TIDMASC

RNS Number : 4477B

ASOS PLC

04 April 2017

4 April 2017

ASOS plc

Global Online Fashion Destination

Interim Results for the six months ended 28 February 2017

Summary results

Six months Six months CCY(3)

GBPm(1) to to 29 February Change Change

28 February 2016(2)

2017

----------------------------- ------------- ---------------- --------- --------

Group revenues(4) 911.5 663.1 37% 31%

Retail sales 889.2 644.6 38% 31%

UK retail sales 340.8 289.5 18% 18%

International retail sales 548.4 355.1 54% 42%

Gross profit 440.1 324.0 36%

--------

Retail gross margin 47.0% 47.4% (40bps)

Gross margin 48.3% 48.9% (60bps)

Profit before tax 27.3 23.9 14%

Diluted earnings per share 26.3p 22.8p 15%

Cash and cash equivalents 154.3 135.9 14%

----------------------------- ------------- ---------------- --------- --------

(1) All numbers subject to rounding throughout this document

(2) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

(3) Constant currency is calculated to take account of hedged

rate movements on hedged sales and spot rate movements on unhedged

sales

(4) Includes retail sales, delivery receipts and third party

revenues

Highlights include:

-- Retail sales grew strongly at +38% on a reported basis and +31% on a constant currency basis

-- Solid UK growth of +18% in a more promotional market

-- Accelerated international performance with reported sales

growth at +54% (constant currency: +42%) aided by the reinvestment

of the FX tailwind

-- Retail gross margin down 40bps on prior year in line with plan

-- Continued engagement from our customers with active

customers(5) +29%, average basket value +3% and average order

frequency(6) +4%

-- Total orders shipped were 23.3m, +33% year on year

-- Transition to Eurohub 2 warehouse on track, US warehouse plans progressing

-- Strong cash position of GBP154.3m; supporting growth and enabling business investment

(5) Defined as having shopped in the last twelve months as at 28

February 2017

(6) Calculated as last twelve months' total orders divided by

active customers

Guidance:

-- Medium term reported sales growth guidance remains unchanged at c.20-25% p.a.

-- Current financial year reported sales growth guidance revised to c.30-35%

-- Full Year PBT anticipated to be broadly in line with market consensus(7)

-- Capital expenditure guidance remains unchanged at GBP150-170m for the current financial year

(7) Company compiled PBT market consensus for FY 2017: range

GBP72m-GBP84.5m, mid-point GBP78.25m, mean GBP80.6m

Nick Beighton, CEO, commented:

"These are a strong set of results, showing great progress

across the business. International growth of 54% has been excellent

and with the Rest of the World segment a stand out performer.

Customer acquisition, up 29%, takes our active customers to over

14m. We passed the 5m active customer mark in the UK, where we have

shown solid sales growth of 18% in a more promotional market. We've

accelerated our significant infrastructure and technology projects

which remain on track, and Eurohub 2 went live in March.

Given the current momentum we are seeing, ASOS is making good

progress towards its ultimate goal of becoming the world's no. 1

destination for fashion-loving 20-somethings."

Investor and Analyst Meeting

There will be a meeting for analysts that will take place at

9.30am today, 4 April 2017, at Numis Securities, 10 Paternoster

Row, London EC4M 7LT. Photo ID and security checks will be required

so please ensure prompt arrival. A webcast of the meeting will be

available both live and following the meeting at www.asosplc.com.

Please register your attendance in advance with Guy Scarborough at

Instinctif Partners on either 020 7457 2047 or

guy.scarborough@instinctif.com.

For further information:

ASOS plc

Nick Beighton, Chief Executive Tel: 020 7756 1000

Officer

Helen Ashton, Chief Financial

Officer

Greg Feehely, Director of Investor

Relations

Website: www.asosplc.com/investors

Instinctif Partners

Tel: 020 7457 2020

Matthew Smallwood / Guy Scarborough

JPMorgan Cazenove

Tel: 020 7742 4000

Michael Wentworth-Stanley / Caroline

Thomlinson

Numis Securities

Tel: 020 7260 1000

Alex Ham / Luke Bordewich

Forward looking statements:

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Background note

ASOS is a global fashion destination for 20-somethings. We sell

cutting-edge fashion and offer a wide variety of fashion-related

content, making ASOS.com the hub of a thriving fashion community.

We sell over 85,000 branded and own-label products through

localised mobile and web experiences, delivering from our

fulfilment centres in the UK, US and Europe to almost every country

in the world.

We tailor the mix of own-label, global and local brands sold

through each of our eight local language websites: UK, US, France,

Germany, Spain, Italy, Australia and Russia.

ASOS's websites attracted 127 million visits during February

2017 (February 2016: 106 million) and as at 28 February 2017 it had

14.1 million active customers(1) (29 February 2016: 10.9 million),

of which 5.0 million were located in the UK and 9.1 million were

located in our international territories (29 February 2016: 4.3

million in the UK and 6.6 million internationally).

(1) Defined as having shopped in the last twelve months as at 28

February 2017

Business Review

The Group has delivered a strong set of results for the six

months to 28 February 2017 with retail sales growth of 38% to

GBP889.2m (H1 2016: GBP644.6m), once again driven by great product

at relevant prices coupled with excellent delivery propositions and

engaging content. As a net exporter, sterling weakness has created

a FX tailwind for the business which has enabled investment above

previously planned levels into both price and proposition. As a

result, UK sales grew by 18% during the period in a highly

promotional market coupled with 54% across the international

territories, with an invigorated Rest of World segment being a

stand out performer.

The Group gross retail margin decreased by 40bps to 47.0% (H1

2016: 47.4%) as we further invested into international price

coupled with prior year price investments yet to annualise,

particularly in the EU. Additionally, investments into our UK

A-List loyalty scheme did not annualise until the end of February

2017. The combined impact of these investments was partially offset

by our trading stance which focuses on driving higher full price

sales mix and hence shallower markdown of clearance stock. Delivery

receipts grew by 21%, less than the retail sales growth, despite

the continued successful expansion of Premier delivery globally, as

more customers took advantage of faster free standard shipping

options. Third-party revenues increased by 15% during the period.

Consequently, the Group gross margin reduced 60bps during the

period to 48.3% (H1 2016: 48.9%).

As anticipated, profit before tax grew by 14% to GBP27.3m (H1

2016: GBP23.9m, restated to exclude the China loss before tax of

GBP2.7m).

The Eurohub 2 site was handed over to us on 29 September 2016

and relocation to this new facility was completed at the beginning

of March 2017 in line with plan. The ramp up of activity has now

commenced.

Great fashion, great price

Our goal has always been to offer 'the greatest possible choice

of relevant fashion at the right price whatever your shape or

size'. We focus on the best curated edit of third party brands

together with the ASOS Brand itself, which combine to give our

20-something customers the most creative, relevant and exciting

choice of fashion available anywhere. Over 4,500 new styles are

launched each and every week, with over 85,000 different products

in stock at any one point in time.

During the period, we launched our Activewear collection.

Initially this has focused on product extensions with existing

brand partners including Nike, Adidas, Puma & Reebok, alongside

the sportswear collections of some better known fashion brands such

as Ted Baker, New Look, Free People & Missguided. The ASOS

Activewear collection will launch later this year, priced alongside

the core own-label ranges. Performance fabrics and technical

constructions will be included to cater for training, running,

dance and yoga with further extensions to the range at a later

point.

We continue to work with third party brands to ensure the most

relevant edit of collections for the season, from collaborating

with some of the largest global retailers on exclusive colours and

prints to new and emerging brands. We increasingly utilise social

networks, ASOS Marketplace and our new Fashion Discovery Project to

help us remain at the leading edge of young fashion globally.

The branded portfolio is continually refreshed. This season

alone we have added 100 new brands whilst removing a similar number

from the portfolio. New brands include well recognised names such

as Under Armour, Miss Selfridge and Burton in addition to locally

sourced, vibrant new brands such as Adolescent Clothing, RVCA,

Current Air, EFLA and many more. Exclusive collaborations have

continued with ASOS White x Saucony, ASOS x WAH London and the ASOS

x House of Holland for Centrepoint. These exclusive collaborations,

when combined with ASOS own-label products, results in 60% of all

sales on our platform being exclusive to ASOS customers.

We are on record as saying that ethically sourcing our product

throughout the supply chain is not optional. It is a business

imperative for ASOS and indeed our industry. Our 20-something

customers care deeply about social issues such as ethics in fashion

and the next generation will care even more. This is also highly

relevant to our shareholders. We have initiated a wide-reaching

plan to drive Fashion with Integrity throughout our business. The

programme includes consolidating our supply base to give us better

visibility of working practices, zero tolerance of abuse of

workers, particularly children, greater transparency of our supply

base and tighter scrutiny of environmental issues where our

products originate.

Awesome on mobile

Our focus on being 'awesome on mobile' continues, aiming to

deliver the most enjoyable and frictionless shopping experience.

The roll-out of the New Mobile Checkout on all ASOS digital

channels has been successfully completed. We now offer a

cutting-edge customer experience designed and developed with a

mobile-first approach, using the latest technologies to provide a

new, seamless checkout experience for our customers. Both Android

and iOS apps continue to attract c.5 star ratings; testament to the

excellent work the ASOS mobile team is delivering.

Over the last six months, daily app downloads have seen a 28%

increase. Our customers have visited the apps eight times a month

on average, spending more than 80 minutes during this time. Mobile

visits are now c.70% (H1 2016: c.60%) of total traffic and 58% (H1

2016: 51%) of orders are placed from a mobile device.

Over the coming months we will be launching a series of updates

for the ASOS Android App featuring a refreshed customer experience

blending the best of the Google UX guidelines and our unique ASOS

shopping experience. Additionally, Apple Pay will be launched on

both iOS App and Mobile Web. Finally, a refreshed 'My Account'

section will be introduced to enable customers to seamlessly find

their order history, delivery and returns updates and A-List

dashboards all in one place.

Engaging content and experience

We continue to invest in engaging our customers with a

multi-channel approach, producing significant quantities of content

and experiences to enrich our product offering and help communicate

our brand in an emotionally engaging way.

Across social channels, which are ever more important in

connecting with our 20-something audience in a credible way, we

continue to see growth in followers and engagement levels. Our

global audience has grown by 25% to 21.3m followers in the last six

months.

We have again achieved improvements in our customer engagement

levels. This includes growth in visits of 27% year on year, 4%

growth in average order frequency, 3% growth in average basket

value and 10bps improvement in our conversion rates. Active

customers are now at 14.1m, representing a 29% increase since last

year and we have now passed the 5m mark in UK active customers.

We have also cemented our position as early adopters of emerging

content formats such as shoppable Instagram stories, Instagram

Live, Facebook Live, Facebook Canvas and Snapchat lenses across key

channels, enabling us to connect with our audience in a way that

feels fresh and evolves as quickly as the platforms themselves.

There has been encouraging results, with 100,000 views per

video/broadcast produced, reaching 32m people with the ASOS

Snapchat Black Friday lense, and engaging more than 13m people

across the US and the UK with the launch of Instagram Stories

advertising.

We have also continued the roll-out of the ASOS magazine to more

customers, with the US version (containing bespoke content as well

as global stories) launching to 100,000 readers in November 2016.

As well as the UK, the magazine is now available in France, Germany

and the US. The ASOS magazine remains the highest circulation

fashion magazine in the UK.

The ASOS A-List loyalty programme has completed its first year.

In the last six months a new dashboard has been developed enabling

customers to more easily track their tier status and loyalty points

on product pages are now in test. This programme continues to be

tested and refined, including customer reward levels, different

ways to earn points and different delivery options at checkout.

Best-in-class service

Our customers continue to have high expectations of service

levels and we strive to offer a friction-free online shopping

experience, every time.

Delivery and returns

Continually enhancing the range of delivery and returns options

enables us to move towards our goal of providing a best-in-class

customer proposition. We have continued to develop the offer at

pace, with over 100 improvements rolled out over the last six

months.

In the UK, enhancements included improving the standard delivery

proposition from four to three days and completing the Click &

Collect roll-out to all Doddle locations.

Internationally, our free returns proposition was extended,

launching in Hong Kong, New Zealand and Switzerland. We are always

looking to improve standard delivery and now all orders to

Switzerland, Finland, Slovakia and Slovenia are being sent using a

fully tracked solution. In addition, we launched a tracked standard

mail solution to a further 10 countries.

Enhanced delivery notifications and in-flight delivery options

have been added across multiple providers, including SMS updates

for our Australian customers, and DHL on Demand services across 22

European next-day delivery lanes.

Standard delivery lead times were improved in 76 countries and

express delivery was accelerated in a further 11 countries. A

delivered duty paid solution was also launched into Switzerland so

that customers no longer have to pay import duty.

Next-day deliver-to-store was launched in Denmark, and over the

next six months we will continue to increase deliver-to-store

options in both the UK and internationally, providing customers

with further choice and flexibility when collecting their

orders.

Customer Care

Providing help and support to our customers throughout their

ASOS journey is essential to delivering a best-in-class service. We

continue to provide support across social media, live chat, email

and telephony. This service is delivered 24/7, 365 days a year

across key local languages to our English, French, German, Spanish,

Italian and Russian customers, with local language speaking support

also available in Dutch, Korean and Mandarin. We have maintained

strong service levels during the first half of the year, responding

to all emails within one hour, all social media communications from

customers within 15 minutes and all live chat or telephony within

30 seconds.

Over the last six months there has been continued investment

into both our people and our technical capabilities to enhance the

level and quality of the service. During the year, we made further

investments in upgrading the self-serve functionality for

customers, improved the live chat offering on both desktop and

mobile, and introduced Facebook Messenger as a contact channel for

all key markets.

Finally, we have continued to invest in the capacity and

infrastructure that allows us to grow our in-house Customer Care

capabilities in line with our growth. To meet these demands, the

decision was made to relocate from our current Customer Care site

in Hemel Hempstead to a new 80,000 square feet Customer Care site

in Leavesden, North Watford, which will allow us to provide a

best-in-class customer service at scale. The aim is to have

completed this transition by the end of this calendar year.

Logistics

UK

During the first half of this year a second despatch sorter was

added in Barnsley and assisted the operation in setting new

despatch records during the Black Friday promotional event. The new

inbound conveyors also allowed for additional intake and throughput

capability.

Our investment at Barnsley continues, with a fifth packing

module currently being installed and due to be operational by the

end of the financial year in readiness for the peak trading period.

This will provide us with additional capacity to support future

growth. Work continues on expanding Barnsley in the second half of

this year, enhancing the current facilities for the people who work

there as well as providing additional office space.

XPO are the partner who operate our Barnsley facility. They

recently entered into a voluntary recognition agreement with the

Community Union on two of their sites, which included the warehouse

in Barnsley. We fully support their decision.

International

In the first week of March 2017 we transitioned over 2m units of

stock from the existing Eurohub 1 facility just outside of Berlin

to the brand new purpose designed and built fulfilment centre,

known as Eurohub 2. The phase 1 build of Eurohub 2 is now

operational and one off transition costs will be included within

operating costs in the second half of the year. To date these are

running in line with plan. The warehouse has more than doubled our

stockholding capacity in Continental Europe and almost quadrupled

throughput capacity, as well as providing greater capability and

opportunity to improve the customer proposition further.

Over the next three months, operations will continue to ramp up

in Eurohub 2 with the receipt of stock and shipping of orders,

which will reduce the need to transfer stock between warehouses and

ultimately prepare us for the first phase of Global Fulfilment.

This programme will enable us to fulfil 100% of orders to Germany,

France, Spain and Italy from Eurohub 2 compared to the previous

c.50% fulfilment levels from Eurohub 1.

In parallel to Phase 1 continuing to ramp up, a ground breaking

ceremony launched Phase 2 last month. Once completed, this will

double the square footage of the fulfilment centre in preparation

for automation in FY 2018.

Our US operation continues to fulfil around 25% of all US

orders, with the remainder being despatched from the UK. As our

third largest market we are looking to gain efficiencies in both

cost and time to serve current and future US customers. We have

recently undertaken an extensive network modelling exercise, based

on total landed cost (supply) and optimised customer service goals

(demand/service offer), in order to identify the optimal location

for our US fulfilment centre. We expect to have decided on that

location very shortly and for a site to be quickly identified

thereafter.

Technology

Over the course of the last six months we have made significant

progress with our technology. Specifically we completed and rolled

out our new digital platform across all territories, ahead of plan

and the Black Friday peak trading period. Our new platform is the

backbone of our entire customer experience on our site and apps; it

is fast, it is reliable and it is flexible. The new platform

delivers our micro-service architecture with fully native mobile

checkouts in our android and iOS apps, and a vastly improved

checkout on desktop and mobile web. Our new platform handled record

volumes of transactions during our peak trading period which at one

point reached 33 orders per second.

A critical strategy behind our new platform was to enable our

future flexibility to deliver technological change and innovation

at pace. During H1 2017, we rolled out over 600 releases across our

platform compared to 340 in H2 2016. This has exceeded our

expectations and apart from the sheer pace of innovation this

implies, demonstrates the flexibility of our new platform. We

delivered new capabilities for our customers, including rolling out

Klarna payments in Norway, Sweden and Finland, Premier in Spain and

Italy, switching the Australian acquiring service to improve

stability and service continuity as well as improving the quality

of our video and image zoom functionality.

We have also completed the development of our fulfilment

software changes and the technology needed to open the new EuroHub

2 fulfilment centre. The new fulfilment software is a major change

and will allow us to control which country sites have access to

which stock pools as well as improve our delivery proposition for

each of these countries over the course of this financial year.

We continued to make good progress with our major transformation

programmes including a new end-to-end merchandising and planning

system for our retail teams ('Truly Global Retail') and a new

finance system; both of which will support our ability to buy, sell

and account for stock in multiple locations and currencies. We will

start to see the first output from these programmes later this

financial year with a new clearance optimisation tool for our

retail teams. In addition to these programmes, we have now

mobilised a programme to replace our people systems and support how

we invest in and develop our critical talent in the business.

Over the next six months, we will continue to evolve and

innovate our digital platform including personalising our

customers' experience across our sites and improving navigation and

order tracking. To further drive our global reach, we will also

launch new payment methods, sites, delivery propositions and

languages. This is in addition to upgrading the 'My Account'

section and refreshing the android app. Finally, our

personalisation team are exploring how machine learning and

artificial intelligence can continue to help us drive these

capabilities further.

We are increasing our investment in customer data and systems

that give us faster information on what our customers think of

ASOS, including a 360 view of our customer, online customer

feedback and specific research tools. We will also continue to

drive forward the multi-year transformation programmes focused on

enhancing internal capabilities across finance, retail and people

teams as well as make the technology infrastructure investments in

our new office and Customer Care centre.

Outlook

During H1 2017, sterling weakness and the resulting FX benefits

have enabled investment into both price and proposition above

previously planned levels. As a result, reported sales growth is

now expected to be in the 30-35% range for this financial year

only, driven by an acceleration in international performance. Over

time, this growth will normalise and hence our medium term reported

sales growth expectation of 20-25% remains in place.

Notwithstanding continued reinvestment of the FX benefit, together

with the transition costs into the new Eurohub 2 facility, sourcing

inflation and a number of other structural cost headwinds, we

expect to deliver PBT broadly in line with market consensus.

Nick Beighton Helen Ashton

Chief Executive Officer Chief Financial Officer

Financial review

Revenue

Six months to 28 February

2017 Group International

GBPm(1) total UK US EU RoW total

------------------------------ ------ ------ ------ ------ ------- --------------

Retail sales 889.2 340.8 124.3 248.9 175.2 548.4

Growth 38% 18% 62% 48% 59% 54%

Growth at constant exchange

rate 31% 18% 39% 36% 53% 42%

Delivery receipts 19.3 7.6 2.9 4.9 3.9 11.7

Growth 21% 6% 7% 53% 39% 34%

Third party revenues 3.0 2.9 0.1 - - 0.1

Growth 15% 21% - - (100%) (50%)

Total revenues 911.5 351.3 127.3 253.8 179.1 560.2

Growth 37% 17% 60% 48% 58% 54%

Growth at constant exchange

rate 31% 17% 38% 36% 52% 41%

------------------------------ ------ ------ ------ ------ ------- --------------

(1) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

The Group generated retail sales growth of 38% during the

period. This was driven by 54% growth in our international markets

(42% in constant currency) as we continued to invest in price and

proposition, coupled with 18% growth in the UK. International

retail sales now account for 62% (H1 2016: 55%) of total retail

sales.

While we continued to see a more promotional market in the UK

during the period, we retained our first place position for unique

visitors to apparel retailers in the 15-34 age range (Comscore,

January 2017). We also saw increases in average order frequency and

conversion, driven in part by engagement in the A-List loyalty

scheme.

US retail sales grew by 62% (39% in constant currency) fuelled

by increases in conversion and average basket sizes following

further price investments and improved delivery speeds.

EU retail sales grew by 48% (36% in constant currency)

benefiting from continued price investments and expansion of

proposition offers, including EU free returns that are yet to

annualise.

Rest of World retail sales accelerated materially growing 59%

(53% in constant currency) during the half, augmented by further

price and proposition investments. Russia was a stand out performer

with over 200% reported sales growth during the period.

Delivery receipts grew by 21%, less than retail sales growth,

despite the continued successful expansion of Premier globally and

launch of this programme in Italy and Spain, as more customers took

advantage of faster free standard shipping options. Third party

revenues increased by 15% as we undertook more marketing campaigns

with third party brands.

Customer engagement

We have seen significant growth in active customers, exiting the

half with 14.1m active customers(1) , an increase of 29% on the

comparative period. Average basket value increased by 3%, driven by

strong full price sales mix in all segments. Conversion(2)

increased by 10bps and average order frequency(3) increased by 4%,

both reflecting the compelling nature of our proposition.

Six months Six months Change

to 28 February to 29 February

2017 2016

--------------------------------- ---------------- ---------------- -------

Active customers(1) (m) 14.1 10.9 29%

Average basket value (including

VAT) GBP70.86 GBP68.86 3%

Average units per basket 2.76 2.70 2%

Average selling price per unit

(including VAT) GBP25.69 GBP25.51 1%

Average order frequency(3) 3.15 3.02 4%

Total orders (m) 23.3 17.5 33%

Total visits (m) 804.8 634.0 27%

Conversion(2) 2.9% 2.8% 10bps

--------------------------------- ---------------- ---------------- -------

(1) Defined as having shopped during the last twelve months as

at 28 February 2017

(2) Calculated as total orders divided by total visits

(3) Calculated as last twelve months' total orders divided by

active customers

Gross profitability

Six months to 28 February

2017 Group International

GBPm(1) total UK US EU RoW Total

--------------------------- -------- ------ --------- ------ --------------

Gross profit 440.1 155.6 76.9 115.2 92.4 284.5

Growth 36% 12% 61% 45% 58% 54%

Retail gross margin 47.0% 42.6% 59.5% 44.3% 50.5% 49.7%

Growth (40bps) (200bps) 90bps (100bps) 20bps -

Gross margin 48.3% 44.3% 60.4% 45.4% 51.6% 50.8%

Growth (60bps) (210bps) 40bps (90bps) 10bps (10bps)

--------------------------- -------- --------- ------ --------- ------ --------------

(1) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

Group retail gross margin decreased by 40bps to 47.0% (H1 2016:

47.4%) as we are yet to annualise prior year price investments,

particularly in the EU, alongside further international price

investments in the current financial year. In the UK, our A-List

loyalty scheme did not annualise until the end of February 2017.

The combined impact of these margin investments was partly offset

by higher full price sales mix and shallower markdown of clearance

stock.

Gross margin (including third-party revenues and delivery

receipts) decreased by 60bps to 48.3% (H1 2016: 48.9%) as more

customers took advantage of our faster free standard shipping

options at the expense of paid-for delivery solutions, particularly

in the UK and the US.

Operating expenses

The Group increased its investment in operating resources by 38%

to GBP413.0m, retaining a 45.3% operating cost ratio in line with

last year.

Six months

Six months to to

28 February 29 February

GBPm 2017 2016(1) Change

------------------------------- -------------- ------------- -------

Distribution costs (140.2) (97.2) (44%)

Payroll and staff costs(2) (74.1) (60.6) (22%)

Warehousing (74.3) (52.8) (41%)

Marketing (48.1) (34.2) (41%)

Production (3.6) (2.9) (24%)

Technology costs (16.4) (11.8) (39%)

Other operating costs (34.8) (26.0) (34%)

Depreciation and amortisation (21.5) (14.8) (45%)

------------------------------- -------------- ------------- -------

Total operating costs (413.0) (300.3) (38%)

Operating cost ratio (% of

sales) 45.3% 45.3% -

------------------------------- -------------- ------------- -------

(1) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

(2) Inclusive of GBP3.4m non-cash share based payment charges

(H1 2016: GBP1.6m)

Distribution costs increased by 70bps to 15.4% of sales, driven

by increased international order mix, expansion of faster delivery

propositions and free returns options compared to last half year,

as well as moving standard deliveries from untracked to tracked

services in many territories.

Payroll and staff costs decreased by 100bps to 8.1% of sales due

to headcount growth of 33% being slower than reported sales growth

(H1 2017: 3,146; H1 2016(3) : 2,363). Non-cash share-based payment

charges included within this cost line amounted to GBP3.4m (H1

2016: GBP1.6m) as we made the third grant to senior management

under our Long-Term Incentive Scheme during the period.

Warehousing costs increased by 20bps to 8.2% of sales due to an

increased Eurohub 1 fulfilment mix, which is currently a less

efficient manual operation, offset in part by productivity

improvements at Barnsley driven by continued investment in

automation technology.

Marketing costs marginally increased by 10bps to 5.3% of

sales.

Other operating costs decreased by 10bps to 3.8% of sales due to

the fixed nature of some of these costs, such as occupancy, legal

and insurance costs. The leveraging of these costs as a percentage

of sales was offset by increases in transaction costs, which grew

in line with volume growth.

Depreciation increased by 10bps to 2.3% of sales following

increased capital expenditure in recent financial years in our

warehouse and IT infrastructure.

(3) Restated to remove the headcount relating to discontinued

operations in China

Discontinued operations

In May 2016, the group discontinued its in-country operations in

China and hence all comparatives have been restated to exclude its

loss before tax of GBP2.7m during the six months to 29 February

2016.

Income statement

The Group generated profit before tax of GBP27.3m, up 14%

compared to last year (H1 2016: GBP23.9m), lower than sales growth

due to gross margin investment of 60bps while operating costs

remained a constant percentage of sales year on year.

Six months Six months

to 28 February to

2017 29 February

GBPm 2016(1) Change

---------------------------------------------- ---------------- ------------- -------

Revenue 911.5 663.1 37%

Cost of sales (471.4) (339.1) 39%

---------------------------------------------- ---------------- ------------- -------

Gross profit 440.1 324.0 36%

Distribution expenses (140.2) (97.2) (44%)

Administrative expenses (272.8) (203.1) (34%)

Operating profit 27.1 23.7 14%

Net finance income 0.2 0.2

---------------------------------------------- ---------------- ------------- -------

Profit before tax from continuing operations 27.3 23.9 14%

Income tax expense (5.4) (5.0)

Profit after tax from continuing operations 21.9 18.9 16%

Loss before tax from discontinued operations - (2.7)

Tax from discontinued operations - (1.0)

---------------------------------------------- ---------------- ------------- -------

Profit after tax from discontinued

operations - (3.7)

---------------------------------------------- ---------------- ------------- -------

Profit for the year attributable to

owners of the parent company 21.9 15.2 44%

---------------------------------------------- ---------------- ------------- -------

(1) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

Taxation

The effective tax rate decreased by 110bps to 19.8% (H1 2016:

20.9%) due to prior year tax adjustments and a decline in

prevailing UK corporation tax rates, adjusted to reflect our

financial year end. Going forward, we expect the effective tax rate

to be approximately 100bps higher than the prevailing rate of UK

corporation tax due to permanently disallowable items.

Earnings per share

Basic and diluted earnings per share increased by 16% and 15% to

26.4p and 26.3p respectively (H1 2016: 22.8p) due to the increase

in profit after tax during the period.

Statement of financial position

The Group continues to enjoy a strong financial position

including a closing cash balance of GBP154.3m (31 August 2016:

GBP173.3m). The reduction in cash includes the payment of last

year's GBP20.2m legal settlement in relation to trademark

infringement disputes with Assos of Switzerland GmbH and Anson's

Herrenhaus KG. Therefore, on an underlying basis the Group was

broadly cash flow neutral for the period.

Net assets increased by GBP47.4m to GBP247.8m during the period

(31 August 2016: GBP200.4m) driven principally by continued capital

expenditure. The reduction in cash following the legal settlement

payment was more than offset by a reduction of GBP27.4m in the fair

value liability position of our outstanding forward contracts since

31 August 2016 due to hedges, which were entered into pre-Brexit at

adverse rates, settling during the period. We exited the half with

intentionally less stock than year-end as a result of the important

transition to Eurohub 2 at the start of March 2017; stock levels

have subsequently begun to rise again. A summary statement of

financial position is shown below.

At At

GBPm 28 February 2017 31 August 2016

-------------------------------------- ------------------ ----------------

Goodwill and other intangible assets 143.7 113.5

Property, plant and equipment 90.5 77.2

Deferred tax asset 7.9 13.3

-------------------------------------- ------------------ ----------------

Non-current assets 242.1 204.0

-------------------------------------- ------------------ ----------------

Inventories 249.0 257.7

Net current payables (342.1) (355.7)

Cash and cash equivalents 154.3 173.3

Derivative financial liabilities (48.6) (76.0)

Current tax liability (6.9) (2.9)

Net assets 247.8 200.4

-------------------------------------- ------------------ ----------------

Statement of cash flows

The Group's cash balance decreased by GBP19.0m to GBP154.3m

during the period (31 August 2016: GBP173.3m) as capital

expenditure of GBP62.4m was offset by a cash inflow from operating

activities of GBP42.2m, driven principally by EBITDA. The working

capital outflow of GBP7.7m includes payment of last year's GBP20.2m

legal settlement. Excluding this, underlying working capital inflow

was GBP12.5m due to lower closing stockholding as a result of the

transition to Eurohub 2 at the start of March 2017. A summary

statement of cash flows is shown below.

Six months to Six months to

GBPm 28 February 2017 29 February 2016

------------------------------------------------------- ------------------ ------------------

Operating profit from continuing operations 27.1 23.7

Loss before tax from discontinued operations - (2.7)

------------------------------------------------------- ------------------ ------------------

Operating profit 27.1 21.0

Depreciation and amortisation 21.5 14.9

Loss on disposal of non-current assets 0.1 -

Working capital (7.7) 14.1

Share-based payments charge 3.4 1.6

Other non-cash items (1.0) (0.3)

Tax paid (1.2) (3.5)

Cash inflow from operating activities 42.2 47.8

Capital expenditure (62.4) (31.9)

Net cash inflow relating to EBT(1) 0.6 -

Net finance income received 0.2 0.3

------------------------------------------------------- ------------------ ------------------

Total cash (outflow)/inflow (19.4) 16.2

Opening cash and cash equivalents 173.3 119.2

Effect of exchange rates on cash and cash equivalents 0.4 0.5

------------------------------------------------------- ------------------ ------------------

Closing cash and cash equivalents 154.3 135.9

------------------------------------------------------- ------------------ ------------------

(1) Employee Benefit Trust and Capita Trust

Fixed asset additions

Six months Six months

to to

28 February 29 February

GBPm 2017 2016

----------------------------- ------------- -------------

Technology 44.9 27.0

Warehouse 18.9 5.7

Office fixtures and fit-out 1.3 1.5

Total 65.1 34.2

----------------------------- ------------- -------------

We continue to invest in our warehousing and technology

infrastructure to support our future growth ambitions. The majority

of our technology spend related to our replatforming programme and

the new global fulfilment programme including an end-to-end retail

merchandising system with supporting finance system, whilst our

warehousing spend related to the build-out of Eurohub 2 and further

automation in Barnsley.

CONDENSED UNAUDITED Consolidated Statement of Total

Comprehensive Income

For the six months ended 28 February 2017

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016(1) 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

CONTINUING OPERATIONS

Revenue 911.5 663.1 1,444.9

Cost of sales (471.4) (339.1) (722.7)

----------------------------------------------- ---------------- ---------------- -----------

Gross profit 440.1 324.0 722.2

Distribution expenses (140.2) (97.2) (216.0)

Administrative expenses (272.8) (203.1) (464.1)

----------------------------------------------- ---------------- ---------------- -----------

Operating profit 27.1 23.7 42.1

Finance income 0.2 0.2 0.7

----------------------------------------------- ---------------- ---------------- -----------

Profit before tax from continuing operations

for the period 27.3 23.9 42.8

Income tax expense (5.4) (5.0) (8.1)

----------------------------------------------- ---------------- ---------------- -----------

Profit after tax from continuing operations

for the period 21.9 18.9 34.7

----------------------------------------------- ---------------- ---------------- -----------

DISCONTINUED OPERATIONS

Loss before tax from discontinued operations - (2.7) (10.1)

Tax from discontinued operations - (1.0) (0.2)

----------------------------------------------- ---------------- ---------------- -----------

Loss after tax from discontinued operations

for the period - (3.7) (10.3)

----------------------------------------------- ---------------- ---------------- -----------

Profit for the period attributable

to owners of the parent company 21.9 15.2 24.4

----------------------------------------------- ---------------- ---------------- -----------

Net translation movements offset in

reserves (0.9) (0.6) (1.4)

Fair value gain/(loss) on derivative

financial liabilities 27.4 (43.2) (82.3)

Income tax relating to these items (5.6) 8.4 16.2

----------------------------------------------- ---------------- ---------------- -----------

Other comprehensive gain/(loss) for

the period(2) 20.9 (35.4) (67.5)

----------------------------------------------- ---------------- ---------------- -----------

Total comprehensive gain/(loss) for

the period attributable to owners of

the parent company 42.8 (20.2) (43.1)

---------------------------------------------- ---------------- ---------------- -------------

Basic Earnings per share (Note 4)

From continuing operations 26.4p 22.8p 41.8p

From discontinued operations - (4.5p) (12.4p)

----------------------------------------------- ---------------- ---------------- -----------

Total 26.4p 18.3p 29.4p

----------------------------------------------- ---------------- ---------------- -----------

Diluted Earnings per share (Note 4)

From continuing operations 26.3p 22.8p 41.7p

From discontinued operations - (4.5p) (12.4p)

----------------------------------------------- ---------------- ---------------- -----------

Total 26.3p 18.3p 29.3p

----------------------------------------------- ---------------- ---------------- -----------

(1) For the six months to 29 February 2016, numbers have been restated

to remove the results of the discontinued operation in China

(2) All items of other comprehensive income may be reclassified

to profit or loss

CONDENSED UNAUDITED Consolidated Statement of Changes in

Equity

For the six months ended 28 February 2017

Equity

Employee attributable

Called Benefit to owners

up share Share Retained Trust Hedging Translation of the Non-controlling Total

capital premium earnings(1) reserve(2) reserve reserve parent interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

At 1 September

2016 2.9 6.9 254.7 (2.6) (60.0) (1.5) 200.4 - 200.4

Profit for the

period - - 21.9 - - - 21.9 - 21.9

Other

comprehensive

income/(loss)

for

the period - - - - 21.8 (0.9) 20.9 - 20.9

------------ ------------ ------------ ------------ ------------ ------------ ------------- ---------------- ------------

Total

comprehensive

income/(loss)

for

the period - - 21.9 - 21.8 (0.9) 42.8 - 42.8

Net cash

received

on exercise

of shares

from EBT(2) - - - 0.6 - - 0.6 - 0.6

Transfer of

shares

from EBT(2)

on exercise - - (0.3) 0.3 - - - - -

Share-based

payments

charge - - 3.4 - - - 3.4 - 3.4

Deferred tax - - 0.6 - - - 0.6 - 0.6

At 28

February 2017 2.9 6.9 280.3 (1.7) (38.2) (2.4) 247.8 - 247.8

============ ============ ============ ============ ============ ============ ============= ================ ============

Equity

Employee attributable

Called Benefit to owners

up share Share Retained Trust Hedging Translation of the Non-controlling Total

capital premium earnings(1) reserve(2) reserve reserve parent interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

At 1 September

2015 2.9 6.9 225.1 (3.6) 6.3 (0.3) 237.3 - 237.3

Profit for the

period - - 15.2 - - - 15.2 - 15.2

Other

comprehensive

income/(loss)

for

the period - - 8.4 - (43.2) (0.6) (35.4) - (35.4)

------------ ------------ ------------ ------------ ------------ ------------ ------------- ---------------- ------------

Total

comprehensive

income/(loss)

for

the period - - 23.6 - (43.2) (0.6) (20.2) - (20.2)

Transfer of

shares

from EBT(2) on

exercise - - (0.2) 0.2 - - - - -

Share-based

payments

charge - - 2.1 - - - 2.1 - 2.1

At 29 February

2016 2.9 6.9 250.6 (3.4) (36.9) (0.9) 219.2 - 219.2

============ ============ ============ ============ ============ ============ ============= ================ ============

Equity

Called Employee attributable

up Benefit to owners

share Share Retained Trust Hedging Translation of the Non-controlling Total

capital premium earnings(1) reserve(2) reserve reserve parent interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 September

2015 2.9 6.9 225.1 (3.6) 6.3 (0.3) 237.3 - 237.3

Profit for the

year - - 24.4 - - - 24.4 - 24.4

Other

comprehensive

loss for the

year - - - - (66.3) (1.2) (67.5) - (67.5)

-------- ---------- ------------ ----------- -------- ------------ ------------- ---------------- -------

Total

comprehensive

income/(loss)

for

the year - - 24.4 - (66.3) (1.2) (43.1) - (43.1)

Net cash

received

on exercise

of shares

from EBT(2) - - - 0.7 - - 0.7 - 0.7

Transfer of

shares

from EBT(2)

on exercise - - (0.3) 0.3 - - - - -

Share-based

payments

charge - - 5.0 - - - 5.0 - 5.0

Deferred tax

on

share options - - 0.5 - - - 0.5 - 0.5

Balance as at

31

August 2016 2.9 6.9 254.7 (2.6) (60.0) (1.5) 200.4 - 200.4

======== ========== ============ =========== ======== ============ ============= ================ =======

(1) Retained earnings includes the share-based payments

reserve

(2) Employee Benefit Trust and Capita Trust

CONDENSED UNAUDITED Consolidated Statement of Financial

PositioN

At 28 February 2017

At At At

28 February 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Non-current assets

Goodwill 1.1 1.1 1.1

Other intangible assets (Note

5) 142.6 91.8 112.4

Property, plant and equipment

(Note 5) 90.5 66.9 77.2

Deferred tax asset 7.9 2.3 13.3

------------- ------------- -------------------

242.1 162.1 204.0

------------- ------------- -------------------

Current assets

Inventories 249.0 198.0 257.7

Trade and other receivables 24.9 23.2 15.0

Deferred tax asset - 0.9 -

Cash and cash equivalents (Note

6) 154.3 135.9 173.3

-------------

428.2 358.0 446.0

------------- ------------- -------------------

Current liabilities

Trade and other payables (367.0) (258.8) (370.7)

Derivative financial liabilities

(Note 7) (44.8) (25.3) (55.0)

Current tax liability (6.9) (5.2) (2.9)

(418.7) (289.3) (428.6)

------------- ------------- -------------------

Net current assets 9.5 68.7 17.4

-------------

Non-current liabilities

Derivative financial liabilities

(Note 7) (3.8) (11.6) (21.0)

(3.8) (11.6) (21.0)

------------- ------------- -------------------

Net assets 247.8 219.2 200.4

============= ============= ===================

Equity attributable to owners

of the parent

Called up share capital 2.9 2.9 2.9

Share premium 6.9 6.9 6.9

Employee Benefit Trust reserve (1.7) (3.4) (2.6)

Hedging reserve (38.2) (36.9) (60.0)

Translation reserve (2.4) (0.9) (1.5)

Retained earnings 280.3 250.6 254.7

Total equity 247.8 219.2 200.4

============= ============= ===================

CONDENSED UNAUDITED Consolidated Statement of Cash Flows

For the six months ended 28 February 2017

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Operating profit from continuing operations 27.1 23.7 42.1

Loss before tax from discontinued operations - (2.7) (10.1)

---------------- ---------------- -----------

Operating profit 27.1 21.0 32.0

Adjusted for:

Depreciation of property, plant and

equipment 5.7 5.1 10.5

Amortisation of other intangible assets 15.8 9.8 21.2

Loss on disposal of non-current assets

from continuing operations 0.1 - 0.8

Loss on disposal of non-current assets

from discontinued operations - - 4.3

Decrease/(increase) in inventories 8.7 (4.2) (63.8)

(Increase)/decrease in trade and other

receivables (10.3) (5.1) 4.2

(Decrease)/increase in trade and other

payables (6.1) 23.4 128.7

Share-based payments charge 3.4 1.6 4.5

Other non-cash items (1.0) (0.3) (1.7)

Income tax paid (1.2) (3.5) (10.0)

---------------- ---------------- -----------

Net cash generated from operating activities 42.2 47.8 130.7

Investing activities

Payments to acquire other intangible

assets (46.1) (23.3) (55.7)

Payments to acquire property, plant

and equipment (16.3) (8.6) (23.5)

Finance income 0.2 0.4 0.8

Net cash used in investing activities (62.2) (31.5) (78.4)

Financing activities

Net cash inflow relating to EBT(1) 0.6 - 0.7

Finance expense - (0.1) (0.1)

---------------- ---------------- -----------

Net cash generated/(used) in financing

activities 0.6 (0.1) 0.6

Net (decrease)/increase in cash and

cash equivalents (19.4) 16.2 52.9

---------------- ---------------- -----------

Opening cash and cash equivalents 173.3 119.2 119.2

Effect of exchange rates on cash and

cash equivalents 0.4 0.5 1.2

---------------- ---------------- -----------

Closing cash and cash equivalents 154.3 135.9 173.3

================ ================ ===========

(1) Employee Benefit Trust and Capita Trust

Notes to the CONDENSED UNAUDITED financial information

For the six months ended 28 February 2017

1. Preparation of the condensed unaudited consolidated financial

information ("interim financial statements")

a) General information

ASOS Plc ('the Company') and its subsidiaries (together, 'the

Group') is a global fashion retailer. The Group sells products

across the world and has websites targeting the UK, US, Australia,

France, Germany, Spain, Italy and Russia. The Company is a public

limited company which is listed on the Alternative Investment

Market (AIM) and is incorporated and domiciled in the UK. The

address of its registered office is Greater London House, Hampstead

Road, London NW1 7FB.

The interim financial statements have been reviewed, not audited

and were approved by the Board of Directors on 3 April 2017.

b) Basis of preparation

The interim financial statements for the six months ended 28

February 2017 have been prepared in accordance with IAS 34,

"Interim Financial Reporting" as adopted by the European Union. The

interim financial statements should be read in conjunction with the

Group's Annual Report and Accounts for the year ended 31 August

2016, which has been prepared in accordance with IFRSs as adopted

by the European Union.

The interim financial statements have been reviewed, not

audited, and do not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. The Annual Report

and Accounts for the year ended 31 August 2016 have been filed with

the Registrar of Companies. The auditors' report on those accounts

was unqualified, did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying the report and did not contain statements under s498 of

the Companies Act 2006.

The Group's business activities together with the factors that

are likely to affect its future developments, performance and

position are set out in the Business Review. The Business Review

describes the Group's financial position and cash flows.

Going concern

The Directors have reviewed current performance and cash flow

forecasts, and are satisfied that the Group's forecasts and

projections, taking account of potential changes in trading

performance, show that the Group will be able to operate within the

level of its current facilities for the foreseeable future. The

Directors have therefore continued to adopt the going concern basis

in preparing the Group's financial statements.

Changes to accounting standards

Various new accounting standards and amendments were issued

during the period, none of which have had an impact in the current

period. The impact of new standards which are not yet effective are

currently under review by the Group, including IFRS 9 'Financial

Instruments, IFRS 15 'Revenue from Contracts with Customers' and

IFRS 16 'Leases'.

Statement of Directors' responsibilities

The Directors confirm that, to the best of their knowledge, the

interim financial statements have been prepared in accordance with

IAS 34 "Interim Financial Reporting" as adopted by the European

Union, and that the interim management report includes a fair

review of the information required.

Accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies set out in the Annual

Report and Accounts for the year ended 31 August 2016.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to the expected total annual

earnings.

2. Principal risks and uncertainties

The Board considers the principal risks and uncertainties which

could impact the Group over the remaining six months of the

financial year to 31 August 2017 to be unchanged from those set out

in the Annual Report and Accounts for the year ended 31 August

2016, summarised as follows:

- Technological risk including the ability to recover

sufficiently from loss of data, robustness and sufficiency of IT

systems and infrastructure, and IT capacity and capability keeping

pace with business growth and complexity

- Financial risks, including ensuring our UK business model is

profitable on a scalable basis in key territories and managing

exposure to changes in foreign exchange rates

- Market risks, including failure to meet customer demand and

changing tastes, understanding additional costs to meet ecommerce

drivers, maintaining our market position and fashionability, or an

inadequate digital experience

- Supply chain risks, including interruption to supply of core

category products and disruption to delivery services or

warehousing activities and capacity

- Reputational risks around (a) our brand name, including trade

mark oppositions, legal claims and formal litigation as a result of

failure or inability to support and protect our brand, trademarks

and domain names, (b) the security of our customer and business

data, including unauthorised access to or breach of our systems and

records and (c) adhering to product quality or ethical trading

standards

- Reliance on key personnel

These are set out in detail on pages 20 to 24 of the Group's

Annual Report and Accounts for the year ended 31 August 2016, a

copy of which is available on the Group's website, www.asosplc.com.

Information on financial risk management is also detailed on pages

81 to 82 of the Annual Report.

3. Segmental analysis

IFRS 8 'Operating Segments' requires operating segments to be

determined based on the Group's internal reporting to the Chief

Operating Decision Maker. The Chief Operating Decision Maker has

been determined to be the Executive Board and has determined that

the primary segmental reporting format of the Group is geographical

by customer location, based on the Group's management and internal

reporting structure.

The Executive Board assesses the performance of each segment

based on revenue and gross profit after distribution expenses,

which excludes administrative expenses.

Six months to 28 February 2017 (unaudited)

UK US EU RoW Total

GBPm GBPm GBPm GBPm GBPm

Retail sales 340.8 124.3 248.9 175.2 889.2

Delivery receipts 7.6 2.9 4.9 3.9 19.3

Third party revenues 2.9 0.1 - - 3.0

---------- -------- --------- ------- ---------

Total segment revenue 351.3 127.3 253.8 179.1 911.5

Cost of sales (195.7) (50.4) (138.6) (86.7) (471.4)

---------- -------- --------- ------- ---------

Gross profit 155.6 76.9 115.2 92.4 440.1

Distribution expenses (38.7) (33.1) (39.3) (29.1) (140.2)

---------- -------- --------- ------- ---------

Segment result 116.9 43.8 75.9 63.3 299.9

Administrative expenses (272.8)

Operating profit 27.1

Finance income 0.2

Profit before tax 27.3

=========

Six months to 29 February 2016 (unaudited)

(1)

UK US EU RoW Total

GBPm GBPm GBPm GBPm GBPm

Retail sales 289.5 76.8 167.9 110.4 644.6

Delivery receipts 7.2 2.7 3.2 2.8 15.9

Third party revenues 2.4 0.1 - 0.1 2.6

---------- -------- -------- -------- ---------

Total segment revenue 299.1 79.6 171.1 113.3 663.1

Cost of sales (160.4) (31.9) (91.9) (54.9) (339.1)

---------- -------- -------- -------- ---------

Gross profit 138.7 47.7 79.2 58.4 324.0

Distribution expenses (33.2) (22.7) (23.3) (18.0) (97.2)

---------- -------- -------- -------- ---------

Segment result 105.5 25.0 55.9 40.4 226.8

Administrative expenses (203.1)

Operating profit 23.7

Finance income 0.2

---------

Profit before tax continuing

operations 23.9

Loss before tax from discontinued

operations (2.7)

---------

Profit before tax 21.2

=========

(1) For the six months to 29 February 2016, numbers have been

restated to remove the results of the discontinued operation in

China

Year to 31 August 2016 (audited)

UK US EU RoW Total

GBPm GBPm GBPm GBPm GBPm

Retail sales 603.8 179.2 374.9 245.8 1,403.7

Delivery receipts 15.3 5.5 7.3 6.4 34.5

Third party revenues 6.4 0.1 0.1 0.1 6.7

Internal revenues - - - 3.0 3.0

-------- ------- -------- -------- ---------

Total segment revenue 625.5 184.8 382.3 255.3 1,447.9

Eliminations - - - (3.0) (3.0)

-------- ------- -------- -------- ---------

Total revenue 625.5 184.8 382.3 252.3 1,444.9

Cost of sales (331.0) (72.9) (202.5) (116.3) (722.7)

-------- ------- -------- -------- ---------

Gross profit 294.5 111.9 179.8 136.0 722.2

Distribution expenses (72.8) (46.8) (54.2) (42.2) (216.0)

-------- ------- -------- -------- ---------

Segment result 221.7 65.1 125.6 93.8 506.2

Administrative expenses (443.2)

Exceptional items (20.9)

---------

Operating profit from continuing

operations 42.1

Finance income 0.7

---------

Profit before tax continuing

operations 42.8

Loss before tax from discontinued

operations (10.1)

---------

Profit before tax 32.7

=========

Due to the nature of its activities, the Group is not reliant on

any individual major customers.

No analysis of the assets and liabilities of each operating

segment is provided to the Chief Operating Decision Maker in the

monthly management accounts therefore no measure of segments assets

or liabilities is disclosed in this note.

There are no material non-current assets located outside the

UK.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the year. Own

shares held by the Employee Benefit Trust and Capita Trust are

eliminated from the weighted average number of ordinary shares.

Diluted earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the period,

adjusted for the effects of potentially dilutive share options.

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

No. of shares No. of shares No. of shares

Weighted average share capital

Weighted average shares in issue

for basic earnings per share 82,986,398 82,967,753 82,972,285

Weighted average effect of dilutive

options 418,556 15,015 224,372

---------------- ---------------- --------------

Weighted average shares in issue

for diluted earnings per share 83,404,954 82,982,768 83,196,657

================ ================ ==============

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Earnings

Earnings attributable to owners

of the parent 21.9 15.2 24.4

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

Pence Pence Pence

Earnings per share from continuing

operations

Basic earnings per share 26.4 22.8 41.8

Diluted earnings per share 26.3 22.8 41.7

Loss per share from discontinued

operations

Basic loss per share - (4.5) (12.4)

Diluted loss per share - (4.5) (12.4)

Earnings per share

Basic adjusted earnings per share 26.4 18.3 29.4

Diluted adjusted earnings per share 26.3 18.3 29.3

================= ================= ===============

5. Capital expenditure and commitments

During the period, the Group capitalised property, plant and

equipment of GBP19.0m and intangible assets of GBP46.1m. Disposals

were immaterial. At the period end capital commitments contracted,

but not provided for by the Group, amounted to GBP10.1m.

6. Reconciliation of cash and cash equivalents

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Net movement in cash and cash equivalents (19.4) 16.2 52.9

Opening cash and cash equivalents 173.3 119.2 119.2

Effect of exchange rates on cash

and cash equivalents 0.4 0.5 1.2

---------------- ---------------- -----------

Closing cash and cash equivalents 154.3 135.9 173.3

================ ================ ===========

The Group has a GBP20.0m revolving loan credit facility which

includes an ancillary GBP10.0m guaranteed overdraft facility and

which is available until October 2018, none of which has been drawn

down as at 28 February 2017.

7. Financial instruments

There are no changes to the categories of financial instruments

held by the Group.

Six months Six months Year to

to 28 February to 29 February 31 August

2017 2016 2016

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Financial assets

Loans and receivables(1) 167.0 149.0 179.0

Financial liabilities

Derivative liabilities used for

hedging at fair value (48.6) (36.9) (76.0)

Amortised cost(2) (360.8) (248.5) (364.9)

================ ================ ===========

(1) Loans and receivables include trade and other receivables

and cash and cash equivalents, and excludes prepayments

(2) Included in financial liabilities at amortised cost are

trade payables, accruals and other payables

The Group operates internationally and is therefore exposed to

foreign currency transaction risk, primarily on sales denominated

in US dollars, Euros and Australian dollars. The Group's policy is

to mitigate foreign currency transaction exposures where possible

and the Group uses financial instruments in the form of forward

foreign exchange contracts to hedge future highly probable foreign

currency cash flows.

These forward foreign exchange contracts are classified above as

derivative financial liabilities and are classified as Level 2

financial instruments under IFRS 13, "Fair Value Measurement." They

have been fair valued at 28 February 2017 with reference to forward

exchange rates that are quoted in an active market, with the

resulting value discounted back to present value. All forward

foreign exchange contracts were assessed to be highly effective

during the period to 28 February 2017 and a net unrealised gain of

GBP27.4m (H1 2016: loss of GBP43.2m) was recognised in equity. All

derivative financial liabilities at 28 February 2017 mature within

two years based on the related contractual arrangements.

8. Related Parties

The Group's related parties are the Employee Benefit Trust,

Capita Trust and key management personnel. There have been no

material changes to the Group's related party transactions during

the six months to 28 February 2017.

9. Contingent Liabilities

From time to time, the Group is subject to various legal

proceedings and claims that arise in the ordinary course of

business which, due to the fast growing nature of the Group and its

e-commerce base, may concern the Group's brand and trading name or

its product designs. At 28 February 2017, there were no pending

claims or proceedings against the Group which were expected to have

a material adverse effect on its liquidity or operations.

At 28 February 2017, the Group had contingent liabilities of

GBP6.4m (H1 2016: GBP3.8m) in relation to supplier standby letters

of credit, rent deposit deeds and other bank guarantees. The

likelihood of cash outflow in relation to these contingent

liabilities is considered low.

Independent review report to ASOS PLC

Report on the condensed unaudited financial information

Our conclusion

We have reviewed ASOS plc's condensed unaudited financial

information (the "interim financial statements") in the half-yearly

report of ASOS plc for the 6 month period ended 28 February 2017.

Based on our review, nothing has come to our attention that causes

us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the AIM Rules for

Companies.

What we have reviewed

The interim financial statements comprise:

-- the condensed unaudited consolidated statement of financial

position as at 28 February 2017;

-- the condensed unaudited consolidated statement of total

comprehensive income for the period then ended;

-- the condensed unaudited consolidated statement of cash flows for the period then ended;

-- the condensed unaudited consolidated statement of changes in

equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the half-yearly

report have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and the AIM Rules for Companies.

As disclosed in Note 1 to the interim financial statements, the

financial reporting framework that has been applied in the

preparation of the full annual financial statements of the Group is

applicable law and International Financial Reporting Standards

(IFRSs) as adopted by the European Union.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The half-yearly report, including the interim financial

statements, is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the

half-yearly report in accordance with the AIM Rules for Companies

which require that the financial information must be presented and

prepared in a form consistent with that which will be adopted in

the company's annual financial statements.

Our responsibility is to express a conclusion on the interim

financial statements in the half-yearly report based on our review.

This report, including the conclusion, has been prepared for and

only for the company for the purpose of complying with the AIM

Rules for Companies and for no other purpose. We do not, in giving

this conclusion, accept or assume responsibility for any other

purpose or to any other person to whom this report is shown or into

whose hands it may come save where expressly agreed by our prior

consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the half-yearly

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

PricewaterhouseCoopers LLP

Chartered Accountants

St Albans

4 April 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSFFADFWSESL

(END) Dow Jones Newswires

April 04, 2017 02:00 ET (06:00 GMT)

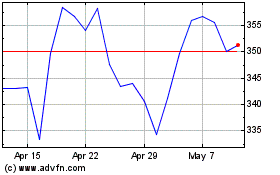

Asos (LSE:ASC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asos (LSE:ASC)

Historical Stock Chart

From Apr 2023 to Apr 2024