ASIA MARKETS: Australia Stocks Look At Best Week In A Month, Yen Weighs On Nikkei

November 20 2015 - 1:18AM

Dow Jones News

By Chao Deng

Shares in Australia are headed for their best week in over a

month on Friday, as investors elsewhere in the region gradually

adjust to the prospect of higher U.S. interest rates.

Australia's S&P/ASX 200 is on track to gain 4.1% this week,

its best weekly percentage jump since the week ended Oct. 9. The

resources sector led the index higher as heavy losses in oil prices

eased this week. The benchmark, up 0.3% Friday, is also headed for

its best close since Nov. 4.

South Korea's Kospi was flat on Friday, gained 1% week-to-date.

The Shanghai Composite Index rose 0.5% on Friday, is also up 1.5%

week-to-date.

Hong Kong's Hang Seng Index slipped 0.2% while Japan's Nikkei Stock Average was up 0.1% Friday.

A weaker yen buoyed Japan shares earlier this week, with the

local currency touching its weakest level since late August. But

the currency strengthened overnight, last up 0.1% at Yen122.82 per

U.S. dollar, after the Bank of Japan's decision to keep its

monetary policy unchanged Thursday.

The Nikkei is up 0.7% this week.

"The main reason [for the region's gains this week] is a more

relaxed approach about the Fed" by investors, said Shane Oliver,

investment strategist with AMP Capital. "Worries about the Fed

causing an emerging market crisis are dissipating."

Viewing the Fed's move as a positive for the equity market marks

a shift from weeks past, when the Federal Reserve's plans sparked

worries about higher borrowing costs and slower growth, pushing

shares lower.

Now, many investors--and even global central bankers--are eager

for the Fed to act, if only to settle pending uncertainty.

Several also said they believe any increase in rates would be

incremental, and that a December move would signal the Fed's vote

of confidence in the global economy.

"We have done everything we can to avoid surprising the markets

and governments when we move, to the extent that several emerging

market and other central bankers have for some time been telling

the Fed to 'just do it,'" said Fed Vice Chairman Stanley Fischer

said in San Francisco Thursday.

In Australia, shares rebounded from heavy selling the previous

week when commodities prices tumbled. Most sectors gained this

week, although energy, telecommunications and utilities stocks

rallied most, by 6.7%, 5.3% and 4.1%, respectively.

Shares of BHP Billiton Ltd. (BHP.AU)(BLT.LN) (BHP.AU)

Australia's largest mining company, are up 1.4% this week after

shedding 11% the previous week. Its shares had fallen to close to a

decade low last Friday amid worries about the fallout from a recent

dam-burst at its jointly owned Brazilian iron-ore mine operation

that killed nine people.

Shares of BHP were up 0.4% on Friday.

"Investors are realizing that the associated selloff in other

resources stocks probably went too far" given that BHP had unique

reasons for its sell off, Mr. Oliver said.

U.S. stocks ended slightly off Thursday, dragged by health care

and energy shares.

Brent oil prices are up 1.5% this week, and up 0.3% Friday at

$44.35 a barrel, after falling roughly 8% the previous week.

U.S. oil futures slipped overnight to $40.54 a barrel, their

lowest level since Aug. 26.

Gold prices are up 0.3% at $1,080.90 a troy ounce.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 01:03 ET (06:03 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

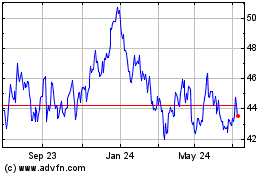

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024