Momentum Continues with Accelerated Creative Cloud and Adobe

Marketing Cloud Adoption

Adobe (Nasdaq:ADBE) today reported financial results for its

fourth quarter and fiscal year 2014 ended Nov. 28, 2014.

Fourth Quarter Financial Highlights

- Adobe achieved revenue of $1.073

billion, near the high end of the targeted range of $1.025 billion

to $1.075 billion.

- Adobe added 644 thousand net new

Creative Cloud subscriptions in the quarter.

- Creative Annualized Recurring Revenue

(“ARR”) grew to $1.676 billion, and total Digital Media ARR grew to

$1.947 billion.

- Adobe Marketing Cloud revenue was $330

million with record bookings in the quarter.

- Diluted earnings per share were $0.14

on a GAAP-basis, and $0.36 on a non-GAAP basis.

- Cash flow from operations was $400

million.

- Deferred revenue grew to a record

$1.155 billion, and unbilled backlog grew to approximately $1.7

billion.

- 66 percent of Adobe’s Q4 revenue was

from recurring sources, compared to 44 percent of Q4 revenue in

fiscal 2013.

- The company repurchased approximately

1.8 million shares during the quarter, returning $127 million of

cash to stockholders.

Fiscal Year 2014 Financial Highlights

- Adobe achieved revenue of $4.147

billion and generated $1.288 billion in operating cash flow during

the year.

- The company reported annual GAAP

earnings per share of $0.50 and non-GAAP earnings per share of

$1.29.

- Creative Cloud subscriptions grew by

more than two million to 3.454 million. In addition, Adobe grew net

new Digital Media ARR by more than $1 billion during the year.

- Adobe Marketing Cloud achieved a record

$1.170 billion in annual revenue, with record annual bookings that

is above the company’s target of 30 percent.

- The company repurchased 10.9 million

shares during the year, returning approximately $689 million of

cash to stockholders.

A reconciliation between GAAP and non-GAAP results is provided

at the end of this press release and on Adobe’s website.

Adobe to Acquire Fotolia

Adobe today announced it has entered into a definitive agreement

to acquire privately-held Fotolia, a leading marketplace for stock

content. Fotolia will be integrated into Adobe Creative Cloud,

providing current and future Creative Cloud members with the

ability to access and purchase over 34 million images and videos,

significantly simplifying and accelerating the design process. The

acquisition of Fotolia cements Creative Cloud’s role as a vibrant

marketplace for creatives to buy and sell assets and services as

well as showcase their talent to a worldwide audience. Adobe also

plans to continue to operate Fotolia as a standalone stock service,

accessible to anyone. Additional information is available in a

separate press release.

Executive Quotes

"Adobe had an outstanding 2014. Creative Cloud adoption outpaced

expectations and the acquisition of Fotolia will add a vibrant

marketplace for our customers. Adobe Marketing Cloud, the leader in

the explosive digital marketing category, continued to drive strong

bookings at the world's biggest brands, agencies and media

companies,” said Shantanu Narayen, Adobe president and chief

executive officer.

“2014 was a pivotal year for Adobe as we completed our business

model transition,” said Mark Garrett, Adobe executive vice

president and chief financial officer. “In 2015 we expect revenue

and earnings to grow sequentially every quarter during the

year.”

Adobe to Webcast Earnings Conference Call

Adobe will webcast its fourth quarter and fiscal year 2014

earnings conference call today at 2:00 p.m. Pacific Time from its

investor relations website: www.adobe.com/ADBE. Earnings documents,

including Adobe management’s prepared conference call remarks with

slides, financial targets and an investor datasheet are posted to

Adobe’s investor relations website in advance of the conference

call for reference. A reconciliation between GAAP and non-GAAP

earnings results and financial targets is also provided on the

website.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements,

including those related to business momentum, the strength of our

cloud business and growth of our bookings, revenue and earnings,

and our ability to complete and integrate the acquisition of

Fotolia, all of which involve risks and uncertainties that could

cause actual results to differ materially. Factors that might cause

or contribute to such differences include, but are not limited to:

failure to develop, market and distribute products and services

that meet customer requirements, introduction of new products and

business models by competitors, failure to successfully manage

transitions to new business models and markets, fluctuations in

subscription renewal rates, risks associated with cyber-attacks and

information security, potential interruptions or delays in hosted

services provided by us or third parties, uncertainty in economic

conditions and the financial markets, and failure to realize the

anticipated benefits of past or future acquisitions.

For a discussion of these and other risks and uncertainties,

please refer to Adobe’s Annual Report on Form 10-K for our fiscal

year 2013 ended Nov. 29, 2013 and Adobe’s Quarterly Reports on Form

10-Q issued in fiscal year 2014.

The financial information set forth in this press release

reflects estimates based on information available at this time.

These amounts could differ from actual reported amounts stated in

Adobe’s Annual Report on Form 10-K for our year ended Nov. 28,

2014, which Adobe expects to file in Jan. 2015.

Adobe assumes no obligation to, and does not currently intend

to, update these forward-looking statements.

About Adobe Systems Incorporated

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2014 Adobe Systems Incorporated. All rights reserved. Adobe,

the Adobe logo, Creative Cloud and Adobe Marketing Cloud are either

registered trademarks or trademarks of Adobe Systems Incorporated

in the United States and/or other countries. All other trademarks

are the property of their respective owners.

Condensed Consolidated Statements of

Income

(In thousands, except per share data;

unaudited)

Three Months Ended Year Ended

November 28, 2014 November 29,

2013 November 28, 2014 November

29, 2013 Revenue: Products $ 327,951 $ 567,232 $

1,627,803 $ 2,470,098 Subscription 628,954 359,723 2,076,584

1,137,856 Services and support 116,423 114,744

442,678 447,286 Total revenue 1,073,328

1,041,699 4,147,065 4,055,240 Cost of

revenue: Products 21,930 26,803 97,099 138,154 Subscription 87,883

77,314 335,432 278,077 Services and support 51,130 43,399

189,549 170,326 Total cost of revenue 160,943

147,516 622,080 586,557 Gross

profit 912,385 894,183 3,524,985 3,468,683 Operating

expenses: Research and development 213,687 205,196 844,353 826,631

Sales and marketing 428,362 431,540 1,671,808 1,620,454 General and

administrative 133,534 138,358 543,332 520,124 Restructuring and

other charges 19,385 2,294 19,883 26,497 Amortization of purchased

intangibles 12,412 13,959 52,424 52,254

Total operating expenses 807,380 791,347 3,131,800

3,045,960 Operating income 105,005 102,836

393,185 422,723 Non-operating income (expense): Interest and

other income (expense), net 105 695 7,267 4,941 Interest expense

(12,678 ) (16,722 ) (59,732 ) (67,508 ) Investment gains (losses),

net 343 1,461 1,156 (4,015 ) Total

non-operating income (expense), net (12,230 ) (14,566 ) (51,309 )

(66,582 ) Income before income taxes 92,775 88,270 341,876 356,141

Provision for income taxes 19,483 22,950 88,325

66,156 Net income $ 73,292 $ 65,320 $

253,551 $ 289,985 Basic net income per share $ 0.15

$ 0.13 $ 0.51 $ 0.58 Shares used to

compute basic net income per share 498,124 499,363

497,867 501,372 Diluted net income per share $ 0.14

$ 0.13 $ 0.50 $ 0.56 Shares used to

compute diluted net income per share 507,451 511,082

508,480 513,476

Condensed Consolidated Balance

Sheets

(In thousands, except par value;

unaudited)

November 28, 2014 November 29,

2013 ASSETS Current assets: Cash and cash equivalents

$ 1,117,400 $ 834,556 Short-term investments 2,622,091 2,339,196

Trade receivables, net of allowances for doubtful accounts of

$7,867 and $10,228, respectively 591,800 599,820 Deferred income

taxes 95,586 102,247 Prepaid expenses and other current assets

175,758 170,110 Total current assets 4,602,635

4,045,929 Property and equipment, net 785,123 659,774

Goodwill 4,721,962 4,771,981 Purchased and other intangibles, net

469,662 605,254 Investment in lease receivable 80,439 207,239 Other

assets 126,315 90,121 Total assets $ 10,786,136

$ 10,380,298 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Trade payables $ 68,377 $ 62,096

Accrued expenses 703,365 656,939 Debt and capital lease obligations

603,229 14,676 Accrued restructuring 17,120 6,171 Income taxes

payable 20,456 10,222 Deferred revenue 1,097,923 775,544

Total current liabilities 2,510,470 1,525,648

Long-term liabilities: Debt and capital lease obligations 911,086

1,499,297 Deferred revenue 57,401 53,268 Accrued restructuring

5,194 7,717 Income taxes payable 125,746 132,545 Deferred income

taxes 341,610 375,634 Other liabilities 73,748 61,555

Total liabilities 4,025,255 3,655,664 Stockholders' equity:

Preferred stock, $0.0001 par value; 2,000 shares authorized — —

Common stock, $0.0001 par value 61 61 Additional paid-in-capital

3,778,314 3,392,696 Retained earnings 6,909,451 6,928,964

Accumulated other comprehensive income (loss) (8,094 ) 46,103

Treasury stock, at cost (103,350 and 104,573 shares, respectively),

net of reissuances (3,918,851 ) (3,643,190 ) Total stockholders'

equity 6,760,881 6,724,634 Total liabilities and

stockholders' equity $ 10,786,136 $ 10,380,298

Condensed Consolidated Statements of

Cash Flows

(In thousands; unaudited)

Three Months Ended November 28, 2014

November 29, 2013 Cash flows from operating

activities: Net income $ 73,292 $ 65,320 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation, amortization and accretion 78,147 81,350 Stock-based

compensation expense 84,949 86,754 Unrealized investment gains, net

(121 ) (1,741 ) Changes in deferred revenue 158,712 94,737 Changes

in other operating assets and liabilities 4,953 (11,438 )

Net cash provided by operating activities 399,932 314,982

Cash flows from investing activities: Purchases,

sales and maturities of short-term investments, net (8,474 ) 11,140

Purchases of property and equipment (36,775 ) (35,121 ) Proceeds

from the sale of property and equipment — 24,260 Purchases and

sales of long-term investments, intangibles and other assets, net

(2,908 ) (294 ) Acquisitions, net of cash (29,802 ) — Net

cash used for investing activities (77,959 ) (15 ) Cash

flows from financing activities: Purchases of treasury stock

(125,000 ) (400,000 ) Proceeds from reissuance of treasury stock,

net 3,619 64,892 Repayment of debt and capital lease obligations

(3,253 ) (6,041 ) Excess tax benefits from stock-based compensation

21,102 40,619 Net cash used for financing activities

(103,532 ) (300,530 ) Effect of exchange rate changes on cash and

cash equivalents (4,370 ) 1,034 Net increase in cash and

cash equivalents 214,071 15,471 Cash and cash equivalents at

beginning of period 903,329 819,085 Cash and cash

equivalents at end of period $ 1,117,400 $ 834,556

Non-GAAP Results

(In thousands, except per share data)

The following tables show Adobe's GAAP

results reconciled to non-GAAP results included in this

release.

Three Months Ended Year Ended

November 28, 2014 November 29,

2013 August 29, 2014 November

28, 2014 November 29, 2013

Operating income: GAAP operating income $ 105,005 $ 102,836

$ 74,176 $ 393,185 $ 422,723 Stock-based and deferred compensation

expense 85,025 86,468 83,682 335,856 332,289 Restructuring and

other charges 19,385 2,294 201 19,883 26,497 Amortization of

purchased intangibles & technology license arrangements 31,331

32,789 31,780 127,000 153,840 Loss contingency — — —

10,000 — Non-GAAP operating income $ 240,746

$ 224,387 $ 189,839 $ 885,924 $ 935,349

Net income: GAAP net income $ 73,292 $ 65,320

$ 44,686 $ 253,551 $ 289,985 Stock-based and deferred compensation

expense 85,025 86,468 83,682 335,856 332,289 Restructuring and

other charges 19,385 2,294 201 19,883 26,497 Amortization of

purchased intangibles & technology license arrangements 31,331

32,789 31,780 127,000 153,840 Investment (gains) losses (343 )

(1,461 ) (669 ) (1,156 ) 4,015 Loss contingency — — — 10,000 —

Income tax adjustments (28,433 ) (20,806 ) (19,114 ) (86,701 )

(116,897 ) Non-GAAP net income $ 180,257 $ 164,604 $

140,566 $ 658,433 $ 689,729 Diluted net

income per share: GAAP diluted net income per share $ 0.14 $

0.13 $ 0.09 $ 0.50 $ 0.56 Stock-based and deferred compensation

expense 0.17 0.17 0.16 0.66 0.65 Restructuring and other charges

0.04 — — 0.04 0.05 Amortization of purchased intangibles &

technology license arrangements 0.06 0.06 0.06 0.25 0.30 Investment

(gains) losses — — — — 0.01 Loss contingency — — — 0.02 — Income

tax adjustments (0.05 ) (0.04 ) (0.03 ) (0.18 ) (0.23 ) Non-GAAP

diluted net income per share $ 0.36 $ 0.32 $ 0.28

$ 1.29 $ 1.34 Shares used in computing

diluted net income per share 507,451 511,082 507,811 508,480

513,476

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information that may

include items such as stock-based and deferred compensation

expenses, restructuring and other charges, amortization of

purchased intangibles and certain activity in connection with

technology license arrangements, investment gains and losses, loss

contingencies and the related tax impact of all of these items,

income tax adjustments, the income tax effect of the non-GAAP

pre-tax adjustments from the provision for income taxes, and the

non-GAAP measures that exclude such information in order to assess

the performance of Adobe's business and for planning and

forecasting in subsequent periods. Whenever Adobe uses such a

non-GAAP financial measure, it provides a reconciliation of the

non-GAAP financial measure to the most closely applicable GAAP

financial measure. Investors are encouraged to review the related

GAAP financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measure as detailed above.

Investor Relations ContactAdobeMike Saviage,

408-536-4416ir@adobe.comorPublic

Relations ContactAdobeColleen Rodriguez,

408-536-6803corodrig@adobe.com

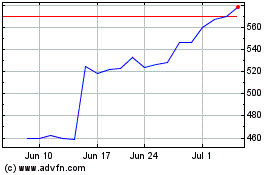

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

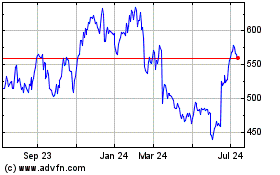

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024