RNS Number:0327W

Tower Resources PLC

21 December 2005

Tower Resources plc ('Tower' or 'the Company')

Further re Acquisition of Neptune Petroleum Limited

Introduction

On 11 August 2005 the Company was pleased to announce that it had conditionally

agreed to acquire the entire issued share capital of Neptune Petroleum Limited

("Neptune") from Peter Taylor, Peter Blakey and Bayview Investments LLC

(together the "Vendors").

The Directors believe that the acquisition of Neptune ("Acquisition") is a good

opportunity for the Company to secure 100% of two frontier oil and gas plays.

This is particularly so in an environment of high oil prices and what the

Directors and Proposed Directors believe to be increased exploration activity in

Africa. The two projects to be acquired under the Acquisition enable the

Company to position itself as an African focussed offshore and onshore oil and

gas explorer.

The Competent Person's Report prepared for Tower indicates that the areas the

subject of Neptune's subsidiaries licences in Namibia and Uganda appear to

contain some of the elements necessary for hosting oil and gas fields. Source

rocks and reservoir units have been identified in both areas and in the Namibian

licence area, seismic data indicates many prospective potentially

hydrocarbon-bearing structures.

In conjunction with the Acquisition, the Company has raised #2,000,000 by way of

a placing of 133,333,333 Ordinary Shares at 1.5 pence per share, to raise

#2,000,000 before costs ("Placing").

Upon completion of the Acquisition and the Placing, the Vendors will hold

approximately 46% of the ordinary share capital of the Company ("Enlarged Issued

Share Capital").

The Acquisition is a reverse takeover of the Company within the meaning of the

AIM Rules and, as required by those rules, is subject to the approval of

Shareholders in general meeting. Shareholder approval will also be required to

approve on a poll a waiver by the Panel in respect of the requirement which

would otherwise arise for the Vendors and Mark Savage (together the "Concert

Party") to make a general offer to Shareholders under Rule 9 of the City Code to

acquire all the Ordinary Shares not held by the Concert Party.

Principal Terms of the Acquisition

Under the terms of the Acquisition Agreement between Tower and the Vendors:

(1) Tower has agreed to purchase the entire issued capital of Neptune for a

total consideration of #4,000,000, to be satisfied by the issue of 200,000,000

Ordinary Shares ("Consideration Shares") to the Vendors at 2 pence per share;

(2) the consideration will be payable on Completion of the Acquisition

Agreement; and

(3) Completion of the Acquisition is conditional on, inter alia, Tower

obtaining Shareholder approval for all of the resolutions to be proposed and

voted on at the Extraordinary General Meeting as detailed in the notice

convening an Extraordinary General Meeting referred to in this announcement ("

Resolutions"), the grant of exploration licences in each of Namibia and Uganda

and #2 million ("Minimum Subscription") having been obtained under the Placing.

The exploration licences have now been granted. It is expected that, assuming

the Resolutions are approved, completion of the Acquisition will take place on

16 January 2006.

Background to and Reasons for the Acquisition

The Company was admitted to AIM on 13 January 2005 as an investing company with

a strategy of undertaking investments in the mining, minerals and oil and gas

sectors. The proposed acquisition of Neptune is the Company's first investment

and represents the start of the implementation of that strategy. Whilst the

properties held by Neptune's subsidiaries are at a very early stage of

exploration, the Directors and the Proposed Directors believe that the available

data is sufficiently encouraging to merit further work and investigation.

Current Trading, Recent Trends and Prospects

The Company is currently an investing company (as defined by the AIM Rules).

Following Completion, the Company's sole business will be that of the holding

company of Neptune. Tower has not had any employees since its incorporation and

Neptune currently has no employees.

The Company has not sold any products or performed any services since

incorporation and there are therefore no significant recent trends in

production, sales and inventory costs and selling prices between the end of the

last financial year and the date of this document.

Reasons for the Placing

The Company is proposing to raise #2,000,000, before expenses, through the issue

of 133,333,333 ordinary shares ("Placing Shares") at 1.5 pence per share ("

Placing Price"). These Placing subscriptions are conditional on Completion and

the Placing Shares being admitted to trading on AIM.

Pursuant to the terms of the placing agreement between the Company and Corporate

Synergy plc ("Placing Agreement"), Corporate Synergy has agreed to use its

reasonable endeavours to place the Placing Shares. The Placing Shares will

represent approximately 29.09% of the issued ordinary share capital of the

Company at admission of the Enlarged Issued Share Capital of the Company to

trading on AIM becoming effective in accordance with Rule 6 of the AIM Rules ("

Admission").

The Placing Shares will, upon issue, rank pari passu in all respects with the

existing ordinary shares, including the right to receive any dividends and other

distributions declared, made or paid following Admission and will be issued

credited as fully paid.

The Placing is conditional, inter alia, on:

(1) the Placing Agreement becoming unconditional and not having been

terminated in accordance with its terms prior to Admission;

(2) the Minimum Subscription having been raised; and

(3) Admission occurring by 17 January 2006 (or such later time and date

as Corporate Synergy and the Company may agree, being no later than 11 February

2006).

The Placing is being made to finance the Company's exploration programme and to

discharge a debt of US$466,184 owed by Neptune to TM Services Limited, a company

of which Peter Taylor and Peter Blakey are the directors and sole shareholders.

The money was lent to Neptune after execution of the Acquisition Agreement to

enable it to finalise its subsidiaries' licences and to commence activities

prior to Completion. The loan agreement and an associated deed of variation are

described in the Company's admission document.

Existing Directors and Proposed Directors

Board changes

On completion of the Acquisition, Ross Warner and Hugh Warner (who were

appointed as directors of the Company on 6 December 2004) will resign as

directors and Peter Taylor, Peter Blakey and Mark Savage will be appointed as

new directors of the Company. The board immediately following Completion will be

as follows:

Russell Langusch BE (Hons) MEngSc (Executive Director) (Age: 55)

Russell Langusch is a petroleum engineer who has accumulated over 29 years'

experience in the upstream oil & gas and finance sectors. This period includes

direct working experience in Australia, South-east Asia and the UK North Sea.

From 1975 Mr Langusch spent 13 years with Schlumberger and Esso in a variety of

roles including field engineer, field service manager, marketing manager,

petrophysicist and senior reservoir engineer. He was then employed by a number

of international investment banks including James Capel, Deutsche Bank and CIBC

World Markets as an Oil & Gas Analyst undertaking company research, corporate

advisory and M&A work. In 2001 he established his own consulting business

providing services to numerous domestic and international clients. Mr Langusch

was appointed managing director of Elixir Petroleum Limited, a dual AIM and

ASX-listed North Sea exploration company, in May 2004.

Peter Taylor BSc CEng (Non-Executive Director) (Age: 58)

Peter Taylor is Joint Chairman of TM Services Ltd, an international oil and gas

consulting company. In 1991, he was a founding member and director of TM Oil

Production Ltd, which is now Dana Petroleum Plc, an oil and gas company listed

on the Official List and one of the UK's leading independents. Mr Taylor was a

director of Dana until 2001. He was also a founding member and director of

Consort Resources Ltd, which became a significant North Sea gas production

company, and of Planet Oil Limited, which was merged with Hardman Resources

Limited in 1998. Mr Taylor was a founding member and director of Star Petroleum

PLC, which was incorporated into Global Petroleum Ltd, which is dual ASX and AIM

listed and which has significant interests in Kenya and the Falkland Islands.

Mr Taylor is a founding member and director of Neptune.

Peter Blakey BSc CEng (Non-Executive Director) (Age: 65)

Peter Blakey is Joint Chairman of TM Services Ltd, an international oil and gas

consulting company. In 1991, he was a founding member and director of TM Oil

Production Ltd, which is now Dana Petroleum Plc, an oil and gas company listed

on the Official List and one of the UK's leading independents. He was also a

founding member and director of Consort Resources Ltd, which became a

significant North Sea gas production company, and of Planet Oil Limited, which

was merged with Hardman Resources Limited in 1998. Mr Blakey was a founder

member and director of Star Petroleum PLC, which was incorporated into Global

Petroleum Ltd, which is dual ASX and AIM listed and which has significant

interests in Kenya and the Falkland Islands. Mr Blakey is a founding member and

director of Neptune.

Mark Savage B. Bus. (Non-Executive Director) (Age: 48)

Mark Savage was born and educated in the United States of America where he

received a business degree from the University of Colorado and was senior

executive for a number of US banks before he joined an Australian based merchant

bank. Mr Savage has experience in debt and equity markets as well as in the

corporate advisory area. He has held directorships with a number of public

companies. Mr Savage is a director of Global Petroleum Ltd which is dual ASX

and AIM listed and which has significant interests in Kenya and the Falkland

Islands.

Dealing restrictions

Each of the Proposed Directors, Bayview Investments LLC, Ascent Capital Pty Ltd,

Elliot Holdings Pty Ltd, David Steinepreis, Oakhurst Enterprises Pty Ltd, Derek

Steinepreis, Talltree Holdings Pty Ltd, Argonaut Capital Limited and EGR

Investments Pty Limited have agreed with the Company that they will not dispose

of any interest in their Ordinary Shares for a period of 12 months from

Admission. The provisions of the lock-in arrangements will not apply in certain

limited circumstances which include, inter alia:

* the acceptance of a general offer for the whole of the issued equity share

capital of the Company in accordance with the City Code, where such disposal

or agreement to dispose is either conditional upon the announcement of such

offer or is by way of acceptance of such offer or the giving of an

irrevocable undertaking to accept such an offer; or

* pursuant to a compromise or arrangement between the Company and its

creditors; or

* for the purpose only of effecting the appointment of a trustee or new

trustee of a family settlement for the benefit of members of the immediate

family of a locked-in Shareholder; or

* by the personal representatives of a locked-in Shareholder in the event

that he should die; or

* pursuant to a court order.

City Code

Persons acting in concert comprise persons who, pursuant to an agreement or

understanding (whether formal or informal), actively co-operate, through the

acquisition by any of them of shares in a company, to obtain or consolidate

control (which is defined in the City Code as a holding, or aggregate holdings,

of shares carrying 30 per cent. or more of the voting rights of a company,

irrespective of whether the holding or holdings give de facto control) of that

company. The Vendors are all shareholders and, in the case of Peter Taylor and

Peter Blakey, directors of Neptune and are therefore, together with Mark Savage,

who is the sole director and shareholder of Bayview Investments LLC (one of the

Vendors), considered to be acting in concert. The Acquisition therefore gives

rise to certain considerations under the City Code. Brief details of the City

Code and the protections it affords to Shareholders are described below.

The City Code has not, and does not seek to have, the force of law. It has,

however, been acknowledged by both the government and other regulatory

authorities that those who seek to take advantage of the facilities of the

securities markets in the UK should conduct themselves in matters relating to

takeovers in accordance with high business standards and so according to the

City Code.

The City Code is issued and administered by the Panel on Takeovers and Mergers

("Panel"). The City Code applies to all takeover and merger transactions,

however effected, where the offeree company is, inter alia, a listed or unlisted

public company, quoted or unquoted and resident in the UK, the Channel Islands

or the Isle of Man (and to certain categories of private limited companies).

Tower is such a company and its Shareholders are therefore entitled to the

protections afforded by the City Code.

Under Rule 9 of the City Code ("Rule 9") where (i) any person acquires shares

which, when taken together with shares already held by him or shares held or

acquired by persons acting in concert with him, carry 30 per cent. or more of

the voting rights of a company subject to the City Code or (ii) any person who,

together with persons acting in concert with him, holds not less than 30 per

cent. but not more than 50 per cent. of the voting rights of a company subject

to the City Code and such person, or persons acting in concert with him,

acquires any additional shares which increase his percentage of the voting

rights, such persons are normally obliged to make a general offer to all the

remaining shareholders to purchase, in cash, their shares at the highest price

paid by him, or any person acting in concert with him, within the preceding 12

months.

By virtue of their being shareholders in and (in the case of Peter Taylor and

Peter Blakey) directors of Neptune, the Vendors and Mark Savage are considered

to be acting in concert. Immediately following Completion, the shareholding of

the Vendors will be, in aggregate, 210,833,334 Ordinary Shares, representing

approximately 46% of the Enlarged Issued Share Capital, as a result of being

issued 200 million new Ordinary Shares pursuant to the Acquisition Agreement and

a further 10,833,334 new Ordinary Shares pursuant to the Placing.

Bayview Investments LLC is a company incorporated in New Mexico, USA. Its sole

director and shareholder is Mark Savage, one of the Proposed Directors. Bayview

is an investment holding company incorporated on 21 January 2005 and it has no

material assets other than its investment in Neptune. It is not required to file

accounts under the laws of its state of incorporation. Pen portraits of the

Vendors are set out under the heading "Existing Directors and Proposed Directors

" in this announcement.

Peter Taylor, Peter Blakey and TM Services Limited, a company of which Peter

Taylor and Peter Blakey are the directors and sole shareholders, are together

interested in an aggregate 34.1 per cent. of the issued share capital of Global

Petroleum Ltd, which is involved in petroleum exploration projects. Otherwise,

neither Peter Taylor, Peter Blakey, Mark Savage nor Bayview Investments LLC has

any interest material to them in any business similar in nature to that of the

Enlarged Group.

The individual holdings of the Vendors following Completion will be as follows:

Immediately following completion of the Acquisition

Name Number of Ordinary Shares % of Enlarged Issued Share Capital*

Peter Taylor 55,416,667 12.09%

Peter Blakey 55,416,667 12.09%

Bayview Investments 100,000,000 21.82%

LLC

Total 210,833,334 46 00%

*assuming Minimum Subscription under the Placing. Each of the Minimum

Subscription and the Acquisition are inter-conditional.

The Panel has agreed, however, subject to Resolution 2 being passed on a poll by

the independent Shareholders at the Extraordinary General Meeting, to waive the

obligation on the Concert Party to make a general offer to Shareholders under

Rule 9 of the City Code which would otherwise arise as a result of the issue of

210,833,334 new Ordinary Shares to the Concert Party pursuant to the Acquisition

and the Placing ("Waiver").

Following Completion, the Vendors will between them hold more than 30 per cent.

but not more than 50% of the Enlarged Issued Share Capital and for as long as

they continue to be treated as acting in concert, any further increase in their

aggregate shareholding will be subject to the provisions of Rule 9 of the City

Code.

None of the Vendors nor any person acting in concert with any of them has

purchased Ordinary Shares in the 12 months immediately preceding the date of

this document. The Waiver, which the Panel has agreed to grant subject to the

passing of the Resolution 2, will be invalidated if any purchases of Ordinary

Shares are made by any of the Vendors or any person acting in concert with any

of them in the period between the date of this document and the Extraordinary

General Meeting. Each of the Vendors and Mark Savage has undertaken to the

Company that he will not make any such purchases of Ordinary Shares.

Extraordinary General Meeting

At the end of the Company's admission document there is a notice convening an

Extraordinary General Meeting of the Company to be held at 30 Farringdon Street,

London EC4A 4HJ at 10.00 a.m. on 16 January 2006 at which the Resolutions will

be proposed to:

(1) approve the Acquisition for the purposes of Rule 14 of the AIM Rules;

(2) approve the Waiver;

(3) to grant authority to the directors pursuant to section 80 of the Act

to allot relevant securities including, inter alia, the Consideration Shares and

the Placing Shares;

(4) to give power to the directors to allot certain relevant securities

free from pre-emption rights as if section 89 of the Act did not apply to such

allotment.

Resolutions (1) to (3) will be proposed as ordinary resolutions while Resolution

(4) will be proposed as a special resolution. As required by the Panel,

Resolution 2 will be taken on a poll of independent shareholders. The

Acquisition is conditional upon, inter alia, all the Resolutions being carried.

Action to be taken

Shareholders will find enclosed with the admission document that is being posted

today a Form of Proxy for use at the Extraordinary General Meeting. Whether or

not Shareholders intend to be present at the meeting, they are requested to

complete, sign and return their Forms of Proxy to the Company's registrars,

Computershare Investor Services PLC, PO Box 82, The Pavilions, Bridgwater Road,

Bristol BS99 7NH as soon as possible but, in any event, so as to arrive no later

than 10.00 a.m. on 14 January 2006. The completion and return of a Form of Proxy

will not preclude Shareholders from attending the meeting and voting in person

should they wish to do so.

Further information

Shareholders' attention is drawn to the information set out in admission

document that is being despatched to them today and in particular to the risk

factors set out in Part 8 thereof.

Recommendation

The Existing Directors of the Company, having been so advised by Nabarro Wells &

Co. Limited, unanimously believe that the Acquisition and the waiver of Rule 9

of the City Code are fair and reasonable and in the best interests of the

Company and its Shareholders as a whole.

Accordingly, the Existing Directors therefore recommend Shareholders to vote in

favour of the Resolutions to be proposed at the EGM, as they intend to do in

respect of their shareholdings, amounting in aggregate to 13,450,000 Ordinary

Shares, representing 10.76 per cent. of the Existing Ordinary Shares. In giving

its advice to the Board, Nabarro Wells & Co. Limited has taken into account the

Existing Directors' commercial assessments.

Information on Neptune

Background

Neptune is the holding company of Neptune Petroleum (Namibia) Limited ("Neptune

Namibia") and Neptune Petroleum (Uganda) Limited ("Neptune Uganda"). Its

directors are Peter Taylor and Peter Blakey.

Neptune Namibia has entered into a petroleum agreement with The Government of

the Republic of Namibia relating to Blocks 1910A, 1911 and 2011A in the Republic

of Namibia.

Neptune Uganda has entered into a production sharing agreement with The

Government of the Republic of Uganda in relation to Exploration Area 5 in the

Republic of Uganda.

Namibia Project

Blocks 1910A, 1911 and 2011A cover an area of approximately 22,000 sq km

offshore Namibia, in water depths ranging from 200 metres to 3,000 metres. It

is believed that the basin or basins covered were formed in response to thermal

subsidence following the rifting preceding the separation of Africa from South

America.

Very few wells have been drilled in the area, but, from the data available, two

oil-prone source rock horizons have been identified, one in the early Aptian and

another in the Cenomanian - Turonian. Other source rocks may be present in the

syn-rift Lacustrine shales of the Hauterivan and possibly in shales in the

pre-rift Karoo section. Potential reservoirs have been encountered in the

Barremian to Cenomanian and Turonian to Maastrichtian successions.

Reconnaissance grids of modern seismic data are available over all the Blocks.

Few wells have been drilled to date but, the presence of oil prone source rocks

and potential reservoirs and the totally unexplored nature of the deeper water

suggests this may be an attractive frontier play.

Uganda Project

Block 5 covers an area of approximately 6,000 sq km. The area is onshore

covering the northern part of the East African Rift Valley in the north west of

Uganda at the northern end of the Albertine Graben. The main objectives are the

Tertiary rift sediments which have been found to be oil and gas bearing in the

acreage to the south.

Oil seeps have been observed all along the edge of the rift but very few modern

wells have been drilled. The Directors and the Proposed Directors believe that

the area is fairly flat savannah and that this should make seismic acquisition

relatively easy. The Directors and the Proposed Directors consider that the

fiscal terms in Uganda are attractive and development scenarios will depend on

the size of accumulation discovered. The initial program will consist of a

study of existing gravity and magnetic data and regional geological studies.

The next stage would be to acquire modern seismic data in order to determine the

size and number of potentially hydrocarbon-bearing structures. The final stage

would be the drilling of wells on the most attractive feature.

Details of the companies

Neptune Petroleum Limited was incorporated in England with registered number

5112493 on 26 April 2004. Its registered office is 5 Charterhouse Square,

London EC1M 6PX. Its issued capital is #4,000 made up of 80,000 ordinary shares

of #0.05 each, all of which are fully paid. It undertakes no activities other

than those associated with it being a holding company. It has never paid a

dividend.

Neptune Petroleum (Namibia) Limited was incorporated in the British Virgin

Islands with registered number 660039 on 6 June 2005. Its registered office is

PO Box 3152, Road Town, Tortola, BVI. Its issued capital is US$2 made up of 2

ordinary shares of US$1 each, both of which are fully paid. It undertakes no

activities other than those associated with the Namibia Project. It has never

paid a dividend.

Neptune Petroleum (Uganda) Limited was incorporated in the British Virgin

Islands with registered number 659047 on 31 May 2005. Its registered office is

PO Box 3152, Road Town, Tortola, BVI. Its issued capital is US$2 made up of 2

ordinary shares of US$1 each, both of which are fully paid. It undertakes no

activities other than those associated with the Uganda Project. It has never

paid a dividend.

Directors and other interests

The interests (all of which are beneficial unless stated otherwise) of the

Existing Directors and the Proposed Directors and their immediate families and

the persons connected with them (within the meaning of Section 346 of the Act)

which have been notified to the Company pursuant to Sections 324 and 328 of the

Act or are required to be disclosed in the Register of Directors' Interests

pursuant to Section 325 of the Act in the issued share capital of the Company

and the existence of which is known to, or could with reasonable due diligence

be ascertained by, any Existing Director or Proposed Director as at the date of

this document are as follows:

Number of Percentage of Number of Percentage of

issued share ordinary shares issued share

Ordinary Shares capital held following capital following

before the the Proposals the Proposals

Proposals before the

Name Proposals

R Langusch 2,500,000 2.00 2,500,000 0.55%

R Warner 1,000,000 0.80 1,000,000 0.22%

H Warner* 3,000,000 2.40 3,000,000 0.65%

P Taylor Nil - 55,416,667 12.09%

P Blakey Nil - 55,416,667 12.09%

M Savage** Nil - 100,000,000 21.82%

Ascent Capital*** 6,950,000 5.56 6,950,000 1.52%

* Hugh Warner's shareholding is held by a family trust called Elliot

Holdings Pty Ltd .

** Mark Savage's shareholding is held by Bayview Investments LLC. Bayview

Investments LLC was incorporated in New Mexico, USA and its sole director and

shareholder is Mr Savage.

*** Ascent Capital Pty Ltd is a company beneficially owned equally by David

Steinepreis, Hugh Warner and Gary Steinepreis.

On Admission, Russell Langusch will be granted an option to subscribe for

3,000,000 Ordinary Shares at 1.5 pence per share.

In addition to the directorships in the Company the Existing Directors and

Proposed Directors hold or have held the following directorships within the five

years immediately prior to the date of this document:

Name Current Directorships Past Directorships

Russell Langusch Elixir Petroleum Ltd Lowell Resources Funds Management Pty Ltd

Elixir Petroleum (UK) Ltd CIBC World Markets Australia Ltd

Langusch & Associates Pty Ltd

Hugh Warner Ascent Capital Pty Ltd Black Rock Oil & Gas PLC

M Health Limited Extract Resources Ltd

Green Rock Energy Limited Medivac Limited

Uranium Resources plc Aeris Technologies Ltd

Deep Yellow Tanzania Limited Peak Hill Gold Mines NL

Copperco Limited

Resonance Health Ltd

Synergy Metals Ltd

View Resources Ltd

IM Medical Ltd

Service Stream Ltd

Peninsular Mineral Limited

Data Centre Holdings Pty Ltd

My Accountants Online Pty Ltd

Black Rock Petroleum NL

Rakov Pty Limited

Fusia Limited

MinRes Resources Inc.

Black Range Minerals Ltd

OBJ Limited

Salus Technologies Limited

Deep Yellow Limited

Sturt Australia Resources NL

Molecular Pharmacology plc

Ascent Resources plc

Ross Warner Uranium Resources PLC Ascent Capital Pty Ltd

Herencia Resources PLC Molecular Pharmacology PLC

Chian Resources PLC

Medici Bioventures PLC

Davos PLC

Nardina Resources PLC

Irvine Energy PLC

Deep Yellow Tanzania Limited

Tarapaca Resources (Bermuda) Limited

Leopard Minerals PLC

Peter Taylor TM Services Limited Cats Eyes Productions Limited

TM Consultants Limited Dana Petroleum PLC

TM Management Consultants Limited Goggle Eyes Productions Limited

TM Information Systems Limited Thames Resources Limited

Sakhalin Petroleum PLC

Star Petroleum PLC

Astral Petroleum Limited Planet Oil International PLC

Global Petroleum Limited Planet Oil Limited

Jupiter Petroleum Limited Pursuit Dynamics PLC

Pursuit Resources Limited Consort Resources Limited

Neptune Petroleum Ltd

Neptune Petroleum (Namibia) Ltd

Neptune Petroleum (Uganda) Ltd

Saturn Petroleum Limited

Comet Petroleum Limited

Peter Blakey TM Services Limited Microfloat Bed Company Limited

TM Consultants Limited Thames Resources Limited

TM Management Consultants Limited Sakhalin Petroleum PLC

TM Information Systems Limited Arden Resources Limited

Star Petroleum PLC Planet Oil International PLC

Astral Petroleum Limited Planet Oil Limited

Global Petroleum Limited Grove Energy Limited

Jupiter Petroleum Limited Consort Resources Limited

Pursuit Resources Limited Goggle Eyes Productions Limited

Neptune Petroleum Ltd Cats Eyes Productions Limited

Neptune Petroleum (Namibia) Ltd

Neptune Petroleum (Uganda) Ltd

Comet Petroleum Limited

Saturn Petroleum Limited

Mark Savage Central Asia Gold Limited M Health Limited

Global Petroleum Limited

Stirling Products Limited

Bayview Investments LLC

Company's accounts

The Company's accounts from the date of incorporation on 6 December 2004 to 30

June 2005 and set out in the appendix to this announcement. Copies will be

posted to shareholders by 31 December 2005 and will be obtainable from Nabarro

Wells & Co. Limited, Saddlers House, Gutter Lane, London EC2V 6HS.

Publication of admission document

The Company will post its admission document to existing shareholders today.

Copies can be obtained from Nabarro Wells & Co. Limited, Saddlers House, Gutter

Lane, London EC2V 6HS.

APPENDIX

Income Statement

For the period ended 30 June 2005

30 June 2005

CONTINUING OPERATIONS #

Administrative expenses (168,938)

Operating loss (168,938)

Investment income 11,350

Loss before taxation (157,588)

Income tax expense -

Loss for the period (157,588)

Loss per share (0.14)

Diluted loss per share (0.14)

Balance Sheet

As at 30 June 2005

30 June 2005

#

ASSETS

Current assets

Cash and cash equivalents 552,412

Total assets 552,412

LIABILITIES

Current liabilities -

Total liabilities -

Net assets 552,412

EQUITY

Share capital 125,000

Share premium 585,000

Retained earnings (157,588)

Total equity 552,412

Cash Flow Statement

For the period ended 30 June 2005

30 June 2005

#

Net cash outflow from operating activities (Note 1) (168,938)

Investing activities

Interest received 11,350

Financing activities

Net proceeds from issue of ordinary share capital 710,000

Net increase in cash and cash equivalents 552,412

Notes to the Cash Flow Statement

30 June 2005

#

1. Cash generated from operations

Operating loss (194,341)

Currency translation differences 25,403

Cash generated from continuing operations (168,938)

NOTES TO THE FINANCIAL INFORMATION

For the period ended 30 June 2005

1. Accounting Policies

Basis of Accounting

The financial information has been prepared under the historical cost convention

and in accordance with International Financial Reporting Standards and IFRIC

interpretations and with the parts of the Companies Act 1985 applicable to

companies reporting under International Financial Reporting Standards.

Foreign Currencies

Transactions in foreign currencies are translated into sterling at the rate of

exchange ruling at the date of the transaction. Monetary assets and liabilities

denominated in foreign currencies are translated at the rate of exchange ruling

at the balance sheet date. The resulting exchange gain or loss is dealt with in

the profit and loss account.

2. Share capital

Period ended

30 June 2005

#

Authorised

10,000,000,000 Ordinary shares of #0.001 each 10,000,000

Issued and fully paid

125,000,000 Ordinary shares 125,000

The Company was incorporated on 6 December 2004 with an authorised share capital

of #10,000,000 divided into 10,000,000,000 ordinary shares of #0.001 each, of

which 2 shares were issued fully paid, on incorporation.

On 13 December 2004 the founders subscribed for an aggregate of 59,999,998

Ordinary Shares, all at par value, to raise #59,998.

On 11 January 2005 the Company allotted 65,000,000 Ordinary Shares for cash at

#0.01 per share to raise #650,000.

3. No dividends were paid or proposed in respect of the period

ended 30 June 2005.

4. Post balance sheet event

On 11 August 2005 the Company announced that it had entered into an agreement to

acquire 100% of two frontier oil and gas plays through the proposed purchase of

the entire issued share capital of Neptune Petroleum Limited from Peter Taylor,

Peter Blakey and Bayview Investments LLC.

**ENDS**

Contacts:

Russell Langusch 07840 523771

Peter Taylor 020 7867 8600

Peter Blakey 020 7867 8600

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTBBTTMMTTBTA

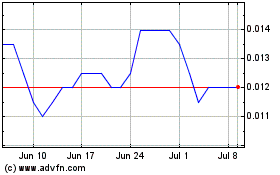

Tower Resources (LSE:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tower Resources (LSE:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024