Additional Proxy Soliciting Materials (definitive) (defa14a)

April 29 2016 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement.

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

|

|

|

|

|

¨

|

|

Definitive Proxy Statement.

|

|

|

|

|

x

|

|

Definitive Additional Materials.

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12.

|

NN, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

NN, INC.

207 Mockingbird Lane

Johnson City, Tennessee 37604

The following information supplements the proxy statement, or the Proxy Statement, of NN, Inc., or the Company, furnished to stockholders of

the Company on April 1, 2016, in connection with the solicitation of proxies by the board of directors of the Company for the 2016 annual meeting of stockholders to be held on Thursday, May 12, 2016, at 11:00 A.M., local time at the Palm

Beach Marriott Singer Island Beach Resort located at 3800 North Ocean Drive, Singer Island, Riviera Beach, Florida 33404. This supplement to the Proxy Statement, or the Supplement, is being filed with the Securities and Exchange Commission on

April 29, 2016 to clarify certain information presented in the sections of the Proxy Statement described below.

In the section of

the Proxy Statement entitled “Proposal IV: Approval of the Amended and Restated 2011 Stock Incentive Plan— Summary of Proposed Changes,” we included the following statement:

“Our Board of Directors has revised the Original Plan and has concluded to amend and restate the Original Plan (i) to allow our

stockholders to approve the performance goals for purposes of compliance with IRC 162(m), and (ii) to make certain other technical amendments to the provisions of the Plan.”

To provide further information and clarification regarding the amendments to the Plan, we note that the technical amendments to which we

referred are amendments to the Plan to include specific limits on (i) the number of shares underlying awards of stock options, stock appreciation rights or certain performance based awards that may be granted under the Plan to any covered

employee on an annual basis and (ii) the amount of cash based awards intended to qualify as performance based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code, that may be granted under the

Plan to any covered employee on an annual basis. A covered employee is an individual to which the requirements of Section 162(m) are applicable.

These annual limits were generally described in the sections of the Proxy Statement under Proposal IV entitled “—Summary of

Plan— Shares Available” and “—Types of Stock-Based Awards—Cash Bonuses,” in which we included the following statements:

“Annually, a participant is not permitted to receive awards in excess of 350,000 shares.”

“Annually, a participant is not permitted to receive cash bonuses in excess of $2,000,000.”

To provide further information and clarification, the annual limits included in the Plan apply to covered employees and to stock options and

stock appreciation rights and to other performance-based awards intended to qualify for the performance-based compensation exemption under Section 162(m) of the Code. The Plan would continue to permit us to grant awards (other than stock

options and stock appreciation rights) to participants who are not covered employees, and to covered employees, in excess of such annual limits if we did not intend such awards to qualify for such a performance-based exemption, which is consistent

with our existing plan and our discussion under “Compliance with Internal Revenue Code Section 162(m)” in the report of our Compensation Committee included in the Proxy Statement.

The complete text of the Plan itself was attached as Appendix A to the Proxy Statement.

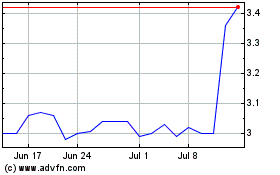

NN (NASDAQ:NNBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

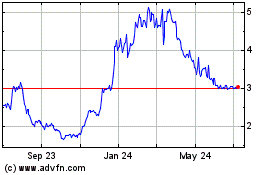

NN (NASDAQ:NNBR)

Historical Stock Chart

From Apr 2023 to Apr 2024