Adamas Finance Asia Limited Receipt of US$820,000 from GCCF

September 26 2016 - 2:01AM

RNS Non-Regulatory

TIDMADAM

Adamas Finance Asia Limited

26 September 2016

Adamas Finance Asia Limited

("ADAM" or the "Company")

Receipt of US$820,000 from Greater China Credit Fund

Adamas Finance Asia Limited is pleased to announce that the

Greater China Credit Fund ("GCCF" or the "Fund"), into which it has

invested US$4 million, has returned investment capital of

approximately US$700,000 to the Company as a result of the Fund's

exit from Project Media announced on 6 July 2016, and has also paid

investment interest of US$120,000 for Q2 2016.

GCCF was established by ADAM's investment adviser, Adamas Asset

Management (HK) Limited ("Adamas"), to provide secured financing

for operationally-strong growth companies in China. As such, the

Fund addresses the trillion dollar funding gap that exists for SMEs

across Greater China, capitalising on the inefficiencies of the

"grey banking" finance industry. It uses a mix of debt, convertible

instruments and structured or preferred equity to minimise

investment risk. It is a closed-end structure targeting a return of

15%-18% net internal rate of return (IRR).

ADAM initially invested US$1 million into GCCF in August 2013,

and followed this with a further US$3 million in March 2016.

GCCF invested US$5.2 million in Project Media in January 2015,

providing bridging finance to support the development of a media

group quoted on the Hong Kong Stock Exchange, with equity in the

business provided as collateral backing. As announced by the

Company in July 2016, the borrower has now repaid in full both the

principal and interest on the loan. With interest received, Project

Media yielded a gross IRR of 22.2%.

Including the US$120,000 interest now paid to ADAM for Q2 2016,

the Company has to date received income distributions from GCCF

totalling US$481,000.

Following the additional return of capital from Project Media,

the Company remains invested in GCCF in the amount of US$3.15

million.

ADAM Chairman John Croft said: "Following our recent interim

results, this new cash distribution represents another positive

step forward for ADAM, and further underscores the long-term

potential of our loan-financing and fund investment strategy. It

also provides another example of the expertise of the Adamas

advisory team in Hong Kong in realising strong returns through

structured deals with Chinese growth companies that meet stringent

due diligence standards."

Enquiries:

Adamas Finance

Asia Limited

John Croft, Non-Executive +44 (0) 1825 830

Chairman 587

Nominated Adviser:

+44 (0) 113 394

WH Ireland Limited 6600

Tim Feather

Liam Gribben

Broker:

+44 (0) 20 7220

finnCap Limited 0500

William Marle

Grant Bergman

Public Relations

Advisers:

First City Public

Relations (Hong

Kong) +852 2854 2666

Allan Piper

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRALJMMTMBATBAF

(END) Dow Jones Newswires

September 26, 2016 02:01 ET (06:01 GMT)

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

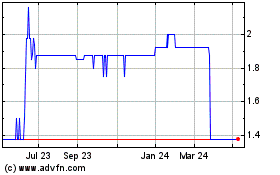

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024