Announces new EUR 1 bln share

buyback program

VELDHOVEN, the Netherlands, 21 January 2015 - ASML

Holding N.V. (ASML) today publishes its 2014 fourth-quarter and

full-year results.

-

Q4 net sales of EUR 1.49 billion, gross margin

44 percent

-

Full-year 2014 sales at a record EUR 5.86

billion, net profit of EUR 1.2 billion

-

ASML guides Q1 2015 net sales at around EUR 1.6

billion and a gross margin of around 47 percent

-

ASML proposes a dividend of EUR 0.70 per

ordinary share for 2014, a 15 percent increase with respect to 2013

and announces a new EUR 1 bln share buyback program

| (Figures in millions of euros unless otherwise

indicated) |

Q4 2014 |

Q3 2014 |

FY 2014 |

FY 2013 |

| Net sales |

1,494 |

1,322 |

5,856 |

5,245 |

| ...of which service and field option sales |

409 |

438 |

1,613 |

1,252 |

| |

|

|

|

|

| Other income (Co-Investment Program) |

20 |

20 |

81 |

64 |

| |

|

|

|

|

| New systems sold (units) |

30 |

24 |

116 |

142 |

| Used systems sold (units) |

5 |

6 |

20 |

15 |

| Average Selling Price (ASP) of net system sales |

31.0 |

29.5 |

31.2 |

25.4 |

| |

|

|

|

|

| Net bookings |

1,387* |

1,397 |

4,902* |

4,644 |

| Net bookings (units) |

51* |

47 |

157* |

166 |

| ASP of booked systems |

27.2* |

29.7 |

31.2* |

28.0 |

| Systems backlog |

2,772* |

2,406 |

2,772* |

1,953 |

| Systems backlog (units) |

82* |

65 |

82* |

56 |

| |

|

|

|

|

| Gross profit |

657 |

578 |

2,596 |

2,177 |

| Gross margin (%) |

44.0 |

43.7 |

44.3 |

41.5 |

| |

|

|

|

|

| Net income |

305 |

244 |

1,197 |

1,015 |

| EPS (basic; in euro) |

0.70 |

0.56 |

2.74 |

2.36 |

| |

|

|

|

|

| End-quarter cash and cash equivalents and short-term

investments |

2,754 |

2,685 |

2,754 |

3,011 |

*) As of Q4 2014 our net bookings and systems

backlog include NXE:3350B orders. For the definition of our net

bookings and system backlog see footnote 4 of our U.S. GAAP

Consolidated Financial Statements.

A complete summary of U.S. GAAP Consolidated Statements of

Operations is published on www.asml.com

CEO Statement

"Our 2014 fourth-quarter net sales came in ahead of guidance, as

the memory sector was stronger than we expected. Full-year sales

rose 12 percent from 2013 to a record EUR 5.86 billion, gross

margin was up almost 3 percentage points to 44.3 percent, while

earnings per share increased by 16 percent to EUR 2.74 per share.

Looking ahead to H1 2015, we expect both our sales to the memory

segment and our service and field option business to continue to be

strong and sales to the logic segment to increase from H2 2014 to

H1 2015, underpinned by the EUR 2.8 billion backlog," ASML

President and Chief Executive Officer Peter Wennink said.

"As extensively discussed during our investor day

in November, our EUV program in 2015 will focus on continuing the

encouraging progress in productivity and in shipping our

fourth-generation EUV tools, the NXE:3350B," Wennink said.

2014 Product Highlights

-

We successfully ramped our newest immersion

system, the NXT:1970Ci and shipped 51 systems

-

Our TWINSCAN immersion systems set new

productivity records: two systems each imaged more than 1.5 million

wafers in a 12-month period

-

A total of seven NXE:3300B EUV systems were in

the field by end-2014

-

On the NXE:3300B systems we achieved the

500-wafer-per-day target that our customers have set for end-2014

and demonstrated stable source operation at 80 W running

continuously for 24 hours at a customer site

-

TSMC ordered two NXE:3350B EUV systems for

delivery in 2015 with the intention to use those systems in

production. In addition, two NXE:3300B systems already delivered to

TSMC will be upgraded to NXE:3350B performance.

-

The ramp in shipments of our YieldStar metrology

tool continued, with a total of 199 systems shipped to all major

customers

Outlook

For the first quarter of 2015, ASML expects net sales of around EUR

1.6 billion, a gross margin of around 47 percent, R&D costs of

about EUR 260 million, other income of about EUR 20 million --

which consists of contributions from participants of the Customer

Co-Investment Program -- and SG&A costs of about EUR 83

million.

Dividend and new Share Buyback

Program

Given ASML's strong financial position and cash flow prospects,

ASML intends to continue to return excess cash to shareholders

through dividends and share buyback programs in accordance with our

policy, thereby supporting its shareholders in their continued

investment in the company.

ASML intends to increase the dividend per ordinary

share by 15 percent compared with last year. Therefore, we will

submit a proposal to the 2015 Annual General Meeting of

Shareholders (AGM) to declare a dividend in respect of 2014 of EUR

0.70 per ordinary share (for a total amount of approximately EUR

300 million), compared with a dividend of EUR 0.61 per ordinary

share paid in respect of 2013.

ASML also announces a new share buyback program,

to be executed within the 2015-2016 timeframe. As part of this

program, ASML intends to purchase up to EUR 750 million of shares

which it intends to cancel upon repurchase. In addition, ASML

intends to purchase as part of this program up to 3.3 million

shares to cover employee stock and stock option plans. This

buyback program will start on 22 January 2015, and at current share

price these intended repurchases represent a total value of

approximately EUR 1 billion.

The share buyback program will be executed within

the limitations of the existing authority granted by the AGM on

April 23, 2014 and of the authority granted at future AGMs. The

share buyback program may be suspended, modified or discontinued at

any time. All transactions under this program will be published on

ASML's website (www.asml.com/investors) on a weekly basis.

About ASML

ASML makes possible affordable microelectronics that improve the

quality of life. ASML invents and develops complex technology for

high-tech lithography machines for the semiconductor industry.

ASML's guiding principle is continuing Moore's Law towards ever

smaller, cheaper, more powerful and energy-efficient

semiconductors. Our success is based on three pillars: technology

leadership combined with customer and supplier intimacy, highly

efficient processes and entrepreneurial people. We are a

multinational company with over 70 locations in 16 countries,

headquartered in Veldhoven, the Netherlands. We employ more than

14,000 people on payroll and flexible contracts (expressed in full

time equivalents). Our company is an inspiring place where

employees work, meet, learn and share. ASML is traded on Euronext

Amsterdam and NASDAQ under the symbol ASML. More information about

ASML, our products and technology, and career opportunities is

available on: www.asml.com

Press conference

A press conference hosted by CEO Peter Wennink and CFO Wolfgang

Nickl will be held at our office in Veldhoven at 11:00 AM Central

European Time / 05:00 AM U.S. Eastern time. An audio webcast of the

press conference is available on www.asml.com, along with a

presentation and a video statement of CEO Peter Wennink.

Investor and Media Conference

Call

A conference call for investors and media will be hosted by CEO

Peter Wennink and CFO Wolfgang Nickl at 15:00 PM Central European

Time / 09:00 AM U.S. Eastern time. Dial-in numbers are: in the

Netherlands +31 20 716 8295 and the US +1 646 254 3388 (no

confirmation code needed). Listen-only access is also available via

www.asml.com

2014 Annual Reports

ASML will publish its 2014 Annual Report on Form 20-F, Statutory

Annual Report, Corporate Responsibility Report and Remuneration

Report on 11 February 2015. The reports will be published on our

website at www.asml.com.

US GAAP and IFRS Financial

Reporting

ASML's primary accounting standard for quarterly earnings releases

and annual reports is US GAAP, the accounting principles generally

accepted in the United States of America. Quarterly US GAAP

consolidated statements of operations, consolidated statements of

cash flows and consolidated balance sheets, and a reconciliation of

net income and equity from US GAAP to IFRS as adopted by the EU

('IFRS') are available on www.asml.com

In addition to reporting financial figures in

accordance with US GAAP, ASML also reports financial figures in

accordance with IFRS for statutory purposes. The most significant

differences between US GAAP and IFRS that affect ASML concern the

capitalization of certain product development costs, the accounting

of share-based payment plans and the accounting of income taxes.

ASML's quarterly IFRS consolidated statement of profit or loss,

consolidated statement of cash flows, consolidated statement of

financial position and a reconciliation of net income and equity

from US GAAP to IFRS are available on www.asml.com

The consolidated balance sheets of ASML Holding

N.V. as of 31 December 2014, the related consolidated statements of

operations and consolidated statements of cash flows for the

quarter ended 31 December 2014 as presented in this press release

are unaudited.

Regulated

Information

This press release, the US GAAP consolidated financial statements,

the IFRS consolidated financial statements and the Statutory

Interim Report published on www.asml.com comprise regulated

information within the meaning of the Dutch Financial Markets

Supervision Act (Wet op het financieel

toezicht).

Forward Looking

Statements

This document contains statements relating to certain projections

and business trends that are forward-looking, including statements

with respect to our outlook, expected customer demand in specified

market segments, expected trends, systems backlog, IC unit demand,

expected financial results, including expected or potential sales,

other income, gross margin and expenses, tool orders and expected

shipment of tools, productivity of our tools and systems

performance, including TWINSCAN and EUV system performance (such as

endurance tests), expected industry trends, the development of EUV

technology and the number of EUV systems expected to be shipped and

timing of shipments, our proposed dividend for 2014 and our

intention to repurchase shares. You can generally identify

these statements by the use of words like "may", "will", "could",

"should", "project", "believe", "anticipate", "expect", "plan",

"estimate", "forecast", "potential", "intend", "continue" and

variations of these words or comparable words. These statements are

not historical facts, but rather are based on current expectations,

estimates, assumptions and projections about the business and our

future financial results and readers should not place undue

reliance on them. Forward-looking statements do not guarantee

future performance and involve risks and uncertainties. These risks

and uncertainties include, without limitation, economic conditions,

product demand and semiconductor equipment industry capacity,

worldwide demand and manufacturing capacity utilization for

semiconductors (the principal product of our customer base),

including the impact of general economic conditions on consumer

confidence and demand for our customers' products, competitive

products and pricing, the impact of manufacturing efficiencies and

capacity constraints, performance of our systems, the continuing

success of technology advances and the related pace of new product

development and customer acceptance of new products, the number and

timing of EUV systems expected to be shipped and recognized in

revenue, our ability to enforce patents and protect intellectual

property rights, the risk of intellectual property litigation,

availability of raw materials and critical manufacturing equipment,

trade environment, changes in exchange rates, available cash,

distributable reserves for dividend payments and share repurchases,

risks associated with the Cymer acquisition and other risks

indicated in the risk factors included in ASML's Annual Report on

Form 20-F and other filings with the US Securities and Exchange

Commission. These forward-looking statements are made only as of

the date of this document. We do not undertake to update or revise

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Link to Press Release

Link to Consolidated Financial Statements

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: ASML Holding via Globenewswire

HUG#1888454

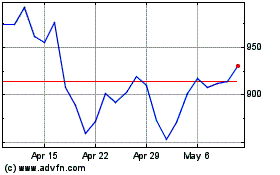

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

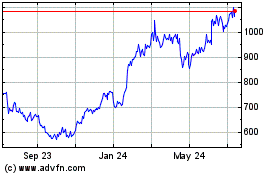

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024