Company Targets 20 Percent Revenue and 30 Percent Non-GAAP

Earnings CAGRs between FY2015 and FY2018

Adobe (Nasdaq:ADBE) today will host a financial analyst meeting

at its Adobe MAX user conference. At the meeting, Adobe management

will outline the company’s momentum and strategy, and discuss

multi-year financial growth targets for its business.

“Adobe is the only company that brings great content and

powerful data together, enabling millions of customers globally to

build high-impact digital experiences,” said Shantanu Narayen,

Adobe president and chief executive officer. “We are targeting 20

percent revenue and 30 percent non-GAAP earnings CAGRs between FY15

and FY18 that reflect our business momentum and growing addressable

markets.”

FY2015 – FY2018 Financial Targets

At its financial analyst meeting today, Adobe management will

discuss FY2015 through FY2018 compound annual growth rate (CAGR)

and annualized recurring revenue (ARR) targets, which are

summarized in the table below.

Total Adobe revenue

Approximately 20 percent CAGR Digital Media segment

revenue Greater than 20 percent CAGR

Digital Media ARR Greater than 20

percent CAGR Adobe Marketing Cloud revenue

Greater than 20 percent CAGR Adobe Marketing Cloud bookings

Approximately 30 percent CAGR Non-GAAP

earnings per share1 Approximately 30

percent CAGR Operating cash flow

Approximately 25 percent CAGR

1As part of its long-term growth targets, Adobe believes it can

achieve approximately 30 percent CAGR in non-GAAP diluted net

income per share. Although the information to enable Adobe to

reconcile and provide GAAP diluted net income per share targets for

those years is not available at this time, reconciling items are

expected to include, stock-based and deferred compensation expense,

amortization of purchased intangibles, investment gains and losses

and income tax adjustments.

In addition to these long-term financial targets, Adobe

management also provided market research information which

concludes the company’s total addressable market will grow to

approximately $48 billion by 2018.

FY2016 Financial Targets

Adobe also will discuss preliminary financial targets for its

fiscal year 2016, which are summarized in the table below.

Total Adobe revenue

Approximately $5.7 billion Digital Media segment revenue

Approximately 20 percent year-over-year growth

Digital Media ARR Approximately 25 percent

year-over-year growth Adobe Marketing Cloud revenue

Approximately 20 percent year-over-year growth Adobe

Marketing Cloud bookings Approximately 30

percent year-over-year growth GAAP earnings per share

Approximately $1.80 Non-GAAP earnings per share

Approximately $2.70

A reconciliation between FY2016 GAAP and non-GAAP earnings per

share targets is provided at the end of this press release.

Adobe to Webcast Financial Analyst Meeting

Adobe will webcast its meeting with financial analysts and

investors in attendance at Adobe MAX beginning at 5:00 p.m. Eastern

Time today. People can access the webcast and slides from this

event from the Adobe Investor Relations webpage at

http://www.adobe.com/ADBE. The live video webcast will last

approximately two and a half hours and will be archived on Adobe's

website for approximately 30 days. There will be no phone dial-in

capability.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements,

including those related to business momentum and strategy, revenue,

margin, earnings, annualized recurring revenue, bookings and

operating cash flow, all of which involve risks and uncertainties

that could cause actual results to differ materially. Factors that

might cause or contribute to such differences include, but are not

limited to: failure to develop, market and distribute products and

services that meet customer requirements, introduction of new

products and business models by competitors, failure to

successfully manage transitions to new business models and markets,

fluctuations in subscription renewal rates, risks associated with

cyber-attacks and information security, potential interruptions or

delays in hosted services provided by us or third parties,

uncertainty in economic conditions and the financial markets, and

failure to realize the anticipated benefits of past or future

acquisitions.

For a discussion of these and other risks and uncertainties,

please refer to Adobe’s Annual Report on Form 10-K for our fiscal

year 2014 ended Nov. 28, 2014, and Adobe's Quarterly Reports on

Form 10-Q issued in fiscal year 2015.

Adobe assumes no obligation to, and does not currently intend

to, update these forward-looking statements.

About Adobe Systems Incorporated

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2015 Adobe Systems Incorporated. All rights reserved. Adobe

and the Adobe logo are either registered trademarks or trademarks

of Adobe Systems Incorporated in the United States and/or other

countries. All other trademarks are the property of their

respective owners.

Reconciliation of GAAP to Non-GAAP Financial Targets

(In millions, except per share data)

The following tables show Adobe's GAAP financial targets

reconciled to non-GAAP financial targets included in this

document.

Fiscal 2016 Diluted net income per share: GAAP

diluted net income per share $ 1.80 Stock-based and deferred

compensation expense 0.78 Amortization of purchased intangibles

0.24 Income tax adjustments (0.12 ) Non-GAAP diluted net income per

share $ 2.70 Shares used to compute diluted net

income per share 510.0

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information that may

include items such as stock-based and deferred compensation

expenses, restructuring and other charges, amortization of

purchased intangibles and certain activity in connection with

technology license arrangements, investment gains and losses and

the related tax impact of all of these items, income tax

adjustments, the income tax effect of the non-GAAP pre-tax

adjustments from the provision for income taxes, and the non-GAAP

measures that exclude such information in order to assess the

performance of Adobe's business and for planning and forecasting in

subsequent periods. Whenever Adobe uses such a non-GAAP financial

measure, it provides a reconciliation of the non-GAAP financial

measure to the most closely applicable GAAP financial measure.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measure

as detailed above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151006006732/en/

AdobeInvestor Relations ContactMike Saviage,

408-536-4416ir@adobe.comPublic

Relations ContactEdie Kissko, 408-536-3034kissko@adobe.com

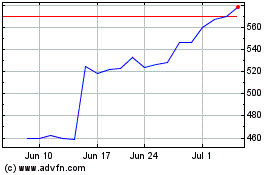

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

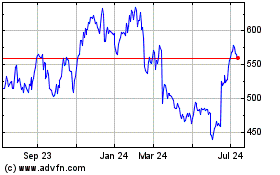

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024