Acquisitions Seen in Self-Driving Market

October 25 2016 - 6:40PM

Dow Jones News

By Greg Bensinger

LAGUNA BEACH, Calif. -- The largest companies with the aim of

creating self-driving vehicles will probably acquire smaller ones

rather than develop the technology in-house, said Niklas Zennstrom,

founder and chief executive of venture firm Atomico Ventures.

"It's really hard for an incumbent to transition themselves into

a technology company," Mr. Zennstrom said Tuesday at the WSJDLive

2016 global technology conference here. "You'll see more and more

acquisitions."

There have been some signs of consolidation already. General

Motors Co. this year bought Cruise Automation Inc. for around $1

billion and invested $500 million into Lyft Inc. with the goal of

introducing self-driving cars as soon as next year.

Stephen Jurvetson, partner at venture firm DFJ, said on the same

panel that Tesla Motors Inc.'s release of its own driver-assistance

software known as Autopilot pushed other companies to consider

entering the self-driving vehicle market.

Earlier at the conference, Lyft President John Zimmer said he

expects autonomous vehicles to represent the majority of trips on

the ride-hailing service.

Separately, when asked about the regulatory and operational

troubles of blood-testing firm Theranos Inc., in which DFJ was an

early investor, Mr. Jurvetson said, "There is not much we can do

when they fail." Mr. Jurvetson said his firm has had little

day-to-day dealings with Theranos.

Mr. Jurvetson chided The Wall Street Journal for its "ad

nauseam" coverage of the Silicon Valley company over the past year,

saying it was "relishing" Theranos's struggles.

Write to Greg Bensinger at greg.bensinger@wsj.com

(END) Dow Jones Newswires

October 25, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

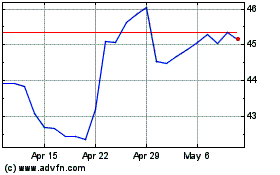

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

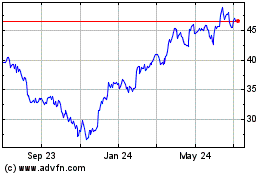

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024