Additional Proxy Soliciting Materials (definitive) (defa14a)

May 18 2015 - 3:07PM

Edgar (US Regulatory)

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

x |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

HAWAIIAN ELECTRIC INDUSTRIES, INC. |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

HAWAIIAN ELECTRIC INDUSTRIES, INC. · PO BOX 730 · HONOLULU, HI 96808-0730

May 15, 2015

Dear Fellow HEI Shareholder:

Our records indicate you have yet to cast your vote on our merger with NextEra Energy.

Please vote FOR the merger today to secure superior value for your

shares and help position Hawaii for a more affordable clean energy future.

I strongly believe, as does the entire HEI Board of Directors, that our merger with NextEra Energy — the leading clean energy company in the U.S. — is a unique opportunity for HEI shareholders and an essential part of assuring a more affordable clean energy future for Hawaii.

Of those shares voted at HEI’s Special Meeting of Shareholders on May 12, about 90% voted in favor of (“FOR”) the merger. That said, because a number of shareholders failed to vote, those “FOR” votes represented only about 70% of our outstanding shares — and we need 75% to approve the merger.

It is important to note that if you do not vote or if you select “abstain,”

your vote will have the same effect as a vote against the merger.

Votes may be submitted by phone, online or by mail. We urge you to vote without delay, but in any event, your vote must be received before June 10th. The enclosed form explains how to submit your vote. Please vote today.

Even if you no longer hold HEI shares, please exercise your right to vote. All HEI shareholders of record as of the close of business on March 23, 2015 are entitled to vote.

If you need any information to help you make a voting decision, please contact HEI

Shareholder Services at 808.532.5841 (toll-free 866.672.5841) or invest@hei.com.

If the merger and spin-off are completed — which can only happen if you and your fellow HEI shareholders approve the merger — you will receive, for each HEI share you own: (i) 0.2413 shares of NextEra Energy common stock, (ii) 1/3 of a share of American Savings Bank’s parent company common stock and (iii) a cash dividend of $0.50. As of May 14, 2015 we estimate the total value of this package to be approximately $32.89 (based on analyst estimates of our bank’s value). Except for the special cash dividend, the value shareholders receive is expected to be tax-free. Compare this to the average closing price of HEI common stock in the 30 trading days prior to the December 3, 2014 announcement of $27.72.

Thank you for your continued support of our companies. We’re confident that merging with NextEra Energy will unlock the value of two strong, local companies, American Savings Bank and Hawaiian Electric, and deliver significant benefits to our shareholders, our customers, our employees and the communities we so proudly serve.

Mahalo,

|

/s/ Jeffrey N. Watanabe |

|

|

|

|

|

Jeffrey N. Watanabe |

|

|

Chairman of the Board of Directors |

|

|

Hawaiian Electric Industries, Inc. |

|

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “predict,” and “target” and other words and terms of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. NEE and HEI caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in any forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the anticipated benefits of the proposed merger involving NEE and HEI, including future financial or operating results of NEE or HEI, NEE’s or HEI’s plans, objectives, expectations or intentions, the expected timing of completion of the transaction, the value, as of the completion of the merger or spin-off of HEI’s bank subsidiary or as of any other date in the future, of any consideration to be received in the merger or the spin-off in the form of stock or any other security, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by any such forward-looking statements include risks and uncertainties relating to: the risk that HEI may be unable to obtain shareholder approval for the merger or that NEE or HEI may be unable to obtain governmental and regulatory approvals required for the merger or the spin-off, or required governmental and regulatory approvals may delay the merger or the spin-off or result in the imposition of conditions that could cause the parties to abandon the transaction; the risk that a condition to closing of the merger or the completion of the spin-off may not be satisfied; the timing to consummate the proposed merger and the expected timing of the completion of the spin-off; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction, including the value of a potential tax basis step up, may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time and attention on merger and spin-off-related issues; general worldwide economic conditions and related uncertainties; the effect and timing of changes in laws or in governmental regulations (including environmental); fluctuations in trading prices of securities and in the financial results of NEE, HEI or any of their subsidiaries; the timing and extent of changes in interest rates, commodity prices and demand and market prices for electricity; and other factors discussed or referred to in the “Risk Factors” section of HEI’s or NEE’s most recent Annual Reports on Form 10-K filed with the Securities and Exchange Commission (the “SEC”). These risks, as well as other risks associated with the merger, are more fully discussed in the definitive proxy statement/prospectus that is included in the Registration Statement on Form S-4 that NEE has filed with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NEE’s and HEI’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of the particular statement and neither NEE nor HEI undertakes any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information And Where To Find It

In connection with the proposed transaction between NEE and HEI, NEE filed with the SEC a registration statement on Form S-4 that includes a definitive proxy statement of HEI and that also constitutes a prospectus of NEE. The registration statement was declared effective by the SEC on March 26, 2015. HEI first mailed the definitive proxy statement/prospectus to its shareholders on March 30, 2015. NEE and HEI may also file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HEI ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from NEE’s website (www.investor.nexteraenergy.com) under the heading “Investor Relations” and then under the heading “SEC Filings.” You may also obtain these documents, free of charge, from HEI’s website (www.hei.com) under the tab “Investor Relations” and then under the heading “SEC Filings.” Additional information about the proposed transaction is available at a joint website launched by the companies at www.forhawaiisfuture.com.

ADDITIONAL INFORMATION

On or about March 30, 2015, we furnished to our shareholders of record as of the close of business on March 23, 2015 a proxy statement/prospectus for our special meeting of shareholders, which is to be reconvened on Wednesday, June 10, 2015. The information below supplements the information set forth in the proxy statement/prospectus regarding our solicitation of proxies.

In addition to D.F. King & Co., Inc., we have engaged Innisfree M&A Incorporated (“Innisfree”) to assist in the solicitation of proxies in connection with the special meeting. We will pay Innisfree a fee of approximately $25,000, plus reasonable expenses, for their services.

Additional Information And Where To Find It

In connection with the proposed transaction between NEE and HEI, NEE filed with the SEC a registration statement on Form S-4 that includes a definitive proxy statement of HEI and that also constitutes a prospectus of NEE. The registration statement was declared effective by the SEC on March 26, 2015. HEI first mailed the definitive proxy statement/prospectus to its shareholders on March 30, 2015. NEE and HEI may also file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HEI ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from NEE’s website (www.investor.nexteraenergy.com) under the heading “Investor Relations” and then under the heading “SEC Filings.” You may also obtain these documents, free of charge, from HEI’s website (www.hei.com) under the tab “Investor Relations” and then under the heading “SEC Filings.” Additional information about the proposed transaction is available at a joint website launched by the companies at www.forhawaiisfuture.com.

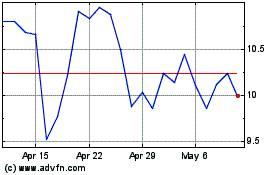

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024