TIDMARGO

RNS Number : 5520S

ARGO Group Limited

25 September 2014

Argo Group Limited

("Argo" or the "Company")

Interim Results for the six months ended 30 June 2014

Argo today announces its interim results for the six months

ended 30 June 2014.

The Company will today make available its interim report for the

six month period ended 30 June 2014 on the Company's website

www.argogrouplimited.com.

Key Highlights for the six month period ended 30 June 2014

- Revenues US$3.9 million (six months to 30 June 2013: US$4.7 million)

- Operating loss US$0.5 million (six months to 30 June 2013: profit US$0.8 million)

- Loss before tax US$0.5 million (six months to 30 June 2013: profit US$1.7 million)

- Net assets US$28.0 million (31 December 2013: US$28.5 million)

Commenting on the results and outlook, Kyriakos Rialas, Chief

Executive of Argo said:

"The potential of rising US interest rates is a continuing

negative for emerging markets. Nevertheless Argo's hedge strategy

and the workout of its private equity illiquid assets resulted in

satisfactory comparative fund performance. Since the period end

liquidity has improved at management company level."

Enquiries

Argo Group Limited

Andreas Rialas

020 7016 7660

Panmure Gordon

Dominic Morley

020 7886 2500

CHAIRMAN'S STATEMENT

The Group and its investment objective

Argo's investment objective is to provide investors with

absolute returns in the funds that it manages by investing in,

inter alia, fixed income, special situations, local currencies and

interest rate strategies, private equity, real estate, quoted

equities, high yield corporate debt and distressed debt, although

not every fund invests in each of these asset classes.

Argo was listed on the AIM market in November 2008 and has a

performance track record dating back to 2000.

Business and operational review

This report sets out the interim results of Argo Group Limited

for the half year ended 30 June 2014.

For the six month period ended 30 June 2014 the Group generated

revenues of US$3.9 million (six months to 30 June 2013: US$4.7

million) with management fees accounting for US$3.5 million (six

months to 30 June 2013: US$3.5 million). The Group did not generate

incentive fees during the period. In the prior period to 30 June

2013 the Group derived incentive fees of US$0.8 million as a result

of the revaluation of an investment in an Indonesian petrochemicals

refinery, PT Trans-Pacific Petrochemical Industries ("TPPI"), which

has not yet been realised.

Total core operating costs for the period are US$2.7 million

compared to US$2.6 million for the six months to 30 June 2013.

Costs will however trend lower in the second half of the year as a

result of cost cutting initiatives implemented in the first half of

2014. Total operating costs have increased by US$0.4 million to

US$4.4 million (six months to 30 June 2013: US$4.0 million) after

bad debt provision. During the period the Group provided against

management fees of US$1,371,000 (EUR1,000,000) (six months to 30

June 2013: US$1,323,000 (EUR1,008,000)) due from Argo Real Estate

Opportunities Fund Limited ("AREOF").

Overall, the financial statements show an operating loss for the

period of US$0.5 million (six months to 30 June 2013: profit US$0.8

million) and a loss before tax of US$0.5 million (six months to 30

June 2013: profit US$1.7 million) reflecting the unrealised loss on

non-current asset investments of US$0.1 million (six months to 30

June 2013: unrealised gain US$1.0 million).

At the period end, the Group had net assets of US$28.0 million

(31 December 2013: US$28.5 million). The Group did not pay a

dividend during the period compared to the prior period when a

dividend of 2.1 cents (1.3 pence) per share was paid on 26 April

2013.

Non-current assets include investments in The Argo Fund ("TAF"),

AREOF and Argo Special Situations Fund LP ("ASSF") at fair values

of US$19.0 million (31 December 2013: US$19.1 million), US$0.2

million (31 December 2013: US$0.2 million) and US$0.08 million (31

December 2013: US$0.09 million) respectively. Our continued

investment in our funds supports the liquidity of those funds and

demonstrates the commitment of the Group towards its fund

investors. This close alignment results in a high correlation

between the performance of the Company and the performance of its

funds. It should be noted, however, that the Group does not intend

to and may not be able to realise these investments in the

immediate future due to the illiquid nature of the assets held by

these funds.

At the period end TAF and ASSF together owed the Group total

management fees of US$3,296,017 (31 December 2013: US$1,817,803)

after a bad debt provision of US$1,000,000 (31 December 2013:

US$650,000). They are currently facing a short term liquidity issue

which is being remedied and whilst a bad debt provision has been

raised against these management fees the directors are confident

that they are fully recoverable. Since the period end US$2,388,000

of these arrears have been settled.

The Argo funds ended the period with Assets under Management

("AUM") at US$277.9 million, 2.4% higher than at the beginning of

the period. The current level of AUM remains below that required to

ensure sustainable profits on a recurring management fee basis and

in the absence of performance fees. This has necessitated a

detailed review of the Group's cost basis and the implementation of

a redundancy programme in the first quarter of the period. The

Group has ensured that the operational framework remains intact and

that it retains the capacity to manage additional fund inflows as

and when they arise.

The number of employees of the Group at 30 June 2014 was 30 (30

June 2013: 40).

The Group has provided AREOF with a notice of deferral in

relation to amounts due from the provision of investment management

services, under which it will not demand payment of such amounts

until the Group judges that AREOF is in a position to pay the

outstanding liability. These amounts accrued or receivable at 30

June 2014 total US$777,090 (EUR569,505) (31 December 2013:

1,265,791 (EUR919,505)) after a bad debt provision of US$4,093,500

(EUR3,000,000) (31 December 2013: US$2,753,200 (EUR2,000,000)).

AREOF continues to meet part of this obligation to the Argo Group

as and when liquidity allows. The AREOF management contract has a

fixed term expiring on 31 July 2018. In November 2013 AREOF offered

Argo Group Limited additional security for the continued support in

the form of debentures and guarantees by underlying intermediate

companies.

During the prior period Argo Group advanced US$1,364,500

(EUR1,000,000) to Bel Rom Trei ("Bel Rom"), an AREOF Group entity

based in Romania that owns Sibiu Shopping City, in order to assist

with its operational cash requirements. The loan is repayable on

demand and accrues interest at 12%. The full amount of the loan and

accrued interest remains outstanding at the period end. The

Directors consider this loan to be fully recoverable on the basis

that discussions with lending banks and potential purchasers of

Sibiu have yielded offers in excess of the debt associated with the

project banks.

Fund performance

Argo Funds

30 30

June June 2013

Launch 2014 2013 year Sharpe Down

Since Annualised

Fund date 6 months 6 months total inception performance ratio months AUM

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

% % % % CAGR US$m

%

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

42

The Argo of

Fund Oct-00 -0.51 8.64 8.49 150.93 7.75 0.66 165 93.8

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo 26

Distressed of

Credit Fund Oct-08 -0.28 11.88 12.64 72.98 10.62 0.85 69 26.3

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo Special 26

Situations of

Fund LP Feb-12 -5.84 -20.65 -23.30 -29.62 -13.56 -1.15 29 88.1

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo Local 14

Markets of

Fund Nov-12 -2.14 -5.34 -9.80 -10.34 -6.27 -1.55 20 4.5

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo Real

Estate 48

Opportunities of

Fund Aug-06 21.30 -7.09 -46.58 -92.70 -31.23 N/A 92 65.2*

-------------- -------- ----------- ---------- ------------- --------------- ------------ ------- --------- ------

Total 277.9

------------------------ ----------- ---------- ------------- --------------- ------------ ------- --------- ------

* NAV only officially measured twice a year, March and

September.

Emerging markets had a difficult start to the period with

currencies being particularly affected. A combination of factors

including bullishness about the US economy, disappointing

manufacturing data in China and ongoing tensions in Ukraine

combined to undermine investor confidence in the earlier part of

the period. Market volatility diminished as tensions eased in

Ukraine following the Russian annexation of Crimea but heightened

once again by the end of the period in response to actions by

separatist forces in Eastern Ukraine. Whilst emerging markets

produced a positive performance overall for the six month period,

Eastern European markets were negative.

Against this backdrop, fund performance was lacklustre with most

of the Argo funds finishing behind at the end of the period. By

comparison, the main hedge fund indices showed a positive return of

5.22% for the same period.

During the period we made very little progress in completing the

previously reported non-binding agreement with Pertamina to acquire

the interest in TPPI. Pertamina has not formally declined but has

suggested that discussions might resume on completion of the

election cycle in Indonesia. The elections took place in July and

it is believed that the victory of Joko Widodo will open the door

to a new reform-minded government that hopefully can implement the

changes the country urgently needs. On 5 August 2014 the

shareholders of TPPI unanimously passed resolutions regarding the

issuance of new shares through unsecured debt to equity conversion.

Consequently, TPPI is now fully authorised to execute all documents

in connection with the implementation of its composition plan. The

new bonds were issued in September 2014 and shares are expected to

be issued in October 2014 once all formalities are complete.

In September 2014 ASSF agreed financing arrangements with a

lender which will ensure that the preferred interests receive

amounts equal in value to their capital contributions and the

amount of the preferred return accrued since the date of issue of

the interests.

The Argo Local Markets Fund ("ALMF") had a difficult first six

months suffering from the broad sell-off in January in response to

the US Federal Reserve's desire to reduce its quantitative easing

programme. The Fund has since recovered due to uncertainties

surrounding the actual date that the Federal Reserve will start to

raise interest rates. The slowdown in global growth seen mostly in

Europe but also in major emerging markets like Brazil, Russia and

even China has raised questions about the medium term growth

prospects for emerging markets and the need to adopt more

accommodative policy through lower interest rates but also weaker

currencies. The strength of the US dollar and further geopolitical

risk has complicated the outlook for growth and the markets remain

at risk of sudden bouts of risk aversion. We continue to believe

that the best way to manage these risks is to invest in a portfolio

of long and short interest rates and FX positions. At the end of

the period ALMF showed a negative return of -2.14%.

While macroeconomic conditions continue to improve, the effects

on the two core markets where AREOF operates remain mixed with

subdued growth in the Romanian market and recent political and

economic upheavals impacting the Ukraine market.

The reduced level of cash flow within AREOF, while being

proactively managed, has resulted in breaches of terms and

covenants on certain loans. This situation is being addressed by

regular communication and negotiation with the lending banks with a

view to restructuring the debt commitments to better align these to

the current level of the AREOF Group's cash flow. While discussions

with the relevant banks are ongoing to find an agreeable solution

for both parties AREOF continues to enjoy the support of its

banks.

AREOF's adjusted Net Asset Value was US$65.7 million (EUR47.8

million) as at 31 March 2014, compared with US$87.8 million

(EUR68.5 million) a year earlier. The adjusted Net Asset Value per

share at 31 March 2014 was US$0.11 (EUR0.08) (30 March 2013:

US$0.14 (EUR0.11)).

AREOF'S ordinary shares on AIM were suspended on 30 August 2013

following breach of a loan covenant and the subsequent loan

termination by the lending bank. On 3 March 2014 AREOF delisted

from AIM to allow loan restructuring discussions to proceed outside

of the extensive disclosure requirements that an AIM listing

entails. The valuation of Argo Group Limited's investment in AREOF

has been based on the equity price prevailing at the time of the

suspension with an additional 25% discount rate applied to that

price.

Awards

Argo Distressed Credit Fund was ranked a top 5 hedge fund over

three years in the category of Emerging Markets Global Funds by

BarclayHedge at the end of March 2014.

Dividends

Argo is working towards the payment of a dividend which will

ultimately depend on the success of the initiatives described

above. The directors did not recommend a final dividend in respect

of the year ended 31 December 2013 but intend to pay an interim

dividend as soon as these initiatives are complete. Going forward,

the Company intends, subject to its financial performance, to pay a

final dividend each year.

Outlook

We enter the second half of the year with a degree of caution

particularly given the continuing conflict in Eastern Ukraine and

uncertainty as to how various markets will respond if the US

Federal Reserve reduces quantitative easing. The top priority in

the next six months will be to continue with our program to

monetise certain of our investments. In the very near term our

growth rate will be heavily influenced by the success of this

program as well as events in Europe. Over the longer term the Board

believes there is significant opportunity for growth in assets and

profits and remains committed to the emerging markets sector.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 30 JUNE 2014

Six months Six months

ended ended

30 June 30 June

2014 2013

Note US$'000 US$'000

Management fees 3,462 3,453

Incentive fees - 803

Other income 423 459

===================================== ===== =========== ================

Revenue 3,885 4,715

===================================== ===== =========== ================

Legal and professional expenses (164) (120)

Management and incentive

fees payable (62) (116)

Operational expenses (572) (612)

Employee costs (1,663) (1,752)

Bad debt provision 9 (1,749) (1,323)

Foreign exchange (loss)/gain (129) 37

Depreciation 7 (72) (65)

Operating (loss)/profit (526) 764

===================================== ===== =========== ================

Interest income on cash and

cash equivalents 115 9

Unrealised (loss)/gain on

investments (105) 958

===================================== ===== =========== ================

(Loss)/profit on ordinary

activities before taxation (516) 1,731

===================================== ===== =========== ================

Taxation 5 (44) (109)

===================================== ===== =========== ================

(Loss)/profit for the period

after taxation attributable

to members of the Company 6 (560) 1,622

Other comprehensive income

Exchange differences on translation

of foreign operations 98 (137)

===================================== ===== =========== ================

Total comprehensive (loss)/income

for the period (462) 1,485

===================================== ===== =========== ================

Six months Six months

Ended Ended

30 June 30 June

2014 2013

US$ US$

Earnings per share (basic) 6 -0.01 0.02

===================================== ===== =========== ================

Earnings per share (diluted) 6 -0.01 0.02

===================================== ===== =========== ================

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2014

30 June At 31 December

2014 2013

Note US$'000 US$'000

Assets

Non-current assets

Fixtures, fittings and

equipment 7 140 177

Investments 8 19,315 19,420

Loans and advances receivable 10 2,206 2,107

=============================== ===== ========== ===============

Total non-current assets 21,661 21,704

=============================== ===== ========== ===============

Current assets

Trade and other receivables 9 4,414 3,300

Cash and cash equivalents 2,285 3,726

Loans and advances receivable 10 179 217

=============================== ===== ========== ===============

Total current assets 6,878 7,243

=============================== ===== ========== ===============

Total assets 28,539 28,947

=============================== ===== ========== ===============

Equity and liabilities

Equity

Issued share capital 11 674 674

Share premium 30,878 30,878

Revenue reserve (1,608) (1,048)

Foreign currency translation

reserve (1,911) (2,009)

=============================== ===== ========== ===============

Total equity 28,033 28,495

=============================== ===== ========== ===============

Current liabilities

Trade and other payables 406 388

Taxation payable 5 100 64

=============================== ===== ========== ===============

Total current liabilities 506 452

Total equity and liabilities 28,539 28,947

=============================== ===== ========== ===============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

FOR THE SIX MONTHS ENDED 30 JUNE 2014

Foreign

Issued currency

share Share Revenue translation

capital premium reserve reserve Total

2013 2013 2013 2013 2013

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2013 674 30,878 (1,674) (2,164) 27,714

Total comprehensive

income

Loss for the period

after taxation - - 1,622 (137) 1,485

Transactions with

owners recorded

directly in equity

Dividends to equity

holders (Note 11) - - (1,348) - (1,348)

As at 30 June 2013 674 30,878 (1,400) (2,301) 27,851

===================== ============== ========== ========== ============== ========

Foreign

Issued currency

share Share Revenue translation

capital premium reserve reserve Total

2014 2014 2014 2014 2014

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2014 674 30,878 (1,048) (2,009) 28,495

Total comprehensive

income

Profit for the

period after taxation - - (560) 98 (462)

Transactions with

owners recorded

directly in equity

Dividends to equity - - - - -

holders (Note 11)

As at 30 June 2014 674 30,878 (1,608) (1,911) 28,033

======================== ========== ========== ========== ============== ========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2014

Six months Six months

ended ended

30 June 30 June

2014 2013

Note US$'000 US$'000

Net cash (outflow)/inflow

from operating activities 12 (1,490) 619

Cash flows used in investing

activities

Interest received on cash

and cash equivalents 1 9

Purchase of fixtures,

fittings and equipment 7 (34) (27)

Net cash used in investing

activities (33) (18)

=============================== ===== =========== ===========

Cash flows used in financing

activities

Dividends paid 11 - (1,348)

Net cash used in financing

activities - (1,348)

=============================== ===== =========== ===========

Net decrease in cash and

cash equivalents (1,523) (747)

Cash and cash equivalents

at 1 January 2014 and

1 January 2013 3,726 5,139

Foreign exchange gain(loss)

on cash and cash equivalents 82 (94)

Cash and cash equivalents

as at 30 June 2014 and

30 June 2013 2,285 4,298

=============================== ===== =========== ===========

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2014

1. CORPORATE INFORMATION

The Company is domiciled in the Isle of Man under the Companies

Act 2006. Its registered office is at 33-37 Athol Street, Douglas,

Isle of Man, IM1 1LB. The condensed consolidated interim financial

statements of the Company as at and for the six months ended 30

June 2014 comprise the Company and its subsidiaries (together

referred to as the "Group").

The consolidated financial statements of the Group as at and for

the year ended 31 December 2013 are available upon request from the

Company's registered office or at www.argogrouplimited.com.

The principal activity of the Company is that of a holding

company and the principal activity of the wider Group is that of an

investment management business. The functional and presentational

currency of the Group undertakings is US dollars. The Group has 30

employees.

Wholly owned subsidiaries Country of incorporation

Argo Capital Management (Cyprus) Cyprus

Limited

Argo Capital Management Limited United Kingdom

Argo Capital Management Property Cayman Islands

Limited

Argo Property Management Srl Romania

North Asset Management Sarl Luxembourg

2. ACCOUNTING POLICIES

(a) Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting. They do not include all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group as at and

for the year ended 31 December 2013.

The Directors have carried out a rigorous assessment of all the

factors affecting the business in deciding to adopt the going

concern basis for the preparation of the accounts. They have

reviewed and examined the Group's financial and other processes

including the annual budgeting process and expect the Group to

generate positive cash flows in the foreseeable future. On the

basis of this review and the liquid assets underpinning the balance

sheet the Directors are confident that the Group has adequate

financial resources to continue in operational existence for the

foreseeable future and therefore continue to adopt the going

concern basis for preparing the accounts.

The Group has prepared forecasts that focus on cash flow

requirements for the period to September 2015. These forecasts

reflect current cost patterns of the Group and take into

consideration current liquidity constraints of funds under

management and therefore their ability to settle management fees

and other receivables (refer to notes 9 and 10). The cash flows of

the Group are linked to the liquidity of the funds and the major

funds of the Group (AREOF, TAF and ASSF) have significant liquidity

challenges at present therefore cash inflows to the Group are

linked to potential liquidity events, the timings of some of which

are uncertain.

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in its consolidated financial statements as at

and for the year ended 31 December 2013.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 24 September 2014.

(b) Financial instruments and fair value hierarchy

The following represents the fair value hierarchy of financial

instruments measured at fair value in the Statement of Financial

Position. The hierarchy groups financial assets and liabilities

into three levels based on the significance of inputs used in

measuring the fair value of the financial assets and liabilities.

The fair value hierarchy has the following levels:

Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement.

3. SEGMENTAL ANALYSIS

The Group operates as a single asset management business.

The operating results of the companies set out in note 1 above

are regularly reviewed by the directors of the Group for the

purposes of making decisions about resources to be allocated to

each company and to assess performance. The following summary

analyses revenues, profit or loss, assets and liabilities:

Argo Argo Six

Capital Argo Capital months

Argo Management Capital Management ended

Group (Cyprus) Management Property 30

Ltd Ltd Ltd Ltd Other June

2014 2014 2014 2014 2014 2014

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Total revenues

for reportable

segments customers - 2,091 1,042 1,794 - 4,927

Intersegment

revenues - - 1,042 - - 1,042

Total profit/(loss)

for reportable

segments (339) 324 (237) (160) - (412)

Intersegment

profit/(loss) - (1,046) 1,042 - - (4)

Total assets

for reportable

segments assets 49,173 3,891 2,570 4,298 75 60,007

Total liabilities

for reportable

segments 77 1,740 221 172 26 2,236

===================== ======== ============ ============= ============= ======== ========

Revenues, profit or loss, assets and Six months

liabilities may be reconciled as follows:

ended

30 June

2014

US$'000

Revenues

Total revenues for reportable segments 4,927

Elimination of intersegment revenues (1,042)

============================================== ===========

Group revenues 3,885

============================================== ===========

Profit or loss

Total loss for reportable segments (412)

Elimination of intersegment loss 4

Other unallocated amounts (108)

============================================== ===========

Loss on ordinary activities before taxation (516)

============================================== ===========

Assets

Total assets for reportable segments 60,007

Elimination of intersegment receivables (1,869)

Elimination of Company's cost of investments (29,599)

============================================== ===========

Group assets 28,539

============================================== ===========

Liabilities

Total liabilities for reportable segments 2,236

Elimination of intersegment payables (1,730)

)

============================================== ===========

Group liabilities 506

============================================== ===========

Argo Argo Six

Capital Argo Capital months

Argo Management Capital Management ended

Group (Cyprus) Management Property 30

Ltd Ltd Ltd Ltd Other June

2013 2013 2013 2013 2013 2013

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Total revenues

for reportable

segments 400 2,943 1,476 1,772 - 6,591

Intersegment

revenues 400 - 1,476 - - 1,876

Total profit/(loss)

for reportable

segments 1,161 456 468 (306) - 1,779

Intersegment

profit/(loss) 400 (1,871) 1,476 - - 5

Total assets

for reportable

segments 49,695 2,837 2,697 3,546 121 58,896

Total liabilities

for reportable

segments 56 954 175 233 26 1,444

===================== ======== ============ ============= ============= ======== ========

Revenues, profit or loss, assets and liabilities Six months

may be reconciled as follows:

ended

30 June

2013

US$'000

Revenues

Total revenues for reportable segments 6,591

Elimination of intersegment revenues (1,876)

================================================== ===========

Group revenues 4,715

================================================== ===========

Profit or loss

Total profit for reportable segments 1,779

Elimination of intersegment profit (5)

Other unallocated amounts (43)

================================================== ===========

Profit on ordinary activities before taxation 1,731

================================================== ===========

Assets

Total assets for reportable segments 58,896

Elimination of intersegment receivables (798)

Elimination of Company's cost of investments (29,598)

================================================== ===========

Group assets 28,500

================================================== ===========

Liabilities

Total liabilities for reportable segments 1,444

Elimination of intersegment payables (795)

================================================== ===========

Group liabilities 649

================================================== ===========

4. SHARE-BASED INCENTIVE PLANS

On 14 March 2011 the Group granted options over 5,900,000 shares

to directors and employees under The Argo Group Limited Employee

Stock Option Plan. All options are exercisable in four equal

tranches over a period of four years at an exercise price of 24p

per share.

The fair value of the options granted was measured at the grant

date using a Black-Scholes model that takes into account the effect

of certain financial assumptions, including the option exercise

price, current share price and volatility, dividend yield and the

risk-free interest rate. The fair value of the options granted is

spread over the vesting period of the scheme and the value is

adjusted to reflect the actual number of shares that are expected

to vest.

The principal assumptions for valuing the options are:

Exercise price (pence) 24.0

Weighted average share

price at grant date

(pence) 12.0

Weighted average option

life (years) 10.0

Expected volatility

(% p.a.) 2.11

Dividend yield (% p.a.) 10.0

Risk-free interest rate

(% p.a.) 5.0

The fair value of options granted is recognised as an employee

expense with a corresponding increase in equity. The total charge

to employee costs in respect of this incentive plan is nil due to

the differential in exercise price and share price.

The number and weighted average exercise price of the share

options during the period is as follows:

Weighted No. of share

average options

exercise

price

Outstanding at beginning

of period 24.0p 4,715,000

Granted during the period - -

Forfeited during the period 24.0p 450,000

============================= ========== =============

Outstanding at end of

period 24.0p 4,265,000

============================= ========== =============

Exercisable at end of

period 24.0p 3,198,750

============================= ========== =============

The options outstanding at 30 June 2014 have an exercise price

of 24p and a weighted average contractual life of 10 years, with

the fourth and final tranche of shares being exercisable on or

after 1 May 2015. Outstanding share options are contingent upon the

option holder remaining an employee of the Group. They expire after

10 years.

No share options were issued during the period.

5. TAXATION

Taxation rates applicable to the parent company and the Cypriot,

UK, Luxembourg, Cayman and Romanian subsidiaries range from 0% to

22% (2013: 0% to 23%).

Income Statement Six months Six months

ended ended

30 June 30 June

2014 2013

US$'000 US$'000

Taxation charge for the period

on Group companies 44 109

================================ =========== ===========

The charge for the period can be reconciled to the (loss)/profit

shown on the Condensed Consolidated Statement of Comprehensive

Income as follows:

Six months Six months

ended ended

30 June 30 June

2014 2013

US$'000 US$'000

(Loss)/profit before tax (516) 1,731

================================== =========== ===========

Applicable Isle of Man tax - -

rate for Argo Group Limited

of 0%

Timing differences 3 2

Non-deductible expenses 12 7

Other adjustments 38 -

Tax effect of different tax

rates of subsidiaries operating

in other jurisdictions (9) 100

================================== =========== ===========

Tax charge 44 109

================================== =========== ===========

Balance Sheet

30 June 31 December

2014 2013

US$'000 US$'000

Corporation tax payable 100 64

========================= ======== ============

6. EARNINGS PER SHARE

Earnings per share is calculated by dividing the net

(loss)/profit for the period by the weighted average number of

shares outstanding during the period.

Six months Six months

ended ended

30 June 30 June

2014 2013

US$'000 US$'000

Net (loss)/profit for the

period after taxation attributable

to members (560) 1,622

===================================== ============= =============

No. of No. of

shares shares

Weighted average number of

ordinary shares for basic

earnings per share 67,428,494 67,428,494

Effect of dilution (Note 4) 4,265,000 5,415,000

===================================== ============= =============

Weighted average number of

ordinary shares for diluted

earnings per share 71,693,494 72,843,494

===================================== ============= =============

Six months Six months

ended ended

30 June 30 June

2014 2013

US$ US$

Earnings per share (basic) -0.01 0.02

Earnings per share (diluted) -0.01 0.02

============================== =========== ===========

7. FIXTURES, FITTINGS AND EQUIPMENT

Fixtures,

fittings

& equipment

US$'000

Cost

At 1 January 2013 372

Additions 46

Disposals (20)

Foreign exchange movement 10

================================ ======================

At 31 December 2013 408

Additions 34

Disposal (167)

Foreign exchange movement 9

================================ ======================

At 30 June 2014 284

================================ ======================

Accumulated Depreciation

At 1 January 2013 151

Depreciation charge for period 89

Disposal (16)

Foreign exchange movement 7

================================ ======================

At 31 December 2013 231

Depreciation charge for period 72

Disposal (167)

Foreign exchange movement 8

================================ ======================

At 30 June 2014 144

================================ ======================

Net book value

At 31 December 2013 177

================================ ======================

At 30 June 2014 140

================================ ======================

8. INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June

2014 2014

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd 0 0

Argo Distressed Credit

100 Fund Ltd 0 0

Argo Special Situations

1 Fund LP 0 0

Argo Local Markets

1 Fund 0 0

0 0

======== ========================= ============= =============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

75,165 The Argo Fund Ltd 16,343 19,011

Argo Real Estate

Opportunities Fund

10,899,021 Ltd 988 223

Argo Special Situations

115 Fund LP 115 81

=========== ======================== ============= =============

17,446 19,315

=========== ======================== ============= =============

31 December 31 December

2013 2013

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd 0 0

Argo Distressed Credit

100 Fund Ltd 0 0

Argo Special Situations

1 Fund LP 0 0

Argo Local Markets

1 Fund 0 0

======== ========================= ============== ==============

0 0

======== ========================= ============== ==============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

75,165 The Argo Fund Ltd 16,343 19,109

Argo Real Estate

Opportunities Fund

10,899,021 Ltd 988 225

Argo Special Situations

115 Fund LP 115 86

=========== ======================== ============= =============

17,446 19,420

=========== ======================== ============= =============

The Argo Fund Limited and Argo Special Situations Fund LP hold

concentrated portfolios of Level 3 assets that are valued based on

inputs other than quoted prices in active markets. Inherently the

assumptions backing these valuations are subject to additional

risks that can have a positive or negative impact on valuation. The

audit reports for the years ended 30 June 2013 and 31 December

2013, respectively, for these funds were modified in respect of the

investment portfolios.

During the prior period, Argo Real Estate Opportunities Fund

Limited ("AREOF") was suspended from trading on AIM, and

subsequently delisted on 3 March 2014 as a result of default

notices on its loans creating uncertainty. The Group's investment

in AREOF is carried at a discount to the last quoted bid price on

AIM from August 2013 at the period end. This investment is

classified as level 3 under IFRS fair value hierarchy reflecting

the non-market observable inputs to its valuation.

The investments held by the Group have been made in support of

the Group's funds under management and in support of their

liquidity profiles and as such they may not be realisable in the

immediate future. The valuations are subject to uncertain events,

for example, liquidity events or debt refinancing that may not be

wholly within the Group's control.

9. TRADE AND OTHER RECEIVABLES

The directors consider that the carrying amount of trade and

other receivables approximates their fair value. All trade

receivable balances are recoverable within one year from the

balance sheet date except as disclosed below.

The Group has provided Argo Real Estate Opportunities Fund

Limited ("AREOF") with a notice of deferral in relation to the

amounts due from the provision of investment management services,

under which it will not demand payment of such amounts until the

Group judges that AREOF is in a position to pay the outstanding

liability. These amounts accrued or receivable at 30 June 2014

total US$777,090 (EUR569,505) (31 December 2013: US$1,265,791,

EUR919,505) after a bad debt provision of US$4,093,500

(EUR3,000,000) (31 December 2013: US$2,753,200, EUR2,000,000).

AREOF continues to meet part of this obligation to the Argo Group

as and when liquidity allows. In November 2013 AREOF offered Argo

Group Limited additional security for the continued support in the

form of debentures and guarantees by underlying intermediate

companies. In the Directors' view these amounts are fully

recoverable although they have concluded that it would not be

appropriate to continue to recognise income without provision from

these investment management services as the timing of such receipts

may be outside the control of the Company and AREOF.

At the period end The Argo Fund Limited and Argo Special

Situations Fund LP together owed the Group total management fees of

US$3,296,017 (31 December 2013: US$1,817,803) after a bad debt

provision of US$1,000,000 (31 December 2013: US$650,000). Both

Funds have a substantial asset base with very few liabilities. They

are currently facing a short term liquidity issue which is being

remedied and whilst a bad debt provision has been raised against

these management fees the directors are confident that they are

fully recoverable. Since the period end US$2,388,000 of these

arrears have been settled.

In the audited financial statements of AREOF at 30 September

2013 and the interim report of AREOF at 31 March 2014, a material

uncertainty surrounding ongoing discussions with its bankers and

the prevailing trading environment was referred to in relation to

the basis of preparation of the financial statements. In the view

of the directors of AREOF, discussions with the banks are

continuing satisfactorily and they have therefore concluded that it

is appropriate to prepare those financial statements on a going

concern basis.

10. LOANS AND ADVANCES RECEIVABLE

During the prior period Argo Group advanced US$1,364,500

(EUR1,000,000) to Bel Rom Trei ("Bel Rom"), an AREOF Group entity

based in Romania that owns Sibiu Shopping City, in order to assist

with its operational cash requirements. Challenging trading

conditions have impacted Bel Rom's cash flow and its ability to

meet payments due to lending banks as and when they fall due. The

situation is being addressed by way of discussions with the lending

banks with a view to restructuring these loans. While these

discussions are on-going to find an agreeable solution for both

parties, Bel Rom continues to enjoy the support of its banks. The

loan is repayable on demand and accrues interest at 12%. The full

amount of the loan and accrued interest remains outstanding at the

year end. The Directors consider this loan to be fully recoverable

on the basis that conditional offers to buy the centre have been

received that indicate a value in excess of the debt attached to

the project. Notwithstanding its repayable on demand terms, the

Directors have classified this amount as non-current within the

financial statements as it is not their intention to demand

repayment in the immediate future and it is unlikely that Bel Rom

will repay the amount in the next 12 months even if it were

demanded.

11. SHARE CAPITAL

The Company's authorised share capital is unlimited with a

nominal value of US$0.01.

30 June 30 June 31 December 31 December

2014 2014 2013 2013

No. US$'000 No. US$'000

Issued and fully

paid

Ordinary shares

of US$0.01 each 67,428,494 674 67,428,494 674

================== ============= ========== ============= ============

67,428,494 674 67,428,494 674

================== ============= ========== ============= ============

The directors did not recommend the payment of a final dividend

for the year ended 31 December 2013 and do not recommend an interim

dividend in respect of the current period. The final dividend for

the year ended 31 December 2012 of US$1,348,287 (GBP876,570) was

paid on 26 April 2013 to ordinary shareholders who were on the

Register of Members on 2 April 2013. Going forward, the Company

intends, subject to its financial performance, to pay a final

dividend each year.

12. RECONCILIATION OF NET CASH (OUTFLOW)/INFLOW FROM OPERATING

ACTIVITIES TO (LOSS)/PROFIT ON ORDINARY ACTIVITIES BEFORE

TAXATION

Six months Six months

ended ended

30 June 30 June

2014 2013

US$'000 US$'000

(Loss)/profit on ordinary

activities before taxation (516) 1,731

Interest income (115) (9)

Depreciation 72 65

Unrealised loss/(gain) on

investments 105 (958)

Net foreign exchange loss/(gain) 129 (37)

Increase/(decrease) in payables 18 (34)

Increase in receivables,

loans and advances (1,175) (45)

Income taxes paid (8) (94)

================================== ============= =============

Net cash (outflow)/inflow

from operating activities (1,490) 619

================================== ============= =============

13. FAIR VALUE HIERARCY

The table below analyses financial instruments measured at fair

value at the end of the reporting period by the level of the fair

value hierarchy (note 2).

At 30 June 2014

Level Level Level Total

1 2 3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value

through profit

or loss - - 19,315 19,315

================== ========== ========== ========= =========

At 31 December 2013

Level Level Level Total

1 2 3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value

through profit

or loss - 19,195 225 19,420

================== ========== ========= ========= =========

14. RELATED PARTY TRANSACTIONS

All Group revenues derive from funds or entities in which two of

the Company's directors, Andreas Rialas and Kyriakos Rialas, have

an influence through directorships and the provision of investment

advisory services.

At the balance sheet date the Company holds investments in The

Argo Fund Limited, Argo Real Estate Opportunities Fund Limited

("AREOF") and Argo Special Situations Fund LP. These investments

are reflected in the accounts at a fair value of US$19,011,287,

US$223,076 and US$80,702 respectively.

The Group has provided AREOF with a notice of deferral in

relation to the amounts due from the provision of investment

management services, under which it will not demand payment of such

amounts until the Group judges that AREOF is in a position to pay

the outstanding liability. These amounts accrued or receivable at

30 June 2014 total US$777,090 (EUR569,505) (31 December 2013:

US$1,265,791, EUR919,505) after a bad debt provision of

US$4,093,500 (EUR3,000,000) (31 December 2013: US$2,753,200,

EUR2,000,000). AREOF continues to meet part of this obligation to

the Argo Group as and when liquidity allows. In November 2013 AREOF

offered Argo Group Limited additional security for the continued

support in the form of debentures and guarantees by underlying

intermediate companies.

In the audited financial statements of AREOF at 30 September

2013 and the interim report of AREOF at 31 March 2014, a material

uncertainty surrounding ongoing discussions with its bankers and

the prevailing trading environment was referred to in relation to

the basis of preparation of the financial statements. In the view

of the directors of AREOF, discussions with the banks are

continuing satisfactorily and they have therefore concluded that it

is appropriate to prepare those financial statements on a going

concern basis.

During the prior period Argo Group advanced US$1,364,500

(EUR1,000,000) to Bel Rom Trei Srl ("Bel Rom"), an AREOF Group

entity based in Romania that owns Sibiu Shopping City, in order to

assist with its operational cash requirements. The loan is

repayable on demand and accrues interest at 12%. The full amount of

the loan and accrued interest remains outstanding at the period

end. The Directors consider this loan to be fully recoverable on

the basis that conditional offers to buy the centre have been

received that indicate a value in excess of the debt attached to

the project. Notwithstanding its repayable on demand terms, the

Directors have classified this amount as non-current within the

financial statements as it is not their intention to demand

repayment in the immediate future and it is unlikely that Bel Rom

will repay the amount in the next 12 months even if it were

demanded.

David Fisher, a non-executive director of the Company, is also a

non-executive director of AREOF.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BIGDCDXDBGSS

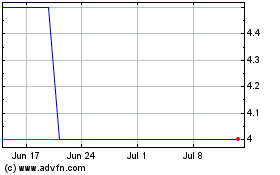

Argo (LSE:ARGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

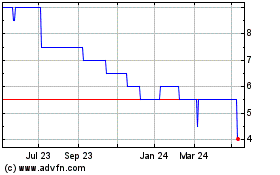

Argo (LSE:ARGO)

Historical Stock Chart

From Apr 2023 to Apr 2024