TIDMADAM

RNS Number : 5031R

Adamas Finance Asia Limited

22 September 2017

Adamas Finance Asia Limited

(AIM: ADAM)

("Adamas Finance Asia", "ADAM", the "Company" or the

"Group")

Interim Consolidated Results for the six months ended 30 June

2017

Repositioning to deliver long-term capital and income growth

Adamas Finance Asia, a London quoted Asian diversified

investment vehicle, announces its interim results for the six

months ended 30 June 2017, after a period of significant progress

in positioning for future growth.

Key Points:

-- Net loss of US$1.03 million (H1 2016: US$454,000)

-- Unrealised fair value gain on asset portfolio of US$337,000 (H1 2016: US$280,000)

-- Consolidated loss per share of US$0.54 (H1 2016: US$0.24)

-- Consolidated NAV at 30 June 2017 of US$76.8 million (31 December 2016: US$77.8 million)

-- Major disposal of legacy asset generating over US$15m of cash available for re-investment

-- Appointment of Harmony Capital as new Investment Manager in May 2017

-- Shareholder approval of changes to Investing Policy

Chairman of Adamas Finance Asia, John Croft, commented: "The

first half of 2017 was one of significant change for the Company as

it started to reposition for future growth following the

appointment of a new Investment Manager in May and a broadening of

the Investing Policy which was approved by shareholders. Activity

included the disposal of the Tian Tong Shan Villa Project,

generating in excess of US$15m in cash now available for

re-investment. Additionally, post the period end, the Company

recently announced the disposal of its investment in Global Pharm

for a cash consideration of US$15.6m. These two disposals represent

a significant step forward and, subject to completion of the Global

Pharm disposal, provide the Company with substantial cash resources

to be deployed into new investments. These proactive actions taken

by the Board have provided us with a much firmer and more positive

platform from which to grow the business.

"As mentioned at the time of our 2016 final results in June, we

have plans to strengthen the Board with some new key appointments.

I was therefore delighted to announce the appointment of Hugh,

Viscount Trenchard to the Board shortly after our 2016 final

results announcement. Hugh brings a wealth of experience in Asia

and a wide network of contacts, as well as insights that will help

shape the Company's new investment strategy and development in the

future.

"I am confident, with our new strategy and Investment Manager in

place, that we will be able to announce further progress during the

remainder of 2017."

Enquiries:

Adamas Finance Asia Limited

John Croft +44 (0) 1825 830587

Nominated Adviser

WH Ireland Limited

Tim Feather

Ed Allsopp

James Sinclair-Ford +44 (0) 113 394 6600

Broker

finnCap Limited +44 (0) 20 7220 0500

William Marle

Grant Bergman

Public Relations Advisers

Buchanan

Charles Ryland

Victoria

Hayns

Henry Wilson +44 (0) 20 7466 5000

About Adamas Finance Asia ("ADAM")

ADAM is a London quoted investment company focusing on

delivering long-term income and capital growth to shareholders

through a diverse portfolio of pan-Asian investments.

ADAM aims to provide uncorrelated returns through a combination

of capital growth and dividend income from a broad spectrum of

national geographies and asset classes.

The Company's recently appointed investment manager Harmony

Capital, which has a dedicated team with real Asian expertise, will

focus on the strategy of creating income and capital growth as well

as addressing the issues of the ongoing legacy portfolio. Harmony

is sourcing predominantly private opportunities and a strong

pipeline already exists. Income generating assets include

investments in property, mining, pharmaceuticals, and telecoms

across Asia.

Chairman's Statement

The first half of 2017 can be characterised as one of

significant change for the Company, which included the disposal of

the Tian Tong Shan Villa Project, generating in excess of US$15m in

cash, now available for re-investment.

Financial results for the period continued to show losses driven

primarily by operating costs, with net portfolio asset valuations

remaining broadly neutral.

The major changes in portfolio asset valuations as compared with

31 December 2016 were as follows:

-- The disposal of the Tian Tong Shan Villa Project resulted in

a write down of US$32.0m in the 2016 accounts. During this

reporting period, the Company announced receipt of US$15.1m in cash

in part settlement of this transaction leaving a balance of US$1.8m

which has been converted into a zero-coupon two-year loan.

-- Post the period end, the Company announced the disposal of

the interest in Global Pharm for a cash consideration of US$15.6m.

The consideration is due to be paid within 120 days of 15 September

2017, the date of the sale agreement. Consequently, the carrying

value of the interest in Global Pharm was written down to US$15.6m

as at 30 June 2017, resulting in a loss of US$1.7m being recognised

in the income statement for the interim results.

-- As at 30 June 2017, the market value of the Company's listed

securities investments had risen by US$1.4m since 31 December

2016.

The principal assets as at 30 June 2017 are detailed below:

Current portfolio

Principal Assets Effective Instrument type Valuation

Interest as at 30

June 2017

US$ million

Global Pharm Holdings Group Redeemable convertible

Inc. - bond 15.6

Fortel Technology Holdings/I-Buying - Interest bearing loan 11.5

Hong Kong Mining Holdings

Limited 10.95% Structured equity 8.7

Meize Energy Industrial Redeemable convertible

Holdings Ltd 7.9% preference shares 8.2

GCCF Investment Fund - 2.7

Listed Securities - 3.4

Other Investments - 10.2

Cash - 15.0

75.4

-------------

Global Pharm Holdings Group Inc. ("Global Pharm") is involved in

pharmaceuticals, the cultivation of herbs for Traditional Chinese

Medicine ("TCM") and TCM processing and distribution. As announced

previously, Global Pharm did not meet the original redemption

payment plan agreed in December 2014. Global Pharm has been

investing in the planned launch of an online Ginseng Exchange in

Jilin Province which resulted in its cash flow being adversely

impacted as it invested in building a stockpile of ginseng in

readiness for the launch of the exchange. At 31 December 2016, an

impairment amounting to US$1.9m was recognised, equivalent to 10%

of the previous US$19.2 million carrying value. The Company

recently announced the disposal of its interest for a cash

consideration of US$15.6m which resulted in a further impairment

charge of US$1.7m being reflected in the interim results. Payment

of the consideration is due within 120 days of 15 September

2017.

Fortel Technology Holdings Limited ("Fortel") During 2016 the

Group agreed to convert its equity holding in Fortel to an

interest-bearing loan in order to facilitate the IPO for its

Chinese subsidiary on the NEEQ exchange in Beijing. The conversion

was completed in October 2016.

Hong Kong Mining Holdings Limited ("HKMH") is a resources

company whose primary asset is a large dolomite magnesium limestone

mine in the province of Shanxi, China. HKMH's application to list

on the Hong Kong Exchange was rejected by the exchange as

previously announced. ADAM's Investment Manager is exploring

various alternatives for restructuring this asset and/or seeking

buyers for its stake. The Company recently provided a small

additional loan amounting to US$400,000 to facilitate the first

stage of a proposed restructuring of this investment. Further

details of this will be announced in due course.

Meize Energy Industries Holdings Limited ("Meize") is a

privately-owned company that designs and manufactures blades for

wind turbines. It has a strong order book and its financial

performance has been in line with expectations. Negotiations

regarding the partial sale and restructuring of this investment are

ongoing.

Investment Manager Appointment

During the reporting period, we announced the appointment of a

new, highly-experienced Investment Manager, Harmony Capital

("HCIL"). HCIL, with affiliates in Singapore, Hong Kong and London,

has its own investment platform and team managed by Mr. Suresh

Withana. The team's focus is the growth and management of ADAM's

business including, but not limited to, assessing investment

opportunities, managing portfolio investments and expanding the

Company's capital base for investment in middle-market companies

across Asia.

Mr. Withana was most recently Global Head of Special Situations

and Co-Head of Asia at Tikehau Capital, the listed investment

management company with approximately EUR10 billion in assets.

Previously he was the co-founder and Chief Investment Officer at

Harmony Capital Partners which deployed US$275 million in Asian

special situations investments. Prior to that, he was a Director of

the Global Special Situations Group at Mizuho International Plc in

London and Vice President, Investment Banking at Merrill Lynch

International. In total, he has accumulated 23 years of experience,

including over 13 years of special situations investing primarily

focused on Asia.

In addition to the appointment of a new Investment Manager, the

shareholders recently approved amendments to the Investing Policy

which is intended to broaden ADAM's activities and provide more

flexibility for the Manager to build a portfolio of investments

producing income and capital gains. These two significant recent

changes have provided us with a much firmer and more positive

platform from which to grow the business.

Board Appointment

As mentioned at the time of our 2016 final results, we also have

plans to strengthen the Board with some key new appointments. I was

therefore delighted to have been able to announce the appointment

of Hugh, Viscount Trenchard to the Board shortly after our final

results announcement. Hugh brings a wealth of experience of the

region and a wide network of contacts, as well as insights that

will help shape the Company's investment strategy and development

in the future.

Outlook

Our objectives are now clearly focused on providing our

shareholders with access to income generating and capital growth

opportunities throughout Asia. With a new Investment Manager in

place, I am confident we can build a strong and diverse pan-Asian

focused portfolio, whilst generating cash from the sale of legacy

holdings.

Asset disposals announced during 2017 will, subject to

completion of the Global Pharm disposal, generate in excess of

US$30m in cash. This will provide the Company for the first time

with significant resources enabling new investments to be made. The

Company's new Investment Manager is working on a strong pipeline of

opportunities and I look forward to announcing details of new

investments in due course."

John Croft

Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Year ended

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

Note US$000 US$000 US$000

Realised gain on disposal

of investments - 5 5

Fair value changes on

financial assets at fair

value through profit

or loss 337 280 (34,094)

Loan Written Off - - (2,238)

Administrative expenses (1,435) (1,075) (1,948)

-------------- ----------- ------------

Operating Loss (1,098) (790) (38,275)

Net finance income /

(expense) 40 136 (18)

Dividend income - 200 911

Other income 28 - 220

Loss before taxation (1,030) (454) (37,162)

Taxation 5 - - -

Loss for the period (1,030) (454) (37,162)

-------------- ----------- ------------

Total comprehensive loss

for the period (1,030) (454) (37,162)

Loss per share 7

(0.24) (19.36)

Basic (0.54) cents cents cents

(0.24) (19.36)

Diluted (0.54) cents cents cents

The results above relate to continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 30 June 31 December

2017 2016 2016

Unaudited Unaudited Audited

Note US$000 US$000 US$000

----------------------------- ----- ----------- ------------ --------------

Assets

Unquoted financial assets

at fair value through

profit or loss 8 60,344 110,091 75,044

Loans and other receivables 1,455 3,749 1,514

Cash and cash equivalents 15,025 869 1,308

----------- ------------ --------------

Total assets 76,824 114,709 77,866

----------- ------------ --------------

Liabilities

Loan payables and interest - -

payables

Other payables and accruals 65 211 77

--------------

Total liabilities 65 211 77

----------- ------------ --------------

Net assets 76,759 114,498 77,789

=========== ============ ==============

Equity and reserves

Share capital 9 129,543 129,543 129,543

Share based payment reserve - 1 -

Accumulated losses (52,784) (15,046) (51,754)

----------- ------------ --------------

Total equity and reserves

attributable to owners

of the parent 76,759 114,498 77,789

=========== ============ ==============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

based Foreign

Share payment translation Accumulated

capital reserve reserve losses Total

US$000 US$000 US$000 US$000 US$000

Group balance at 1 January

2016 129,543 1 - (14,592) 114,952

Loss for the period - - - (454) (454)

Other comprehensive

income

Total comprehensive

expense for the period - - - (454) (454)

Group balance at 30

June 2016 129,543 1 - (15,046) 114,498

--------- --------- ------------- ------------ ----------

Loss for the period - - - (36,708) (36,708)

Other comprehensive

income - - - - -

Total comprehensive

expense for the period - - - (36,708) (36,708)

--------- --------- ------------- ------------ ----------

Share-based payments - (1) - - (1)

Group balance at 31

December 2016 129,543 - - (51,754) 77,789

--------- --------- ------------- ------------ ----------

Loss for the period - - - (1,030) (1,030)

Other comprehensive

income - - - - -

Total comprehensive

expense for the period - - - (1,030) (1,030)

--------- --------- ------------- ------------ ----------

Group balance at 30

June 2017 129,543 - - (52,784) 76,759

--------- --------- ------------- ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Year ended

30-Jun 30-Jun 31 December

2017 2016 2016

Unaudited Unaudited Audited

US$'000 US$'000 US$'000

-------------------------------------- ----------- ----------- ------------

Cash flow from operating activities

Loss before taxation (1,030) (454) (37,162)

Adjustments for:

Dividend Income - (200) (911)

Net finance (income) / expense (40) (136) 18

Loan Written Off - - 2,238

Fair value changes on unquoted

financial assets at fair value

through profit or loss (337) (280) 34,094

Realised gain on disposal of

investment - (5) (5)

Share-based expenses - - (1)

Decrease in other receivables (12) 65 (12)

(Decrease)/ increase in other

payables and accruals 99 (52) (186)

Net cash used in operating

activities (1,320) (1,062) (1,927)

Cash flow from investing activities

Dividend income received - 200 1,611

Proceed received from unquoted

financial assets at fair value

through profit or loss 15,001 3,263 756

Purchase of unquoted financial

assets at fair value through

profit and loss - (2,560) (2,560)

Loans granted 36 - -

Proceeds from repayment of

loan granted - - 2,400

----------- ----------- ------------

Net cash generated from investing

activities 15,037 903 2,207

----------- ----------- ------------

Cash flows from financing activities

Net finance income received - (216) (216)

Loans repaid - (2,400) (2,400)

Net proceeds from issue of

shares - - -

----------- ----------- ------------

Net cash used in financing

activity - (2,616) (2,616)

----------- ----------- ------------

Net (decrease)/ increase in

cash & cash equivalents during

the period 13,717 (2,775) (2,336)

Cash & cash equivalents at

the beginning of the period 1,308 3,644 3,644

Cash & cash equivalents at

the end of the period 15,025 869 1,308

=========== =========== ============

Notes to the financial information

1. CORPORATE INFORMATION

The Company is a limited company incorporated in the British

Virgin Islands ("BVI") under the BVI Business Companies Act 2004 on

18 January 2008. The address of the registered office is Commerce

House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British

Virgin Islands VG 1110 and its principal place of business is

811-817, 8/F, Bank of America Tower, 12 Harcourt Road, Central,

Hong Kong.

The Company is quoted on the AIM Market of the London Stock

Exchange (code: ADAM) and the Quotation Board of the Open Market of

the Frankfurt Stock Exchange (code: 1CP1).

The principal activity of the Company is investment holding. The

Group is principally engaged in investing primarily in unlisted

assets in the areas of luxury resorts real estate, pharmaceutical,

mining, power generation, telecommunications, media and technology

("TMT"), and financial services or listed assets driven by

corporate events such as mergers and acquisitions, pre-IPO, or

re-structuring of state-owned assets.

The condensed consolidated interim financial information was

approved for issue on 22 September 2017.

2. BASIS OF PREPARATION

The condensed consolidated interim financial information has

been prepared in accordance with International Accounting Standard

("IAS") 34 "Interim Financial Reporting".

3. PRINCIPAL ACCOUNTING POLICIES

The condensed consolidated interim financial information has

been prepared on the historical cost convention, as modified by

revaluation of certain financial assets and financial liabilities

at fair value through the income statement.

The accounting policies and methods of computation used in the

condensed consolidated financial information for the six months

ended 30 June 2017 are the same as those followed in the

preparation of the Group's annual financial statements for the year

ended 31 December 2016 and are those the Group expects to apply

into financial statements for the year ending 31 December 2017.

The seasonality or cyclicality of operations does not impact on

the interim financial information.

4. SEGMENT INFORMATION

The operating segment has been determined and reviewed by the

Board to be used to make strategic decisions. The Board considers

there to be a single business segment, being that of investing

activity, which is reportable in two cash generating units.

The reportable operating segment derives its revenue primarily

from debt investment in several companies and unquoted

investments.

The Board assesses the performance of the operating segments

based on a measure of adjusted Earnings Before Interest, Taxes,

Depreciation and Amortisation ("EBITDA"). This measurement basis

excludes the effects of non-recurring expenditure from the

operating segments such as restructuring costs. The measure also

excludes the effects of equity-settled share-based payments and

unrealised gains/losses on financial instruments.

The segment information provided to the Board for the reportable

segments for the periods are as follows:

BVI

Six months ended

30 Jun 30 Jun 31 Dec

2017 2016 2016

US$000 US$000 US$000

-

Realised gain on disposal of investments 0 5 5

Fair value changes on financial assets

at fair value through profit or loss 337 280 (34,094)

Financial income 40 136 80

Dividend income - 200 911

Other income 28 - 220

Note: There is no activity for the business segment in HK.

5. TAXATION

No charge to taxation arises for the six months ended 30 June

2017 and 2016 as there were no taxable profits in either

period.

Tax reconciliation:

Six months ended Year ended

30 June 30 June 31 December

2017 2016 2016

US$000 US$000 US$000

Loss before taxation (1,030) (454) (37,162)

----------- -------- ------------

Effective tax charge at 16.5%

(2015:16.5%) (170) (221) (6,132)

Effect of:

Differences in overseas taxation

rates 170 221 6,132

----------- -------- ------------

Effective tax rate - - -

----------- -------- ------------

The effective tax charge is calculated based on the rate of

corporate tax in Hong Kong. As at 30 June 2017, the Group has no

unused tax losses (30 June 2016: Nil) available for offset against

future profits.

6. DIVID

The Board does not recommend the payment of an interim dividend

in respect of the six months ended 30 June 2017 (30 June 2016:

Nil).

7. LOSS PER SHARE

The calculation of the basic and diluted loss per share

attributable to owners of the Group is based on the following:

Six months ended Year ended

30 June 30 June 31 December

2017 2016 2016

US$000 US$000 US$000

Numerator

Basic / Diluted: Net Gain/ (loss) (1,030) (454) (37,162)

--------- -------- ------------

Number of shares

'000 '000 '000

Denominator

Basic: Weighted average shares 191,967 191,967 191,967

Effect of diluted securities:

Share options - 150 -

Warrant - - -

--------- -------- ------------

Adjusted weighted average

Diluted: shares 191,967 192,117 191,967

--------- -------- ------------

For the six months ended 30 June 2017 and 2016, the share

options are anti-dilutive and therefore the weighted average shares

in issue are 191,967,084 and 191,967,084 respectively.

8. UNQUOTED FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June 31 December

2017 2016 2016

US$000 US$000 US$000

At the beginning of the period 75,044 110,593 110,593

Fair value changes through

profit and loss 337 280 (34,094)

Addition - 2,560 2,480

Disposals (15,037) (3,342) (3,935)

At the end of the period 60,344 110,091 75,044

========= ========= ============

9. SHARE CAPITAL

Number of Amount

Shares US$000

Authorised, called-up and fully paid

ordinary shares of no par value each

at 31 December 2016 and 30 June 2017 191,967,084 129,543

============ ========

Under the BVI corporate laws and regulations, there is no

concept of "share premium", and all proceeds from the sale of no

par value equity shares is deemed to be share capital of the

Company.

10. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

The following table provides an analysis of financial

instruments that are measured subsequent to initial recognition at

fair value, grouped into Level 1, 2 or 3 based on the degree to

which the fair value is observable:

l Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities;

l Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the assets or liability, either directly or

indirectly; and

l Level 3 fair value measurements are those derived from inputs

that are not based on observable market data.

As at As at As at

30 June 30 June 31 December

2017 2016 2016

US$000 US$000 US$000

Level 3

Unquoted financial assets at

fair value through profit or

loss (note 8) 60,344 110,091 75,044

--------- --------- -------------

60,344 110,091 75,044

--------- --------- -------------

There is no transfer between levels in the current period.

Carrying values of all financial assets and liabilities are

approximate to fair values. The value of level 3 investments has

been determined using the yield capitalisation (discounted cash

flow) method.

11. RELATED PARTY TRANSACTIONS

During the period under review, the Group entered into the

following transactions with related parties and connected

parties:

30 June 30 June 31 December

2017 2016 2016

Note US$000 US$000 US$000

Amount due to Directors (i)

* John Croft 12 7 -

* Ernest Wong Yiu Kit 3 2 2

* Conor MacNamara 6 3 3

Amount due from

Adamas Global Alternative Investment

Management Inc. 309 49 292

Period-end balance arising

from sales/ purchases of services

Management fee to Investment

Manager (ii) 735 609 1,182

(i) The amounts due thereto are unsecured, interest free and

have no fixed term of repayment. There are no other contracts of

significance in which any director has or had a material interest

during the current period.

(ii) Adamas Global Alternative Investment Management Inc. was

the Investment Manager of the Group until 1 May 2017. The

management fee which is calculated and paid bi-annually in advance

calculated at an annual rate of 1% of the higher of the net asset

value of the Company's portfolio of assets or market

capitalisation.

(iii) Harmony Capital Investors Limited is the current

Investment Manager of the Group and the appointment starts from 1

May 2017. The management fee which is calculated and paid

bi-annually in advance calculated at an annual rate of 1.75% of the

net asset value of the Company's portfolio of assets. Management

fees of US$235,000 and US$500,000 were incurred for Harmony Capital

and Adamas Global Alternative Investment Management Inc.

respectively during the reporting period.

12. COPIES OF THE INTERIM REPORT

The interim report is available for download from

www.adamasfinance.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DGGDCRSDBGRB

(END) Dow Jones Newswires

September 22, 2017 02:00 ET (06:00 GMT)

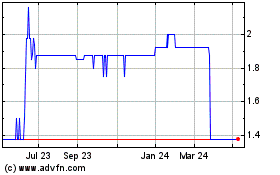

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024