Regulatory News:

THIS ANNOUNCEMENT AND THE INFORMATION HEREIN IS NOT FOR

RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY

OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA, THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

AVEVA Group PLC (“AVEVA”), one of the world's leading

providers of engineering design and information management

solutions, and Schneider Electric SE (“Schneider

Electric”)(Paris:SU) today announce that they have reached a

non-binding agreement on the key terms and conditions of an

acquisition of selected Schneider Electric industrial software

assets (including, among others, the former Invensys software

assets) (“Schneider Software”) by AVEVA (the

“Transaction”).

Schneider Software’s product portfolio offers solutions in

Process Engineering & Optimisation, Operations Planning &

Scheduling, Operations Execution Management, Asset Management,

Operations Control and Information Management.

AVEVA will acquire Schneider Software on a debt-free cash-free

basis and receive from Schneider Electric upon completion £550

million for consideration of new AVEVA shares to be issued to

Schneider Electric, such that Schneider Electric will own 53.5% of

the Enlarged AVEVA Group’s (as defined below) fully diluted share

capital immediately post completion. Based on the current AVEVA

share price, the c. 74.0 million AVEVA shares to be issued to

Schneider Electric as part of the Transaction have a current market

value of c. £1.3 billion. The cash payment (described above) from

Schneider Electric will be distributed upon completion (together

with AVEVA’s net excess cash, as described below) to AVEVA’s

shareholders (excluding Schneider Electric).

Given the relative size of Schneider Software and AVEVA, the

Transaction will be classified as a reverse takeover of AVEVA under

the Listing Rules of the UK Listing Authority (the “UKLA”).

Certain information on Schneider Software has been provided by

Schneider Electric and is included in the Additional Information

section of this announcement.

Strategic rationale and other benefits of the

Transaction

The Directors of AVEVA and Schneider Electric believe that there

is a clear and compelling industrial logic and strategic rationale

for a combination of AVEVA and Schneider Software (forming, the

"Enlarged AVEVA Group"). The Transaction will, among other

things:

- Create a global leader in industrial

software, with scale and relevance in key-markets and a best in

class technology portfolio with combined revenues and Adjusted

EBITA of c. £534 million and c. £130 million, respectively;

- Provide a comprehensive integrated

offering through its combined product portfolio – including among

others Schneider Electric’s SimSciTM, WonderwareTM and AvantisTM

solutions alongside AVEVA PDMSTM, AVEVA Everything3DTM and AVEVA

NETTM – creating a holistic and more visible value proposition

enabling the Enlarged AVEVA Group to better navigate specific

cycles by covering all aspects of the Digital Asset lifecycle

through Process Simulation, detailed 3D Design, Asset Data

Management, Operations Management and Asset Performance Management

for large, complex engineering projects in the process and plant

industries;

- Diversify AVEVA’s end-markets,

enhancing its position in Oil & Gas, Power and Marine while

adding leading positions in other verticals including Chemicals,

Food and Beverage, Mining, Water and Waste Water, and

Pharmaceuticals thereby substantially enlarging the total

addressable market;

- Improve geographic and end market

coverage, with AVEVA benefitting from Schneider Software’s exposure

to the Americas market (the Americas will contribute approximately

36% of revenues in the Enlarged AVEVA Group versus 18% of AVEVA’s

revenues today);

- Create additional value for

shareholders through the potential for material revenue and cost

synergies;

- Provide an exciting commercial

opportunity for the Enlarged AVEVA Group to leverage Schneider

Electric’s multiple go-to-market channels;

- Position the Enlarged AVEVA Group as a

strong player best able to continue to take advantage of future

M&A opportunities;

- Create a compelling equity story,

underpinned both by an enhanced strategic positioning and a

strengthened financial profile for the Enlarged AVEVA Group;

and

- Establish a "best-in–class" management

team and increased brand profile for attracting further

talent.

Key terms of the Transaction

The key terms are set out below and the Transaction is subject

to, inter alia, mutual due diligence, the agreement and execution

of legally binding documentation and approval by the Boards of

AVEVA and Schneider Electric:

- AVEVA will acquire Schneider Software

on a debt-free cash-free basis and receive from Schneider Electric

upon completion £550 million for consideration of new AVEVA shares

to be issued to Schneider Electric, such that Schneider Electric

will own 53.5% of the Enlarged AVEVA Group’s fully diluted share

capital immediately post completion. Based on the current AVEVA

share price, the c. 74.0 million AVEVA shares to be issued to

Schneider Electric as part of the Transaction have a current market

value of c. £1.3 billion. The cash payment (described above) from

Schneider Electric will be distributed upon completion (together

with AVEVA’s net excess cash, as described below) to AVEVA’s

shareholders (excluding Schneider Electric);

- On completion, AVEVA shareholders will:

- Retain a 46.5% ownership of the

Enlarged AVEVA Group, with combined revenues and Adjusted EBITA of

c. £534 million and c. £130 million, respectively;

- Receive a cash payment of £550 million

(to be paid by Schneider Electric to AVEVA and subsequently

distributed to AVEVA shareholders, excluding Schneider Electric),

being equivalent to £8.55 per AVEVA share on a fully diluted basis

and representing 48% of AVEVA’s fully diluted market capitalisation

as at 17 July 2015 (being the closing price on the latest date

practicable prior to publication of this announcement);

- Receive any net excess cash held on

AVEVA’s balance sheet to be paid to AVEVA shareholders (excluding

Schneider Electric), such excess cash being calculated by reference

to future cash requirements of the Enlarged AVEVA Group and after

adjustment for post-tax pension provisions and other debt related

items, in each case as to be agreed between AVEVA and Schneider

Electric; and

- Have an opportunity to benefit further,

through their shareholding, from the revenue and cost synergies

which are expected to arise from the combination of the two

businesses, and their resulting enhanced market presence;

- It is intended that the Enlarged AVEVA

Group will continue to be admitted to listing on the Official List

of the UKLA (“Official List”) and to trading on the London

Stock Exchange plc’s main market for listed securities;

- The Board of the Enlarged AVEVA Group

will be constituted as follows:

- The existing Board of Directors of

AVEVA to remain in place on completion. Specifically, Philip Aiken

(AVEVA’s Chairman), Richard Longdon (AVEVA’s CEO) and James Kidd

(AVEVA’s CFO) will remain in place following completion, in order

to drive the strategy, implementation and integration of Schneider

Software;

- Two additional non-executive directors

proposed by Schneider Electric to be appointed to the Board of the

Enlarged AVEVA Group on completion;

- In order for the Board of the Enlarged

AVEVA Group to comprise a majority of independent non-executive

directors (including the Chairman), one additional independent

non-executive director proposed by AVEVA to be appointed on or

shortly after completion;

- The Board of the Enlarged AVEVA Group

will continue to have an independent non-executive Chairman for a

period of not less than two years following completion. Thereafter,

Schneider Electric will have the right to appoint the Chairman from

one of its two non-executive directors. The Chairman of a meeting

of the Board of the Enlarged AVEVA Group will have a casting vote

in case of equality of votes on questions arising at any

meeting;

- The Vice Chairman of the Board of the

Enlarged AVEVA Group to be appointed from one of Schneider

Electric’s two non-executive directors on completion; and

- A new COO will be appointed from

Schneider Software but will not be appointed to the Board of the

Enlarged AVEVA Group;

- Schneider Electric will agree to

maintain AVEVA’s progressive dividend policy;

- There will be a standstill period for:

- Two years post completion of the

Transaction during which Schneider Electric cannot increase its

shareholding above 53.5% of the Enlarged AVEVA Group’s fully

diluted share capital or vote in favour of a de-listing of the

Enlarged AVEVA Group without the approval of the majority of the

Enlarged AVEVA Group’s non-executive independent directors;

- A further 18 months period thereafter

during which Schneider Electric cannot increase its shareholding to

75% or above of the Enlarged AVEVA Group’s fully diluted share

capital without the approval of the Enlarged AVEVA Group’s

non-executive independent directors, other than by way of a general

offer under the City Code on Takeovers and Mergers (the “City

Code”), provided that such offer is:

- At an offer price not less than a 20%

premium to the 30-day volume weighted average of the Enlarged AVEVA

Group’s share price at the time of the first announcement of the

general offer and is recommended by a majority of the Enlarged

AVEVA Group independent non-executives (or include an acceptance

condition which requires the acceptance of the offer by a majority

of the other shareholders in the Enlarged AVEVA Group); or

- Recommended by a majority of the

Enlarged AVEVA Group’s non-executive independent directors;

- Thereafter, Schneider Electric will be

under no restrictions on further acquisitions of shares or offers,

nor be required to maintain the Enlarged AVEVA Group’s

listing;

- Schneider Electric intends to comply

with the Listing Rules of the UKLA and will enter into a

relationship agreement with the Enlarged AVEVA Group on completion.

Under the terms of the relationship agreement, Schneider intends to

agree to only enter into agreements and arrangements with the

Enlarged AVEVA Group on an arm’s length basis and on normal

commercial terms;

- In the event that the Enlarged AVEVA

Group is de-listed, the relationship agreement will be terminated

and all protections set out therein (including the standstill

provisions described above) would cease to apply; and

- Schneider Electric and AVEVA will enter

into a collaboration agreement in connection with R&D and

commercial activities in order to optimise the generation of

synergies for the benefit of both parties.

Commenting on the Transaction, Richard Longdon, Chief Executive

Officer of AVEVA said:

“The transaction will be transformational to AVEVA, creating a

global leader in industrial software, which will be able to better

compete on a global scale. Through the acquisition of Schneider

Software, AVEVA will significantly expand its scale and product

portfolio, diversify its end user markets and increase its

geographic exposure to the US market, in line with our strategic

goals.

The transaction is expected to provide significant value to our

shareholders via the upfront cash payment and a share of the

Enlarged AVEVA Group to benefit from synergies and a compelling

equity story underpinned by an enhanced strategic positioning.”

Commenting on the Transaction, Jean-Pascal Tricoire, Chairman

and CEO of Schneider Electric said:

“Working on a combination of AVEVA and selected Schneider

Electric industrial software assets represents a promising

opportunity for the stakeholders of both companies. The combination

will create a global leader in industrial software, with a unique

portfolio of asset management solutions from design & build to

operations and will address customers’ requirements along the full

asset life cycle in key industrial and infrastructure markets. It

will also create the right environment for the software teams to

develop aggressively their business, while benefiting from the

multiple commercial access of Schneider around the world.

We believe that through increased scale, complementary footprint

and joint R&D capabilities, the transaction will generate

synergies that will benefit customers and shareholders alike.”

Other

Once legally binding documentation has been executed, completion

of the Transaction is likely to be conditional on, inter alia, any

consultation procedures involving the personnel's representative

bodies, as well as the approval of AVEVA’s shareholders and any

regulatory and anti-trust approvals required.

There can be no certainty that the discussions between AVEVA and

Schneider Electric will lead to a transaction, nor what the final

terms or timing of any such transaction may be.

Under Listing Rule 5, certain information regarding Schneider

Software is required to be provided to ensure that there is

sufficient information available to the public with regard to the

Transaction in order to avoid a suspension of AVEVA’s shares. The

information required under this Listing Rule has been provided by

Schneider Electric and included in the Additional Information

section of this announcement. The Board of AVEVA considers that

this announcement and Additional Information section of this

announcement contains sufficient information about Schneider

Software to provide a properly informed basis for assessing

Schneider Software’s financial position. Furthermore, the Board of

AVEVA confirms that AVEVA has made the necessary arrangements with

Schneider Electric to enable AVEVA to keep the market informed

without delay of any developments concerning Schneider Software

that would be required to be released were Schneider Software part

of AVEVA.

The Board of AVEVA also confirms that until such time as a

prospectus is published in relation to the Transaction or

discussions between the parties are terminated (or such other date

as required by the UKLA), AVEVA will make any announcement that

would be required in order to be compliant with its obligation

under the Disclosure and Transparency Rules of the Financial

Conduct Authority on developments in relation to Schneider Software

as if Schneider Software were already part of AVEVA.

A further announcement will be made as and when appropriate.

Settlement, listing and dealing

As the Transaction will be classified as a reverse takeover of

AVEVA under the Listing Rules of the UKLA, application will need to

be made to the UKLA and the London Stock Exchange plc for the

ordinary shares of Enlarged AVEVA Group to be admitted to the

Official List and to trading on the London Stock Exchange plc’s

main market for listed securities respectively. The Transaction is

expected to be accounted for as a reverse takeover of AVEVA under

IFRS.

A prospectus will be required to be published in relation to the

application for admission to the Official List of the new and

existing shares in Enlarged AVEVA Group. Such a prospectus will

include audited financial statements of Schneider Software prepared

in accordance with the Listing Rules and the Prospectus Rules of

the UKLA. It is possible that the financial information contained

in any prospectus published in relation to the Transaction may

differ from the financial information included in the Additional

Information section of this announcement.

The eligibility of Enlarged AVEVA Group has not yet been agreed

with the UKLA. An application regarding the eligibility of Enlarged

AVEVA Group will be made in the event agreement is reached in

relation to the Transaction. It is expected that admission to the

Official List will become effective and that dealings, for normal

settlement, of the Enlarged AVEVA Group’s securities will commence

on the day that the Transaction is completed.

Rule 9 Whitewash

Following completion of the Transaction, it is expected that

Schneider Electric will hold in excess of 50 per cent. of the

voting rights of the Enlarged AVEVA Group (calculated on a fully

diluted basis). Under Rule 9 of the City Code, a person who

acquires an interest in shares which, taken together with shares in

which he is already interested, carry 30 per cent. or more of the

voting rights of a company must normally make a mandatory offer

under Rule 9 of the City Code for all the remaining shares in the

company. It is intended that consent of the Panel on Takeovers and

Mergers will be sought for the waiver of the obligation on

Schneider Electric to make a general offer for all the issued

shares of AVEVA, such waiver to be subject to approval by a vote of

the independent shareholders in a General Meeting. In this case,

approval for the waiver of the obligation which would otherwise

arise for Schneider Electric to make an offer for AVEVA under Rule

9 of the City Code would be sought from AVEVA’s shareholders at the

AVEVA General Meeting.

Sources and Bases

Information contained within this announcement has been

calculated on the basis of the following:

- AVEVA fully diluted number of shares in

issue of 64,337,352 as at 17 July 2015 (being the latest date

practicable prior to publication of this announcement)

- AVEVA share price of 1,772p as at 17

July 2015 (being the closing price on the latest date practicable

prior to publication of this announcement)

- The historical average USD GBP FX rate

for the year ended 31 March 2015 of 0.6212

- AVEVA financial information sourced

from the AVEVA Annual Report and Accounts for the year ended 31

March 2015

- Schneider Software financial

information sourced from the financial information presented in the

Additional Information section of this announcement, as provided by

Schneider Electric

- Combined revenue calculated by adding

AVEVA reported revenue for the year ended 31 March 2015 of £208.7m

plus Schneider Software revenue for the same period (as presented

in the Additional Information section of this announcement) of

$524m, as translated into pounds sterling at the average FX rate

for the corresponding period, as mentioned above

- Combined Adjusted EBITA calculated by

adding AVEVA Adjusted EBITA for the year ended 31 March 2015 of

£61.8m plus Schneider Software EBITA for the same period (as

presented in the Additional Information section of this

announcement) of $110m, as translated into pounds sterling at the

average FX rate for the corresponding period, as mentioned

above

- Adjusted EBITA for AVEVA for the year

ended 31 March 2015 (£61.8m) calculated as adjusted profit before

tax of £62.1m pre net finance income of £0.3m

The management team of AVEVA will be hosting a conference call

at 08:00 this morning. Participants are advised to join the call at

least 15 minutes prior to the commencement of the call in order to

register. The dial in details are as follows:

Telephone: +44 (0)20 3427 1902

Conference call code: 6827683

Participants will be able to ask questions during the Q&A

session. A full replay facility will be made available later in the

day.

IMPORTANT NOTICES:

Lazard & Co., Limited, which is authorised and regulated in

the UK by the Financial Conduct Authority, is acting as financial

adviser to AVEVA and no one else in connection with the Transaction

and will not be responsible to anyone other than AVEVA for

providing the protections afforded to clients of Lazard & Co.,

Limited nor for providing advice in relation to the Transaction or

any other matters referred to in this announcement. Neither Lazard

& Co., Limited nor any of its affiliates owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Lazard & Co., Limited in

connection with this announcement, or any transaction or statement

contained herein.

Numis Securities Limited ("Numis"), which is authorised and

regulated in the UK by the Financial Conduct Authority, is acting

as corporate broker and sponsor to AVEVA and no one else in

connection with the Transaction and will not be responsible to

anyone other than AVEVA for providing the protections afforded to

clients of Numis nor for providing advice in relation to the

Transaction or any other matters referred to in this announcement.

Neither Numis nor any of its affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Numis, in connection with this

announcement, or any transaction or statement contained herein.

Morgan Stanley & Co. International plc ("Morgan Stanley"),

which is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority in the UK, is acting as financial adviser to

Schneider Electric and no one else in connection with the

Transaction. In connection with such matters, Morgan Stanley, its

affiliates and their respective directors, officers,

employees and agents will not regard any other person as their

client, nor will they be responsible to any other person for

providing the protections afforded to their clients or for

providing advice in relation to the Transaction, the contents of

this announcement or any other matter referred to herein.

Ondra LLP, operating under the name Ondra Partners (“Ondra

Partners”), which is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority in the UK, is acting as financial

adviser to Schneider Electric and no one else in connection with

the Transaction. In connection with such matters, Ondra Partners,

its affiliates and their respective directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to any other person for providing the

protections afforded to their clients or for providing advice in

relation to the Transaction, the contents of this announcement or

any other matter referred to herein.

Neither this announcement nor any copy of it may be taken or

transmitted directly or indirectly into Australia, Canada, the

Republic of South Africa, Japan, the United States or to any

persons in any of those jurisdictions, except in compliance with

applicable securities laws. Any failure to comply with this

restriction may constitute a violation of Australian, Canadian,

South African, Japanese or US securities laws. The distribution of

this announcement in other jurisdictions may be restricted by law

and persons into whose possession this announcement or other

information referred to herein comes should inform themselves

about, and observe, any such restrictions.

This announcement is not intended to, and does not constitute or

form part of any offer, invitation or the solicitation of an offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of, any securities pursuant to this announcement or

otherwise.

This announcement has been issued by AVEVA and Schneider

Electric and is the sole responsibility of AVEVA.

Nothing in this announcement constitutes an undertaking by

either AVEVA or Schneider Electric to enter into a binding

agreement in connection with the Transaction.

This announcement does not constitute or form part of any offer,

invitation to sell, otherwise dispose of or issue, or any

solicitation of any offer to purchase or subscribe for, any shares

or other securities nor shall it or any part of it, nor the fact of

its distribution form the basis of, or be relied on in connection

with, any contract commitment or investment decision.

This announcement has been prepared for the purposes of

complying with the applicable law and regulation of the United

Kingdom and the information disclosed may not be the same as that

which would have been disclosed if this announcement had been

prepared in accordance with the laws and regulations of any

jurisdiction outside of the United Kingdom.

The Transaction, if implemented, would constitute a ‘whitewash’

transaction for the purposes of the City Code. Accordingly, nothing

in this announcement should be construed as constituting a formal

offer or evidencing an intention to make a formal offer for AVEVA.

In particular, nothing in this announcement constitutes a “possible

offer” or a “firm intention to make an offer” for the purposes of

the City Code.

This announcement does not constitute an offer of securities for

sale in the United States of America or an offer to acquire or

exchange securities in the United States of America. No offer to

acquire securities or to exchange securities for other securities

has been made, or will be made, directly or indirectly, in or into,

or by use of the mails, any means or instrumentality of interstate

or foreign commerce or any facilities of a national securities

exchange of, the United States of America or any other country in

which such offer may not be made other than (i) in accordance with

the tender offer requirements under the US Securities Exchange Act

of 1934, as amended, or the securities laws of such other country,

as the case may be, or (ii) pursuant to an available exemption from

such requirements.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements may be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"envisages", "plans", "projects", "anticipates", "targets", "aims",

"expects", "intends", "may", "will" or "should" or, in each case,

their negative or other variations or comparable terminology, or by

discussions of strategy, plans, objectives, goals, future events or

intentions. These forward looking statements include all matters

that are not historical facts and involve predictions.

Forward-looking statements may and often do differ materially from

actual results. Any forward-looking statements reflect AVEVA's and

Schneider Electric’s current view with respect to future events and

are subject to risks relating to future events and other risks,

uncertainties and assumptions relating to AVEVA's or Schneider

Software’s business, results of operations, financial position,

liquidity, prospects, growth or strategies and the industry in

which it operates. Forward-looking statements speak only as of the

date they are made and cannot be relied upon as a guide to future

performance. Save as required by law or regulation, AVEVA and

Schneider Electric disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements in this announcement that may occur due to any change in

its expectations or to reflect events or circumstances after the

date of this announcement. Nothing in this announcement should be

construed as a profit forecast And no statement in this

announcement should be interpreted to mean that earnings per share

of AVEVA for the current or future financial years would

necessarily match or exceed the historical published earnings per

share of AVEVA.

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

Except as explicitly stated, neither the content of the AVEVA

nor Schneider Electric website, nor any website accessible by

hyperlinks on the AVEVA or Schneider Electric website is

incorporated in, or forms part of, this announcement.

Additional Information on Schneider Software

Provided By Schneider Electric

1 Introduction

This section of the announcement includes the following

information concerning Schneider Software:

- A description of Schneider Software

including key non-financial operating or performance measures as

well as trend information regarding Schneider Software; and

- Financial information on Schneider

Software, comprising profit and loss, balance sheet and cash flow

information for the financial years ended 31 March 2013, 2014 and

2015, together with details of the basis of preparation, including

details of accounting policies, and certain segmental and other

disclosures.

2 Overview of Schneider Software

Schneider Software is a leading industrial software player and a

market leader in markets and technology areas adjacent to those of

AVEVA. Schneider Software comprises certain historical software

assets of Schneider Electric and Invensys plc former software

assets (“Invensys Software”) acquired in January 2014. Its wide

portfolio covers 6 main technology areas providing strong coverage

of the customer value chain in the continuous process and batch

manufacturing industries and the infrastructure market (covering

power, water and wastewater, transportation infrastructure).

Schneider Software portfolio covers the customer value chain in

its target vertical markets through its offerings in Process

Engineering & Optimisation; Operations Planning &

Scheduling; Operations Execution Management; Asset Management;

Operations Control and Information Management under various brands

such as Wonderware, SimSci, Avantis, Citect and ClearScada.

Schneider Software has a global footprint spanning North

America, Europe, the Middle-East, Asia Pacific and Latin America

with c. 2,000 employees worldwide, with 8 global R&D centres

and 23 project execution centres. Schneider Software’s market reach

is further extended through an ecosystem of key partnerships and

alliances, including over 160 product technology partners, over

3,500 certified developers, and global project delivery alliances

to enhance execution capabilities in key vertical and geographical

markets such as Oil & Gas, Food & Beverage, Life Sciences

and Smart Cities. In the year ended 31 March 2015, approximately

40% of revenues arose from North America, 29% from EMEA, 19% from

Asia Pacific, 8% from Latin America, and 5% from other markets.

Schneider Software works with 10 of the top 15 mining companies,

18 of the top 20 pharmaceutical companies, 19 of the top 20

petroleum companies, 22 of the top 45 food and beverage companies

and 22 of the top 40 chemical companies (see Footnote A).

In the financial year ended 31 March 2015, Schneider Software

revenues were $524 MM with an Adjusted EBITA of $110 MM,

representing a 21.0% margin.

3 Schneider Software Key Non-Financial Operating and

Performance Information

The six technology areas of Schneider Software can be aggregated

into three broad offering areas on the basis of business model and

nature of revenues.

In Process Engineering, the business delivers process design and

simulation software to EPCs and end users in capital intensive

industries such as upstream, refining, chemicals and power

generation to enable the design and commissioning of capital

assets. The market for this offering has been impacted by the

current pressure on capital projects especially in the oil and gas

sector. The revenues in this area are primarily through term

licensing of the software, which includes software maintenance

support over the term of the license.

In Operations Management, (comprising the aggregate of Process

Optimisation, Operations Planning and Scheduling, Operations

Execution Management, Asset Management and Information Management),

the business delivers operational efficiency solutions through a

portfolio of applications for optimising production and supply

chain processes, ensuring the reliability and availability of

capital assets and the management of real-time operational

information for decision support. This offering area serves

customers across multiple industries primarily in the continuous

process and hybrid manufacturing sectors. The diversity of

industries addressed provides a measure of risk mitigation against

sector specific capital budget constraints. The revenues in this

area are realised through projects, comprising a perpetual license

of the software, provision of system integration services for

configuration of the software, and post-implementation software

maintenance support.

In Operations Control, the business delivers real-time

visualisation and control software solutions to ensure that assets

are operated to target performance criteria. The offerings are

applicable across all manufacturing and infrastructure sectors that

operate instrumented assets. This business has a wide industry and

geographical footprint and operates through a global channel

network of distributors, VARs and system integrators. The revenues

in this area are realised through perpetual licensing of the

software and software maintenance support, secured through the

channel.

Schneider Software maintains its competitive advantage through

investing in market leading technology products. Approximately 14%

of its revenues are invested in R&D, of which the majority is

spent on new feature development and next generation programs. The

business manages its R&D efficiency through globally deployed

lean agile development practices that drive YoY R&D

productivity improvement, enabling faster time to market for its

solutions. The business also has approximately 50% of its

development headcount in low cost locations, both internal and with

an outsourcing partner, enabling effective management of the

R&D cost base. The business maintains a high level of customer

satisfaction, aggregating 95% across its offering areas. This is a

people and innovation centric business, with a global workforce of

over 2,000 professionals operating out of 8 main innovation centres

and 23 project execution centres worldwide. The business maintains

a high level of attention on employee development and talent

management.

4 Current Trading and Prospects

For the financial year ended 31 March 2015 (FY15), Schneider

Software reported standalone revenues of c. $524 MM. Since FY15,

Schneider Software has traded in line with Schneider Electric’s

expectations based on the macro-economic environment and the impact

on the capital intensive industries that it serves, associated with

the decline in oil prices. The trading environment has manifested

in some delays in order intake and start-up of awarded contracts

associated with increased cycle time on capital investments, from

customers most sensitive to the oil price. Schneider Software

management expects this trading environment to continue through

FY16. Historically, revenue tends to peak in Q3 and Q4 of the

financial year ending March with first half trading performance

representing approximately 42% to 49% of total FY revenues. A

significant portion of revenues are typically weighted toward the

end of the quarter primarily in the licence revenue stream.

5 Selected unaudited Financial Information on

Schneider Software

The basis of preparation of the following unaudited financial

information on Schneider Software is set out below.

Income statement $ MM $

MM $ MM USD FY13

FY14 FY15 Revenue 468

520 524 Cost of sales (172) (188) (189)

Gross

profit 296 332 335 Research &

development (58) (73) (73) Selling, general & administrative

expenses (136) (141) (152)

EBITA adjusted 102

118 110 Other operating income & expenses (2)

(10) (6) Restructuring costs (2) - -

EBITA 98

108 103 Amortisation & impairment of purchase

accounting intangibles (4) (13) (43)

Operating income

94 96 60

- Schneider Software revenues have

increased from $468 MM to $524 MM over FY13-15, i.e. a 6% CAGR,

driven by:

- Organic growth of c. 5%:

- 18% growth of maintenance, 3.1% growth

of services and 0.5% growth of licenses

- 7.1% growth of North America, 9.6% of

LatAm, 3.5% for Europe and 4.3% contraction of APAC

- Consolidation of InStep in FY15 (Instep

has been consolidated from its 14 November 2014 acquisition date

and made a $5.6 MM revenue contribution in the period, compared

with full year revenues of $13.4 MM)

Cash Flow Statement $ MM $ MM

$ MM USD FY13 FY14

FY15 Cash flow from operating activities

66 110 76 Cash flows from investing

activities (2) 11 (5) Change in group loan

funding (62) (118) (73) Net financial income - - 1

Cash flows

from financing activities (62) (117) (72)

Impact of exch. rates on cash and cash equivalents - (1) (5)

Net

increase / (decrease) in cash and cash equivalents 3

3 (6) Opening cash and cash equivalents

9 12 15 Closing cash and cash

equivalents 12 15 9 Cash flow from

operating activities incl. capital expenditure 63

102 69

Balance Sheet

$MM

$MM

$MM

USD

FY13

FY14

FY15

Goodwill 172 1 375 1 419 Intangible assets 42 329 298 Tangible

assets and deferred tax assets 9 10 9

Non-current assets

223

1 714

1 726

Group funding, net (15) 98 178 Cash and cash equivalents 12 15 9

Other current assets 119 130 150

Current assets

116

243

337

Total assets

339

1 957

2 063

Invested equity 153 1 625 1 745 Other comprehensive income

(2) - 1

Total invested equity

151

1 625

1 746

Provisions 3 1 4 Pension liabilities 5 5 5 Deferred tax liabilities

6 137 124

Non-current liabilities

15

143

133

Current liabilities

173

190

184

Total liabilities

339

1 957

2 063

Basis of Preparation

The unaudited selected financial information on Schneider

Software (the “Schneider Software Financial Information”) set out

above has been prepared from i) the audited financial statements

prepared under IFRS of the software business of Schneider

(“Schneider Software”) for the financial years ended 31 March 2013,

2014 and 2015, which include the results of the Invensys Software

business (“Invensys Software”) from its date of acquisition by

Schneider Electric in January 2014; and ii) the audited financial

statements prepared under IFRS of the software business of Invensys

Software for the financial years ended 31 March 2013 and 2014.

The Schneider Software Financial Information presents over the

three year period the financial results of Schneider Software

aggregated with the results of Invensys Software prior to its

acquisition by Schneider Electric. The pre-acquisition revenue and

Adjusted EBITA contribution of Invensys Software was $416.1 MM and

$103.0 MM respectively for the year ended 31 March 2013, and $358.8

MM and $78.0 MM respectively for the year ended 31 March 2014. No

adjustment has been made to reflect the full period impact of other

less material acquisitions made by Schneider Software or Invensys

Software during the three year period.

Certain other adjustments have been made to reflect the

standalone performance of Schneider Software operating

independently of the wider Schneider Electric group on a basis

consistent with the transaction currently envisaged. These

adjustments principally relate to i) including adjustments to

reflect the financial impact of running the business on a

standalone basis; ii) reversing the impact of capitalising research

and development expenditure in certain (non-Invensys) entities of

Schneider Software, to better reflect consistency with the

capitalisation practice of both Invensys Software and AVEVA; and

iii) other various adjustments mainly composed of the exclusion of

one reporting entity not proposed to be included in the

transaction. The aggregate impact of these adjustments on the

revenues and Adjusted EBITA of Schneider Software for the three

financial years ended 31 March 2013, 2014 and 2015 was a revenue

increase of $5.9 MM, $9.7 MM, and $5.9 MM respectively, and an

Adjusted EBITA decrease of $16.0 MM, $13.8 MM, and $14.8 MM

respectively.

Therefore Schneider Software Financial Information is not

intended to present IFRS compliant financial statements.

Adjusted EBITA correspond to operating income before

amortisation of purchase accounting intangible assets,

restructuring costs, share-based payment and other operating income

and expenses.

Schneider Software entities are a combination of legal entities

in certain countries and the software portion of other legal

entities that also include non-software related businesses. The

software portion of these legal entities has been carved-out and

included in the financial information as described in this basis of

preparation.

Assets and liabilities of software entities acquired by

Schneider Electric from unrelated parties during the periods

presented have been reflected as transfers of business under common

control recorded through equity at their carrying values (including

goodwill) resulting from the purchase accounting of such entities

in the consolidated financial statements of Schneider Electric as

of the dates such transfers occurred. The increase in Schneider

Software’s assets and liabilities between the financial years ended

31 March 2013 and 31 March 2014 can be mainly attributed to the

consolidation of the assets and liabilities of Invensys Software

following the completion of the acquisition of Invensys plc by

Schneider Electric on January 17, 2014.

Assets and liabilities of Invensys Software have been reflected

as a transfer of business under control from Schneider Electric

recorded through equity at their carrying values (including

goodwill) resulting from the purchase accounting of Invensys

Software by Schneider Electric. As a consequence, this acquisition

is a non-cash transaction for Schneider Software and its impact on

Schneider Software cash flow is limited to the net cash of Invensys

Software at the time of the acquisition for $11.4 MM.

Assets and liabilities of software operations carved-out from

legal entities with other non-software operations have been

initially recorded through Schneider Software funding (expressed as

“Group funding, net” in the Balance Sheet) at their estimated

carrying values in the consolidated financial statements of

Schneider Electric.

For defined benefit pension plans, the assets and obligations

have been included in the Schneider Software Financial Information

to the extent that Invensys Software is expected to be responsible

for fulfilling these defined benefit pension obligations.

Cash management is performed at a global level by Schneider

Electric. The financing position and financing costs of Schneider

Software included in the Schneider Software Financial Information

may not be indicative of the financial position, results of

operations and cash flows that would have been presented if

Schneider Software had been a standalone entity.

Current income tax has been determined based on the pre-tax

profits of Schneider Software on a standalone basis without taking

into account net operating losses within the wider Invensys or

Schneider Electric group. Current income tax, other than taxes owed

directly to tax jurisdictions, is deemed to have been settled by or

to Schneider Electric or Invensys as a transfer from or to

Schneider Electric or Invensys equity in the year the related

income taxes were recorded.

Schneider Software has not in the past formed a separate legal

group, and therefore it is not meaningful to reflect any share

capital for Schneider Software. Schneider Software’s invested

equity represents the sum of cumulative net capital invested by

Schneider Electric, accumulated earnings of Schneider Software and

other elements of comprehensive income.

Schneider Software Financial Information has been prepared on

the assumption that Schneider Software is a going concern, meaning

it will continue its operations in the foreseeable future and will

be able to realise assets and discharge liabilities in the normal

course of its operations.

Schneider Software Financial Information is presented in US

Dollars ($).

Differences Between AVEVA and Schneider

Software Accounting Policies

To date, no significant differences between Schneider Software

and AVEVA’s accounting policies applied in the preparation and

presentation of their respective financial information for each of

the Financial Years ended 31 March 2013, 31 March 2014 and 31 March

2015 have been identified, save potentially in respect of the

non-maintenance element of certain term licences, which AVEVA’s

practice is to recognise up-front if certain criteria are met,

rather than spread over the term of the licence.

Operating Segment

Information

1. Operating and reportable segment:

The business of Schneider Software reflected in the Schneider

Software Financial Information has not been operated as an

integrated business under the responsibility of a software

dedicated chief operating decision maker in charge of all software

operations within Schneider Electric over the periods presented nor

were discrete reporting data available for this business within

Schneider Electric.

As a consequence, for the periods presented Schneider Software

had no reporting segments identifiable under IFRS 8 – Operating

Segments.

2. Revenue by revenue stream

Schneider Software does not have any external customer

representing more than 10% of its revenue as at March 31, 2015 and

March 31, 2014.

Breakdown of revenue by revenue stream is as follows:

Revenue by Revenue Stream $ MM $

MM $ MM USD FY13

FY14 FY15 Software maintenance 107 126 152

Software licenses 237 247 239 Engineering services 124

147 133

Total revenues 468

520 524

3. Revenue by geography

Revenue from external clients (based on domicile of customers)

is as follows:

Revenue by GeographyUSD $ MM

FY13

$ MM

FY14

$ MM

FY15

North America 177 200 209 Europe Middle East

Africa 141 152 152 Asia Pacific 107 109 98 Latin America 34 35 40

Rest of world 9 24 25

Total revenues

468 520 524

Operating expenses

Other operating income and expenses are detailed as follows:

Other Operating Expenses $ MM $

MM $ MM USD FY13

FY14 FY15 Transition costs (1) (2) (2)

Share-based payment (0) (2) (1) Acquisition costs (1) (5) (3) Other

0 - (0)

Other operating income and

expenses (2) (10) (6)

Transition costs mainly related to the acquisition of Invensys

by Schneider Software.

Related party

disclosures

The Schneider Software Financial Information includes

transactions with Invensys and Schneider Electric’s non-Software

subsidiaries. No material transactions took place between Invensys

Software and Schneider Electric.

Related Party Disclosures $ MM $

MM $ MM USD FY13

FY14 FY15 Income: Revenue 47 54 45

Balance sheet items: Amounts receivable from related

parties (15) 98 178

Receivables from related parties reflect mainly the cash which

is centralised at Schneider Electric level according to the cash

pooling scheme and trade receivables and payables resulting from

transactions with Invensys affiliates.

Footnotes

Footnote A: Lists of the top mining, pharmaceutical, food and

beverage, and chemical companies have been determined using the

companies’ revenues over the 12 month period to their last reported

financial year end, while the list of the top petroleum companies

has been determined using the companies’ working interest

production over the same period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150719005036/en/

AVEVA Group PLCRichard Longdon (Chief Executive

Officer)James Kidd (Chief Financial Officer)Derek Brown (Head of

Investor Relations)+44 1223 556655orLazard (Financial Adviser)Cyrus

KapadiaRichard HoyleOlivier Christnacht+44 20 7187 2000orNumis

(Corporate Broker and Sponsor)Simon WillisRupert KreftingJamie

Lillywhite+44 20 7260 1000orHudson Sandler (Financial PR)Andrew

HayesWendy BakerAlex Brennan+44 20 7796 4133orSchneider Electric

SEAnthony Song (Investor Relations)+33 (0) 1 41 29 83

29orVéronique Roquet-Montégon (Press)+33 (0) 1 41 29 70 76orMorgan

Stanley (Financial Adviser)Simon SmithJean-Baptiste CharletLaurence

Hopkins+44 20 7425 8000orOndra Partners (Financial Adviser)Michael

ToryRodolphe Roch+44 20 7082 8751

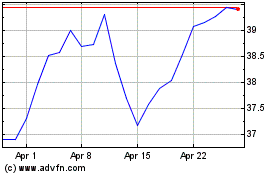

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024