Activist Elliott Takes Stake in Alcoa--3rd Update

November 23 2015 - 3:14PM

Dow Jones News

By John W. Miller

Hedge fund Elliott Management Corp. has accumulated a 6.4% stake

in Alcoa Inc. following the company's decision in September to

split in two, spinning off its more diverse parts-making business

from its raw aluminum operations.

The disclosure, announced in a securities filing, marked the

second activist move this year on a major U.S. metals and mining

company, after Carl Icahn's investment in Freeport-McMoRan Inc.

Investors appeared to view the move as an endorsement of Alcoa's

plan, sending its shares up 5.6% at $12.24 in New York trading.

Representatives of Elliott, a New York hedge fund founded by

Paul Singer, have been meeting with senior Alcoa executives,

including Chief Executive Klaus Kleinfeld. Elliott's analysis that

Alcoa is the most undervalued of U.S. metals and mining firms

prompted the investment, according to people with familiar with the

matter.

The sector has been battered by the downturn in metals prices,

and Elliott studied possible investments in other companies. It

concluded that Alcoa was the best target because of its thriving

aerospace and automotive business, which, the hedge fund believes,

has been overshadowed by the commodity bust, these people said.

Alcoa was advised of the share purchase "several weeks ago," the

New York-based company said in a statement.

Prices for raw aluminum have fallen by over 40% since 2011, and

Alcoa's share price has fallen by a similar amount.

That decline, Alcoa and Elliott believe, masks the prosperity of

the company's aerospace and auto businesses and was behind the

aluminum company's announcement in late September that it would

spin off its more profitable and diverse parts-making units. The

deal is expected to close in the second half of next year, with

Alcoa shareholders owning all outstanding shares of both

companies.

The raw metals business, hurt by falling aluminum prices, will

include the company's bauxite-mining, alumina-refining and

aluminum-production businesses and will still be called Alcoa to

reflect the company's heritage as the world's first industrial

producer of aluminum.

The other entity, which for now Alcoa is calling its "value-add

company, " will comprise its global rolled products, engineered

products and solutions, and transportation-and-construction

businesses. The Alcoa entities "now each have the strength and

scale to each stand on their own," Mr. Kieinfeld said when the

split was detailed.

Mr. Kleinfeld, a former chief executive at Siemens AG, has shut

down Alcoa's unprofitable raw aluminum smelters while expanding its

manufactured parts business, including through deals. Last year, it

bought U.K. jet-engine parts maker Firth Rixson Ltd., and this year

Pittsburgh-based RTI International Metals Inc., one of the world's

biggest makers of fabricated titanium products for the aerospace

industry.

More changes could be in store as Elliott gets more involved.

Although the hedge fund's representatives have shied away from

issuing orders, they are eager to have a "conversation" with Alcoa

about improving the company's profit margins, according to people

familiar with the matter.

Alcoa's spinoff will compete with Portland-based Precision

Castparts Corp., which Warren Buffett's Berkshire Hathaway Inc.

bought in August for $37.2 billion, including debt, Buffett's

biggest acquisition yet.

In the third quarter, Alcoa posted a profit of $44 million, or 2

cents a share, down from $149 million, or 12 cents a share, a year

earlier. Revenue fell 11% to $5.57 billion.

Write to John W. Miller at john.miller@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 23, 2015 14:59 ET (19:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

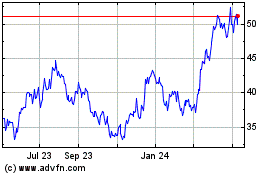

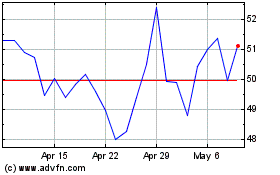

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024