AXA Sells U.K. Pensions and Direct Protection Businesses to Phoenix

May 27 2016 - 3:20AM

Dow Jones News

By Nick Kostov

PARIS-- AXA SA has agreed to sell its investment, pensions and

direct protection businesses in the U.K. to Phoenix Group Holdings

for GBP375 million ($549.77 million) in cash, part of the French

insurer's strategy to exit some parts of Europe and invest in

faster growing markets.

Phoenix, one of the largest providers of insurance services in

the U.K., said it would finance the deal through a combination of a

new share placing and new debt.

AXA, Europe's second-largest insurer, said last month it had

already agreed to sell one part of its U.K. business--an adviser

platform business called Elevate--to Standard Life PLC for an

undisclosed amount, as well as announcing the sale of its offshore

investment bonds business based in the Isle of Man in April.

Taken together, AXA has raised GBP632 million from the sale of

its entire U.K. life and savings business, the company said. It

said the divestments would reduce net profit by EUR400 million

($447.68 million).

AXA and its peers in Europe have been grappling with the

region's uncertain investment market and low interest rates that

have hurt its asset management and savings products. The deal is

part of the French insurer's strategy to exit parts of Europe to

then reinvest in faster growing markets and more profitable

businesses.

The transaction with Phoenix Group--which includes the sale of

AXA's direct protection business Sunlife in the U. K.--is expected

to close in the second half of 2016.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

May 27, 2016 03:05 ET (07:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

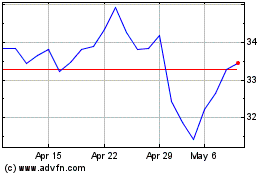

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024