ASIA MARKETS: Australian Stocks Log Their Best Week In A Month

November 20 2015 - 4:16AM

Dow Jones News

By Chao Deng

All key markets gain on prospect of U.S. rate hike

Shares in Australia logged their best week in over a month

Friday, while investors elsewhere in the region gradually adjusted

to the prospect of higher U.S. interest rates.

Australia's S&P/ASX 200 gained 4.1% this week, its best

weekly percentage jump since the week ended Oct. 9. The benchmark

was up 0.3% Friday, the best close since Oct. 29, with the

resources sector leading the gains as oil-price declines

stabilized.

Elsewhere, Indonesia's JSX was up 0.7% on Friday and 1.8% for

the week. Japan's Nikkei Stock Average rose 1.4% for the week, and

0.1% on Friday.

Hong Kong's Hang Seng Index and the Shanghai Composite Index

rose 1.6% and 1.4%, respectively, for the week, while South Korea's

Kospi gained 0.8%. On Friday, The Hang Seng added 1.1%, Shanghai

was up 0.4% and the Kospi rose 0.1%.

"The main reason [for the region's gains this week] is a more

relaxed approach about the Fed" by investors, said Shane Oliver,

investment strategist with AMP Capital. "Worries about the Fed

causing an emerging market crisis are dissipating."

Stock-market investors have started to view the Federal

Reserve's tilt toward a near-term interest-rate rise more

positively -- a shift from recent weeks, when worries about higher

borrowing costs and slower growth triggered selling.

Now, many investors, as well as global central banks, are eager

for the Fed to act, if only to settle the uncertainty.

Some said they believe any rate rises would be incremental, and

that a December increase would signal the Fed's vote of confidence

in the global economy.

"We have done everything we can to avoid surprising the markets

and governments when we move, to the extent that several emerging

market and other central bankers have for some time been telling

the Fed to 'just do it,'" said Fed Vice Chairman Stanley Fischer

said in San Francisco Thursday.

In Australia, shares rebounded from heavy selling the previous

week when commodities prices tumbled. Energy shares on the S&P

ASX 200 have gained 6.6% this week, after an 8.4% tumble the

previous week.

Shares of BHP Billiton Ltd. (BHP.AU)(BLT.LN) (BHP.AU)

Australia's largest mining company, are up 1.3% this week, having

shed 11% the previous week, close to a decade low amid worries

about the fallout from a recent dam-burst at its Brazilian iron-ore

operation. Shares were up 0.4% Friday.

"Investors are realizing that the associated selloff in other

resources stocks probably went too far" given that BHP had unique

reasons for its selloff, Oliver said.

Meanwhile, the fallout from slumping commodities' prices and

continuing concerns about China's economic slowdown continue to

weigh on shares in Singapore, where many resources firms,

shipbuilders and property companies trade. The FTSE Strait Times

Index fell 0.2% on Friday, led by declines in traders like Noble

Group Ltd. (N21.SG) and Olam International Ltd. (O32.SG) , down

2.4% and 1.6%, respectively. The index is on track to lose 0.4%

this week.

The benchmark is down 13.4% year to date, surpassing Indonesia's

JSX as the worst performing market in Asia. The JSX is off 12.9%

year to date.

Shares of Noble Group have fallen 6.7% this week in the wake of

recent accusations of irregular accounting. Fitch Ratings said

Friday that Noble's liquidity profile is "just enough" to maintain

its triple B rating. Moody's and Standard & Poor's this week

placed the firm on negative outlook on concerns over its debt and

liquidity.

A weaker yen helped buoy Japanese shares earlier this week, as

the local currency touched its lowest level since late August. But

the yen strengthened Thursday after the Bank of Japan kept its

monetary policy unchanged. The yen last traded at Yen123.01 per

U.S. dollar, up 0.1% from late in Asia Thursday.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 04:01 ET (09:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

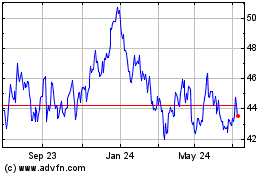

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024