Provides Financial Guidance for 2017

Acme United Corporation (NYSE MKT:ACU) today announced that net

sales for the fourth quarter ended December 31, 2016 were $26.4

million compared to $23.1 million in the same period of 2015, an

increase of 14%. Net sales for the year ended December 31, 2016

were $124.6 million, compared to $109.8 million in 2015, an

increase of 13%.

For the quarter ended December 31, 2016, net income was

$551,000, or $0.15 per diluted share, compared to $440,000, or

$0.12 per diluted share, for the comparable period of 2015, both

increases of 25%. Net income for the year ended December 31, 2016

was $5.9 million, or $1.64 per diluted share, compared to $4.8

million, or $1.30 per diluted share, for the prior year, an

increase of 22% in net income and 26% in earnings per share.

Chairman and CEO Walter C. Johnsen said, “Our team delivered

strong results in 2016, and I am very proud of all of their

efforts. In particular, we achieved strong growth in Wescott

cutting tools. The Company generated strength in revenues in the

First Aid business with improved margins. We increased market

shares for both our Cuda fishing tools and Camillus hunting knives.

The DMT sharpening business which we acquired in February 2016

exceeded our expectations, while our Canadian and European

businesses delivered strong performances.”

Mr. Johnsen added, “We are entering 2017 with confidence. Our

core businesses are doing well and growing. We acquired Spill Magic

this month, which provides world-class fluid absorbent solutions

for safety, and look forward to building its sales and earnings.

For 2017, we are providing guidance of approximately $137 million

in sales and net income of $6.7 million.”

In the Company’s U.S. segment, net sales for the quarter ended

December 31, 2016 increased 13% compared to the same period in 2015

due to strong sales of Camillus knives, Cuda fishing tools, and

first aid kits. Revenues from our acquisition of DMT contributed

$1.7 million in the fourth quarter and $5.5 million since its

acquisition in February 2016 through year-end. Net sales for the

year ended December 31, 2016 grew 15% over the comparable period in

2015 due to strong sales of Westcott school and office products,

Camillus knives, Cuda fishing tools and first aid products.

Net sales in Canada for the quarter ended December 31, 2016

increased 12% in both U.S. dollars and local currency compared to

the same period in 2015. Net sales in Canada for the year ended

December 31, 2016 were constant in U.S. dollars but increased 4% in

local currency.

European net sales for the quarter ended December 31, 2016

increased 25% in both U.S. dollars and local currency compared to

the same period in 2015. Net sales for the year ended December 31,

2016 increased 9% in both U.S. dollars and local currency. The

sales increases in Europe for both periods was due to market share

gains in the office products channel.

Gross margin was 37.2% in the fourth quarter of 2016 versus

35.8% in the comparable period last year. The higher gross margin

was primarily due to a favorable product mix. Gross margin was

36.6% for the year ended December 31, 2016 compared to 36% in

2015.

The Company’s bank debt less cash and cash equivalents on

December 31, 2016 was $27.0 million compared to $23.5 million on

December 31, 2015. During the year, the Company paid approximately

$7.0 million for the acquisition of the assets of DMT, spent $0.9

million on stock repurchases and paid $1.3 million in dividends on

its common stock. The Company also generated $7.8 million in free

cash flow.

Acme United will hold a conference call to discuss its quarterly

and year-end results, which will be broadcast over the Internet on

Thursday, February 23, 2017, at 12:00 p.m. EST. To listen or

participate in a question and answer session, dial 877-888-4312.

International callers may dial 785-424-1876. Access to the live

webcast of the conference call can be found in the Investor

Relations section of the Company’s website, www.acmeunited.com. A

replay may be accessed under Investor Relations, Audio Archives.

Access also by logging on to www.streetevents.com.

ACME UNITED CORPORATION is a leading worldwide supplier

of innovative cutting, measuring and safety products to the school,

home, office, hardware, sporting goods and industrial markets. Its

leading brands include Westcott®, Clauss®, Camillus®, Cuda®,

PhysiciansCare®, First Aid Only®, Pac-Kit® and DMT®. For more

information, visit www.acmeunited.com.

Forward-looking statements in this report, including without

limitation, statements related to the Company’s plans, strategies,

objectives, expectations, intentions and adequacy of resources, are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Investors are cautioned

that such forward-looking statements involve risks and

uncertainties including, without limitation, the following: (i)

changes in the Company’s plans, strategies, objectives,

expectations and intentions, which may be made at any time at the

discretion of the Company; (ii) the impact of uncertainties in

global economic conditions, including the impact on the Company’s

suppliers and customers; (iii) changes in client needs and consumer

spending habits; (iv) the impact of competition and technological

changes on the Company; (v) the Company’s ability to manage its

growth effectively, including its ability to successfully integrate

any business it might acquire; (vi) currency fluctuations; and

(vii) other risks and uncertainties indicated from time to time in

the Company’s filings with the Securities and Exchange

Commission.

ACME UNITED CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF INCOMEYEAR END REPORT

2016(Unaudited)

Quarter Ended Quarter Ended Amounts in

$000's except per share data

December 31, 2016 December 31,

2015 Net sales $ 26,376

$ 23,118 Cost of goods sold 16,564

14,852 Gross profit 9,812 8,266

Selling, general, and administrative expenses 9,105

7,611 Income from operations 707 655

Interest expense (233) (154) Interest

income 6 7 Net interest expense

(227) (147) Other expense, net (38)

(18) Total other expense, net (265)

(165) Pre-tax income 442 490 Income

tax (benefit) expense (109) 50 Net income

$ 551 $ 440 Shares

outstanding - Basic 3,325 3,354 Shares

outstanding - Diluted 3,668 3,696

Earnings per share basic $ 0.17 $

0.13 Earnings per share diluted 0.15

0.12

ACME UNITED CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF INCOMEYEAR END REPORT 2016

(cont.)(Unaudited)

Year Ended Year Ended Amounts in

$000's except per share data

December 31, 2016 December 31,

2015 Net sales $ 124,574 $

109,812 Cost of goods sold 79,019

70,251 Gross profit 45,555 39,561

Selling, general, and administrative

expenses

37,113 32,214 Income from operations

8,442 7,347 Interest expense (869)

(570) Interest income 0 5 Net

interest expense (869) (565) Other expense,

net (76) (168) Total other expense, net

(945) (733) Pre-tax income 7,497

6,614 Income tax expense 1,646 1,820

Net income $ 5,851 $ 4,794

Shares outstanding - Basic 3,328 3,335

Shares outstanding - Diluted 3,578 3,687

Earnings per share basic $ 1.76

$ 1.44 Earnings per share diluted 1.64

1.30

ACME UNITED CORPORATIONCONDENSED

CONSOLIDATED BALANCE SHEETSYEAR END REPORT

2016(Unaudited)

Amounts in $000's

December 31, 2016 December 31,

2015

Assets:

Current assets: Cash $ 5,911 $

2,426 Accounts receivable, net 20,021

19,565 Inventories 37,238 35,508

Prepaid and other current assets 2,294 2,135

Total current assets 65,464 59,634

Property and equipment, net 7,973 7,401

Intangible assets, less amortization 13,988

11,951 Goodwill 3,948 1,406 Other

assets 694 1,029 Total assets $

92,067 $ 81,421

Liabilities and

stockholders' equity:

Current liabilities Accounts payable $

7,339 $ 6,664 Other current liabilities

5,481 5,273 Total current liabilities

12,820 11,937 Non-current liabilities Long

term debt 32,936 25,913 Other non current

liabilities 190 388 Total liabilities

45,946 38,238 Total stockholders' equity

46,121 43,184 Total liabilities and stockholders'

equity $ 92,067 $ 81,421

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223005309/en/

Acme United CorporationPaul G. Driscoll, 203-254-6060FAX:

203-254-6521

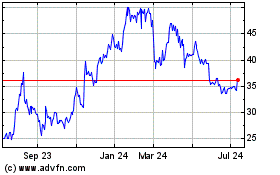

Acme United (AMEX:ACU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acme United (AMEX:ACU)

Historical Stock Chart

From Apr 2023 to Apr 2024