Adobe Systems Agrees to Acquire TubeMogul

November 10 2016 - 9:37AM

Dow Jones News

By Tess Stynes

Adobe Systems Inc. (ADBE) agreed to acquire ad technology

company TubeMogul (TUBE) in a deal valued at roughly $515 million

that aims to strengthen Adobe's position in digital marketing and

advertising technology.

The deal, expected to close early next year, is valued at

roughly $540 million, net of debt and cash.

TubeMogul holders will receive $14 a share for each share held,

an 83% premium to Wednesday's close. The company's shares have been

halved since April amid a shift in ad spending from desktop to

mobile. The stock soared 82% to $13.98 in recent premarket

trading.

Brad Rencher, Adobe's digital marketing general manager, said

that with the acquisition of TubeMogul, Adobe is aiming to create a

"one-stop shop" for video advertising for its marketing cloud

customers.

TubeMogul's technology includes a product designed to help

marketers buy web video ads aimed at specific people using

automated software through direct buys with a number of well-known

media companies simultaneously.

Adobe and TubeMogul share some big customers, including Allstate

Corp. (ALL), Johnson & Johnson (JNJ) and Southwest Airlines Co.

(LUV).

TubeMogul, which will become part of Adobe's digital marketing

business, will continue to be led by its current chief executive,

Brett Wilson.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

November 10, 2016 09:22 ET (14:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

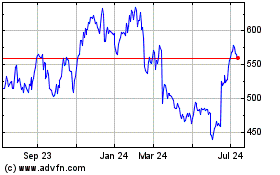

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

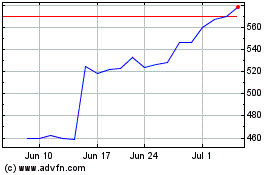

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024