TIDMADAM

RNS Number : 7994D

Adamas Finance Asia Limited

02 May 2017

Adamas Finance Asia Limited

CHANGE OF INVESTMENT MANAGER AND Proposed change to the

Investing Policy

The Directors of ADAM are pleased to announce a change in the

investment manager and a proposed change in the Investing Policy,

as well as to provide an update on the asset portfolio.

Harmony Capital has been appointed as the Company's new

Investment Manager. Further details are set out below.

A circular is expected to be posted to Shareholders on 3 May

2017 which will incorporate a notice of general meeting to be held

on 25 May 2017 at which a resolution will be proposed to amend the

Investing Policy. Further details are set out below.

1. Asset Portfolio

Since the adoption of the revised Investing Policy in April

2015, the Company, through its previous Investment Manager, AGAIM,

has continued to manage the existing asset portfolio.

The current position of the principal existing assets is set out

below.

Changtai Jinhongbang Real Estate Development Co. Ltd

("CJRE")

On 4 January 2017 the Company announced that it had agreed terms

for the sale of its indirect interest in CJRE, which owns a resort

development in Fujian Province, China for a total consideration of

up to RMB 113.58 million (approximately US$16.4 million).

Global Pharm Holdings Group Inc. ("Global Pharm")

The Company entered a redemption agreement with Global Pharm in

December 2014. Payments totaling approximately US$6 million have

been received since that time, leaving an outstanding principal

balance of approximately US$19 million, plus accrued interest. The

Company, through its Manager, has been in regular dialogue with

Global Pharm over a revised redemption schedule.

Fortel Technology Holdings Limited ("Fortel")

On 6 October 2016 the Company announced a restructuring of its

interest in Fortel. The Company now holds a US$11.3 million

interest-bearing loan which is repayable after three years with a

coupon of 3% per annum in the first year and 8% per annum

thereafter. The borrowers are Mr. David Chen and Ms. Zhong Ying

Ying who own 100% of the I-Buying e-commerce business, which was

previously owned by Fortel. The loan is personally guaranteed by

Mr. Duncan Chui.

Hong Kong Mining Holdings Limited ("HKMH")

The Company has an effective 10.95% interest in HKMH, which owns

a large dolomite magnesium limestone mine in the province of

Shanxi, China. HKMH's application to list on the Hong Kong Stock

Exchange was unsuccessful and the Manager has been in discussions

with HKMH over its plans.

Meize Energy Industries Holdings Limited ("Meize")

The Company holds an effective 7.9% interest in Meize, which

designs and manufactures blades for wind turbines, through

redeemable convertible preference shares. The Manager is in

discussions with Meize over the potential redemption of the

Company's interest.

2. Background to and reasons for the Change of Manager

The Company has taken the decision to appoint a new Investment

Manager in order to have a dedicated team to manage both the

existing portfolio and to build and manage a new asset portfolio

pursuant to the proposed new Investing Policy as explained further

below.

With effect from 1 May 2017 Harmony Capital replaced Adamas

Global Alternative Investment Management Inc. as the Company's

Investment Manager. The existing services agreement between the

Company and AGAIM was terminated with effect from 30 April

2017.

Harmony Capital is incorporated in the Cayman Islands and is the

process of registering with the Cayman Islands Monetary Authority.

The principals and owners of Adamas Asset Management, Mr. Paul

Heffner and Mr. Barry Lau own, through wholly owned companies, the

majority of the share capital of HCIL.

As Investment Manager to ADAM, HCIL is run independently of

Adamas Asset Management with its own investment platform and team

managed by Mr. Suresh Withana. The team's focus is the growth and

management of ADAM's business including, but not limited to,

assessing investment opportunities, managing portfolio investments

and expanding the Company's capital base for investment. As a

result of its affiliation, HCIL also has discretionary access to

the resources of the Adamas Asset Management platform.

Mr. Withana was most recently Global Head of Special Situations

and Co-Head of Asia at Tikehau Capital, the listed investment

management company with approximately EUR10 billion in assets.

Previously he was the co-founder and Chief Investment Officer at

Harmony Capital Partners which deployed US$275 million in Asian

special situations investments. Prior to that, he was a Director of

the Global Special Situations Group at Mizuho International Plc in

London and Vice President, Investment Banking at Merrill Lynch

International. In total, he has accumulated 23 years of experience,

including over 13 years of special situations investing primarily

focused on Asia.

The key terms of the Management Agreement are:

-- an initial term of three years;

-- an annual Management Fee of 1.75% of NAV payable semi-annually in advance;

-- an annual Incentive Fee of 20% of any year on year increase

in audited NAV, subject to a High Water Mark and the Hurdle;

-- warrants to subscribe for 20,000,000 Ordinary Shares, to be

issued in five equal tranches with an exercise price equivalent to

a 20% premium to the audited NAV per Ordinary Share at 31 December

2016 and exercisable within ten years of the date of grant;

-- HCIL has the ability to nominate one director to the Board

subject to approval by the Company's nominated adviser; and

-- following initial three year term, the Company can terminate

the Management Agreement on 12 months' notice. If not terminated, a

new term will commence every three years, at the end of which the

Company can terminate on 12 months' notice.

Related Party Transaction

The principals and owners of Adamas Asset Management, Mr. Paul

Heffner and Mr. Barry Lau, own, through wholly owned companies, the

majority of the share capital of HCIL. As a result, the Management

Agreement is a related party transaction under the AIM Rules. The

Directors consider, having consulted with WH Ireland Limited, that

the terms of the Management Agreement are fair and reasonable

insofar as Shareholders are concerned.

3. Background to and reasons for the proposed Change of Investing Policy

Current Investing Policy

The current Investing Policy, as set out in the Company's

circular to Shareholders dated 20 March 2015, is as follows:

1. The Company has an indefinite life and is targeting both

capital and income returns over time for its Shareholders.

2. The Company will provide credit finance to companies,

principally SMEs in Asia with a focus on Greater China. It will

seek to do this by either:

a. providing finance directly to companies, in particular where

such companies are held through offshore structures or are

otherwise already majority owned or controlled by non-PRC investors

("Direct Financings"); and

b. providing finance indirectly to companies, whereby the

Company will become a limited partner or shareholder in an existing

affiliated or third party fund which itself has a strategy to

invest in underlying companies which need credit finance

("Financing Through Funds").

3. The key parameters of the financing transactions in which the

Company will participate, whether as Direct Financings or Financing

Through Funds, are:

a. target companies are SMEs in Asia with a focus on Greater China;

b. financing will be generally sector agnostic, but will focus

on agriculture, clean energy, consumer, food and beverage,

healthcare, new materials, real estate and natural resources;

and

c. the average maturity of transactions will range from 3 to 24 months.

4. Direct Financings will:

a. on a per investment basis, represent not more than 20% of the

Company's net asset value immediately following the relevant

transaction; and

b. be managed actively, including through appropriate investor

protections which will be negotiated on each transaction.

5. The Company will not use debt to finance transactions, but

may take on debt at the Company level with no specific limit.

New Investing Policy

The Directors believe that, in order to facilitate the building

of a new portfolio, the Company requires a more opportunistic

Investing Policy in order to allow the Manager the flexibility to

invest across Asia, across sectors and across the capital structure

of companies. Furthermore, given the long-term nature of the

Company's investment horizon, the Directors believe that a more

flexible Investing Policy should enable the Manager to navigate

changes in the relative attractiveness of various financing asset

classes in Asia through economic cycles and, potentially,

geopolitical shifts which may increase the sovereign risk

associated with specific countries relative to others within the

region.

Finally, and most importantly, the Board expects the Company's

investment portfolio to be repositioned over time such that it

generates both income and capital gains.

In order to facilitate the Company's strategic objectives, the

Company is proposing the Resolution to amend the Investing Policy

to the following:

1. The Company has an indefinite life and is targeting both

capital gains and income distributions for its Shareholders over

time.

2. The Company will provide equity and credit funding to

companies, principally in the Pan-Asia region or with a connection

to Asia. It will seek to do this by:

-- providing funding directly to companies via the provision of

loans or other credit instruments which may be secured against

assets of the borrower or its affiliates ("Direct Financings");

-- providing funding to companies to accelerate their growth,

expand the scale of their business and/or to consolidate their

organisational structure in preparation for a public listing.

Investments could be in the form of structured equity, debt and

hybrid debt securities. ("Pre-IPO Investments");

-- providing growth, development or acquisition capital in the

form of equity or quasi-equity to companies within growth

industries ("Growth Private Equity");

-- providing funding to transactions structured around significant corporate events such as recapitalisations, debt restructurings, buybacks of shares, asset spin-offs and corporate reorganisations ("Event Driven Special Situations");

-- investing in publicly traded or 'over-the-counter' traded

equity or credit securities, such as preferred stock, common stock,

high yield bonds, senior loans, warrants, where the market is

mispricing a company's securities and thereby offering an

attractive risk-adjusted return due to one-off or short term

factors ("Opportunistic Special Situations"); and

-- investing (in addition to securing co-investment rights for

the Company) as a limited partner or shareholder in third party

managed vehicles which have a strategy to provide credit and/or

equity funding to companies in a specific industry ("Indirect

Financing").

3. The Company will be sector agnostic in its investment activities.

4. New investments will be managed actively, including through

appropriate investor protections which will be negotiated on each

transaction as appropriate and relevant.

5. The Company will consider using debt to finance transactions

on a case by case basis and may assume debt on its own balance

sheet when appropriate to enhance returns to Shareholders and/or to

bridge the financing needs of its investment pipeline.

The Directors believe that the proposed Change of Investing

Policy will broaden ADAM's activities and provide more flexibility

for the Manager to build a portfolio of investments producing

income and with the potential for capital gains. The Directors

further believe that the Change of Investing Policy also enables

ADAM to:

-- increase the breadth of the transactions and opportunities it can consider;

-- lower its overall investment risk by diversifying across

financing asset classes, geography and industries; and

-- implement its long-term objective of providing Shareholders

with a stock that produces income and retains the potential for

appreciation.

4. Recommendation

The Board considers that the Resolution to be put to the General

Meeting is in the best interests of the Company and its

Shareholders as a whole. Accordingly, the Directors unanimously

recommend that all Shareholders vote in favour of the Resolution to

be proposed at the General Meeting, as they intend to do in respect

of their own beneficial holdings, comprising 232,127 Ordinary

Shares, representing approximately 0.12% of the existing issued

share capital of the Company.

Enquiries:

Adamas Finance Asia Limited

John Croft +44 (0) 1825 830587

WH Ireland Limited - Nominated Adviser

+44 (0) 113 394

6600

Tim Feather +44 (0) 117 945

Ed Allsopp 3444

finnCap Limited - Broker

William Marle +44 (0) 20 7220

Grant Bergman 0500

First City Public Relations

(Hong Kong) +852 2854 2666

Allan Piper +44 (0) 7438 148968

DEFINITIONS

"Adamas Asset Adamas Asset Management (HK)

Management" Limited

"AGAIM" Adamas Global Alternative Investment

Management Inc. of Maples Corporate

Services Limited, PO Box 309,

Ugland House, Grand Cayman, KY1-1104,

Cayman Islands

"BST" British Summer Time

"BVI" British Virgin Islands

"Change of Investing the proposed change of Investing

Policy" Policy, further details of which

are set out in the Circular

"Circular" the circular to Shareholders

expected to be dated 3 May 2017

in relation to the Change of

Investing Policy

"Company" or "ADAM" Adamas Finance Asia Limited,

a company registered in the BVI

with registered number 1459602

"General Meeting" the general meeting of the Company

to be held at 10.00 a.m. BST/

5.00 p.m. HKT time on 25 May

2017

"Greater China" the People's Republic of China,

Taiwan and the Special Administrative

Regions of Hong Kong and Macau

"Harmony Capital" Harmony Capital Investors Limited

or "HCIL" of Elian Fiduciary Services (Cayman)

Limited, 190 Elgin Avenue, George

Town, Grand Cayman KY1-9007,

Cayman Islands

"High Water Mark" in calculating whether any Incentive

Fee is due and payable under

the Management Agreement, the

audited NAV for the relevant

year being equal to or greater

than that for any previous year

in which the Incentive Fee was

paid

"HKT" Hong Kong Time

"Hurdle" in calculating whether any Incentive

Fee is due and payable under

the Management Agreement, the

audited NAV for the relevant

year being at least 105% of the

previous year's audited NAV

"Incentive Fee" the incentive fee potentially

payable to the New Investment

Manager by the Company in respect

of the services provided by the

New Investment Manager pursuant

to the Management Agreement

"Investing Policy" the investing policy of the Company

from time to time

"Investment Manager" the investment manager of the

or "Manager" Company from time to time

"Management Agreement" the agreement entered into between

(1) the Company and (2) HCIL

dated 1 May 2017

"Management Fee" the annual management fee payable

to the New Investment Manager

by the Company in respect of

the services provided by the

New Investment Manager pursuant

to the Management Agreement

"NAV" net asset value

"New Investment Harmony Capital

Manager"

"Ordinary Shares" ordinary shares of no par value

each of the Company

"PRC" the People's Republic of China

"RMB" Renminbi, the lawful currency

of the PRC

"Shareholder(s)" holder(s) of Ordinary Shares

"SMEs" small and medium-sized enterprises

"US$" US dollars

All references to dates and times in this announcement are to

BST unless otherwise stated. References to the singular shall

include references to the plural, where applicable, and vice

versa.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUUUAUPMGRG

(END) Dow Jones Newswires

May 02, 2017 02:01 ET (06:01 GMT)

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

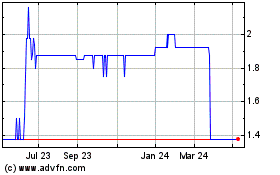

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024