unallocated expenses (248)

-------------

Profit from operations 11,412

Finance income 50

Finance costs (50)

------------------------ -------- -------- -------------

Profit before tax 11,412

Tax (2,301)

------------------------ -------- -------- -------------

Profit for the period 9,111

------------------------ -------- -------- -------------

5. Segment information (continued)

At 30 June 2017

(unaudited) Branded OEM Consolidated

Other information GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- -------------

Capital additions:

Software intangibles 612 10 622

Development 271 100 371

Property, plant and equipment 591 652 1,243

Depreciation and amortisation (664) (787) (1,451)

-------------------------------- -------- -------- -------------

Balance sheet

Assets

Segment assets 113,873 42,039 155,912

Unallocated assets 103

-------------------------------- -------- --------

Consolidated total assets 156,015

-------------------------------- -------- -------- -------------

Liabilities

Segment liabilities 10,153 6,857 17,010

-------------------------------- -------- -------- -------------

Consolidated total liabilities 17,009

-------------------------------- -------- -------- -------------

Re-presented six months ended

30 June 2016 Branded OEM Consolidated

(unaudited) GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- -------------

Revenue 21,622 17,531 39,153

------------------------------- -------- -------- -------------

Result

------------------------------- -------- -------- -------------

Segment result 6,134 3,524 9,658

Unallocated expenses (644)

-------------

Profit from operations 9,014

Finance income 57

Finance costs (55)

------------------------------- -------- -------- -------------

Profit before tax 9,016

Tax (1,680)

------------------------------- -------- -------- -------------

Profit for the period 7,336

------------------------------- -------- -------- -------------

At 30 June 2016 (re-presented)

(unaudited) Branded OEM Consolidated

Other information GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- -------------

Capital additions:

Software intangibles 27 98 125

Development 97 52 149

Property, plant and equipment 708 283 991

Depreciation and amortisation (609) (813) (1,422)

-------------------------------- -------- -------- -------------

Balance sheet

Assets

Segment assets 88,520 44,407 132,927

Unallocated assets 214

-------------------------------- -------- --------

Consolidated total assets 133,141

-------------------------------- -------- -------- -------------

Liabilities

Segment liabilities 10,425 7,643 18,068

-------------------------------- -------- -------- -------------

Consolidated total liabilities 18,068

-------------------------------- -------- -------- -------------

5. Segment information (continued)

Year ended

31 December 2016 (re-presented) Branded OEM Consolidated

(audited) GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------------- --------------

Revenue 45,306 37,315 82,621

---------------------------------- ---------- ---------------- --------------

Result

---------------------------------- ---------- ---------------- --------------

Segment result 11,313 8,677 19,990

Unallocated expenses (885)

--------------

Profit from operations 19,105

Finance income 108

Finance costs (111)

---------------------------------- ---------- ---------------- --------------

Profit before tax 19,102

Tax (3,410)

---------------------------------- ---------- ---------------- --------------

Profit for the year 15,692

---------------------------------- ---------- ---------------- --------------

At 31 December 2016

(audited) (re-presented) Branded OEM Consolidated

Other Information GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------------- --------------

Capital additions:

Software intangibles 596 199 795

Development 157 102 259

Property, plant and equipment 1,105 418 1,523

Depreciation and amortisation (1,309) (1,600) (2,909)

---------------------------------- ---------- ---------------- --------------

Balance sheet

Assets 97,498 47,388 144,886

Segment assets

Unallocated assets 120

---------------------------------- ---------- ---------------- --------------

Consolidated total assets 145,006

---------------------------------- ---------- ---------------- --------------

Liabilities

Segment liabilities 12,020 7,458 19,478

---------------------------------- ---------- ---------------- --------------

Geographical segments

The Group operates in the UK, Germany, the Netherlands, the

Czech Republic, with a sales office located in Russia and a sales

presence in the USA. In presenting information on the basis of

geographical segments, segment revenue is based on the geographical

location of customers. Segment assets are based on the geographical

location of the assets.

The following table provides an analysis of the Group's sales by

geographical market, irrespective of the origin of the goods or

services, based upon location of the Group's customers:

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30 June 2017 30 June 2016 31 December 2016

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------------- ----------------- -----------------

United Kingdom 7,650 8,926 17,457

Germany 9,853 8,421 18,345

Europe excluding United Kingdom and Germany 11,358 10,481 21,360

United States of America 16,082 10,660 23,505

Rest of World 967 665 1,954

--------------------------------------------- ----------------- ----------------- -----------------

45,910 39,153 82,621

--------------------------------------------- ----------------- ----------------- -----------------

5. Segment information (continued)

The following table provides an analysis of the Group's total

assets by geographical location.

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30 June 2017 30 June 2016 31 December 2016

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------------- ----------------- -----------------

United Kingdom 89,352 72,559 80,580

Germany 61,904 56,768 59,950

Europe excluding United Kingdom and Germany 4,197 3,597 3,962

United States of America 562 217 514

--------------------------------------------- ----------------- ----------------- -----------------

156,015 133,141 145,006

--------------------------------------------- ----------------- ----------------- -----------------

6. Financial Instruments' fair value disclosures

It is the policy of the Group to enter into forward foreign

exchange contracts to cover specific foreign currency payments and

receipts.

The Group held the following financial instruments at fair value

at 30 June 2017. The Group has no financial instruments with fair

values that are determined by reference to significant unobservable

inputs i.e. those that would be classified as level 3 in the fair

value hierarchy, nor have there been any transfers of assets or

liabilities between levels of the fair value hierarchy. There are

no non-recurring fair value measurements.

The following table details the forward foreign currency

contracts outstanding as at the period end:

Ave. exchange rate Foreign currency Contract value Fair value

30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 2016 30 June 31 Dec 2016

2017 2016 2017 2016 2017 2017

USD:GBP1 USD:GBP1 USD'000 USD'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash flow

hedges

Sell US

dollars

Less than 3

months 1.405 1.467 5,750 5,250 4,091 3,579 (332) (673)

3 to 6

months 1.382 1.421 6,750 5,250 4,883 3,696 (296) (548)

7 to 12

months 1.317 1.423 23,700 10,500 17,990 7,377 (58) (1,079)

Over 12

months 1.301 1.319 2,000 22,200 1,537 16,829 19 (857)

------------ ----------- ----------- ----------- ----------- ----------- ------------ ----------- ------------

38,200 43,200 28,501 31,481 (667) (3,157)

------------ ----------- ----------- ----------- ----------- ----------- ------------ ----------- ------------

Ave. exchange rate Foreign currency Contract value Fair value

30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 30 June 31 Dec

2017 2016 2017 2016 2017 2016 2017 2016

EUR:GBP1 EUR:GBP1 EUR'000 EUR'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash flow hedges

Sell Euros

Less than 3

months 1.254 1.290 1,150 1,050 917 814 (96) (85)

3 to 6 months 1.237 1.263 1,350 1,250 1,092 990 (100) (73)

7 to 12 months 1.232 1.245 1,350 2,500 1,096 2,009 (100) (146)

Over 12 months 1.137 1.192 2,550 2,400 2,244 2,013 (24) (72)

----------------- ----------- ---------- ----------- ----------- -----------

6,400 7,200 5,349 5,826 (320) (376)

----------------- ---------- ----------- ---------- ----------- ---------- ----------- ----------- -----------

7. Exceptional items

During the six months ended 30 June 2017, the Group incurred

exceptional items of GBPnil (2016 H1: GBP361,000, for an aborted

acquisition).

8. Taxation

The weighted average tax rate for the Group for the six month

period ended 30 June 2017 was 21.35% (six months ended 30 June

2016: 22.5%, year ended 31 December 2016: 22.11%). The effective

rate of current tax for the six months ended 30 June 2017 was 20.2%

(six months ended 30 June 2016: 18.6%, year ended 31 December 2016:

17.9%) after the application of patent box and research and

development tax relief, with some off-set for disallowable

expenditure.

9. Dividends

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30 June 2017 30 June 2016 31 December 2016

Amounts recognised as distributions to equity holders in the

period:

Final dividend for the year ended 31 December 2015 of 0.55p

per ordinary share - 1,150 1,150

Interim dividend for the year ended 31 December 2016 of

0.30p per ordinary share - - 633

Final dividend for the year ended 31 December 2016 of 0.62p 1,307 - -

per ordinary share

----------------- ----------------- -----------------

1,307 1,150 1,783

10. Contingent liabilities

The Directors are not aware of any contingent liabilities faced

by the Group as at 30 June 2017 (30 June 2016: GBPnil, 31 December

2016: GBPnil).

11. Share capital

Share capital as at 30 June 2017 amounted to GBP10,606,000 (30

June 2016: GBP10,499,000, 31 December 2016: GBP10,524,000). During

the period the Group issued 1,643,393 shares in respect of

exercised share options, LTIPS and the Deferred Share Bonus

Scheme.

12. Going concern

In carrying out their duties in respect of going concern, the

Directors have carried out a review of the Group's financial

position and cash flow forecasts for the next 12 months. These have

been based on a comprehensive review of revenue, expenditure and

cash flows, taking into account specific business risks and the

current economic environment.

With regards to the Group's financial position, it had cash and

cash equivalents at 30 June 2017 of GBP55.2 million and a

five-year, GBP30 million, multi-currency, revolving credit

facility, obtained in December 2014, with an accordion option under

which AMS can request up to an additional GBP20 million on the same

terms. The credit facility is provided jointly by HSBC and The

Royal Bank of Scotland PLC. It is unsecured on the assets of the

Group and is currently undrawn.

While the current economic environment is uncertain, AMS

operates in markets whose demographics are favourable, underpinned

by an increasing need for products to treat chronic and acute

wounds. Consequently, market growth is predicted. The Group has a

number of long-term contracts with customers across different

geographic regions and also with substantial financial resources,

ranging from government agencies through to global healthcare

companies.

After taking the above into consideration, the Directors have

reached the conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

condensed consolidated financial statements.

13. Principal risks and uncertainties

Further detail concerning the principal risks affecting the

business activities of the Group is detailed on pages 40 and 41 of

the Annual Report and Accounts for the year ended 31 December 2016.

There have been no significant changes since the last annual

report.

14. Seasonality of sales

There are no significant factors affecting the seasonality of

sales between the first and second half of the year.

15. Events after the balance sheet date

There has been no material event subsequent to the end of the

interim reporting period ended 30 June 2017.

16. Copies of the interim results

Copies of the interim results can be obtained from the Group's

registered office at Premier Park, 33 Road One, Winsford Industrial

Estate, Winsford, Cheshire, CW7 3RT and are available on our

website "www.admedsol.com".

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QLLFFDKFXBBK

(END) Dow Jones Newswires

September 13, 2017 02:00 ET (06:00 GMT)

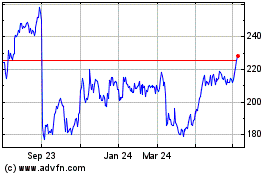

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

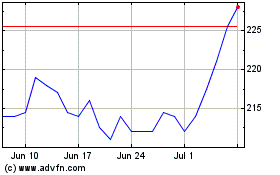

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024