TIDMAXS

RNS Number : 7635P

Accsys Technologies PLC

22 November 2016

AIM: AXS

Euronext Amsterdam: AXS

22 November 2016

ACCSYS TECHNOLOGIES PLC ("Accsys" or "the Company")

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2016

Accsys, the chemical technology group, focused on the

acetylation of wood, today announces interim results for the

consolidated group for the six months ended 30 September 2016.

Unaudited Unaudited

six six

months ended months ended

30 Sept 30 Sept

2016 2015

Accoya(R) revenue EUR22.5m EUR21.9m

Total Revenue EUR25.1m EUR26.3m

Gross Profit EUR6.8m EUR9.4m

EBITDA EUR(1.3m) EUR1.3m

Loss before taxation EUR(2.9m) EUR(0.1m)

Period end cash balance EUR7.9m EUR7.5m

See note 2 of the Group financial statements for reconciliation

of Operating loss to EBITDA

Financial highlights

-- Demand for Accoya continues to grow with sales volumes

increasing by 4% to 17,506m(3) and with growth accelerating into

the second half of the financial year;

-- Group revenue decreased by 5% due to an expected reduction in

licence related income and an unexpected supply chain bottleneck

which has now been resolved;

-- Further licensing income expected in the second half of the financial year;

-- A number of factors contributed to a lower EBITDA including

lower licence related income, timing of annual plant maintenance

stop, a new pricing regime with Solvay and higher costs associated

with the proposed Tricoya consortium; and

-- A cash balance of EUR7.9m at 30 September 2016 (31 March

2016: EUR8.2m) reflects operating loss in the period and new plant

investment, off-set by EUR4.2m proceeds from the sale of land in

Arnhem.

Operational highlights

-- Building work commenced on the expansion of Accoya manufacturing plant in Arnhem;

-- We remain on track to increase manufacturing capacity by 20,000m(3) by December 2017;

-- Significant progress has been made towards completion of the

proposed Tricoya consortium with BP and Medite with final

agreements, including funding from third parties, expected later

this year; and

-- Detailed planning progressing in respect of the wood chip

acetylation plant to be located in Hull.

Paul Clegg, Chief Executive commented: "In this financial period

we have made further significant strategic and operational progress

to increase our Accoya and Tricoya manufacturing capacity which

will be transformational for the Group. The expansion of the Accoya

plant in Arnhem and the formation of the Tricoya consortium are

both fundamental for the future of the Company. Despite results

being down on the previous half year, we remain confident of the

results for the full year and beyond."

There will be a presentation relating to these results at 10:00

GMT on 22 November 2016. The presentation will take the form of a

web based conference call, details of which are below:

Webcast link:

Click here or copy and paste ALL of the following text into your

browser:

http://edge.media-server.com/m/p/bcsg2woj

Conference call details for participants:

Confirmation Code: 2293862

Participants, Local - London, United

Kingdom: +44(0)20 3450 9987

Participants, National free phone - United

Kingdom: 0800 279 4992

Participants will have to quote the above code when dialling

into the conference.

For further information, please contact:

Accsys Technologies Paul Clegg, CEO via MHP Communications

PLC Hans Pauli, Executive Director,

Corporate Development

Will Rudge, FD

Nominated Adviser: Oliver

Cardigan

Jamie Lillywhite

Corporate Broking: Christopher

Wilkinson +44 (0) 20 7260

Numis Securities Ben Stoop 1000

Tim Rowntree +44 (0) 20 3128

MHP Communications Kelsey Traynor 8100

Frank Neervoort +31 681 734 236

Off the Grid (The Netherlands) Yvonne Derkse +31 622 379 666

Accsys Technologies PLC

Chairman's statement

Overview

We have made good progress in the period, in particular with two

major projects intended to significantly increase manufacturing

capacity for Accoya and Tricoya. These will ultimately enable us to

substantially increase our revenue, through additional capacity and

generate profitability whilst enabling us to exploit our products

and technologies in what we continue to believe is a very

significant market.

Sales of Accoya continued to grow with total sales volumes

increasing by 4% to 17,506m(3) . We experienced supply bottleneck

issues in the period which, although these have now been resolved,

will necessitate further investment in inventory going forward.

Further sales growth is expected in the second half of the year.

This will continue to be constrained until the expansion of our

manufacturing facility in Arnhem is completed. Total revenue

decreased by 5% to EUR25.1m (2015: EUR26.3m) largely as result of

an expected reduction in lower income associated with our licensing

contract with Solvay.

Group EBITDA was a loss of EUR1.3m for the period with the

reduction from last year primarily resulting from the lower licence

related income noting that the prior year included EUR1.8m of

one-off licensing related income. In addition, profitability was

impacted by the timing of our annual maintenance stop moving back

to September compared to October last year, together with a

proportion of Accoya sales sold at lower prices to Solvay from

January 2016 following their assumption of responsibility for sales

and marketing and the commencement of the 76,000m(3) five year

off-take agreement. Operating costs increased by 9% in the period

to EUR10.2m largely as a result of business development activities

as we actively pursued long term opportunities and incurred one-off

advisory fees.

Our cash balance decreased to EUR7.9m at 30 September 2016 from

EUR8.2m at 31 March 2016. A EUR2.7m cash out-flow was partly

attributable to the loss in the period, and also impacted by a

EUR1.1m working capital out-flow. EUR1.8m was invested during the

period in our existing manufacturing operations together with the

initial stages and planning work associated with the Arnhem

expansion and the proposed Tricoya plant. This was off-set by

EUR4.2m proceeds from the sale of our land adjacent to our plant in

Arnhem, which also resulted in a gain on disposal of EUR0.6m.

We have commenced construction work in respect of the expansion

of our Accoya manufacturing plant in Arnhem. We have obtained all

necessary permits, completed the sale and leaseback of our land and

placed orders for key long lead time items of equipment. Work has

commenced on site and we appointed Fabricom B.V. as the

Engineering, Procurement and Construction contractor enabling the

third reactor to be built by the end of 2017, increasing our

manufacturing capacity by 50% to approximately 60,000m(3) .

We have also made significant progress towards the completion of

the proposed Tricoya consortium with BP and Medite, to build and

operate the world's first wood chip acetylation plant on the

Saltend Chemicals Park in Hull. The parties expect to finalise the

detailed agreements associated with the site and the consortium by

the end of this year. In addition, substantial progress has been

made in respect of the remaining funding, with term sheets obtained

in respect of bank debt and non-binding heads of terms agreed with

third party funders which are expected to enable the consortium to

proceed. Under these arrangements Accsys is expected to retain the

majority ownership of the consortium and consolidate its

results.

Outlook

I am pleased by the progress made towards achieving additional

manufacturing capacity for both Accoya and Tricoya. I believe these

represent key milestones in our ambition to maximise the value

associated with our technologies, and will enable us to meet the

demand for our products, with significant benefits to our

profitability.

Demand for Accoya and Tricoya remains strong and we were

disappointed that we could not satisfy demand in the first half due

to the supply bottleneck issues. These are now resolved and we

expect sales volumes to continue to grow in the immediate term,

although such growth will be limited until our new manufacturing

capacity comes on stream.

Overall, I continue to be confident that we are in a strong

position and look forward to reporting further progress in respect

of the Tricoya consortium in the near future.

Patrick Shanley

Chairman

21 November 2016

Accsys Technologies PLC

Chief Executive's statement

Introduction

Accsys has taken important steps towards securing additional

manufacturing capacity and in turn being able to meet the

substantial opportunity which exists to monetise our products and

technology.

We have been very busy progressing the two major projects for

the Group; the expansion of our Accoya manufacturing plant and the

completion of the proposed Tricoya consortium to build the new

Tricoya Plant in Hull. Demand remains strong for Accoya and we have

been focused on ensuring the additional manufacturing capacity is

built by the end of the next calendar year to meet this demand and

grow sales.

Progress with Accoya(R) manufacturing and sales

Revenue from the sale of Accoya(R) increased by 3% to EUR22.5m

in the first half of the year compared to a particularly strong

period in the previous year. The increase was attributable to a 4%

increase in Accoya volumes sold to 17,506m(3) . The relatively

small increase reflects supply chain bottleneck issues that

resulted in us being unable to meet some sales potential. These

issues are now resolved but in the future we will need to invest in

further inventory as sales grow. We will continue to manage demand

as we approach the maximum capacity of our existing manufacturing

plant.

Demand for Accoya continues to remain strong, and we continue to

believe the overall market opportunity is in excess of 1 million

m(3) annually. It remains very strong in the UK with no impact from

the Brexit result having so far been evident. We have previously

reported that the Benelux economies experienced a prolonged period

of downturn in the construction industry and some of our customers

were particularly impacted. We are now seeing an improvement and

increased level of activity with sales increasing in Belgium, but

with sales and marketing in the Netherlands requiring additional

focus that is now under way.

Sales in Solvay's region, covering key states in central Europe

and Scandinavia, decreased following the immediate transition of

responsibility to Solvay on 1 January 2016, however we are pleased

that the transition has otherwise gone smoothly and we expect sales

to increase in the immediate future. Sales to North America have

increased strongly following the addition of new sales team members

last year and we continue to believe the region represents a

substantial opportunity in the longer term.

We have 61 Accoya distributor, supply and agency agreements in

place covering most of Europe, Australia, Canada, Chile, China,

India, Israel, Mexico, Morocco, New Zealand, South Africa, parts of

South-East Asia and Middle-East and the USA.

The gross manufacturing margin of 25%, which compared to 30% in

the same period last year, was impacted by the timing of our annual

maintenance stop and pricing. No price increases were implemented

in the period, however sales to Solvay from 1 January 2016 were at

a lower price to reflect Solvay taking responsibility for sales and

commitment to buy a minimum of 76,000m(3) over a five-year

period.

Our annual maintenance period, during which no Accoya is

produced, took place in September 2016 compared to October 2015,

resulting in increased costs in this period. The underlying

manufacturing margin however continues to benefit from economies of

scale associated with higher manufacturing volumes and this is

expected to improve in the second half of the year. The 25% margin

represents an increase compared to the 23% recorded in the second

half of the last financial year.

The manufacturing segment's profitability helps demonstrate the

potential returns achievable from manufacturing Accoya(R) on an

even larger scale. This will be particularly relevant when we

benefit from the economies of scale expected from operating a

larger plant. Also our profitability has been impacted by

significant volumes (approximately 16% of total Accoya(R) volume in

the period (2015: 18%)) sold to Medite at lower prices, reflecting

the on-going Tricoya market development activities as well as the

reduced prices for Accoya sold to Solvay under the five year

off-take agreement.

Expansion of Accoya capacity in Arnhem

We have made good progress in respect of the expansion of our

Accoya manufacturing plant in Arnhem. During the period we have

obtained all necessary permits, which has enabled us to start work

on site.

We completed the sale of the land adjacent to our existing plant

to the same purchaser who acquired the existing plant's land and

buildings in 2011 and 2012. The sale resulted in proceeds of

EUR4.2m and a gain on sale of the land of EUR0.6m. The landlord has

commenced work on building a warehouse and new office building

which will connect to our existing plant and enable us to operate

the expanded plant more efficiently.

We have placed the order for the third reactor, a key item of

equipment with a long lead-time. In addition, we have recently

appointed Fabricom B.V. as the EPC (Engineering, Procurement and

Construction) contractor who will carry out the majority of the

work on site. The expansion is expected to be complete by the end

of 2017 with sales growth expected to increase thereafter. This is

expected to initially include increased sales to Medite to enable

further market development ahead of the dedicated wood chip

acetylation plant in Hull becoming operational.

The expansion involves the addition of a third reactor which

will increase the capacity of the plant to approximately 60,000m(3)

, enabling Accoya manufacturing revenue to increase to in excess of

EUR80m over time. In addition, this first stage of the expansion

includes the full chemical infrastructure in readiness for a fourth

reactor to be added at a later date when needed, increasing

capacity by a further 20,000m(3) . The capital expenditure for this

first stage of the expansion is being funded by a loan from Solvay,

incremental fees due from Solvay, including fees expected in the

second half of the financial year, together with the Group's

internal financial resources.

The expansion allows the market development of Accoya to

continue at the fastest pace possible, increasing the certainty of

supply for Accoya customers and users. It also enables Accsys to

continue to develop global markets effectively, building on the

expertise that it has developed over the last few years.

The significant market opportunity also requires us to invest in

developing our supply chain to ensure that Accsys is able to secure

our necessary raw materials to meet the demand over the longer

term.

Tricoya Technologies Limited ('TTL')

In February 2016 we announced BP's participation in the proposed

consortium (the 'Consortium') to fund, build and operate the

world's first Tricoya(R) wood elements acetylation plant. Accsys

and BP Ventures ('BPV') agreed initial funding in respect of the

Consortium, with BPV acquiring an initial 3% equity interest in

Tricoya Technologies Limited , implying a valuation of TTL at EUR35

million.

Since then, significant progress has been made with our

Consortium partners, BP and Medite, in respect of detailed planning

and the agreements associated with the Consortium and the proposed

wood chip acetylation plant. The Hull plant will have an initial

capacity of 30,000 tonnes per annum (tpa) (sufficient to

manufacture 40,000m(3) of panels) with scope for expansion. A

minimum of 40% of the plant's output is expected to be sold to

Medite under committed take-or-pay agreements, which corresponds to

break-even cash flow level. The plant is expected to cost

approximately EUR62m, with a further EUR14m required for continued

market seeding, operations, marketing, IP development and

engineering functions.

Final agreements relating to the Consortium, the site, the

supply of chemicals from BP and the off-take agreement with Medite

are expected to be completed by the end of the year. BP and Medite

are also expected to invest a total of EUR30m with the remainder

funded by third parties, including bank debt. In this respect, the

Consortium has also made good progress on securing finance with

term sheets received from a number of providers of project finance

debt and heads of terms agreed with further third party providers

of finance which is expected to result in sufficient funding to

allow the Consortium to be completed. The agreements are expected

to result in Accsys consolidating the Consortium, retaining a

majority ownership of the shares.

Subsequent to the period end, the Consortium parties agreed

further interim funding to enable the next stages of the project to

progress, including the land clearance of the site in Hull and

initial steps associated with the detailed engineering.

Medite Tricoya(R) has continued to be manufactured during the

period using Accoya sold by Accsys to Medite using a temporary

process, pending construction of the dedicated Tricoya plant. This

has enabled sales of Medite Tricoya to grow, with sales volumes of

Medite Tricoya panels increasing by 39% in the calendar year to

September. The increasing sales continue to support our belief that

in time, sales of Tricoya panels could exceed 1.6 million m(3) per

annum.

Intellectual property

Accsys has increased its number of patent applications in the

recent period by expanding its patent families to 23, including

those relating to Tricoya(R) . Applications filed now number 198,

filed in 43 countries. To date 45 patents have been granted in

various countries throughout the world.

Our principal trademark portfolio remains unchanged with our

brands Accoya(R) , Tricoya(R) , the Trimarque device and Accsys(R)

, including transliterations in Arabic, Chinese and Japanese,

protected by registration in 56 countries.

The Company continues to invest in the generation and protection

of valuable know-how and confidential information relating to its

products and processes.

Outlook

The start of our Accoya plant expansion is a key milestone for

the Company. The initial 50% increase in capacity will help us to

meet customer demand and will also increase our profitability as we

benefit from economies of scale and strive to improve our

manufacturing efficiency. This will strengthen Accsys financially

and will better position us to take advantage of the significant

opportunity that we continue to believe exists to monetise our

intellectual property.

The proposed Tricoya Consortium is an exciting prospect and the

parties are working hard to conclude the necessary agreements and

funding later this year, which will enable the first plant to be

built. This would represent a further significant increase in our

overall manufacturing capability and another route to monetise our

intellectual property.

In the shorter term we will continue to grow the Accoya market

in key regions by focusing on sales and marketing activities, which

enable us to develop underlying demand and market acceptance while

at the same time managing the demand ahead of new capacity becoming

on stream by the end of next year.

Paul Clegg

Chief Executive

21 November 2016

Accsys Technologies PLC

Financial Review

Statement of comprehensive income

Group revenue decreased by 5% to EUR25.1m for the six months

ended 30 September 2016 (2015: EUR26.3m). Manufacturing revenue

increased by 1% to EUR24.4m, with revenue from Accoya(R) increasing

by 3% to EUR22.5m, largely as a result of higher sales volumes.

Included in this is revenue attributable to Medite for the

manufacture of Tricoya(R) , which decreased by 2% to EUR2.7m (2015:

EUR2.8m) largely due to timing of deliveries, noting that Medite's

own sales continued to grow in excess of 30%. Licensing and

business development revenue of EUR0.7m (2015: EUR2.2m) was

attributable to our Accoya licensee, Solvay, in respect of the

commencement of the Arnhem expansion and marketing services. The

prior year included EUR1.3m in respect of the expired Global

Marketing agreement with Solvay with a further EUR0.5m of income

recorded in respect of monies received attributable to the Tricoya

project, neither of which was repeated in the current period.

Gross margin decreased from 36% to 27% compared to the same

period in the previous year largely due to the reduction in licence

related income as described above and an increase in cost of sales.

Gross manufacturing margin decreased from 30% to 25% due to the

impact of the timing of the annual maintenance stop, noting that

the gross manufacturing margin in the second half of the last

financial year, which included the annual maintenance stop, was

23%. In addition there was a reduction in pricing to Solvay

effective from 1 January 2016 on the assumption by Solvay of

responsibility for sales and marketing associated with their

76,000m(3) five-year off-take agreement.

Other operating costs, increased from EUR9.4m to EUR10.2m. Staff

costs increased by EUR0.2m to EUR4.8m due to annual inflation

salary increases, an increase in headcount and a change to

management bonuses in which a larger proportion was paid in cash

rather than deferred shares compared to previous periods. This

increase was mitigated as our UK cost base benefited from the

strengthening of the Euro against Sterling during the period. The

Group has undertaken various business development projects

including incurring costs associated with the Arnhem expansion, the

proposed Tricoya consortium and pursuing other long term

opportunities which also contributed to the increase by EUR0.4m.

The remaining increase in costs was largely attributable to

corporate head office costs.

Research and development costs decreased from EUR0.8m to EUR0.6m

as a result of an increase in internal activities which have been

capitalised as intangible assets. See note 7.

Full details of TTL's results have been included in note 6.

Group average headcount increased from 119 in the period to 30

September 2015, to 120 in the period to 31 March 2016 and 124 in

the period to 30 September 2016, with the increase predominantly

attributable to temporary staff supporting the two major

projects.

The increase in the loss before tax by EUR2.8m to EUR2.9m (2015:

EUR0.1m) can largely be attributed to the lower revenue and gross

margin.

The tax charge of EUR0.4m (2015: EUR0.2m) is based on our

expected tax rate for the year and is attributable to the profits

arising from manufacturing operations, offset by expected research

and development tax credits.

Cash flow and financial position

At 30 September 2016, the Group held cash balances of EUR7.9m,

representing a EUR0.3m reduction compared to 31 March 2016. The

reduction in cash in the period is attributable to an increase in

working capital of EUR1.1m, investment in tangible and intangible

fixed assets of EUR1.8m, out-flows from operating activities of

EUR1.5m and offset by the proceeds from the sale of land of

EUR4.2m.

Cash out-flow from operating activities before changes in

working capital of EUR1.5m represented a decrease compared to

EUR1.8m cash in-flow in the equivalent period in the previous year,

reflecting the underlying decline in profits of the Group. The

change in working capital in the six months to September 2016 of

EUR1.1m (2015: EUR3.3m) included an increase relating to

inventories of EUR1.7m in the period due to the expected increase

in sales in the second half of the year and our need to build

inventory levels generally to satisfy customer demand. There was

also an increase in trade and other receivables of EUR0.8m and

trade and other payables of EUR1.4m due to shorter-term working

capital fluctuations.

Investment in tangible fixed assets of EUR1.5m (2015: EUR0.7m)

consisted predominantly of equipment and services in respect of the

Accoya plant expansion and equipment subsequently installed during

the maintenance stop in September which is expected to result in

improved efficiency and reliability of the plant. EUR0.2m of

capitalised internal development costs consisted predominantly of

capitalised costs in respect of Tricoya Technologies Limited (2015:

EUR1.2m, included capitalised costs associated with the

pre-construction engineering for the Hull plant).

Trade and other receivables increased to EUR6.4m (2015: EUR4.3m)

largely as a result of an increase in pre-paid inventory due to be

received shortly after the period end in order to satisfy the

expected higher sales in the second half of the year compared to

the second half of the prior year. Inventory otherwise decreased

marginally to EUR10.2m compared to September 2015 (2015:

EUR10.3m).

The increase in trade and other payables to EUR9.5m (2015:

EUR8.1m) includes the expenses associated with various projects

currently being undertaken by the Group such as the Arnhem plant

expansion, Tricoya Technologies Limited plant construction and

business development activities.

Risks and uncertainties

The Group's principal risks and uncertainties are unchanged from

those set out in its 2016 Annual Report. In addition, as described

above, there is a risk associated with ensuring that our supply

chain is able to meet the demand associated with the increasing

sales. The Group expects to further invest in inventory going

forward as part of the strategy to ensure there are no supply chain

bottlenecks.

Going concern

These condensed consolidated financial statements are prepared

on a going concern basis, which assumes that the Group will

continue in operational existence for the foreseeable future, which

is deemed to be at least 12 months from the date these interim

results were approved. As part of the Group's going concern review,

the Directors have reviewed the Group's trading forecasts and

working capital requirements for the foreseeable future. These

forecasts indicate that, in order to continue as a going concern,

the Group is dependent on achieving certain operating performance

measures relating to the production and sales of Accoya(R) wood

from the plant in Arnhem and the collection of on-going working

capital items in line with internally agreed budgets.

The Directors have considered the internally agreed budgets and

performance measures and believe that appropriate controls and

procedures are in place or will be in place to make sure that these

are met. The Directors believe, while some uncertainty inherently

remains in achieving the budget, in particular in relation to

market conditions outside of the Group's control, that there are a

sufficient number of alternative actions and measures that can be

taken in order to achieve the Group's medium and long term

objectives.

Therefore, the Directors believe that the going concern basis is

the most appropriate basis on which to prepare the financial

statements.

William Rudge

Finance Director

21 November 2016

Accsys Technologies PLC

Directors responsibility statement

The Directors confirm to the best of their knowledge:

-- The Group financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRSs') as adopted by the European Union and Article 4 of the IAS

Regulation and give a true and fair view of the assets,

liabilities, financial position and profit or loss of the

Group.

-- The interim results include a fair review of the information

required by DTR 4.2.7R being an indication of important events that

have occurred during the first six months of the financial year and

a description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- The interim Management Report (Narrative) include a fair

review of the information required by DTR 4.28R being disclosure of

related party transactions and changes therein since the last

annual report.

By order of the Board

Angus Dodwell

Company Secretary

21 November 2016

Accsys Technologies PLC

Consolidated interim statement of comprehensive income for the

six months ended 30 September 2016

Note Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Total Total Total

Accoya(R) wood revenue 22,534 21,862 43,466

Licence revenue 500 328 2,849

Other revenue 2,025 4,104 6,454

--------------------------- ----- ---------- ---------- ----------

Total revenue 2 25,059 26,294 52,769

Total cost of sales (18,236) (16,916) (34,597)

Gross profit 6,823 9,378 18,172

Other operating costs 3 (10,176) (9,389) (18,460)

Other gains 4 601 - -

Loss from operations (2,752) (11) (288)

Finance income 1 16 13

Finance expense (104) (98) (191)

Loss before taxation (2,855) (92) (466)

Tax charge (373) (240) (402)

Loss for the period (3,228) (332) (868)

---------- ---------- ----------

Gain arising on

translation of foreign

operations - 33 (27)

Total comprehensive

loss for the period (3,228) (299) (895)

========== ========== ==========

Total comprehensive

loss for the year

is attributable to:

Owners of Accsys

Technologies PLC (3,186) (299) (885)

Non-controlling interests (42) - (10)

Total comprehensive

loss for the period (3,228) (299) (895)

========== ========== ==========

Basic and diluted

loss per ordinary

share 5 EUR(0.04) EUR(0.00) EUR(0.01)

The notes set out on pages 15 to 24 form an integral part of

these condensed financial statements.

Accsys Technologies PLC

Consolidated interim statement of financial position at 30

September 2016

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

Note 2016 2015 2016

EUR'000 EUR'000 EUR'000

Non-current assets

Intangible assets 7 10,945 10,965 10,980

Property, plant and

equipment 8 16,914 19,201 20,272

27,859 30,166 31,252

---------- ---------- ----------

Current assets

Inventories 10,184 10,272 8,345

Trade and other receivables 6,441 4,267 5,647

Cash and cash equivalents 7,866 7,501 8,186

Corporation tax 545 470 412

25,036 22,510 22,590

---------- ---------- ----------

Current liabilities

Trade and other payables (9,455) (8,136) (8,063)

Obligation under finance

lease (347) (265) (354)

Corporation tax (1,929) (1,132) (1,425)

(11,731) (9,532) (9,842)

---------- ---------- ----------

Non-current liabilities

Obligation under finance

lease (1,868) (1,759) (1,947)

(1,868) (1,759) (1,947)

---------- ---------- ----------

Net current assets 13,305 12,978 12,748

Total net assets 39,296 41,385 42,053

Equity and reserves

Share capital - Ordinary

shares 9 4,531 4,489 4,495

Share premium account 128,792 128,779 128,792

Other reserves 10 107,421 106,855 107,441

Retained deficit (201,586) (198,839) (198,842)

Own shares (34) (46) (47)

Foreign currency translation

reserve 153 147 153

Capital value attributable

to Accsys Technologies

PLC 39,277 41,385 41,992

Non-controlling interest

in subsidiary 19 - 61

Total equity 39,296 41,385 42,053

The notes set out on pages 15 to 24 form an integral part of

these condensed financial statements.

Accsys Technologies PLC

Consolidated interim statement of changes in equity for the 6

months ended 30 September 2016

Total

equity

Foreign attributable

currency to equity

Share trans- shareholders

capital Share Other Own lation Retained of the Non-Controlling Total

Ordinary premium reserves Shares reserve earnings company interests Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at

30 Sept 2015

(unaudited) 4,489 128,779 106,855 (46) 147 (198,839) 41,385 - 41,385

-

Total

comprehensive

income/(expense)

for the period - - - - 6 (526) (520) (10) (530)

Share based

payments - - - - - 523 523 - 523

Shares issued 6 - - (1) - - 5 - 5

Premium on

shares issued - 13 - - - - 13 - 13

Issue of

subsidiary

shares to

non-controlling

interests - - 586 - - - 586 71 657

Balance at

31 March 2016 4,495 128,792 107,441 (47) 153 (198,842) 41,992 61 42,053

========= ======== ========= ======== ========= ========== ============== ================= =================

Total

comprehensive

expense for

the period - - - - (0) (3,186) (3,186) (42) (3,228)

Share based

payments - - - - - 442 442 - 442

Shares issued 36 - - 13 - - 49 - 49

Issue of

subsidiary

shares to

non-controlling

interests - - (20) - - - (20) - (20)

Balance at

30 Sept 2016

(unaudited) 4,531 128,792 107,421 (34) 153 (201,586) 39,277 19 39,296

========= ======== ========= ======== ========= ========== ============== ================= =================

See note 8 for details concerning other reserves.

Non-controlling interests relates to the investment of BP

Ventures into Tricoya Technologies Limited (note 6)

The notes set out on pages 15 to 24 form an integral part of

these condensed financial statements.

Accsys Technologies PLC

Consolidated interim statement of cash flow for the six months

ended 30 September 2016

Unaudited Unaudited Audited

6 months 6 months Year End

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Loss before taxation (2,855) (92) (466)

Adjustments for:

Amortisation of intangible assets 276 254 524

Depreciation of property, plant and

equipment 1,090 1,075 2,148

Net (gain)/loss on disposal of property,

plant and equipment (601) (3) 35

Net Finance expense 103 82 177

Equity-settled share-based payment expenses 442 515 1,038

Cash outflows from operating activities

before changes in working capital (1,545) 1,831 3,456

Decrease/(Increase) in trade and other

receivables (765) 609 (714)

(Decrease)/Increase in deferred income (23) (1,586) (1,661)

(Decrease)/Increase in inventories (1,712) (2,379) (453)

(Increase)/Decrease in trade and other

payables 1,394 203 (176)

Net cash absorbed by operating activities

before tax (2,651) (1,322) 452

Tax (paid)/received (2) (2) 229

Net cash absorbed by operating activities (2,653) (1,324) 681

========== ========== =========

Cash flows from investing activities

Interest received 1 17 5

Expenditure on intangible assets (244) (1,206) (1,490)

Disposal of property, plant and equipment 4,223 2 3

Purchase of property, plant and equipment (1,507) (728) (2,565)

Net cash absorbed by investing activities 2,473 (1,915) (4,047)

========== ========== =========

Cashflows from financing activities

Repayment of finance lease (86) (39) (106)

Interest Paid (104) (98) (191)

Proceeds from issue of share capital 50 107 1,124

Share issue costs - - (44)

Net cash from financing activities (140) (30) 783

========== ========== =========

Net decrease in cash and cash equivalents (320) (3,269) (2,583)

Effect of exchange loss on cash and

cash equivalents - (16) (15)

Opening cash and cash equivalents 8,186 10,786 10,786

Closing cash and cash equivalents 7,866 7,501 8,186

========== ========== =========

The notes set out on pages 15 to 24 form an integral part of

these interim financial statements.

Accsys Technologies PLC

Notes to the financial statements for the 6 months ended 30

September 2016

1. Accounting policies

General Information

The principal activity of the Group is the production and sale

of Accoya(R) solid wood and exploitation of technology for the

production and sale of Accoya(R) wood and Tricoya(R) wood elements

via the Company's 100% owned subsidiaries, Titan Wood Limited,

Titan Wood B.V., Titan Wood Technology B.V., Titan Wood Inc. and

97% owned subsidiary, Tricoya Technologies Limited (collectively

the 'Group'). Manufactured through the Group's proprietary

acetylation processes, these products exhibit superior dimensional

stability and durability compared with alternative natural, treated

and modified woods as well as more resource intensive man-made

materials.

The Company is a public limited company, which is listed on AIM

in the United Kingdom and Euronext in the Netherlands, and is

domiciled in the United Kingdom. The registered office is

Brettenham House, 19 Lancaster Place, London, WC2E 7EN.

The condensed consolidated interim financial statements were

approved on 21 November 2016.

These condensed consolidated interim financial statements have

been reviewed, not audited.

Basis of accounting

The Group's condensed financial statements in these interim

results have been prepared in accordance with IFRS issued by the

International Accounting Standards Board as endorsed by the

European Union, in particular International Accounting Standard

(IAS) 34 "interim financial reporting". The financial information

for the six months ended 30 September 2016 and the six months ended

30 September 2015 is unaudited. The comparative financial

information for the full year ended 31 March 2016 does not

constitute the group's statutory financial statements for that

period although it has been derived from the statutory financial

statements for the year then ended. A copy of those statutory

financial statements has been delivered to the Registrar of

Companies and which were approved by the Board of Directors on the

14 June 2016. The auditors' report on those accounts was

unqualified and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

for the year ended 31 March 2016.

The accounting policies adopted are consistent with those of the

previous financial year except for taxes on income in the interim

periods which are accrued using the tax rate that would be

applicable to the expected total annual profit or loss.

Changes in accounting policies

No new accounting standards, amendments or interpretations have

been adopted in the period which have any impact on these condensed

financial statements, or are expected to affect the Group's 2017

Annual Report other than as noted below. The accounting policies

and methods of computation are consistent with those applied in the

31 March 2016 annual financial statements.

Going concern

These condensed consolidated financial statements are prepared

on a going concern basis, which assumes that the Group will

continue in operational existence for the foreseeable future, which

is deemed to be at least 12 months from the date these interim

results were approved. As part of the Group's going concern review,

the Directors have reviewed the Group's trading forecasts and

working capital requirements for the foreseeable future. These

forecasts indicate that, in order to continue as a going concern,

the Group is dependent on achieving certain operating performance

measures relating to the production and sales of Accoya(R) wood

from the plant in Arnhem and the collection of on-going working

capital items in line with internally agreed budgets.

The Directors have considered the internally agreed budgets and

performance measures and believe that appropriate controls and

procedures are in place or will be in place to make sure that these

are met. The Directors believe, while some uncertainty inherently

remains in achieving the budget, in particular in relation to

market conditions outside of the Group's control, that there are a

sufficient number of alternative actions and measures that can be

taken in order to achieve the Group's medium and long term

objectives. Therefore, the Directors believe that the going concern

basis is the most appropriate on which to prepare the financial

statements.

2. Segmental reporting

The Group's business is the development, commercialisation and

licensing of proprietary technology for the manufacture of

Accoya(R) wood, Tricoya(R) wood elements and related acetylation

technologies. Segmental reporting is divided between licensing

activities, the manufacturing and sale of Accoya(R) and research

and development activities.

Licensing, management

Result by Segment: and business development

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Revenue 714 2,205 5,422

Cost of sales - - -

Gross profit/(loss) 714 2,205 5,422

Other operating

costs (6,308) (5,420) (10,063)

Loss from operations (5,594) (3,215) (4,641)

Loss from Operations (5,594) (3,215) (4,641)

Depreciation

and amortisation 341 281 609

EBITDA (5,253) (2,934) (4,032)

---------------------- ---------- ---------- ---------

Manufacturing

---------------------------------

Revenue 24,345 24,089 47,347

Cost of sales (18,236) (16,916) (34,597)

Gross profit/(loss) 6,109 7,173 12,750

Other operating

costs (3,297) (3,205) (6,487)

Other gain 601 - -

Profit/(loss)

from operations 3,413 3,968 6,263

Profit/(loss)

from operations 3,413 3,968 6,263

Depreciation

and amortisation 1,057 1,022 2,016

EBITDA 4,470 4,989 8,279

---------------------- ---------- ---------- ---------

Research and development

---------------------------------

Revenue - - -

Cost of sales - - -

Gross profit/(loss) - - -

Other operating

costs (571) (764) (1,910)

Loss from operations (571) (764) (1,910)

Loss from Operations (571) (764) (1,910)

Depreciation

and amortisation 26 23 47

EBITDA (545) (741) (1,863)

---------------------- ---------- ---------- ---------

Total

---------------------------------

Revenue 25,059 26,294 52,769

Cost of sales (18,236) (16,916) (34,597)

Gross profit/(loss) 6,823 9,378 18,172

Other operating

costs (10,176) (9,389) (18,460)

Other gain 601 - -

Loss from operations (2,752) (11) (288)

Finance income 1 17 13

Finance expense (104) (98) (191)

Loss before

taxation (2,855) (92) (466)

Loss from Operations (2,752) (11) (288)

Depreciation

and amortisation 1,423 1,325 2,672

========== ========== =========

EBITDA (1,329) 1,314 2,384

---------------------- ---------- ---------- ---------

Licensing, Management and Business Development

Revenue is attributable to the licensing of the Group's

technology to third parties and other monies received in respect of

its business development activities.

Other operating costs include all remaining costs unless they

are directly attributable to Manufacturing or Research and

Development. This includes marketing, business development and the

majority of the Group's administration costs including the head

office in London (previously Windsor) as well as the US office.

Headcount = 27 (2015: 22)

Manufacturing

Revenue includes the sale of Accoya(R) and other revenue,

principally relating to the sale of acetic acid. All costs of sales

are allocated against manufacturing activities unless they can be

directly attributable to a licensee.

Other operating costs include depreciation of the Accoya plant

all other costs associated with the operation of the manufacturing

site, including directly attributable administration costs.

Headcount = 86 (2015: 84)

Research and Development

Costs are associated with various R&D activities associated

with Accoya(R) and Tricoya(R) products and processes.

Headcount = 12 (2015: 13)

Assets and liabilities cannot be readily allocated to the three

segments and therefore no additional segmental information has been

disclosed.

Analysis of revenue by geographical destination:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

UK and

Ireland 10,577 9,571 21,426

Rest of

Europe 5,924 7,868 14,085

Benelux 3,762 3,904 7,764

Americas 2,849 2,449 4,846

Asia-Pacific 1,814 2,345 4,382

Rest of

World 133 156 266

25,059 26,294 52,769

========== ========== =========

The segmental assets in the current and previous periods were

predominantly held in Europe. Additions to property, plant,

equipment and intangible assets in the current and previous periods

were predominantly incurred in Europe. Sales to UK and Ireland

included the sales to Medite.

3. Other operating costs

Other operating costs consist of the operating costs, other than

the cost of sales, associated with the operation of the plant in

Arnhem and the offices in Dallas and London (previously

Windsor).

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Sales and marketing 2,006 1,805 3,743

Research and development 571 764 1,863

Depreciation and amortisation 1,423 1,326 2,672

Other operating

costs 2,259 2,097 3,554

Administration

costs 3,917 3,397 6,628

10,176 9,389 18,460

=================== ========== =========

Administrative costs include costs associated with Business

Development and Legal departments, Intellectual Property as well as

Human Resources, IT, Finance, Management and General Office and

include the costs of the Group's head office costs in London

(previously Windsor) and the US office in Dallas.

The total cost of EUR10.2m in the current period includes

EUR1.4m in respect of Tricoya Technologies Limited ('TTL') compared

to EUR0.9m in the previous period.

The Group headcount increased from 119 during period to 30

September 2015 to 121 during period to 31 March 2016 and then to

125 to period to 30 September 2016.

During the period EUR0.2m of costs were capitalised and are

included within intangible fixed assets (2015: EUR1.2m). In

addition EUR0.3m of development costs have been capitalised and are

included within tangible fixed assets (2015: EUR0.5m) in relation

to the expansion of the manufacturing facility in Arnhem. The

previous period figure includes EUR1m in respect of the Tricoya(R)

Front End Engineering and Design Package.

4. Other gains

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Gain from disposal of land 635 - -

Net gain/(loss) from disposal

of equipment (34) - -

601 - -

========== ========== =========

Agreements were reached in August 2016 for the sale and

leaseback for the land in Arnhem resulting in proceeds of EUR4.2m

received in the period. A resulting gain of EUR635,000 was

recognised as a result of the book value of the land being lower

than the sale price. Under the arrangements, the landlord has

agreed to construct a new warehouse and office building which will

be connected to Accsys's existing manufacturing site. This building

will be built by the landlord and leased to Accsys over a 20 year

period with further option to renew. The landlord is the same

landlord that Accsys sold land and buildings to in 2011 and 2012

associated with the existing manufacturing plant.

5. Loss per share

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

Basic and diluted loss per share 2016 2015 2016

Total Total Total

Weighted average number of

Ordinary shares in issue ('000) 90,248 89,287 89,568

Loss for the period (EUR'000) (3,186) (332) (858)

Basic and diluted loss per share EUR(0.04) EUR(0.00) EUR(0.01)

========== ========== ==========

Basic and diluted losses per share are based upon the same

figures. Share options are considered anti-dilutive as these would

increase the loss per share.

6. Tricoya Technologies Limited

Tricoya Technologies Limited ('TTL'), was incorporated in order

to develop and exploit Accsys' Tricoya technology for use within

the worldwide panel products market estimated to be worth more than

EUR60 billion annually.

In February 2016 BP's participation in the proposed consortium

(the 'Consortium') to fund, build and operate the world's first

Tricoya(R) wood elements acetylation plant was announced. Accsys

and BP Ventures ('BPV') agreed initial funding in respect of the

Consortium, with BPV acquiring an initial 3% equity interest in

Tricoya Technologies Limited ('TTL'), implying a valuation of TTL

at EUR35 million today. The plant is expected to be located at the

Saltend Chemicals Park in Hull, UK, adjacent to BP's existing

acetyls facility.

Since then, significant progress has been made with our

Consortium partners, BP and Medite, in respect of detailed planning

and the agreements associated with the Consortium and the proposed

wood chip acetylation plant. The Hull plant will have an initial

capacity of 30,000 tonnes per annum (tpa) (sufficient to

manufacture 40,000m(3) of panels) with scope for expansion. A

minimum of 40% of the plant's output is expected to be sold to

Medite under committed take-or-pay agreements, which corresponds to

break-even cash flow level. The plant is expected to cost

approximately EUR62m, with a further EUR14m required for continued

market seeding, operations, marketing, IP development and

engineering functions.

Final agreements relating to the Consortium, the site, the

supply of chemicals from BP and the off-take agreement with Medite

are expected to be completed by the end of the year. BP and Medite

are also expected to invest a total of EUR30m with the remainder

funded by third parties, including bank debt. In this respect, the

Consortium has also made good progress on securing finance with

term sheets received from a number of providers of project finance

debt and heads of terms agreed with further third party providers

of finance which is expected to result in sufficient funding to

allow the Consortium to be completed.

Subsequent to the period end, the Consortium parties agreed

further interim funding to enable the next stages of the project to

progress, including the land clearance of the site in Hull and

initial steps associated with the detailed engineering.

There was increased activity in the current period in relation

to preparing to commence detailed work following completion of the

Consortium agreements. The increased cost consists of higher staff

costs, research and development and Intellectual Property.

During the period ended 30 September 2016, TTL has been fully

consolidated and the results are included as part of the overall

group results and included within the Business Development segment

as set out in Note 2.

Subsequent to the period end, the Consortium parties agreed

further interim funding to enable the next stages of the project to

progress, including the land clearance of the site in Hull and

initial steps associated with the detailed engineering.

The TTL results for the period from 1 April 2016 to 30 September

2016, together with the balance sheet as at 30 September 2016 are

set out below:

Income statement for TTL:

Consolidated Consolidated Consolidated

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Licence revenue - 75 75

Other income 23 30 243

Total revenue 23 105 318

============= ============= =============

Costs:

Staff costs 814 612 864

Research & development (excluding

staff costs) 38 60 142

Intellectual Property 338 151 303

Sales & marketing 26 18 214

Amortisation 84 66 143

Total operating costs 1,300 907 1,666

============= ============= =============

Finance income - - -

EBIT 1,277 802 1,348

============= ============= =============

Group share of EBIT 1,235 802 1,338

============= ============= =============

Tricoya Technologies Limited statement of financial position at

30 September 2016:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Non-current assets

Intangible assets 3,192 2,899 3,065

Current assets

Receivables due within one year 160 160 230

Cash and cash equivalents 298 117 1,519

Total current assets 458 277 1,749

---------- ---------- ---------

Current liabilities

Trade and other payables (2,404) (2,099) (2,220)

Net current assets (1,946) (1,822) (471)

---------- ---------- ---------

Net assets 1,246 1,078 2,594

========== ========== =========

97% attributable to Accsys Technologies

2016 (2015: 100%) 1,209 1,078 2,517

Less elimination of mark-up on recharged - (14) -

costs

========== ========== =========

Equity and reserves

Share capital 8,206 5,900 8,206

Accumulated loss (7,560) (5,422) (6,212)

Other reserves 600 600 600

Total equity 1,246 1,078 2,594

========== ========== =========

Intangible assets represents internal development costs

capitalised relating to the development of the Tricoya product and

production process, including Front End Engineering and Design

which has been undertaken in the period in respect of the first

Tricoya production plant envisaged to be funded, constructed and

operated by the proposed new Consortium.

7. Intangible assets

Internal Intellectual

Development property

costs rights Goodwill Total

EUR'000 EUR'000 EUR'000 EUR'000

Cost

At 31 March 2015 4,037 73,292 4,231 81,560

Additions 1,206 - - 1,206

At 30 September 2015 5,243 73,292 4,231 82,766

Additions 285 - - 285

At 31 March 2016 5,528 73,292 4,231 83,051

============ ============= ========= ========

Additions 241 - - 241

At 30 September 2016 5,769 73,292 4,231 83,292

============ ============= ========= ========

Accumulated amortisation

At 31 March 2015 358 71,188 - 71,546

Amortisation 117 138 - 255

At 30 September 2015 475 71,326 - 71,801

Amortisation 132 138 270

At 31 March 2016 607 71,464 - 72,071

============ ============= ========= ========

Amortisation 138 138 276

At 30 September 2016 745 71,602 - 72,347

============ ============= ========= ========

Net book value

At 30 September 2016 5,024 1,690 4,231 10,945

At 31 March 2016 4,921 1,828 4,231 10,980

At 30 September 2015 4,768 1,966 4,231 10,965

At 31 March 2015 3,679 2,104 4,231 10,014

8. Property, plant and equipment

Land and Plant Office

buildings and machinery equipment Total

EUR'000 EUR'000 EUR'000 EUR'000

Cost or valuation

At 31 March 2015 5,251 28,365 822 34,438

Additions - 682 46 728

Disposals - - (12) (12)

Foreign currency translation

(loss) - - (7) (7)

At 30 September 2015 5,251 29,047 849 35,147

Additions - 1,792 389 2,181

Disposals - (114) 1 (113)

Foreign currency translation

gain - - (1) (1)

At 31 March 2016 5,251 30,725 1,238 37,214

Additions - 1,343 53 1,396

Disposals (3,606) (64) - (3,670)

Foreign currency translation

(loss) - - 2 2

At 30 September 2016 1,645 32,004 1,293 34,942

=========== =============== =========== ========

Depreciation

At 31 March 2015 424 13,732 734 14,890

Charge for the period 59 971 45 1,075

Disposals - - (12) (12)

Foreign currency translation

(loss) - - (7) (7)

At 30 September 2015 483 14,703 760 15,946

Charge for the period 58 941 74 1,073

Disposals - (76) - (76)

Foreign currency translation

gain - - (1) (1)

At 31 March 2016 541 15,568 833 16,942

Charge for the period 59 947 84 1,090

Disposals - (6) - (6)

Foreign currency translation

(loss) - - 2 2

At 30 September 2016 600 16,509 919 18,028

=========== =============== =========== ========

Net book value

At 31 March 2015 4,827 14,633 88 19,548

At 30 September 2015 4,768 14,344 89 19,201

At 31 March 2016 4,710 15,157 405 20,272

At 30 September 2016 1,045 15,495 374 16,914

9. Share capital

In the period ended 30 September 2015:

Own shares represents 786,893 ordinary shares of EUR0.05 each in

the capital of the Company ("Ordinary Shares") issued to an

Employee Benefit Trust ('EBT') at nominal value on 30 June

2015.

On 6 July 2015, a total of 20,000 Ordinary Shares were issued to

employees under the Company's share option scheme.

In addition, of the 783,597 Ordinary Shares which had been

issued to the EBT at nominal value on 18 August 2014, 746,241

Ordinary Shares vested on 1 July 2015. Of these beneficiaries

elected to sell 390,683 Ordinary Shares in the market.

On 8 August 2015, a total of 27,825 Ordinary Shares were issued

and released to employees together with the 22,825 Ordinary Shares

issued to an employee trust on 8 August 2014 under the terms of the

Employee Share Participation Plan (the "Trust").

On 13 August 2015, a total of 63,909 Ordinary Shares were issued

to a trust under the terms of the Trust.

In the period ended 31 March 2016:

On 10 December 2015, a total of 16,123 Ordinary Shares were

issued to a Trust under the terms of the Employee Share

Participation Plan.

In the period ended 31 September 2016:

Own shares represents 673,355 Ordinary Shares issued to the EBT

at nominal value on 4 July 2016.

In addition, of the Ordinary Shares which had been issued to the

EBT previous year, 938,449 Ordinary Shares vested on 15 July 2016.

Of these beneficiaries elected to sell 498,318 Ordinary Shares in

the market.

On 15 August 2016, a total of 63,909 Ordinary Shares were issued

and released to various employees under the terms of the Employee

Share Participation Plan.

10. Other Reserves

Capital

redemp- Total

tion Warrant Merger Other Other

reserve reserve reserve reserve reserves

EUR000 EUR000 EUR000 EUR000 EUR000

Balance at 30 September 2015 148 - 106,707 - 106,855

Issue of subsidiary shares

to non-controlling interests (299) - - 885 586

Balance at 31 March 2016 (151) - 106,707 885 107,441

========= ========= ========= ========= ==========

Adjustment to liability relating

to non-controlling interests (20) - - - (20)

Balance at 30 September 2016 (171) - 106,707 885 107,421

========= ========= ========= ========= ==========

The opening balance from September 2015 of the capital

redemption reserve represents the amounts transferred from share

capital on redemption of deferred shares in a previous period. The

movement for the year ended 31 March 2016 and in the

current period reflects obligations arising from the investment

by BP Ventures into Tricoya Technologies Limited and that BP

Venture's on-going participation is conditional upon the

finalisation of the full proposed Consortium.

The merger reserve arose prior to transition to IFRS when merger

accounting was adopted.

The other reserve represents the amounts received for subsidiary

share capital from non-controlling interests (note 11).

11. Transactions with non-controlling interests

On 3 February 2016, TTL issued 500,000 Series A Preference

shares for the consideration of EUR1m for 3% equity share capital

of TTL. The carrying amount of the non-controlling interests in TTL

on the date of acquisition was EUR71,000. The Group recognised an

increase in other reserves in the prior period, as summarised

below.

Transactions with non-controlling Unaudited Unaudited Audited

interests

6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

EUR'000 EUR'000 EUR'000

Carrying amount of non-controlling

interests issued 885 - (71)

Consideration paid by non-controlling

interests - - 1,000

Share issue costs relating

to non-controlling interests - - (44)

Excess of consideration paid

recognised in Group's equity 885 - 885

========== ========== =========

12. Events occurring after the reporting period

On 24 October 2016, TTL issued further shares for the

consideration of EUR1m. EUR0.4m was contributed by Accsys with

EUR0.6m contributed by BP Ventures, bringing their total investment

to EUR1.6m.

Accsys Technologies PLC

Independent review report to Accsys Technologies PLC

Our conclusion

We have reviewed Accsys Technologies PLC's consolidated interim

financial statements (the "interim financial statements") in the

interim results for the six months ended 30 September 2016 of

Accsys Technologies Plc for the 6 month period ended 30 September

2016. Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the AIM Rules for

Companies.

What we have reviewed

The interim financial statements comprise:

-- the consolidated interim statement of financial position as at 30 September 2016;

-- the consolidated interim statement of comprehensive income for the period then ended;

-- the consolidated interim statement of cash flows for the period then ended;

-- the consolidated interim statement of changes in equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the interim results

for the six months ended 30 September 2016 have been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union and the AIM

Rules for Companies.

As disclosed in note 1 to the interim financial statements, the

financial reporting framework that has been applied in the

preparation of the full annual financial statements of the Group is

applicable law and International Financial Reporting Standards

(IFRSs) as adopted by the European Union.

Our responsibilities and those of the directors

The interim results for the six months ended 30 September 2016,

including the interim financial statements, is the responsibility

of, and has been approved by, the directors of the Company. The

directors are responsible for preparing the interim results for the

six months ended 30 September 2016 in accordance with the AIM Rules

for Companies which require that the financial information must be

presented and prepared in a form consistent with that which will be

adopted in the Company's annual financial statements.

Our responsibility is to express a conclusion on the interim

financial statements in the interim results for the six months

ended 30 September 2016 based on our review. This report, including

the conclusion, has been prepared for and only for the Company for

the purpose of complying with the AIM Rules for Companies and for

no other purpose. We do not, in giving this conclusion, accept or

assume responsibility for any other purpose or to any other person

to whom this report is shown or into whose hands it may come save

where expressly agreed by our prior consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the interim

results for the six months ended 30 September 2016 and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the interim financial

statements.

PricewaterhouseCoopers LLP

Chartered Accountants

London

21 November 2016

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFEILSLLFIR

(END) Dow Jones Newswires

November 22, 2016 02:01 ET (07:01 GMT)

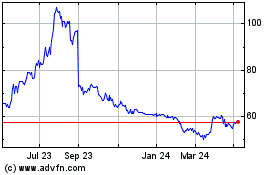

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

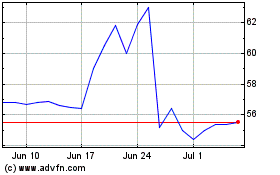

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Apr 2023 to Apr 2024