Adamas Finance Asia Limited GCCF successfully exits Project Media

July 06 2016 - 2:00AM

RNS Non-Regulatory

TIDMADAM

Adamas Finance Asia Limited

06 July 2016

ADAMAS FINANCE ASIA LIMITED

Greater China Credit Fund successfully exits Project Media

Adamas Finance Asia Limited ("ADAM" or the "Company") is pleased

to announce that the Greater China Credit Fund L.P. (the "Fund" or

"GCCF"), into which the Company has invested US$4.0 million, has

achieved a successful exit from Project Media, a bridging-finance

investment project that has yielded a gross internal rate of return

(IRR) of 22.2%.

GCCF is an investment vehicle established by ADAM's investment

manager, Hong Kong-based Adamas Asset Management (HK) Limited

("Adamas"), to provide secured financing for operationally-strong

growth companies in China.

The Project Media financing involved the provision by GCCF of

HK$40 million (approximately US$5.1 million) in bridge funding to

support the development of a media business listed on the Hong Kong

stock exchange. The collateral backing for the loan was a

proportion of the borrower's shareholding in the listed company.

The borrower has now repaid in full both the principal and interest

on the loan, and the successful exit has increased GCCF's net asset

value by US$1.5 million, with the cash generated now available for

future investment.

ADAM's initial US$1 million investment in GCCF in August 2013

has to date yielded dividend distributions totalling US$361,000.

The Company invested a further US$3.0 million into GCCF in March

2016.

ADAM Chairman John Croft said: "This successful exit from

Project Media provides another important example of how our Hong

Kong advisory team is able to structure successful deals with

strong Chinese partners who meet stringent due diligence standards.

The bridging finance has been repaid in full and on schedule, and

we look forward to further returns from our continuing investment

in GCCF."

GCCF's investment in Project Media was in line with the

strategic approach set by the Adamas Hong Kong team, which places

strong emphasis on rigorous due diligence, tight management

involvement and robust collateral.

Established in August 2013, GCCF aims to address the trillion

dollar funding gap that exists for SMEs across Greater China,

capitalising on the inefficiencies of the "grey banking" finance

industry. The Fund is a four-year closed-end structure targeting a

return of 15%-18% net IRR.

Enquiries:

Adamas Finance Asia Limited

John Croft +44 (0) 1825 830587

WH Ireland Limited

Tim Feather +44 (0) 113 394

Liam Gribben 6600

First City Public Relations

(Hong Kong) +852 2854 2666

Allan Piper

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRABDGDRRUGBGLU

(END) Dow Jones Newswires

July 06, 2016 02:00 ET (06:00 GMT)

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

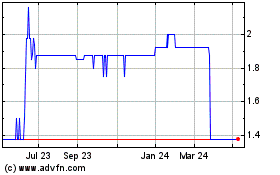

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024