Additional Proxy Soliciting Materials (definitive) (defa14a)

April 25 2016 - 2:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

Pentair

plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Dear Pentair Shareholder:

We are writing to address the recent negative vote recommendation from Institutional Shareholder Services Inc. (“ISS”) for our

advisory vote on executive compensation at our 2016 Annual General Meeting of Shareholders. Specifically, ISS’ conclusion that there is a disconnect between our Chief Executive Officer’s (“CEO’s”) pay and performance is

incorrect. As ISS observes, 2015 was a challenging year for our business. However, those challenges were fully reflected in declining CEO pay:

|

|

•

|

|

The CEO’s year-over-year total compensation declined by 36%, from $14,836,702 in 2014 to $9,504,041 in 2015;

|

|

|

•

|

|

Over 2/3 of the CEO’s 2015 compensation consisted of stock-based awards, the value of which is dependent on strong financial performance going forward.

|

|

|

•

|

|

We did not pay out any annual incentive compensation to our named executive officers for 2015;

|

|

|

•

|

|

The long-term performance cash plan for the three-year performance period ending on December 31, 2015 paid out significantly below target, at 62.4%;

|

|

|

•

|

|

We did not authorize any base salary or target annual incentive opportunity increases for the CEO; and

|

|

|

•

|

|

From 2013-2015, the CEO’s “realizable pay” (as calculated by ISS by adjusting for changes in the value of equity awards during this period) was approximately $11 million lower than the CEO’s

“granted pay” reported in our proxy statements (see page 7 of the ISS report).

|

Glass, Lewis & Co., a

leading proxy advisory firm, has recommended that shareholders vote FOR our advisory vote on executive compensation, specifically noting Pentair’s “track record of aligning pay with performance.”

Consistent with our stated philosophy of linking pay-for-performance, rigorous annual and long-term incentive plans, which motivate our

executives to achieve strategic business goals that translate into shareholder value, remain at the center of our executive compensation programs. Specifically:

|

|

•

|

|

Any payment under our annual and long-term incentive plans require the attainment of rigorous performance thresholds and stretch targets. This means that above market compensation is not paid out unless stretch goals

are achieved under both plans. The best evidence of this is that, as described above, we did not pay out any annual incentive compensation to our named executive officers for 2015 and our long-term performance cash plan paid out well below target;

|

|

|

•

|

|

Our annual incentive plan has financial performance measures – operating income, free cash flow generation and revenue growth – that correlate strongly with two of our corporate objectives: to improve the

financial return from our businesses and to strengthen our balance sheet through cash flow improvement and debt reduction; and

|

|

|

•

|

|

Our long-term incentive awards (stock options, restricted stock units and cash-settled performance units) require meaningful financial performance over a longer time horizon for any value to be realized. Stock options

are granted with an exercise price equal to our stock price at the date of grant and therefore deliver value only if our stock price increases after the date of grant. Restricted stock units include a performance hurdle based on adjusted net income.

Cash-settled performance units will be earned only if we achieve performance goals based on compounded annual growth rate of revenue and return on invested capital over a three-year performance period.

|

In addition, we are always looking for ways to further enhance our compensation program, and we

previously announced several revisions to our 2016 plan that we believe will bring about an even closer connection between pay and performance. In particular, starting in 2016, we will be replacing cash-settled performance units with performance

share units to further strengthen the alignment of named executive officers’ interests with the interests of our long-term shareholders. The performance share units will only vest if we meet three-year performance goals for earnings per share

(“EPS”) growth, a metric that we believe closely correlates with the creation of long-term shareholder value.

Furthermore, we

have adopted a policy of not including automatic single trigger change in control vesting and excise tax gross-ups in new agreements with our executive officers, and the employment agreement recently entered into with Ms. Wozniak, President of

our Flow & Filtration Solutions segment, did not contain either of these features. As of December 31, 2015, the actual payments by the Company associated with legacy excise tax gross-ups due to named executive officers would be less

than $2 million.

We would also like to point out that our executives are subject to meaningful stock ownership requirements. For

instance, the CEO must hold shares with an equivalent value of 6 times his base salary. He has gone well beyond this requirement, and as of December 31, 2015, the CEO holds shares worth more than 24 times his base salary. The CEO’s large

stake in Pentair further reinforces his alignment with shareholders, especially in a period of time when the stock price declines, and results in him adopting an “ownership mentality” when leading our Company.

In conclusion, we ask for your support in our advisory vote on executive compensation at our 2016 Annual General Meeting of Shareholders,

which is scheduled for May 10, 2016. ISS’s negative recommendation was based on a flawed analysis of our compensation programs that did not appropriately take into account the significant declines in our CEO’s pay in 2015 or the

performance-based nature of our annual and long-term incentive compensation programs. We hope that you will find this summary and the more complete discussion of our executive compensation programs found in our Compensation Discussion &

Analysis compelling evidence of our strong CEO pay-for-performance practices. We appreciate your continued support.

***Please Vote

Today***

Pentair’s Board of Directors, as fellow shareholders, urges you to vote “FOR” each of the proposals

outlined in the proxy statement previously sent to you.

Thank you for your investment in Pentair plc and for voting your shares. If

you have any questions or need help voting your shares, please call our proxy solicitation firm, Morrow & Co., LLC at 1-800-267-0201.

|

|

|

Sincerely,

|

|

|

|

/s/ David A. Jones

|

|

David A. Jones

|

|

Chair of the Compensation Committee

of the

Pentair plc Board of Directors

|

2

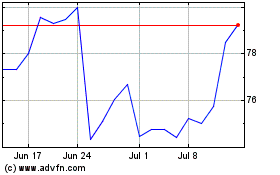

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024