Advance Auto Says CEO to Retire, Adds Starboard CEO to Board

November 12 2015 - 9:00AM

Dow Jones News

Advance Auto Parts Inc., under pressure from activist investor

Starboard Value LP, said its chief executive was retiring in the

new year as the seller of automotive parts also reported

disappointing quarterly results, lowered its profit outlook and

announced store closures.

Starboard, whose 3.7% stake in the company was revealed in

September by The Wall Street Journal, has pushed the company to

improve its profitability, which the hedge fund has said trails

peers AutoZone Inc. and O'Reilly Automotive Inc.

Thursday, Advance Auto said it reached an agreement with the New

York hedge fund, under which Starboard Chief Executive Jeffrey

Smith would be added to Advance Auto's board. In addition,

Starboard and Advance Auto will each add two directors to the

board, which will increase in size to 13 members from 12.

Advance Auto also said Chief Executive Darren Jackson will

retire Jan. 2 and that President George Sherman will add the title

of interim CEO on Jan. 3, the beginning of the company's next

fiscal year. Mr. Jackson has been with the company for more than 11

years, the last eight as CEO.

Effective immediately, Chairman John Brouillard will become

executive chairman. Advance Auto said the change will enable Mr.

Brouillard to work closely in an advisory capacity with Mr.

Sherman. Mr. Brouillard said the board would consider external

candidates as well as Mr. Sherman for the role of permanent

CEO.

Mr. Brouillard said that during Mr. Jackson's tenure as CEO,

Advance Auto has doubled in size while growing its market value

over $10 billion and increasing its share price to $195 from

$33.

Mr. Brouillard also welcomed Starboard's Mr. Smith as "a

respected leader, investor and valued board member."

Separately, Advance Auto said acquisition-related impacts cut

into its third-quarter earnings. The company said same-store sales

rose 0.5% in the quarter, and it expects them at flat to down

slightly for the current quarter.

Overall, the company said it earned $120.5 million, or $1.63 a

share, compared with $122.2 million, or $1.66 a share, a year

earlier. Revenue edged up 0.5% to $2.30 billion.

Analysts expected earnings of $2.09 a share on revenue of $2.33

billion.

Citing the earnings shortfall, coupled with continuing

integration headwinds and the soft start to the fourth quarter,

Advance Auto lowered its per-share forecast for full-year

comparable cash earnings to $7.75 to $7.90, down from its previous

range of $8.10 to $8.30.

The company also said it plans to close an additional 30 stores

in the latter part of 2015, at an expected expense of between $10

million and $15 million.

Shares, which have increased about 33% over the past 12 months,

fell 9.3% to $176.50 in premarket trading.

Write to Anne Steele at Anne.Steele@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 08:45 ET (13:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

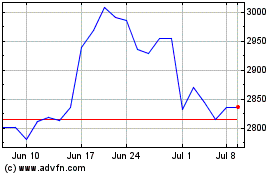

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

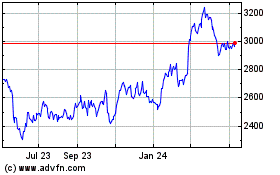

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024