Additional Proxy Soliciting Materials (definitive) (defa14a)

February 04 2015 - 4:02PM

Edgar (US Regulatory)

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

x |

Soliciting Material under §240.14a-12 |

|

|

|

HAWAIIAN ELECTRIC INDUSTRIES, INC. |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

Hawaiian Electric Employee Email

As Alan mentioned in his email to you last week, our joint PUC application with NextEra Energy for approval of the proposed merger involving our companies is a key milestone. We hope you’ve had a chance to read the news release and even the actual application.

We know you probably still have a lot of questions. Here’s information that addresses some of the questions that followed last week’s legislative briefing and application filing.

Jobs

Are there plans to consolidate certain functions with NextEra Energy on the mainland? As noted in the FAQ on the intranet and reiterated at the briefing, it’s too soon to know what NextEra Energy is going to do several years down the road. What works for NextEra Energy’s other companies may not necessarily work for Hawai‘i. NextEra Energy understands that, and that’s why the company wants to get to know our organization, our workforce and our business needs before making future decisions.

Company management

During the legislative briefing, NextEra Energy Hawai‘i President Eric Gleason reiterated that our companies will be locally managed. In addition, the application states that the president and management team of Hawaiian Electric will be based in Hawaii. Also, NextEra Energy has committed to establish a local, independent advisory board consisting of six to 12 members with substantial ties to the local community.

Our long-term plans

During last week’s briefing, several legislators asked for specifics on NextEra Energy’s long-term energy plans for Hawai‘i. NextEra Energy made it clear they are supportive of the plans we filed last August and that they aren’t coming in with a separate energy plan of their own.

Resources to support our plans

The PUC application says that subject to approval of certain conditions, for at least four years after the merger is completed, we won’t request a general base rate increase and we’ll forego part of our decoupling revenue adjustments which will save customers approximately $60 million. That sounds good for customers, but how then will we afford the significant investments in our grid that are needed to continue moving forward with our transformation plans? It’s important to note that the proposal doesn’t say we would forego the additional decoupling revenues that are for recovery of investment in capital projects. Also, NextEra Energy’s good credit ratings can help lower the cost of securing the funds needed to invest in the grid. And as we have been doing, we still need to continue identifying opportunities for efficiency and cost savings.

Lowering customer bills

Will the merger help lower customer bills, and if so, when? Yes, but it’s going to take time. Remember, roughly 70 percent of a customer’s bill goes to pay for fuel – largely oil – and fuel-related costs. And the cost of oil, which we don’t markup, is not something we control. We need to reduce our dependence on oil in order to see a real impact on customer bills. That’s why more low-cost renewables and liquefied natural gas are key initiatives of our transformation plan. As noted, NextEra Energy’s more favorable credit ratings can also help lower costs. And being part of NextEra Energy can help boost our buying power, providing economies of scale that can reduce costs and help lower customer bills.

We’ll continue to share new information with you as it becomes available. We encourage you to attend one of the remaining employee Town Hall sessions, and to continue sending your feedback to CorporateCommunications@hawaiianelectric.com. Mahalo!

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “predict,” and “target” and other words and terms of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. HEI cautions readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in any forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the anticipated benefits of the proposed merger involving NextEra Energy, Inc. (NEE) and HEI, including future financial or operating results of NEE or HEI, NEE’s or HEI’s plans, objectives, expectations or intentions, the expected timing of completion of the transaction, the value, as of the completion of the merger or spin-off of HEI’s bank subsidiary or as of any other date in the future, of any consideration to be received in the merger or the spin-off in the form of stock or any other security, potential benefit of tax basis step up to HEI shareholders, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by any such forward-looking statements include risks and uncertainties relating to: the risk that HEI may be unable to obtain shareholder approval for the merger or that NEE or HEI may be unable to obtain governmental and regulatory approvals required for the merger or the spin-off, or required governmental and regulatory approvals may delay the merger or the spin-off or result in the imposition of conditions that could cause the parties to abandon the transaction; the risk that a condition to closing of the merger or the completion of the spin-off may not be satisfied; the timing to consummate the proposed merger and the expected timing of the completion of the spin-off; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction, including the value of a potential tax basis step up to HEI shareholders, may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time and attention on merger and spin-off-related issues; general worldwide economic conditions and related uncertainties; the effect and timing of changes in laws or in governmental regulations (including environmental); fluctuations in trading prices of securities and in the financial results of NEE, HEI or any of their subsidiaries; the timing and extent of changes in interest rates, commodity prices and demand and market prices for electricity; and other factors discussed or referred to in the “Risk Factors” section of HEI’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission. These risks, as well as other risks associated with the merger, are more fully discussed in the proxy statement/prospectus that is included in the Registration Statement on Form S-4 that has been filed with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in HEI’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of the particular statement and HEI does not undertake any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed business combination transaction between NEE and HEI will be submitted to the shareholders of HEI for their consideration. In connection with the proposed transaction between NEE and HEI, on January 8, 2015, NEE filed with the SEC a registration statement on Form S-4 that includes a preliminary proxy statement of HEI and that also constitutes a prospectus of NEE. HEI will provide the proxy statement/prospectus to its shareholders. These materials are not yet final and will be amended. NEE and HEI also plan to file other documents with the SEC regarding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document which HEI may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HEI ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from HEI’s website (www.hei.com) under the tab “Investor Relations” and then under the heading “SEC Filings.” Additional information about the proposed transaction is available at www.forhawaiisfuture.com.

PARTICIPANTS IN THE MERGER SOLICITATION

NEE, HEI, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from HEI shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of HEI shareholders in connection with the proposed transaction is set forth in the preliminary proxy statement/prospectus that has been filed with the SEC. You can find information about NEE’s executive officers and directors in its definitive proxy statement filed with the SEC on April 4, 2014. You can find information about HEI’s executive officers and directors in its definitive proxy statement filed with the SEC on March 25, 2014 and in its Annual Report on Form 10-K filed with the SEC on February 21, 2014. Additional information about NEE’s executive officers and directors and HEI’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4. You can obtain free copies of these documents from HEI using the contact information above.

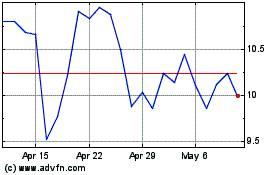

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

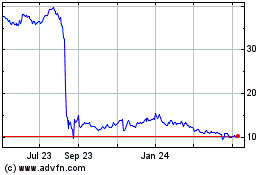

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024