Abbott Labs Swings to Loss After Booking Charge on Mylan Stake -- 2nd Update

October 19 2016 - 2:52PM

Dow Jones News

By Joseph Walker and Anne Steele

The EpiPen pricing controversy roiling Mylan NV has ensnared

another large health care company, albeit indirectly.

Abbott Laboratories, Mylan's largest shareholder, said on

Wednesday that it had written down the value of its investment in

the EpiPen maker by $947 million to reflect a sharp decline in

Mylan's share price through the end of the quarter on September

30.

Abbott said the accounting charge contributed to a $329 million

loss in the quarter, or 22 cents a share, compared with a

year-earlier profit of $580 million, or 38 cents a share, a year

earlier.

For now, the write-down is only a paper loss, and could be

reduced or even erased if Mylan's share price rebounds before any

Abbott sale of the stock. Mylan declined to comment.

Abbott currently owns a roughly 13% stake in Mylan, or nearly 70

million shares.

Abbott has been Mylan's biggest shareholder since selling part

of its overseas pharmaceuticals operations to Mylan last year in

exchange for 110 million Mylan shares that were valued at $5.77

billion when the transaction closed. Abbott sold more than a third

of the shares last year for $2.29 billion.

Abbott Chief Executive Miles White has faced frequent questions

from analysts about when he would sell the remaining shares. Mr.

White said last year that Abbott intends to sell the shares at some

point, but that he was not in a hurry to do so.

In an April 2015 conference call with analysts, Mr. White noted

that Mylan's share price had already risen significantly since

completing the acquisition with Abbott.

"I think it's been prudent to hold it," Mr. White said on the

2015 call. "It's proven to be a great value-gainer for us." The

topic didn't come up on Wednesday's conference call. An Abbott

spokesperson declined to comment on the company's plans for the

Mylan stock.

But through September 30, Mylan shares had fallen about 27% from

the time Abbott acquired the stock. Mylan's stock has fallen 17%

over the past three months alone amid popular outrage and political

scrutiny of the company's substantial price increases for the

EpiPen emergency allergy treatment.

In the third quarter, Abbott's sales rose 3% to $5.3 billion.

Mr. White cited strong performance in established pharmaceuticals

and medical devices sales, which rose 5.3% and 6.4%, respectively.

However, sales slipped 2% in Abbott's nutrition segment, the

company's largest.

Abbott's adjusted profit -- excluding certain items including

the Mylan write-down -- and revenue topped expectations. Abbott

narrowed and raised at the midpoint its 2016 adjusted earnings view

to $2.19 to $2.21 a share, from a previous range of $2.14 to

$2.24.

In April, Abbott agreed to buy St. Jude Medical Inc. for $25

billion amid consolidation in the health-care sector. Companies are

responding to cost pressures by beefing up, increasing their

negotiating leverage and pricing power. St. Jude and Abbott have

said they expect the merger to close in the fourth quarter.

St. Jude Medical on Wednesday said its third-quarter revenue

rose, led by a 13% sales increase abroad, though profit edged

lower.

Write to Joseph Walker at joseph.walker@wsj.com and Anne Steele

at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 19, 2016 14:37 ET (18:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

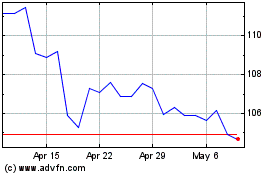

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

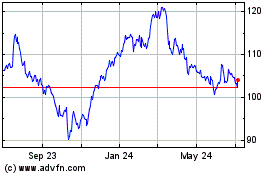

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024