Acquisition

August 21 2006 - 9:00AM

UK Regulatory

RNS Number:9005H

CRH PLC

21 August 2006

N E W S R E L E A S E

21 August 2006

CRH TO ACQUIRE ASHLAND PAVING AND CONSTRUCTION, INC. (APAC)

IN GROUP'S LARGEST EVER TRANSACTION

Agreement to acquire APAC

CRH plc, the international building materials group, announces that its US

subsidiary, Oldcastle Materials, Inc., has reached agreement to purchase Ashland

Paving And Construction, Inc. (APAC) for a total consideration, including zero

net debt at acquisition, of US$ 1,300 million (euro 1,008 million); the final

price to be adjusted for seasonal working capital and some other accounts at

completion. Goodwill arising on the transaction is estimated at approximately

US$450 million. This agreement follows extensive due diligence under the terms

of an exclusivity agreement with APAC's parent company, Ashland Inc., announced

on 19 June 2006. Completion of the purchase of APAC, which has received

antitrust clearance, is anticipated before the end of August. CRH will finance

the acquisition using debt.

APAC's business

APAC, headquartered in Atlanta , GA , is a leading US aggregates, asphalt and

heavy highway construction company with approximately 9,700 employees and

extensive operations in 14 mid-western and southern states. In the 12 months

ending June 2006 sales amounted to US$ 2.9 billion with profit before interest,

tax, depreciation and amortisation (EBITDA) of approximately US$ 220 million,

before charging depreciation and amortisation of US$ 106 million. Gross assets

as at 30 June 2006 were US$1,665 million.

In the year ended June 2006 APAC produced 32.5 million tons of aggregates, 31

million tons of asphalt and 1 million cubic yards of readymixed concrete.

Approximately one-third of APAC's aggregates production and two-thirds of

asphalt production are consumed internally by APAC's construction operations.

APAC has vertically integrated aggregates, asphalt and highway construction

operations in Kansas , Missouri , Oklahoma , Arkansas and Mississippi , all with

leading regional market positions. APAC is also a leading integrated player in

the Memphis area of western Tennessee , in eastern Tennessee/western North

Carolina and in southern Florida . Total permitted reserves amount to over 2

billion tons. In addition APAC has significant asphalt and highway construction

operations in West Virginia , Virginia , Alabama , Georgia , the Carolinas,

northern Florida and Texas .

Management

APAC's President Kirk Randolph who has over 20 years experience with APAC will

continue to have responsibility for APAC as part of CRH's Americas Materials

division which is led by Mark Towe working closely with Tom Hill head of our

overall Americas business. Key APAC operational management will remain with the

business and join the Americas Materials division. In addition, a number of

senior managers from Americas Materials will be assigned to work with the

existing APAC team to assist with its integration.

CRH Americas Materials division

CRH's existing Americas Materials division is the number one US asphalt producer

with 2005 volumes of 41 million tons; the fourth largest US aggregates company

with 2005 volumes of 162 million tons and a top 10 readymixed concrete player

with volumes of 8.5 million cubic yards. The division operates in 32 US states,

primarily in the Northeast, Midwest and West. In the year ending December 2005

the Americas Materials Division reported sales of US$ 3.9 billion and EBITDA of

US$ 613 million, before charging depreciation and amortisation of US$ 205

million. APAC will be integrated with the existing Americas Materials divisional

structure which is currently divided into four major regional groupings; New

England , New York / New Jersey , Central and West.

Acquisition benefits

The acquisition of APAC represents a major expansion for CRH into new materials

markets in mid-western and southern US states and significantly increases CRH's

position as a top tier aggregates and leading asphalt producer in the US . APAC

provides increased exposure to US infrastructure spending and a development

platform for future growth in new regions. The acquisition offers significant

scope for margin improvement through administrative, operational and purchasing

synergies - estimated at US$ 20 million per annum in the near term rising to US$

40 million within three years - and is expected to contribute positively to CRH

earnings.

Commenting on the agreement to purchase APAC, Liam O'Mahony, CRH Chief

Executive, said: "I am delighted that agreement has been reached for the

purchase of APAC which represents a major milestone in the development of our

Americas Materials business and the largest ever transaction to be completed by

CRH. We aim to build on this significant new platform through enhancing the

materials focus of APAC's business and through the application of the Americas

Materials Division's vertically integrated approach to aggregates, asphalt and

highway construction."

-----

This announcement contains certain forward-looking statements as defined under

US legislation. By their nature, such statements involve uncertainty; as a

consequence, actual results and developments may differ from those expressed in

or implied by such statements depending on a variety of factors including the

specific factors identified in this announcement and other factors discussed in

our Annual Report on Form 20-F filed with the SEC.

All references to tons in this announcement are to short tons in line with US

practice.

-----

CRH will host an analysts' conference call at 2.30 p.m. BST today to discuss

this announcement. The dial-in number is +44 20 7138 0816. A recording of the

conference call will be available from 4.00 p.m. BST by dialling +44 20 7806

1970. The security code for the replay will be 2741758#.

A presentation to accompany this call will be available from 1.00 p.m. on CRH's

website at www.crh.com.

Contact CRH at Dublin 404 1000 (+353 1 404 1000)

Liam O'Mahony, Chief Executive

Myles Lee, Finance Director

Eimear O'Flynn, Head of Investor Relations

Maeve Carton, Group Controller

CRH plc, Belgard Castle , Clondalkin, Dublin 22, Ireland TELEPHONE

+353.1.4041000 FAX +353.1.4041007

E-MAIL mail@crh.com WEBSITE www.crh.com Registered Office,

42 Fitzwilliam Square, Dublin 2, Ireland

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQPUUWWRUPQGPG

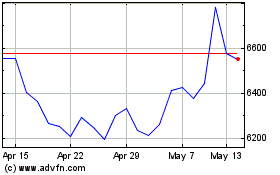

Crh (LSE:CRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

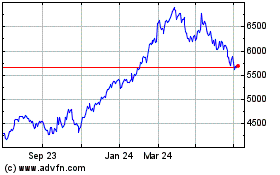

Crh (LSE:CRH)

Historical Stock Chart

From Apr 2023 to Apr 2024