ASML affirms 2020 growth opportunity

October 31 2016 - 3:01AM

NEW YORK, United States, 31 October 2016 - ASML

Holding NV (ASML) today confirms its view, first stated at the 2014

investor day, of an annual revenue opportunity of EUR 10 billion in

2020. The operational leverage in our business model is expected to

lead to an opportunity in 2020 to increase the gross margin to

around 50 percent and together with expected higher sales to a rise

in earnings per share to more than 8 euros. The planned acquisition

of Hermes Microvision Inc. (HMI) will provide additional

opportunities for growth.

At ASML's Investor Day today in New York City,

executive management will lay out the key drivers, market

opportunities and operational priorities that are expected to

enable the company's continued growth and value creation.

The event starts at 9:00 AM Eastern Time (2:00 PM

Central European Time) and will be webcast live on

www.asml.com.

About ASML

ASML is one of the world's leading manufacturers of chip-making

equipment. Our vision is to enable affordable microelectronics that

improve the quality of life. To achieve this, our mission is to

invent, develop, manufacture and service advanced technology for

high-tech lithography, metrology and software solutions for the

semiconductor industry. ASML's guiding principle is continuing

Moore's Law towards ever smaller, cheaper, more powerful and

energy-efficient semiconductors. This results in increasingly

powerful and capable electronics that enable the world to progress

within a multitude of fields, including healthcare, technology,

communications, energy, mobility, and entertainment. We are a

multinational company with over 70 locations in 16 countries,

headquartered in Veldhoven, the Netherlands. We employ more than

15,500 people on payroll and flexible contracts (expressed in full

time equivalents). ASML is traded on Euronext Amsterdam and NASDAQ

under the symbol ASML. More information about ASML, our products

and technology, and career opportunities is available on

www.asml.com.

Forward-Looking

Statements

This document contains statements relating to certain projections

and business trends that are forward-looking, including statements

with respect to annual revenue opportunity in 2020, expected

opportunities for increases in gross margin, expected higher sales,

expected opportunities for an increase in EPS in 2020, the growth

opportunities created by ASML's acquisition of HMI and the drivers,

market opportunities and operational priorities that are expected

to enable the ASML's growth and value creation. You can generally

identify these statements by the use of words like "may", "will",

"could", "should", "project", "believe", "anticipate", "expect",

"plan", "estimate", "forecast", "potential", "intend", "continue"

and variations of these words or comparable words. These statements

are not historical facts, but rather are based on current

expectations, estimates, assumptions and projections about the

business and our future financial results and readers should not

place undue reliance on them.

Forward-looking statements do not

guarantee future performance and involve risks and uncertainties.

These risks and uncertainties include, without limitation, economic

conditions, product demand and semiconductor equipment industry

capacity, worldwide demand and manufacturing capacity utilization

for semiconductors (the principal product of our customer base),

including the impact of general economic conditions on consumer

confidence and demand for our customers' products, competitive

products and pricing, the impact of any manufacturing efficiencies

and capacity constraints, performance of our systems, the

continuing success of technology advances and the related pace of

new product development and customer acceptance of new products

including EUV, the number and timing of EUV systems expected to be

shipped and recognized in revenue, delays in EUV systems production

and development, our ability to enforce patents and protect

intellectual property rights, the risk of intellectual property

litigation, availability of raw materials and critical

manufacturing equipment, trade environment, changes in exchange

rates, changes in tax rates, available cash and liquidity, our

ability to refinance our indebtedness, distributable reserves for

dividend payments and share repurchases and timing of resumption of

the share repurchase plan, and other risks indicated in the risk

factors included in ASML's Annual Report on Form 20-F and other

filings with the US Securities and Exchange Commission. These

forward-looking statements are made only as of the date of this

document. We do not undertake to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Link to Press Release

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: ASML Holding via Globenewswire

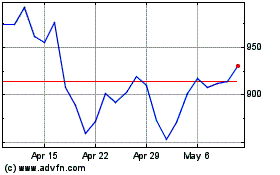

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

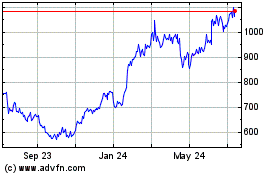

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024