RNS Number:0864Z

Sondex PLC

26 May 2004

Sondex plc

Proposed acquisition of Geolink International Limited

and Underwritten Placing and Open Offer of 13,118,029 Open Offer Shares at 160

pence per Open Offer Share

Key points

* Proposed acquisition of Geolink International Limited for a total

consideration of #31.5 million

* Geolink is a specialist designer, manufacturer and supplier of

Measurement While Drilling (MWD) downhole technology and has also recently

introduced Logging While Drilling (LWD) products

* Proposed acquisition will be funded by a new term loan of #13.0

million, the issue of shares of approximately #4.1 million to the vendors and

the majority of the net proceeds of a placing and open offer raising

approximately #21.0 million

* In the 10 months to 29 February 2004, Geolink generated operating

profits before goodwill amortisation of #3.5 million on sales of #11.2 million

* The proposed acquisition is expected to be earnings enhancing and the

Directors believe that the favourable outlook for Geolink will contribute

significantly to the enlarged Group's earnings potential

* Geolink has a similar business model to Sondex and operates in a

closely related sector

* The Directors believe that Geolink will:

- provide a good technical fit of downhole technologies

- provide a number of opportunities for further significant growth

- fit Sondex's strategy of developing a range of solutions to enhance oil & gas

recovery

- provide a platform for further product range extensions

* Subject to shareholder approval at an EGM to be held on 23 June 2004,

the proposed acquisition is expected to complete on 30 June 2004

* In a separate announcement issued this morning, Sondex reported its

preliminary results for the year ended 29 February 2004

* The Annual General Meeting of Sondex is to be held immediately prior

to the EGM on 23 June 2004. Notice of the AGM is expected to be sent to

shareholders today

Martin Perry, Chief Executive, said:

"The acquisition of Geolink will significantly enhance Sondex's position as a

leading supplier of downhole technology to the oil and gas industry; there is an

excellent fit with our own products and business model. In addition to immediate

earnings enhancement, the acquisition will provide important opportunities for

further growth."

26 May 2004

Enquiries:

Sondex plc

Martin Perry, Chief Executive 020 7457 2020 (today)

Chris Wilks, Finance Director 0118 932 6755 (thereafter)

College Hill

James Henderson 020 7457 2020

Nick Elwes 020 7457 2020

This announcement has been issued by and is the sole responsibility of Sondex

plc and has been approved solely for the purposes of section 21 of the Financial

Services and Markets Act 2000 by Collins Stewart Limited, which is acting

exclusively for Sondex plc and no-one else in connection with the Acquisition

and the Placing and Open Offer. Collins Stewart Limited, which is a member of

the London Stock Exchange and is authorised and regulated by the Financial

Services Authority, will not be responsible to anyone other than Sondex plc for

providing the protections offered to the clients of Collins Stewart Limited, or

for providing advice to any other person in relation to the contents of this

announcement or matters or arrangements referred to herein.

This announcement does not constitute or form part of an offer, or any

solicitation of an offer to subscribe or buy, any securities to any person in

any jurisdiction to whom or in which such offer or solicitation is unlawful.

The distribution of this announcement in certain jurisdictions may be restricted

by law and therefore persons into whose possession this announcement comes

should inform themselves about and observe any such restrictions. Any failure

to comply with these restrictions may constitute a violation of the securities

laws of any such jurisdiction. Any purchase of or application for shares in the

Placing and Open Offer should only be made on the basis of information contained

in the formal prospectus to be issued in connection with the Placing and Open

Offer and any supplement thereto.

The information contained herein is not for publication or distribution in or

into the United States of America. These materials are not an offer of

securities for sale in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities Act of 1933,

as amended, and may not be offered or sold in the United States absent

registration under that Act or an available exemption from registration. No

public offering of the securities referred to herein will be made in the United

States.

The information contained in this announcement is not for publication or

distribution to persons in Australia, Canada, Japan, the Republic of Ireland or

South Africa. Subject to certain exceptions, the Open Offer Shares may not,

directly or indirectly, be offered, sold, taken up or delivered in, into or from

Australia, Canada, Japan, the Republic or Ireland or South Africa.

Prices and values of, and incomes from shares may go down as well as up and an

investor may not get back the amount invested, it should be noted that past

performance is no guide to future performance. Persons needing advice should

consult an independent financial adviser.

Certain statements made in this announcement are forward-looking statements.

Such statements are based on current expectations and, by their nature, are

subject to a number of risks and uncertainties that could cause actual results

and performance to differ materially from any expected future results or

performance expressed or implied by the forward-looking statement. The

information and opinions contained in this announcement are subject to change

without notice and Sondex plc assumes no responsibility or obligation to update

publicly or revise any of the forward-looking statements contained herein.

Not for release, publication or distribution, in whole or in part, in or into

the United States, Australia, Canada, Japan, the Republic of Ireland or South

Africa.

Introduction

Sondex announced today that it has agreed, subject, inter alia, to Shareholder

approval, to acquire the entire issued share and loan capital of Geolink for a

consideration of approximately #31.5 million, of which #26.3 million will be

payable in cash to the Loan Note Holders on Completion and #5.2 million will be

satisfied by payment of approximately #1.1 million in cash and the allotment of

the Consideration Shares to the Geolink Shareholders.

In order to fund the Acquisition, Sondex proposes to raise approximately #18.2

million (net of expenses of the Acquisition and the Placing and Open Offer) by

way of a Placing and Open Offer of 13,118,029 Open Offer Shares at 160 pence per

Open Offer Share, representing a discount of 3.9 per cent. to the closing

middle-market price of an Ordinary Share on 25 May 2004 (the latest practicable

date prior to the publication of this announcement). In addition, Sondex has

entered into an agreement to borrow up to #33 million (comprising an existing

term loan facility of approximately #14 million, a new term loan facility of #13

million and a new working capital facility of #6 million) under the terms of

committed bank facilities provided by Bank of Scotland. The Open Offer Shares

(other than the Committed Shares) are to be placed conditionally with

institutional and other investors, subject to the right of Qualifying

Shareholders to participate in the Open Offer. The Placing and Open Offer (save

in respect of the Committed Shares) has been underwritten by Collins Stewart and

is conditional on, inter alia, the approval of the Acquisition by Shareholders.

Reasons for the Acquisition

Geolink has a similar business model to Sondex and operates in a closely related

sector. The Directors believe that Geolink has a strong reputation within its

marketplace, a good product range, experienced management and that the

Acquisition is in the best interests of the Company and its Shareholders as a

whole. In addition, the Directors believe that the Acquisition will:

* provide a good technical fit of downhole technologies;

* provide a number of opportunities for further significant growth;

* fit Sondex's strategy of developing a range of solutions to enhance oil

and gas recovery; and

* provide a platform for further product range extensions.

The Acquisition is expected to be earnings enhancing and the Directors believe

that the favourable outlook for Geolink will contribute significantly to the

Enlarged Group's earnings potential. References to the anticipated effect of the

Acquisition on future earnings should not be interpreted as a profit forecast.

Information on Geolink

Introduction

Geolink is a specialist designer, manufacturer and supplier of Measurement While

Drilling (MWD) downhole technology for the global oil and gas industry. Geolink

has also recently entered the Logging While Drilling (LWD) market. Geolink's

products, over 90 per cent. of which are exported, are sold around the world to

national oil companies and independent directional drilling companies. Geolink

also rents its product range to customers. The data generated by Geolink's

products facilitate cost efficient directional drilling of oil and gas wells

within known reservoirs, which, in turn, enables the recovery of oil and gas

from existing fields to be maximised. The Directors believe that Geolink has a

strong reputation within its market and represents a significant opportunity to

enhance the prospects of Sondex. In the ten month period ended 29 February 2004,

Geolink generated operating profits before amortisation of intangible assets of

#3.5 million on sales of #11.2 million. In the ten month period ended 29

February 2004, Geolink directors' aggregate emoluments were #452,000. The

aggregate emoluments of the ongoing directors of Geolink for the current

financial year are expected to be #179,000. Geolink had net assets of #0.7

million as at 29 February 2004.

History

Geolink (UK) Limited was founded in Aberdeen in 1989 with the objective of

producing an innovative MWD system for sale to directional drilling operators in

the international oil and gas market. At that time, existing MWD systems had

only been developed by the large service companies. The "Orienteer" Directional

Survey MWD System was launched by Geolink in 1990 and by the mid 1990s

significant growth had been achieved as the Orienteer System had gained good

market penetration.

In 1996, Geolink launched the Gamma Ray Logging System and between the late

1990s and 2002 the product line was further developed with the introduction of

new products including the "Sentinel" Shock and Vibration Monitor System, a

Positive Mud Pulser System and an Electromagnetic Telemetry System, which are

described below.

In 1999, Unidril Energy Limited was incorporated with the objective of

purchasing MWD equipment from Geolink (UK) Limited for the purpose of renting it

to directional drilling operators. The shareholding structure of Unidril Energy

Limited differed from that of Geolink (UK) and the companies were therefore

independent and not part of a group. Unidril Energy Limited established a

subsidiary, Unidril Energy L.P., which opened an office in Houston, USA in 2001

and it also established a subsidiary, Unidril Energy de Venezuela C.A., in

Venezuela in 2002.

Geolink International Limited, a new holding company, was incorporated in March

2002 and, to facilitate the exit of four of the six founder shareholders of

Geolink (UK) Limited and Unidril Energy Limited, acquired ownership of the

entire issued share capital of Geolink (UK) from the Geolink (UK) Vendors on 30

April 2002 and Unidril Energy Limited from the Unidril Vendors on 31 May 2002.

Since that date, the day to day management of Geolink has been undertaken by

Alasdair Macrae, aged 49, and other senior managers. Alasdair joined the Geolink

Group in April 1998 and is the Managing Director. Two of the founder

shareholders, Messrs. Moorley and Dickinson, have remained, largely in a

non-executive capacity and are to resign as directors from the Geolink board and

as employees on Completion.

An important enhancement to the product range, the "TRIM" resistivity tool, was

introduced in 2002/2003 and allowed Geolink to enter a newer and growing LWD

market.

Marketplace and products

Information gathered during the drilling of a well comes from a number of

sources, with logging and measurement while drilling being important elements.

Measurement While Drilling is the gathering of data relating to the position and

movement of the drillstring itself. Logging While Drilling is retrieval of data

that helps identify the formation properties of rocks being drilled through.

The Directors believe that the full range of MWD and LWD services are only

provided by the major oilfield service companies, such as Schlumberger, Baker

Hughes and Halliburton and are typically performed on the high profile

exploration and development wells, which are drilled in newly discovered oil or

gas fields. In known fields a reduced range of MWD and LWD services is usually

run, to keep the cost of drilling wells down, to maximise efficiency and to

reach remaining reserves, with further formation evaluation data retrieved, if

needed, by wireline logging.

Geolink provides products to companies who perform directional drilling in known

fields, where the number of wells drilled is higher but the production cost, and

therefore the level of reliance on oil and gas prices, is lower than in newly

discovered oil and gas fields.

Geolink's products provide information to the operator of a drillstring in

respect of the direction and position of the drill bit and also information in

respect of the characteristics of the formations being drilled through. This

information enables the operator to direct the drillstring towards the target

reserves.

A key challenge with MWD and LWD is the transmission of data to the surface, in

real time. Geolink has taken a patent protected "mud pulse" data transmission

technology and incorporated it in a product which is marketed as being simple to

operate, of high quality and reliable.

Conditions while drilling are particularly arduous, with high temperatures,

pressures and vibration and shock. Instruments such as those supplied by

Geolink are made up of precision sensors and electronics. Survival and

reliability is crucial to an MWD or LWD product's success. Any failure of an

instrument will have negative financial consequences, since more than twelve

hours drilling rig time could be lost if the equipment needs to be replaced. The

Directors believe that Geolink's products have a reputation within the

marketplace for quality and reliability. Geolink's current product range

includes the following:

* "Orienteer" Directional Survey MWD system - the original Geolink

electronics survey assembly provides directional and position information and

forms the platform for the other Geolink sensors that are available.

* Gamma Ray Logging System - uses Geolink's own gamma ray sensor to

monitor background radiation levels in strata being drilled. It has its own

battery and power supply and is therefore able to provide real-time and memory

logging, independent of the main tool functions.

* "TRIM" Resistivity Tool - provides LWD information on resistivity of

materials being drilled. Information from the Gamma tool and the TRIM tool is

used by the operator to identify the nature of the rock strata in which the

drill is operating.

* "Sentinel" Shock and Vibration Monitor System - provides continuous data

in respect of shocks and vibration to the drillstring, enabling action to be

taken before the drill bit, drillstring or MWD tool is caused to fail.

* Retrievable System/Positive Mud Pulser System - an optional, alternative

telemetry-driven system that enables Geolink's product range to be recovered in

the event that the drillstring becomes stuck in the borehole.

* "EmTel" EM Telemetry System - an electromagnetic data transmission

system compatible with the Orienteer product range. Two-way communication with

the surface enables downhole selection of the tool operating mode.

Geolink has also developed the "Guardian" Pressure During Drilling Monitoring

System which is expected to be commercially launched in 2004. It provides a

measurement of the pressure in the drill string and the borehole near to the

drill bit and transmits the information to the surface. This information can be

used to enhance drilling performance and to give early warning of events that

might compromise the integrity of the reservoir.

Research and development

The Geolink research and development function plays an important part in both

developing existing products and in designing new products in order to increase

the product offering to both existing and potential customers. The research and

development team totals 11 personnel comprising development staff, technicians

and software engineers. Current projects include: modernising user control

software to a Windows environment, enhancements to several existing products and

development of a number of new products, either in response to specific customer

demand or to envisaged market demand.

Intellectual property

Geolink develops and typically retains ownership of the majority of the

intellectual property it uses in the operation of its business. Geolink owns or

has applications pending for a number of patents in several jurisdictions

relating to, inter alia, the "Gamma Ray Detection and Measurement Device", the "

Positive Mud Pulser" and the "Improved Signalling System". Historically Geolink

has also licensed numerous patents and used and sublicensed the related

technology in conjunction with its MWD equipment. Some of the licensed patents

have expired, but the Directors believe that there is no one patent which is

critical to the ongoing success of Geolink. Rather, it is the combination of

know-how, material usage and experience of manufacturing processes which

differentiate Geolink's products in the marketplace and thereby create barriers

to entry for potential competitors.

Geolink is also the registered owner of two trade marks embodying Geolink's

company name. These are registered in class 9 (computer and data processing

apparatus and instruments, computer programmes, computer software, data storage

materials, magnetic and optical data carriers and recording media disks, tapes

and wires). These trademarks are due for renewal on 6 December 2004.

Manufacture and production

Geolink manages production of its entire product range in-house from its sites

in Aberdeen. Like Sondex, Geolink sub-contracts the manufacture of the majority

of components to specialist suppliers, most of whom are located in Scotland and

the Midlands. Sub-assembly and final assembly are conducted in-house. In order

to maintain Geolink's reputation for the quality and reliability of its

products, each product is thoroughly tested by Geolink prior to being despatched

to the customer.

Sales and marketing

Geolink carries out its sales and marketing operations from its head-office in

Aberdeen and through sales offices in Houston, USA and Venezuela. Regular sales

trips are made to existing and potential customers by a team of five sales

professionals, with marketing material distributed by email and mail. The

Directors believe that a significant number of new leads come from 'word of

mouth' referrals, thereby reinforcing Geolink's reputation for the quality of

its products within its marketplace.

The Directors believe a significant opportunity exists to broaden Geolink's

sales and also to generate increased sales for Sondex by marketing the Geolink

product range to Sondex's client base and vice versa.

Customers

Geolink's customer base includes national and independent oil and gas companies

in countries such as China and Iran. Geolink's customers also include

independent directional drilling companies and MWD specialists. Geolink is not

reliant on any one customer and due to the nature of its product range the top

two or three customers vary from year to year. In addition, there is also the

opportunity for exceptional orders to be secured such as those from the Iranian

National Oil Company in 2001 and 2002. In the ten months ended 29 February 2004,

Geolink's top five clients accounted for approximately 62 per cent. of turnover.

Geolink sells to a number of Sondex's existing customers but the Directors

believe that further opportunities exist to market Sondex's product range to

those of Geolink's customers that Sondex currently does not sell to and vice

versa.

Competition

The main competitors, but also potential customers of Geolink, are the major

service companies such as Schlumberger, Baker Hughes and Halliburton. These

companies develop and produce equipment for their own drilling service units,

but do not sell such equipment, except in territories where their freedom to

market drilling services is restricted, such as Russia and China. Schlumberger

and Baker Hughes have, however, also been customers of Geolink in territories

where US embargoes preclude the use of US built equipment.

The Directors believe that the only significant independent MWD system supplier

currently competing with Geolink is Tensor, a subsidiary of GE Power Systems.

Senior management and employees

The Directors believe that Geolink has an experienced management team in the

essential areas of sales, research and development and manufacturing. Strategic

management will be injected from Sondex, together with strong financial

controls. Many of the development and production activities are similar and will

allow for cross-fertilisation between the two companies.

A table setting out Geolink's employees as at 29 February 2004 split by function

is set out below:

Manufacturing 28

Directors 4

Research and development 11

Sales and customer support 15

Repair and maintenance 4

Administration 13

Total: 75

Summary financial information on Geolink

In the ten months ended 29 February 2004, Geolink generated operating profits

before amortisation of intangible assets of #3.5 million on turnover of #11.2

million. This compares to operating profits before amortisation of intangible

assets of #2.3 million on turnover of #12.4 million in the fourteen month period

ended 30 April 2003. In the ten month period ended 29 February 2004, Geolink

directors' aggregate emoluments were #452,000. The aggregate emoluments of the

ongoing directors of Geolink for the current financial year are expected to be

#179,000. As at 29 February 2004, net assets were #0.7 million (30 April 2003: #

(0.3) million). The vast majority of Geolink's revenues are earned in US Dollars

and these results have been achieved despite Geolink not hedging its income

versus the weakness in the US Dollar. Following the Acquisition it is proposed

to extend the Sondex Group currency hedging arrangements to include Geolink.

Accordingly, the new term loan facility totalling #13 million will be

denominated in US Dollars and the excess dollar generation (over that required

to fund the Group's US Dollar costs such as its US office and US sourced

components) will be hedged using appropriate hedging instruments such as forward

and option contracts.

Principal terms and funding of the Acquisition

Sondex has agreed, conditional upon, inter alia, Shareholder approval and

Admission, to acquire the entire issued share and loan capital of Geolink for a

consideration of approximately #31.5 million, of which #26.3 million will be

payable in cash to the Loan Note Holders on Completion and #5.2 million will be

satisfied by payment of approximately #1.1 million in cash and the allotment of

the Consideration Shares in the Company to the Geolink Shareholders.

Of the cash consideration, #1.0 million will be paid into a joint retention

account pending the agreement or determination of the net working capital and

the tangible fixed assets of Geolink as shown by completion accounts to be

prepared following Completion and #1.6 million will be paid into a joint account

as security for claims under the warranties and the tax deed.

The overall consideration payable to the Geolink Shareholders is subject to a

net working capital adjustment mechanism. The maximum additional consideration

to be paid by the Company under this mechanism to the Geolink Shareholders shall

not exceed #1.5 million, which is in addition to the #1.0 million to be paid

into the joint retention account referred to above.

The Company proposes to fund the Acquisition as to approximately #14.4 million

from the net proceeds of the Placing and Open Offer and the balance from the

committed bank facilities provided by Bank of Scotland, namely the new term loan

of #13 million. The remainder of the net proceeds of the Placing and Open Offer,

being approximately #3.8 million, will be applied towards increased investment

to accelerate the expansion of the Enlarged Group.

It is anticipated that Completion will take place on 30 June 2004 following

Shareholder approval and Admission.

Current trading and prospects

Sondex has today issued its audited results for the financial year ended 29

February 2004, from which the financial information in this section is

extracted.

Group revenues grew to #17.5 million, an increase of 21 per cent., and earnings

before amortisation of goodwill and one-off flotation costs and taking into

account realised exchange gains increased by 31 per cent. to #5.9 million

representing earnings per share of 9.4p per share on a diluted pro-forma basis.

The Group's operating profit before flotation costs and amortisation of goodwill

and intangible assets was #5.3 million in 2004 (2003 - #4.5 million),

representing a net margin on turnover of 30.3 per cent. (2003 - 31.0 per cent.).

This operating profit increase of 17 per cent. was achieved despite an increase

in Research & Development expenditure from #1.5 million to #2.0 million (an

increase of 33 per cent.) and a depreciation in the Sterling value of Dollar

sales achieved during the year.

Reflecting these results, the Board is proposing a final dividend for the year

of 1.2p per share, amounting to a total of 1.8p for the year.

Sondex

Trading since the year-end for Sondex has been in line with the Directors'

expectations with positive current market and customer indications. The actual

order book and pending order list provide confidence in continuing underlying

growth.

Geolink

Management accounts for Geolink since 29 February 2004 indicate that monthly

revenues are in line with expectations. Customer indications are positive and

provide confidence for the current financial year.

Prospects of the Enlarged Group

As stated in the annual results released today the Board intends to continue to

expand the Enlarged Group through investment in organic product development and

growth, and through a considered and focused acquisition strategy with the aim

of bringing together a platform of technology that can be made available to the

service sector of the oil and gas industry. The Directors believe that the

Enlarged Group can look forward to sustainable growth in the current financial

year.

Management of the Enlarged Group

Day to day management of Geolink will continue to be undertaken by the existing

management team under the leadership of the current Managing Director, Alasdair

Macrae. An executive board will be established, with representation from the key

Geolink management and the Sondex executive team, which will meet regularly and

ensure that synergies are being achieved where possible and a common direction

is maintained across the Enlarged Group.

New banking arrangements

As referred to above, the Company has entered into new committed bank facilities

with Bank of Scotland of up to #33 million (comprising an existing term loan

facility of approximately #14 million, a new term loan facility of #13 million

and a new working capital facility of #6 million) to fund the Acquisition and

provide additional working capital facilities for the Enlarged Group.

Principal terms of the Placing and Open Offer

The Company proposes to raise approximately #18.2 million (net of expenses of

the Acquisition and Placing and Open Offer) by the allotment and issue of

13,118,029 Open Offer Shares at 160 pence per Open Offer Share pursuant to the

Placing and Open Offer. The Open Offer Shares (other than the Committed Shares)

are being conditionally placed by Collins Stewart at the Issue Price with

institutional and other investors subject to clawback (other than in relation to

the Firm Placed Shares) in respect of valid applications made by Qualifying

Shareholders under the Open Offer for such Open Offer Shares.

Collins Stewart has agreed, acting as agent on behalf of the Company, to invite

Qualifying Shareholders to apply under the Open Offer for 13,118,029 Open Offer

Shares at the Issue Price on the basis of:

1 Open Offer Share for every 3 Existing Ordinary Shares

registered in the names of Qualifying Shareholders on the Record Date. If a

Shareholder has sold or otherwise transferred all of his Existing Ordinary

Shares before the Record Date, he is not entitled to participate in the Open

Offer. Where appropriate, entitlements of Qualifying Shareholders will be

rounded down to the nearest whole number of Open Offer Shares and any fractional

entitlements to Open Offer Shares that would otherwise have arisen will be

disregarded in calculating Qualifying Shareholders' pro rata entitlements. Such

fractional entitlements will be aggregated and included within the Placing, with

the proceeds retained for the benefit of the Company.

Qualifying Shareholders may apply for any number of Open Offer Shares up to

their maximum entitlement which, in the case of Qualifying non-CREST

Shareholders, is equal to the number of Open Offer Entitlements as shown in

their Application Form, or in the case of Qualifying CREST Shareholders, is

equal to the number of Open Offer Entitlements standing to the credit of their

stock account in CREST. No application in excess of a Qualifying Shareholder's

pro rata entitlement will be met and any Qualifying Shareholder so applying will

be deemed to have applied for his or her maximum entitlement. Qualifying

Shareholders with holdings of Existing Ordinary Shares in both certificated and

uncertificated form will be treated as having separate holdings for the purposes

of calculating pro rata entitlements under the Open Offer.

Pursuant to the Placing and Open Offer Agreement, Collins Stewart has

conditionally agreed to place with institutional and other investors or, to the

extent that it fails to do so, to itself subscribe for the Open Offer Shares

(other than the Committed Shares) at the Issue Price, subject to and to the

extent that valid applications are not made by Qualifying Shareholders under the

Open Offer for such Open Offer Shares.

The New Ordinary Shares will be issued credited as fully paid, be identical to

and rank pari passu in all respects with the Existing Ordinary Shares, including

the right to receive all dividends and other distributions declared, made or

paid on or after Admission, with the exception of the proposed final dividend

announced today, for which only the Existing Ordinary Shares are eligible. None

of the New Ordinary Shares are being made available to the public other than

pursuant to the Placing and Open Offer and the Acquisition Agreement.

The Placing and Open Offer is conditional on the Placing and Open Offer

Agreement becoming or being declared unconditional in all respects and not being

terminated before 8.00 a.m. on 28 June 2004 (or such later time and/or date,

being not later than 8.00 a.m. on 12 July 2004, as Collins Stewart and the

Company may agree). The principal conditions to the Placing and Open Offer

Agreement are:

* the passing of the Resolutions;

* the Facilities Agreement becoming unconditional in all respects (save

for any condition relating to the Placing and Open Offer Agreement becoming

unconditional);

* the Acquisition Agreement having become unconditional in all respects

(save for any condition relating to the Placing and Open Offer Agreement or

Admission) and completed in escrow subject only to payment of the consideration

due under that agreement; and

* Admission having become effective by no later than 8.00 a.m. on 28 June

2004 or such later time and/or date as Sondex and Collins Stewart may agree

(but, in any event, not later than 8.00 a.m. on 12 July 2004).

If Admission does not take place, the Open Offer Shares will not be issued under

the Placing or the Open Offer and all monies received by the Company's receiving

agent, Capita IRG, will be returned to the applicants (at the applicants' risk

and without interest) as soon as possible thereafter and in any event not later

than 26 July 2004. Any Open Offer Entitlements admitted to CREST will thereafter

be disabled.

Application has been made to the UK Listing Authority for the New Ordinary

Shares to be admitted to the Official List and to the London Stock Exchange for

the New Ordinary Shares to be admitted to trading on the London Stock Exchange's

market for listed securities. It is expected that Admission will become

effective and that dealings in the New Ordinary Shares will commence on 28 June

2004.

The Open Offer is not being made, subject to certain exemptions, to certain

Shareholders (including those resident in the United States, Canada, Australia,

Japan, South Africa or the Republic of Ireland) and, accordingly, Application

Forms are not being sent to and Open Offer Entitlements are not being credited

to such Shareholders.

The Board is mindful of the Competition Commission's recommendations with regard

to competitive tendering of sub-underwriting commissions. To this end the

Company has agreed to pay sub-underwriting commissions to sub-underwriters of

0.5 per cent. of the aggregate value of the Open Offer Shares (other than the

Committed Shares and the Firm Placed Shares) issued subject to clawback by

Qualifying Shareholders under the Open Offer.

Directors' intentions

The Directors have irrevocably undertaken to vote in favour of the Resolutions

in respect of their aggregate holdings of 6,271,031 Existing Ordinary Shares,

representing approximately 15.9 per cent. of the issued ordinary share capital

of the Company.

Certain of the Directors, namely Messrs Paterson, Colvin and Pinchbeck, have

irrevocably committed to take up, or procure to be taken up, their entitlements

in full which represent, in aggregate, 9,999 Open Offer Shares under the Open

Offer. Further, William Stuart-Bruges has irrevocably committed to take up, or

procure to be taken up, his entitlements to 15,625 Open Offer Shares. Such

Committed Shares, representing approximately 0.2 per cent. of the total Open

Offer Shares, have not been placed by Collins Stewart under the Placing and are

not being underwritten by Collins Stewart. Martin Perry, Christopher Wilks and

Peter Collins have irrevocably undertaken not to take up all of their

entitlements and William Stuart-Bruges has irrevocably undertaken not to take up

the remainder of his entitlements, representing, in aggregate, 2,064,718 Open

Offer Shares under the Open Offer, representing approximately 15.7 per cent. of

the total Open Offer Shares. These Firm Placed Shares have been placed firm by

Collins Stewart with institutional and other investors (including William Colvin

who has undertaken to subscribe for 7,500 of the Firm Placed Shares) and are not

subject to clawback by Qualifying Shareholders under the Open Offer.

Dividends

The New Ordinary Shares will rank pari passu in all respects with the Existing

Ordinary Shares including the right to receive any dividends paid, made or

declared by the Company save for the final dividend proposed today of 1.2 p per

Existing Ordinary Share for the year ended 29 February 2004.

Following the Acquisition, the Board intends to maintain Sondex's stated

dividend policy of paying dividends on Ordinary Shares, while maintaining a

suitable level of dividend cover and retaining the majority of earnings to fund

the development and growth of the Enlarged Group's business and products under

development.

References to dividends and dividend policy should not be interpreted as a

dividend forecast or a profit forecast.

Prospectus

A Prospectus containing further details of the proposed Acquisition and the

Placing and Open Offer is expected to be sent to Shareholders today.

Expected Timetable of Principal Events

2004

Record Date for the Open Offer close of business on 25 May

Ex-entitlement date for the Open Offer 26 May

Open Offer Entitlements credited to stock accounts in

CREST of Qualifying CREST Shareholders by 27 May

Recommended latest time for requesting withdrawal of

Open Offer Entitlements from CREST 4.30 p.m. on 15 June

Latest time for depositing Open Offer Entitlements into

CREST 3.00 p.m. on 17 June

Latest time and date for splitting of Application Forms (to

satisfy bona fide market claims) 3.00 p.m. on 18 June

Latest time and date for receipt of Forms of Proxy

for the Annual General Meeting 11.00 a.m. on 21 June

Latest time and date for receipt of Forms of Proxy

for the Extraordinary General Meeting 11.15 a.m. on 21 June

Latest time and date for receipt of completed Application

Forms and payment in full under the Open Offer or

settlement of relevant CREST instruction (as appropriate) 11.00 a.m. on 22 June

Annual General Meeting 11.00 a.m. on 23 June

Extraordinary General Meeting Immediately after the AGM on

23 June

Admission and commencement of dealings in the New

Ordinary Shares 8.00 a.m. on 28 June

Expected date for crediting of Open Offer Shares to CREST

stock accounts in uncertificated form 28 June

Completion of Acquisition 30 June

Despatch of definitive share certificates for the New

Ordinary Shares in certificated form by 6 July

Definitions

The following definitions apply throughout this announcement unless the context

requires otherwise:

"Acquisition" the proposed acquisition of the entire issued share and loan capital of

Geolink International Limited by Sondex plc pursuant to the Acquisition

Agreement

"Acquisition Agreement" the conditional agreement between Robert Trevor Dickinson and Anthony

Moorley and others and the Company, a summary of the principal terms of

which will be set out in the Prospectus

"Admission" admission of the New Ordinary Shares (i) to the Official List and (ii)

to the London Stock Exchange's market for listed securities becoming

effective in accordance, respectively, with the Listing Rules and the

Admission and Disclosure Standards

"Admission and Disclosure the requirements contained in the publication "Admission and Disclosure

Standards" Standards" dated April 2004 containing, inter alia, the admission

requirements to be observed by companies seeking admission to trading

on the London Stock Exchange's market for listed securities

"Annual General Meeting" the annual general meeting of the Company convened for 11.00am on 23

June 2004, notice of which is to be posted to Shareholders with the

Prospectus

"Application Form" the application form relating to the Open Offer being sent to

Qualifying non-CREST Shareholders only with the Prospectus

"Bank of Scotland" or "BoS" the Governor and Company of the Bank of Scotland, a wholly owned

subsidiary of HBoS plc

"Board" or "Directors" the Board of Directors of the Company

"Capita IRG" Capita IRG Plc, The Registry, 34 Beckenham Road, Beckenham, Kent BR3

4TU

"Collins Stewart" Collins Stewart Limited, a wholly owned subsidiary of Collins Stewart

Tullett plc

"Committed Shares" 25,624 Open Offer Shares which represent the entitlements to apply to

the Company for Open Offer Shares under the Open Offer of Messrs.

Paterson, Stuart-Bruges, Colvin and Pinchbeck who have provided

irrevocable undertakings to the Company to take up such Open Offer

Shares under the Open Offer

"Company" Sondex plc, the ultimate holding company of the Group

"Completion" completion of the Acquisition in accordance with the terms of the

Acquisition Agreement

"Consideration Shares" the 2,500,886 new Ordinary Shares to be issued pursuant to the

Acquisition Agreement

"CREST" the relevant system (as defined in the Uncertificated Securities

Regulations 2001) ("the Regulations)) in respect of which CRESTCo

Limited is the Operator (as defined in the Regulations)

"CRESTCo" CRESTCo Limited, the operator of CREST

"Currency" unless otherwise indicated, all references in this announcement to "

pounds sterling", "#" or "p" are to the lawful currency of the United

Kingdom and references to "US Dollars", or "$" are to the lawful

currency of the United States. Sondex prepares its financial

statements in pounds sterling

"Enlarged Group" the Group as enlarged following the Acquisition

"Existing Ordinary Shares" the 39,354,089 Ordinary Shares in issue as at the date of the

Prospectus, all of which are traded on the London Stock Exchange's

market for listed securities

"Extraordinary General Meeting" the extraordinary general meeting of the Company to be held immediately

after the Annual General Meeting on 23 June 2004, notice of which will

be set out at the end of the Prospectus

"Facilities Agreement" the #13,000,000 senior term loan facility agreement dated 25 May 2004

between the Company, BoS and certain other material subsidiaries of the

Company, details of which will be set out in the Prospectus

"Firm Placed Shares" 2,064,718 Open Offer Shares which represent the entitlements to apply

to the Company for Open Offer Shares under the Open Offer of Messrs.

Perry, Stuart-Bruges, Wilks and Collins who have provided irrevocable

undertakings to the Company not to take up such Open Offer Shares under

the Open Offer

"Form of Proxy" the forms of proxy for use in connection with the Annual General

Meeting and the Extraordinary General Meeting to be sent to the

Shareholders with the Prospectus

"Geolink" Geolink International Limited

"Geolink Group" Geolink and, where applicable, its subsidiaries

"Geolink Shareholders" namely, Victor Allan, Federico Casavantes, Robert Trevor Dickinson,

John Elphinstone, James Harrison, Anthony Moorley, Alasdair Macrae,

Stephen Page and Shaun Robertson

"Geolink (UK)" Geolink (UK) Limited

"Geolink (UK) Vendors" namely, Anthony Moorley, Kenneth Prain, David McLaughlin, the

McLaughlin Family Trust, Robert Trevor Dickinson, David Newton, the

Gearhart Family Partnership and the trustees of the Geolink (UK)

Limited Funded Unapproved Retirement Benefit Scheme

"Group" the Company and, where applicable, its subsidiaries

"Issue Price" 160p per Open Offer Share

"Listing Rules" the Listing Rules of the UK Listing Authority, made under Part VII of

the Financial Services and Markets Act 2000

"Loan Note Holders" namely, Trevor Dickinson, the Gearhart Family Partnership, David

McLaughlin, Anthony Moorley, David Newton, Kenneth Prain, the Geolink

(UK) Limited Unapproved Retirement Benefit Scheme and the McLaughlin

Family Trust

"London Stock Exchange" London Stock Exchange plc

"New Ordinary Shares" together, the Open Offer Shares and the Consideration Shares

"Official List" the Official List of the UK Listing Authority

"Open Offer" the offer by Collins Stewart as agent for the Company to Qualifying

Shareholders to subscribe for Open Offer Shares on the terms and

subject to the conditions set out in the letter from Collins Stewart in

Part II of the Prospectus and in the Application Form

"Open Offer Entitlement" an entitlement to apply to subscribe for one Open Offer Share,

allocated to a Qualifying Shareholder pursuant to the Open Offer

"Open Offer Shares" the 13,118,029 new Ordinary Shares to be issued pursuant to the Placing

and Open Offer

"Ordinary Shares" ordinary shares of 10 pence each in the capital of the Company

"Placing" the conditional placing of the Open Offer Shares (other than the

Committed Shares) at the Issue Price, subject to the right of

Qualifying Shareholders to apply for such shares pursuant to the Open

Offer (other than in relation to the Firm Placed Shares)

"Placing and Open Offer Agreement the conditional agreement dated 26 May 2004 between Sondex and Collins

" Stewart

"Prospectus" the Prospectus detailing the proposed Acquisition and the Placing and

Open Offer

"Qualifying CREST Shareholders" Qualifying Shareholders whose Ordinary Shares on the register of

members of the Company at the close of business on the Record Date are

in uncertificated form

"Qualifying non-CREST Qualifying Shareholders whose Ordinary Shares on the register of

Shareholders" members of the Company at the close of business on the Record Date are

in certificated form

"Qualifying Shareholders" Shareholders of Existing Ordinary Shares whose names appear in the

register of members at the close of business on the Record Date, other

than certain Overseas Shareholders as set out in paragraph 7 of Part

VIII of the Prospectus

"Record Date" the record date for the Open Offer, being close of business on 25 May

2004

"Resolutions" the resolutions set out in the Notice of Extraordinary General Meeting

at the end of the Prospectus

"Shareholder" a holder of Ordinary Shares

"Sondex" or "the Group" the Company and where applicable, its subsidiaries

"stock account" an account within a member account in CREST to which a holding of a

particular share or other security in CREST is credited

"UK Listing Authority" the Financial Services Authority, in its capacity as the competent

authority under the Financial Services and Markets Act 2000 for

admission of securities to the Official List

"Unidril" Unidril Energy Limited, a wholly owned subsidiary of Geolink

"Unidril Vendors" namely, the Newton Family Trust, Marvin Gearhart, the Geolink (UK)

Limited Funded Unapproved Retirement Benefit Scheme, Alasdair Macrae,

Melanie Macrae, James Macrae, Alice Macrae, James Hamson, Stephen Page,

Shaun Robertson and Victor Allan

"United Kingdom" or "UK" the United Kingdom of Great Britain and Northern Ireland

"United States" or "US" the United States of America, its territories and possessions, any

state of the United States of America and the District of Columbia

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUNURRSWRVURR

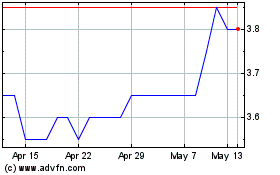

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Apr 2023 to Apr 2024