Achieves Record Creative Cloud, Adobe Document Cloud and

Adobe Experience Cloud Revenue in Fiscal 2017

Adobe (Nasdaq:ADBE) today reported financial results for its

fourth quarter and fiscal year 2017 ended Dec. 1, 2017.

In its fourth quarter of fiscal year 2017, Adobe achieved

quarterly revenue of $2.01 billion, which represents 25 percent

year-over-year growth. In fiscal year 2017, Adobe achieved annual

revenue of $7.30 billion, which also represents 25 percent

year-over-year growth.

"Adobe delivered record revenue of $2 billion in Q4," said

Shantanu Narayen, president and CEO, Adobe. "Our strong business

momentum is driven by the market-leading solutions we provide to

empower people to create and businesses to digitally

transform.”

“Adobe achieved record annual and quarterly revenue, and the

leverage in our business model once again drove record profit and

earnings," said Mark Garrett, executive vice president and CFO,

Adobe. “We are raising our fiscal 2018 revenue target and remain

bullish about delivering strong top line and bottom line

growth.”

Fourth Quarter Fiscal Year 2017 Financial Highlights

- Adobe achieved record quarterly revenue

of $2.01 billion in its fourth quarter of fiscal year 2017, which

represents 25 percent year-over-year growth.

- Diluted earnings per share was $1.00 on

a GAAP-basis, and $1.26 on a non-GAAP basis.

- Digital Media segment revenue was $1.39

billion, with Creative and Document Cloud achieving record

quarterly revenue of $1.16 billion and $235 million,

respectively.

- Digital Media Annualized Recurring

Revenue (“ARR”) grew to $5.23 billion exiting the quarter, a

quarter-over-quarter increase of $359 million.

- Adobe Experience Cloud achieved record

revenue of $550 million, which represents 18 percent year-over-year

growth.

- Operating income grew 37 percent and

net income grew 26 percent year-over-year on a GAAP-basis;

operating income grew 37 percent and net income grew 39 percent

year-over-year on a non-GAAP basis.

- Cash flow from operations was a record

$833 million and deferred revenue grew to an all-time high of $2.49

billion.

- The company repurchased approximately

1.9 million shares during the quarter, returning $297 million of

cash to stockholders.

Fiscal Year 2017 Financial Highlights

- Adobe achieved record annual revenue of

$7.30 billion in fiscal year 2017, representing 25 percent

year-over-year growth.

- The company reported annual GAAP

diluted earnings per share of $3.38 and non-GAAP diluted earnings

per share of $4.31.

- Digital Media segment revenue was $5.01

billion, with Creative and Document Cloud achieving record annual

revenue of $4.17 billion and $837 million, respectively. Digital

Media ARR grew by $1.24 billion during the year.

- Adobe Experience Cloud achieved record

annual revenue of $2.03 billion, representing 24 percent

year-over-year growth.

- Operating income grew 45 percent and

net income grew 45 percent year-over-year on a GAAP-basis;

operating income grew 40 percent and net income grew 42 percent

year-over-year on a non-GAAP basis.

- Adobe generated a record $2.91 billion

in operating cash flow during the year.

- The company repurchased 8.2 million

shares during the year, returning $1.10 billion of cash to

stockholders.

A reconciliation between GAAP and non-GAAP results is provided

at the end of this press release and on Adobe’s website.

Adobe to Webcast Earnings Conference Call

Adobe will webcast its fourth quarter and fiscal year 2017

earnings conference call today at 2:00 p.m. Pacific Time from its

investor relations website: www.adobe.com/ADBE. Earnings documents,

including Adobe management’s prepared conference call remarks with

slides, financial targets and an investor datasheet are posted to

Adobe’s investor relations website in advance of the conference

call for reference. A reconciliation between GAAP and non-GAAP

earnings results and financial targets is also provided on the

website.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements,

including those related to business momentum, product adoption,

revenue, annualized recurring revenue, subscription bookings,

non-operating other expense, tax rate on a GAAP and non-GAAP basis,

earnings per share on a GAAP and non-GAAP basis, and share count,

all of which involve risks and uncertainties that could cause

actual results to differ materially. Factors that might cause or

contribute to such differences include, but are not limited to:

failure to develop, acquire, market and offer products and services

that meet customer requirements, introduction of new technology,

complex sales cycles, fluctuations in subscription renewal rates,

our ability to predict such renewals and risks related to the

timing of revenue recognition from our subscription offerings,

potential interruptions or delays in hosted services provided by us

or third parties, risks associated with cyber-attacks, information

security and privacy, failure to realize the anticipated benefits

of past or future acquisitions, changes in accounting principles

and tax regulations, and uncertainty in the financial markets and

economic conditions in the countries we operate as a multinational

corporation. For a discussion of these and other risks and

uncertainties, please refer to Adobe’s Annual Report on Form 10-K

for our fiscal year 2016 ended Dec. 2, 2016, and Adobe's Quarterly

Reports on Form 10-Q issued in fiscal year 2017.

The financial information set forth in this press release

reflects estimates based on information available at this time.

These amounts could differ from actual reported amounts stated in

Adobe’s Annual Report on Form 10-K for our year ended Dec. 1, 2017,

which Adobe expects to file in Jan. 2018.

Adobe assumes no obligation to, and does not currently intend

to, update these forward-looking statements.

About Adobe

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2017 Adobe Systems Incorporated. All rights reserved. Adobe,

Adobe Document Cloud, Adobe Experience Cloud, Creative Cloud, and

the Adobe logo are either registered trademarks or trademarks of

Adobe Systems Incorporated in the United States and/or other

countries. All other trademarks are the property of their

respective owners.

Condensed Consolidated Statements of

Income

(In thousands, except per share data;

unaudited)

Three Months Ended Year Ended December

1,2017*

December 2, 2016

December 1,

2017*

December 2, 2016 Revenue: Subscription

$ 1,695,987 $ 1,262,273 $ 6,133,869 $ 4,584,833 Product 192,876

221,926 706,767 800,498 Services and support 117,732 124,220

460,869 469,099 Total revenue 2,006,595

1,608,419 7,301,505 5,854,430 Cost of

revenue: Subscription 170,218 122,196 623,048 461,860 Product

15,552 17,427 57,082 68,917 Services and support 85,102

76,933 330,361 289,131

Total cost of revenue

270,872 216,556 1,010,491 819,908

Gross profit 1,735,723 1,391,863 6,291,014 5,034,522

Operating expenses: Research and development 324,026 257,849

1,224,059 975,987 Sales and marketing 574,104 495,042 2,197,592

1,910,197 General and administrative 169,567 148,192 624,706

576,202 Amortization of purchased intangibles 18,686 18,500

76,562 78,534 Total operating expenses

1,086,383

919,583 4,122,919 3,540,920 Operating

income 649,340 472,280 2,168,095 1,493,602 Non-operating

income (expense): Interest and other income (expense), net 10,496

553 36,395 13,548 Interest expense (19,116 ) (17,518 ) (74,402 )

(70,442 ) Investment gains (losses), net 2,292 1,385

7,553 (1,570 ) Total non-operating income (expense), net

(6,328 ) (15,580 ) (30,454 ) (58,464 ) Income before income taxes

643,012 456,700 2,137,641 1,435,138 Provision for income taxes

141,463 57,087 443,687 266,356 Net

income $ 501,549 $ 399,613 $ 1,693,954 $

1,168,782 Basic net income per share $ 1.02 $ 0.81

$ 3.43 $ 2.35 Shares used to compute basic net

income per share 492,108 495,641 493,632

498,345 Diluted net income per share $ 1.00 $ 0.80

$ 3.38 $ 2.32 Shares used to compute diluted

net income per share 500,060 501,176 501,123

504,299

_________________________________________

* We early adopted ASU No. 2016-09,

Improvements to Employee Share-Based Payment Accounting, during the

first quarter of fiscal 2017. As required by the standard, excess

tax benefits recognized on stock-based compensation expense were

reflected in our provision for income taxes rather than paid-in

capital on a prospective basis. We recorded excess tax benefits

within our provision for income taxes, rather than paid-in capital,

starting the first quarter of fiscal 2017.

Condensed Consolidated Balance Sheets

(In thousands, except par value;

unaudited)

December 1, 2017 December 2,

2016 ASSETS Current assets: Cash and cash equivalents

$ 2,306,072 $ 1,011,315 Short-term investments 3,513,702 3,749,985

Trade receivables, net of allowances for doubtful accounts of

$9,151 and $6,214, respectively 1,217,968 833,033 Prepaid expenses

and other current assets 210,071 245,441 Total

current assets 7,247,813 5,839,774 Property and equipment,

net 936,976 816,264 Goodwill 5,821,561 5,406,474 Purchased and

other intangibles, net 385,658 414,405 Investment in lease

receivable — 80,439 Other assets 143,548 139,890

Total assets $ 14,535,556 $ 12,697,246

LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities:

Trade payables $ 113,538 $ 88,024 Accrued expenses 993,773 739,630

Income taxes payable 14,196 38,362 Deferred revenue 2,405,950

1,945,619 Total current liabilities 3,527,457

2,811,635 Long-term liabilities: Debt 1,881,421 1,892,200

Deferred revenue 88,592 69,131 Income taxes payable 173,088 184,381

Deferred income taxes 279,941 217,660 Other liabilities 125,188

97,404 Total liabilities 6,075,687 5,272,411

Stockholders’ equity: Preferred stock, $0.0001 par value; 2,000

shares authorized — — Common stock, $0.0001 par value 61 61

Additional paid-in-capital 5,082,195 4,616,331 Retained earnings

9,573,870 8,114,517 Accumulated other comprehensive income (loss)

(111,821 ) (173,602 ) Treasury stock, at cost (109,572 and 106,580

shares, respectively), net of reissuances (6,084,436 ) (5,132,472 )

Total stockholders’ equity 8,459,869 7,424,835 Total

liabilities and stockholders’ equity $ 14,535,556 $

12,697,246

Condensed

Consolidated Statements of Cash Flows

(In thousands; unaudited)

Three Months Ended December 1,2017*

December 2, 2016 Cash flows from operating

activities: Net income $ 501,549 $ 399,613 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation, amortization and accretion 81,234 81,860 Stock-based

compensation expense 120,050 87,530 Unrealized investment (gains)

losses, net (2,251 ) (771 ) Changes in deferred revenue 289,952

216,765 Changes in other operating assets and liabilities (157,314

) (89,396 ) Net cash provided by operating activities 833,220

695,601 Cash flows from investing activities:

Purchases, sales and maturities of short-term investments, net

62,199 (97,891 ) Purchases of property and equipment (37,684 )

(48,633 ) Purchases and sales of long-term investments, intangibles

and other assets, net (4,149 ) 3,426

Net cash provided by (used for) investing

activities

20,366 (143,098 ) Cash flows from financing

activities: Purchases of treasury stock (300,000 ) (300,000 ) Taxes

paid related to net share settlement of equity awards, net of

proceeds from treasury stock reissuances (18,877 ) (6,283 )

Repayment of capital lease obligations (632 ) (22 ) Excess tax

benefits from stock-based compensation — 5,836 Net

cash used for financing activities (319,509 ) (300,469 ) Effect of

exchange rate changes on cash and cash equivalents (2,555 ) (8,391

) Net increase in cash and cash equivalents 531,522 243,643 Cash

and cash equivalents at beginning of period 1,774,550

767,672 Cash and cash equivalents at end of period $

2,306,072 $ 1,011,315

_________________________________________

* We early adopted ASU No. 2016-09,

Improvements to Employee Share-Based Payment Accounting, during the

first quarter of fiscal 2017. As required by the standard, excess

tax benefits recognized on stock-based compensation expense were

reflected in our provision for income taxes rather than paid-in

capital on a prospective basis. We also elected to prospectively

apply the change in presentation of excess tax benefits wherein

excess tax benefits recognized on stock-based compensation expense

were classified as operating activities in our condensed

consolidated statements of cash flows starting the first quarter of

fiscal 2017. Prior period classification of cash flows related to

excess tax benefits was not adjusted.

Non-GAAP Results

(In thousands, except per share data)

The following tables show Adobe's GAAP

results reconciled to non-GAAP results included in this

release.

Three Months Ended Year Ended

December 1, 2017 December 2,

2016 September 1, 2017

December 1, 2017 December 2,

2016 Operating income: GAAP operating income $

649,340 $ 472,280 $ 545,674 $ 2,168,095 $ 1,493,602 Stock-based and

deferred compensation expense 122,180 86,584 117,968 462,317

351,553 Restructuring and other charges (359 ) (285 ) — (456 )

(1,508 ) Amortization of purchased intangibles 34,817 31,143

36,655 143,492 136,056 Non-GAAP

operating income $ 805,978 $ 589,722 $ 700,297

$ 2,773,448 $ 1,979,703 Net income:

GAAP net income* $ 501,549 $ 399,613 $ 419,569 $ 1,693,954 $

1,168,782 Stock-based and deferred compensation expense 122,180

86,584 117,968 462,317 351,553 Restructuring and other charges (359

) (285 ) — (456 ) (1,508 ) Amortization of purchased intangibles

34,817 31,143 36,655 143,492 136,056 Investment (gains) losses, net

(2,292 ) (1,385 ) (975 ) (7,553 ) 1,570 Income tax adjustments

(25,982 ) (63,118 ) (24,146 ) (130,756 ) (137,350 ) Non-GAAP

net income $ 629,913 $ 452,552 $ 549,071 $

2,160,998 $ 1,519,103 Diluted net

income per share: GAAP diluted net income per share* $ 1.00

$ 0.80 $ 0.84 $ 3.38 $ 2.32 Stock-based and deferred compensation

expense 0.24 0.17 0.24 0.92 0.70 Amortization of purchased

intangibles 0.07 0.06 0.07 0.29 0.27 Investment (gains) losses, net

— — — (0.02 ) — Income tax adjustments (0.05 ) (0.13 ) (0.05 )

(0.26 ) (0.28 ) Non-GAAP diluted net income per share $ 1.26

$ 0.90 $ 1.10 $ 4.31 $ 3.01

Shares used in computing diluted net income per share

500,060 501,176 500,398 501,123 504,299

Three Months Ended December 1, 2017 Effective

income tax rate: GAAP effective income tax rate* 22.0 %

Stock-based and deferred compensation expense 0.2 Income tax

adjustments (1.2 ) Non-GAAP effective income tax rate** 21.0 %

_________________________________________

* We early adopted ASU No. 2016-09,

Improvements to Employee Share-Based Payment Accounting, during the

first quarter of fiscal 2017. As required by the standard, excess

tax benefits recognized on stock-based compensation expense were

reflected in our provision for income taxes rather than paid-in

capital on a prospective basis. We recorded excess tax benefits

within our provision for income taxes, rather than paid-in capital,

starting the first quarter of fiscal 2017. ** Our non-GAAP

effective income tax rate of 21% is an annualized rate based on

estimates for the entire fiscal year, whereas the GAAP effective

income tax rate of 22% is the rate for the quarter based on tax

events within the quarter. Income tax adjustments, which are

included in both GAAP and non-GAAP earnings, will fluctuate from

quarter-to-quarter but will normalize over the fiscal year due to

the timing of tax events including the timing of recognition of

excess tax benefits within each quarter.

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information as well

as non-GAAP measures, which may exclude items such as stock-based

and deferred compensation expenses, restructuring and other

charges, amortization of purchased intangibles and certain activity

in connection with technology license arrangements, investment

gains and losses, the related tax impact of all of these items,

income tax adjustments, and the income tax effect of the non-GAAP

pre-tax adjustments from the provision for income taxes. Adobe uses

these non-GAAP measures in order to assess the performance of

Adobe's business and for planning and forecasting in subsequent

periods. Whenever such a non-GAAP measure is used, Adobe provides a

reconciliation of the non-GAAP financial measure to the most

closely applicable GAAP financial measure. Investors are encouraged

to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measure as detailed above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171214006267/en/

Investor RelationsAdobeMike Saviage,

408-536-4416ir@adobe.comorPublic RelationsAdobeDan

Berthiaume, 408-536-2584dberthia@adobe.com

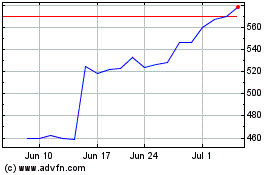

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

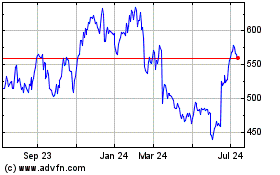

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024