Adamas Finance Asia Limited Restructuring of Investment in Fortel (8775L)

October 06 2016 - 4:26AM

UK Regulatory

TIDMADAM

RNS Number : 8775L

Adamas Finance Asia Limited

06 October 2016

Adamas Finance Asia Limited

("ADAM", the "Company" or the "Group")

RESTRUCTURING OF INVESTMENT IN FORTEL TECHNOLOGY HOLDINGS

LIMITED

The Directors of ADAM are pleased to announce that as a result

of a restructuring the Company's indirect 33.6% shareholding in

Fortel Technology Holdings Limited ("FTH") has been converted into

a US$11.3 million interest-bearing loan. The conversion represents

a step in the Company's long-term strategy to convert its legacy

portfolio into income-generating assets. As at 30 June 2016 the

Group's portfolio was valued at US$110.1 million, with the interest

in FTH representing US$11.3 million.

BVI-based FTH previously controlled all of the economic interest

in the Fortel IT solutions and services businesses in China, which

include the I-Buying e-commerce operation. The restructuring of FTH

has been undertaken in preparation for the IPO of I-Buying on the

National Equities Exchange and Quotations market in Beijing, China

(the "Restructuring").

The Restructuring involved an intra-group transfer of the Fortel

IT solutions and services business to I-Buying as a pre-cursor to

I-Buying seeking the IPO. As a result, FTH no longer controls an

operating business, and accordingly ADAM has negotiated a new

instrument to preserve its economic interest.

Under the Restructuring, HK-based Fortel Solutions Limited

("FSL"), which is a wholly owned subsidiary of FTH, has provided a

loan (the "Loan") of RMB119 million (approximately US$18.1 million)

to Mr. David Chen and Ms. Zhong Ying Ying (the "Borrowers") who now

own 100% of the I-Buying business. ADAM's wholly owned subsidiary,

CPE TMT Holdings Limited ("CPE"), has transferred its equity

shareholding in FTH to Imperia Capital Investment Holdings Limited

("Imperia"), a major shareholder in FTH. In return, FSL has novated

to CPE US$11.3 million worth of the Loan.

The terms of the novated portion of the Loan are that it is

repayable after three years and has a coupon of 3% per annum in the

first year and 8% per annum thereafter. Duncan Chui who, as a

result of the Restructuring, indirectly controls a significant

shareholding in FTH, has personally guaranteed the obligations of

the Borrowers to the Company in respect of the Loan. The Loan is

secured by a share pledge of the 33.6% equity stake in FTH that has

been transferred to Imperia.

ADAM Chairman John Croft said: "This restructuring represents a

small but significant move in line with our stated objective of

positioning the Company to become cash generative with no legacy

asset portfolio. It fits with our intended focus on collaterised

lending, structured finance and strategic finance."

Enquiries:

Adamas Finance Asia Limited

John Croft +44 (0) 1825 830587

WH Ireland Limited

Tim Feather +44 (0) 113 394

Ed Allsopp 6600

First City Public Relations

(Hong Kong) +852 2854 2666

Allan Piper

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGIBDGXDGBGLL

(END) Dow Jones Newswires

October 06, 2016 04:26 ET (08:26 GMT)

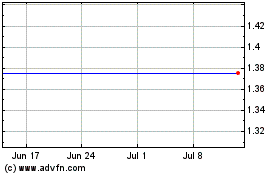

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

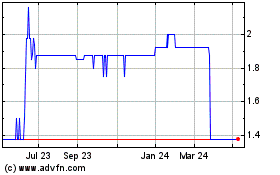

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024